Trump AI Policy 2025: “No Federal Bailout” for AI Companies — Industry Implications

By Sezarr Overseas News | Published: November 11, 2025 | Last Updated: November 11, 2025

Editorial Disclaimer: This analysis represents editorial opinion based on publicly available information as of November 11, 2025. Policy predictions and market analysis should not be used as the sole basis for investment or business decisions. Readers are advised to conduct their own research and consult with qualified professionals before making financial decisions.

Executive Summary

Bottom Line: The Trump administration has definitively ruled out federal bailouts for AI companies, signaling a market-driven approach that will increase private-sector risk while potentially accelerating industry consolidation. This stance arrives amid growing concerns about whether AI stocks are driving a market bubble, and as major infrastructure deals like OpenAI’s $38B AWS partnership reshape the competitive landscape.

Policy Announcement: David Sacks Declares “No Federal Bailout” for AI

On November 6, 2025, David Sacks publicly declared that the United States would not provide federal bailouts to AI firms. In a post on X (formerly Twitter), Trump’s AI and Crypto Czar wrote:

“The U.S. has at least 5 major frontier model companies. If one fails, others will take its place.”

— David Sacks, White House AI & Crypto Czar (Source: X/Twitter)

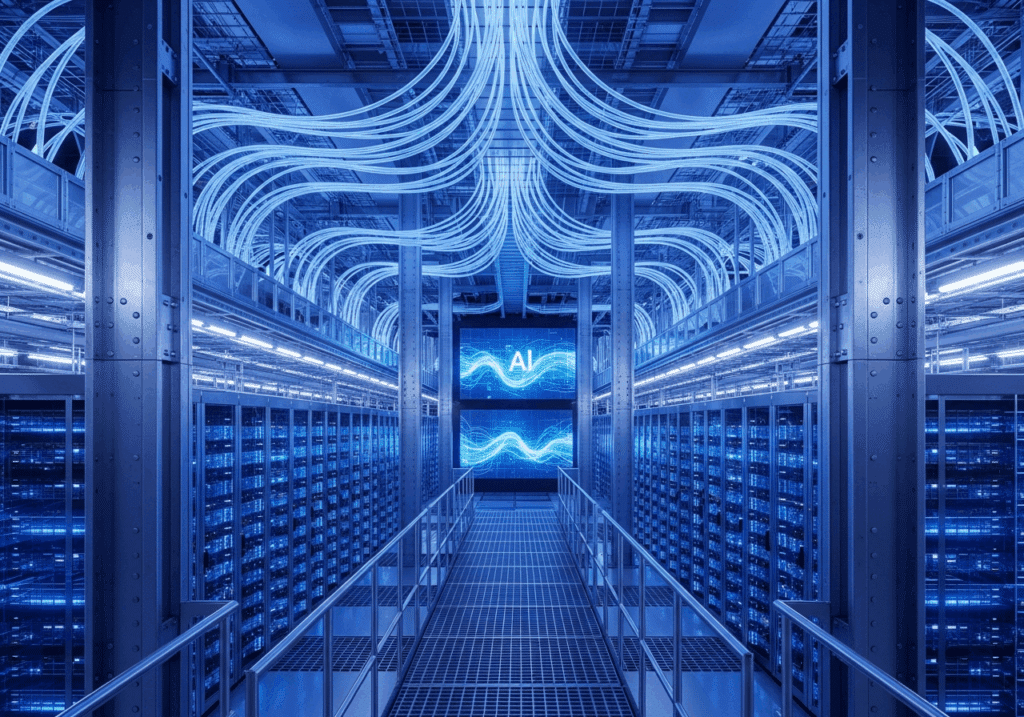

Sacks emphasized the administration’s infrastructure-focused approach: “We do want to make permitting and power generation easier. The goal is rapid infrastructure buildout without increasing residential rates for electricity.”

This declaration followed controversial comments from OpenAI CFO Sarah Friar at a Wall Street Journal event, where she initially suggested the company might benefit from federal “backstop” guarantees for infrastructure financing. Friar later clarified on LinkedIn that she “muddied the point” and that OpenAI was not seeking government guarantees.

Timeline of Key Events

- November 5, 2025: OpenAI CFO Sarah Friar suggests federal “backstop” at WSJ Tech Live event

- November 5, 2025 (Evening): Friar walks back comments on LinkedIn

- November 6, 2025: David Sacks declares “no federal bailout for AI”

- November 7, 2025: Sam Altman reinforces position: “If we screw up and can’t fix it, we should fail”

Industry Reaction: Market Impact and Corporate Responses

The announcement triggered immediate reactions across the technology sector, with measurable market volatility and swift corporate clarifications.

Market Response

Market analysts noted increased volatility in AI-dependent stocks following Sacks’ announcement. On November 6, 2025, the SPDR S&P 500 ETF (SPY) dipped 0.94%, while the Nasdaq-100 tracking Invesco QQQ Trust (QQQ) dropped 1.65%. The volatility reflects broader concerns about whether AI stocks are forming a bubble, with ripple effects extending to cryptocurrency markets as Bitcoin crashed below $100K amid AI stock fears.

Corporate Clarifications

OpenAI CEO Sam Altman moved quickly to address concerns about the company’s financial strategy. In statements to media outlets, Altman said:

“If we screw up and can’t fix it, we should fail, and other companies will continue on doing good work and servicing customers. The ecosystem and economy would be fine.”

— Sam Altman, OpenAI CEO (Source: Reuters via MarketScreener)

Altman clarified that while OpenAI has discussed government loan guarantees for chip manufacturing facilities (as part of broader supply chain initiatives), the company has not sought guarantees for data center construction.

Startup and Investor Implications

For smaller AI companies and venture capital firms, the policy clarification signals several key changes:

- Higher due diligence standards: Investors will likely demand stronger business models and clearer paths to profitability, especially given concerns about potential AI market bubbles

- Increased capital costs: Without potential government backing, risk premiums may increase funding costs, particularly for compute-intensive operations amid surging demand for advanced AI chips

- Consolidation pressure: Smaller players may face acquisition pressure from larger firms with major cloud partnerships like OpenAI’s massive AWS deal

- Infrastructure opportunities: Companies focused on enabling infrastructure may benefit, especially those developing thermal management solutions like Samsung’s heat-pass technology for high-performance AI chips

- Geopolitical considerations: Supply chain resilience becomes crucial amid widening US restrictions on Nvidia chip exports to China

Policy Rationale: Free-Market Approach to AI Development

The Trump administration’s stance reflects several key philosophical and strategic considerations rooted in market-driven innovation principles.

Market Discipline and Competition

By refusing to backstop failing companies, the administration embraces the principle that market competition should determine winners and losers in the AI space. Sacks’ emphasis on the U.S. having “at least 5 major frontier model companies” suggests confidence in the sector’s competitive depth and resilience.

Avoiding Moral Hazard

The policy aims to prevent the moral hazard problem where companies take excessive risks knowing they might be rescued by taxpayers. In the capital-intensive AI sector, where companies like OpenAI have committed over $1.4 trillion in infrastructure spending, this consideration becomes particularly relevant.

Infrastructure Enablement Strategy

While financial bailouts are off the table, the administration continues to support infrastructure development through regulatory streamlining. Sacks has emphasized the importance of reducing regulatory barriers and accelerating power generation capacity for AI infrastructure while keeping residential electricity costs stable.

Historical Context: Government Intervention vs. Market-Led Innovation

The current policy represents a significant departure from various models of government involvement in emerging technologies throughout U.S. history.

Past Interventionist Approaches

Historically, the U.S. government has played significant roles in technology development through DARPA funding for internet infrastructure, support for semiconductor manufacturing, and crisis interventions like the 2008-2009 automotive industry bailouts. The internet itself emerged from government research initiatives, demonstrating how public investment can seed transformative technologies.

Hybrid Support Models

Recent administrations have typically employed mixed approaches: providing research grants, tax incentives, and regulatory support while avoiding direct financial guarantees for private companies. The CHIPS and Science Act, for example, provided substantial subsidies for semiconductor manufacturing while maintaining arms-length relationships with individual companies.

The New Market-First Paradigm

The Trump administration’s approach emphasizes infrastructure facilitation without financial underwriting, marking a distinct shift toward pure market-based risk allocation in AI development. This represents a philosophical bet that American entrepreneurial capacity and competitive markets will outperform state-directed approaches.

International Comparisons: Divergent Global AI Strategies

The U.S. position contrasts sharply with other major economies’ approaches to AI development, creating distinct competitive dynamics in the global AI race.

| Country/Region | Government Role | Financial Support | Regulatory Approach |

|---|---|---|---|

| United States (Trump) | Infrastructure Facilitator | No Bailouts/Limited Direct Support | Light Touch, Pro-Innovation |

| China | Direct Investor/Director | Substantial State Funding | State-Controlled Development |

| European Union | Regulator + Partner | Targeted Subsidies/Grants | Comprehensive AI Act Framework |

China’s State-Led Model

China pursues direct government investment in AI companies, state direction of strategic sectors, and substantial industrial policies designed to create national champions. This model provides stability and scale but may limit innovation through bureaucratic oversight.

European Union’s Regulatory-Plus-Support Model

The EU combines comprehensive regulation (such as the AI Act) with targeted subsidies and public-private partnerships, emphasizing safety, ethics, and privacy alongside innovation support. This approach prioritizes risk mitigation over rapid development.

Implications for Global Competition

For multinational companies and investors, these divergent approaches create a complex landscape: operating in the U.S. entails higher financial risk but potentially less regulatory burden; China offers state backing with more control; the EU provides regulatory clarity with compliance costs.

Economic Implications: AI Ecosystem and Investment Landscape

The policy shift will have wide-ranging effects across the AI investment ecosystem, from early-stage startups to established tech giants.

Impact on AI Startups

Increased Risk Assessment: Without government safety nets, both entrepreneurs and investors must assume complete market risk for business failures. This will likely accelerate the maturation of business models and financial planning in the sector.

Capital Market Adjustments: Venture capitalists and other investors may demand stronger proof of concept, clearer monetization strategies, and more conservative growth projections. The era of “growth at all costs” funding may give way to more disciplined capital allocation.

Infrastructure Cost Pressures: Companies requiring massive compute and power resources must secure private capital or face operational constraints, potentially favoring those with existing cloud partnerships or internal infrastructure capabilities.

Venture Capital and Investment Trends

Enhanced Due Diligence: Investment decisions will likely involve more rigorous financial modeling and technical risk assessment processes, with particular attention to cash burn rates and paths to profitability.

Portfolio Strategy Shifts: VCs may favor companies with proven revenue models or those serving essential enterprise functions over speculative consumer applications that might have previously counted on eventual government support.

Infrastructure Investment Opportunities: Given the administration’s support for infrastructure enabling, companies in data center development, power generation, and semiconductor manufacturing may attract increased investment as “picks and shovels” plays.

Large Technology Companies

Established players like Google, Microsoft, Amazon, and Meta may benefit from the policy through several mechanisms:

- Competitive advantages: Their existing infrastructure and revenue streams provide natural moats against smaller competitors facing funding pressures, with companies like Microsoft forming specialized superintelligence teams to dominate enterprise AI

- Acquisition opportunities: Distressed AI startups may become attractive acquisition targets at favorable valuations, especially those with innovative applications in sectors like AI wellness and healthcare

- Infrastructure partnerships: Government facilitation of power and permitting may accelerate their data center expansion plans, crucial for meeting surging demand for AI computing power

- Supply chain advantages: Better positioned to navigate evolving chip export restrictions due to their established vendor relationships and financial resources

Global Economic Impact

The policy may have broader implications for U.S. competitiveness in the global AI race. While market discipline could strengthen surviving companies, the absence of state support might disadvantage American firms competing against heavily subsidized Chinese or European counterparts in international markets.

AI Application Spillovers

The market-driven approach will particularly impact emerging AI applications across various sectors:

- Healthcare Innovation: Companies developing AI-powered wellness applications and breakthrough treatments like innovative weight loss medications will need stronger private funding strategies

- Biomedical Research: Promising developments such as AI-designed antibiotics for superbugs may face longer commercialization timelines without government backing

- Enterprise Solutions: Business-focused AI development, including efforts like Microsoft’s enterprise superintelligence initiatives, may benefit from clearer market signals and customer validation requirements

Frequently Asked Questions

Will the U.S. government provide any support for AI companies?

The Trump administration will support AI development through infrastructure facilitation (streamlined permitting, power grid connections) but will not provide financial bailouts or loan guarantees for private AI companies. The focus is on enabling the ecosystem rather than supporting individual companies.

How does this policy affect OpenAI and other major AI companies?

Major AI companies must operate without expecting federal rescue if their business models fail. They must rely entirely on private funding and revenue generation, which may accelerate the development of sustainable business models but also increases pressure on companies with high capital requirements. This shift occurs alongside major cloud infrastructure deals like OpenAI’s $38B AWS partnership and amid growing enterprise competition as companies like Microsoft form specialized AI teams.

What does this mean for AI startup funding?

AI startups may face higher capital costs and more stringent investor requirements, as the risk of business failure cannot be offset by potential government intervention. This will likely favor startups with clearer paths to profitability and less capital-intensive models, especially given current concerns about whether AI stocks are forming a market bubble. The policy adds another layer of risk assessment for investors already grappling with market volatility.

How does the U.S. approach compare to China’s AI strategy?

Unlike China’s state-led model with direct government investment and control, the U.S. is pursuing a market-driven approach where private companies bear full financial risk and reward. This creates different competitive dynamics and may favor different types of innovation.

Will this policy slow AI innovation in America?

The administration argues that market discipline will strengthen the sector by eliminating weaker players and ensuring only viable business models survive. Critics worry it could disadvantage U.S. companies competing against state-supported foreign rivals, particularly in capital-intensive areas like advanced semiconductor research.

What about infrastructure support for AI development?

The government will continue to facilitate AI infrastructure development through regulatory streamlining, faster permitting processes, and power grid modernization. The goal is to reduce systemic bottlenecks while maintaining market discipline for individual companies.

Key Takeaways for Business Leaders and Investors

Strategic Planning Imperatives

- Risk Management: Develop robust contingency plans that don’t rely on government rescue; build resilient business models that can weather market downturns

- Capital Strategy: Secure adequate private funding or develop self-sustaining revenue models; consider longer funding runways given increased market risk and concerns about potential AI market bubbles

- Infrastructure Focus: Leverage government infrastructure facilitation programs while tracking hardware innovations such as advanced thermal management technologies and navigating chip supply dynamics

- Global Positioning: Consider how the market-driven U.S. model affects competitiveness against state-supported international rivals, especially regarding evolving chip export restrictions

Investment Considerations

- Due Diligence Enhancement: Implement more rigorous financial and technical assessment processes; focus on unit economics and scalability while tracking chip availability and demand trends

- Portfolio Diversification: Balance speculative AI ventures with infrastructure investments, including emerging opportunities in healthcare applications and biomedical innovations

- Timeline Adjustments: Plan for potentially longer development cycles given increased capital constraints and higher survival thresholds

- Market Sensitivity: Monitor cross-asset correlations, particularly how AI stock volatility affects cryptocurrency markets and broader tech sentiment

- Strategic Partnerships: Consider consolidation opportunities and major infrastructure partnerships like large-scale cloud agreements

Policy Monitoring

- Regulatory Tracking: Monitor infrastructure facilitation policies and their implementation timelines

- International Competitiveness: Assess how U.S. policy compares to evolving approaches in China, EU, and other major markets

- Market Signals: Watch for early indicators of consolidation, funding difficulties, or competitive advantages emerging from policy implementation

Conclusion: Market-Led Innovation in the AI Era

The Trump administration’s definitive rejection of AI bailouts represents a clear philosophical choice: American AI leadership will be determined by market forces rather than government intervention. This approach emphasizes private sector responsibility, competitive discipline, and infrastructure enablement over financial guarantees.

For industry stakeholders, the message is unambiguous: success in the AI sector must be earned through market performance, not government backing. Companies must build sustainable business models, investors must carefully assess risks, and the entire ecosystem must operate under true market discipline.

While this policy may increase near-term financial pressures on AI companies, it also potentially strengthens the sector’s long-term competitiveness by eliminating moral hazard and ensuring that only viable business models survive and thrive. The approach represents a bet on American entrepreneurial capacity and market dynamics as the best mechanism for achieving AI leadership.

The global implications are significant: as China pursues state-led AI development and Europe balances regulation with support, America is betting that market-driven innovation will prove superior in the long run. The success or failure of this approach will likely influence global AI policy frameworks for years to come, making 2025 a critical year for observing the practical outcomes of these divergent strategies.

For investors and entrepreneurs, the new landscape demands greater financial discipline but also potentially offers clearer competitive advantages for those who can successfully navigate market-based selection pressures. The companies that emerge from this environment may be more resilient, efficient, and globally competitive than those that might have developed under government protection.

Related Coverage from Sezarr Overseas News

AI Market & Investment Analysis

- Are AI Stocks Driving 75% of Market Returns? Bubble Analysis

- Bitcoin Crashes Below $100K as AI Stock Fears Trigger Crypto Selloff

- OpenAI’s $38B AWS Deal Reshapes AI Cloud Competition Forever

AI Technology & Innovation

- Microsoft Forms Superintelligence Team to Lead Enterprise AI Race

- Nvidia CEO Reports Surging Demand for Blackwell AI Chips

- Samsung Exynos 2600 Heat-Pass Block: Thermal Breakthrough

AI Applications in Healthcare

- AI Wellness Apps Transform Personalized Healthcare in 2025

- AI Breakthrough: MIT Designs Millions of Antibiotics vs Superbugs

- Oral Weight Loss Pill Shows 16.6% Results Rivaling Ozempic Shots

Global Trade & Policy

External Resources

- CNBC: Artificial Intelligence News Coverage

- White House: Artificial Intelligence Initiatives

- Reuters: AI Technology Coverage

Primary Sources: CNBC, Reuters, Official X/Twitter statements, and verified government communications as of November 11, 2025.

Conflict of Interest Disclosure: Sezarr Overseas News maintains editorial independence and has no financial interests in the companies or policies discussed in this analysis.

Editorial Standards: All quotes and claims have been verified against primary sources. This analysis represents our editorial team’s interpretation of publicly available information and should not be considered investment advice.

Last Updated: November 11, 2025