Published: November 19, 2025 | Author: Sezarr | Reading Time: 12 minutes

TL;DR: Key Takeaways for 2025 Stock Market

Global equities face a year of modest, selective returns rather than broad rallies in 2025. The International Monetary Fund projects global growth at 3.2% in 2025, slowing to 3.1% in 2026—signaling constrained earnings expansion across major indices. Leading research houses including Goldman Sachs, Morgan Stanley, and J.P. Morgan forecast single-digit to low double-digit gains for core indices, with specific opportunities in AI and cloud infrastructure, renewable energy systems, and selective emerging market exposures.

The winning strategy centers on thematic selection, quality anchoring, and tactical liquidity management—not passive index investing. Investors who actively rotate between high-conviction sectors while maintaining defensive positions will likely capture the best risk-adjusted returns.

Investment Disclaimer: This article provides educational information and market analysis based on current economic projections from the International Monetary Fund, Federal Reserve, Goldman Sachs, Morgan Stanley, and other authoritative sources. It does not constitute personalized financial advice, investment recommendations, or solicitation to buy or sell securities. Stock market investments carry inherent risks, including potential loss of principal. Past performance does not guarantee future results. Consult with a qualified financial advisor before making investment decisions tailored to your specific financial situation, risk tolerance, and investment objectives.

1. Macroeconomic Picture: Growth, Inflation, and Interest Rates

Slow But Steady: Global Growth Outlook

The International Monetary Fund’s October 2025 World Economic Outlook projects global economic growth decelerating to 3.2% in 2025, followed by 3.1% in 2026. This represents a meaningful slowdown from 3.3% growth in 2024 and remains substantially below the pre-pandemic historical average of 3.7%. Advanced economies are forecast to expand at approximately 1.5% annually, while emerging market and developing economies will grow just above 4%.

This moderate growth trajectory supports earnings expansion but significantly weakens the case for broad market multiple expansion. The EFG International analysis notes that while revised forecasts for 2025 show 0.2 percentage points improvement from July projections, the outlook reflects persistent trade tensions, elevated uncertainty, and constrained investment activity.

For United States equity markets specifically, growth is expected to moderate to 2.0% in 2025 before marginally accelerating to 2.1% in 2026, according to IMF data. This deceleration from 2024’s stronger pace creates a challenging environment for companies dependent on robust domestic consumption.

Inflation Trajectory and Central Bank Policy Stance

Global inflation readings have moderated substantially from 2022-2023 peaks, with the IMF projecting headline inflation declining to 4.2% in 2025 and further to 3.6% in 2026. However, significant regional variation persists. The United States faces above-target inflation with upside risks, while many other economies experience more subdued price pressures.

The Federal Reserve implemented a 25 basis point rate cut in September 2025, reducing the federal funds rate to a target range of 4.00%-4.25%. Federal Open Market Committee projections indicate a median federal funds rate of 3.50%-3.75% by end-2025, with only one additional quarter-point cut anticipated in 2026. This conservative easing path reflects persistent inflation concerns and labor market resilience.

J.P. Morgan Global Research expects two more rate cuts in 2025, followed by one in 2026, characterizing the September move as a “risk management cut” rather than the start of an extended easing cycle. The divergence between dovish FOMC dot plot projections and more hawkish inflation forecasts suggests monetary policy will remain data-dependent and potentially restrictive longer than markets initially anticipated.

Implications for Equity Markets

The macroeconomic environment creates several direct implications for equity investors:

Constrained Earnings Growth: Moderate GDP expansion limits revenue growth potential across sectors, making earnings beats more difficult and reducing justification for valuation premium expansion.

Interest Rate Sensitivity: If the Federal Reserve cuts rates more aggressively than current projections suggest, growth-oriented equities will receive a meaningful tailwind through improved discount rates. Conversely, if rates remain elevated due to persistent inflation, defensive sectors, value stocks, and dividend-paying companies will likely outperform.

Regional Divergence: Emerging markets growing at 4% create selective opportunities for investors willing to conduct country-level fundamental analysis, particularly in economies with reform momentum and manageable debt levels.

2. What Major Investment Banks Are Predicting for 2025

Leading asset managers and investment banks have released their 2025 outlooks, providing valuable baseline scenarios for portfolio planning. While consensus exists around modest positive returns, the range of outcomes remains wide, reflecting elevated uncertainty.

Goldman Sachs: Measured Optimism with Concentration Concerns

Goldman Sachs forecasts the S&P 500 reaching 6,500 by year-end 2025, representing an approximate 10% total return including dividends. Chief U.S. equity strategist David Kostin projects earnings per share growth of 11% in 2025 and 7% in 2026, supported by 2.5% real GDP growth and corporate revenue expansion aligned with 5% nominal GDP growth.

However, Goldman Sachs emphasizes that current valuations at 21.7x forward P/E ratio rank in the 93rd historical percentile, creating meaningful downside risk if economic conditions deteriorate. The firm notes that the Magnificent Seven technology stocks will continue outperforming but by only seven percentage points—the narrowest margin in seven years—suggesting broader market participation.

Goldman Sachs identifies tariff risks and higher bond yields as primary threats to the base case, while acknowledging that friendlier fiscal policy or more dovish Federal Reserve action could drive upside scenarios.

Morgan Stanley: Embracing Market Breadth

Morgan Stanley similarly targets 6,500 for the S&P 500, with strategist Michael Wilson highlighting the potential for Fed rate cuts and post-election policy clarity to drive sentiment materially higher. The firm emphasizes that earnings growth is broadening beyond mega-cap technology, with mid-single-digit revenue growth, expanding profit margins, and improving business cycle indicators supporting the forecast.

Morgan Stanley maintains an unusually wide range of outcomes: bull case of 7,400 (26% upside), base case of 6,500, and bear case of 4,600 (22% decline). This reflects the heightened uncertainty around trade policy, immigration enforcement, and government spending trajectories under shifting political priorities.

J.P. Morgan: AI Investment Cycle Driving Momentum

J.P. Morgan projects the S&P 500 reaching 6,500, emphasizing that 2025 represents a transition year focused on how low interest rates can ultimately decline rather than when cuts begin. The bank highlights AI-driven investments and improving global economic policy coordination as key growth drivers.

J.P. Morgan expects the global easing cycle to support risk assets including equities and high-yield bonds, though the firm cautions against expecting a surge in corporate borrowing despite lower rates. The bank notes that strong corporate balance sheets and elevated debt servicing costs will keep credit expansion measured.

Calibrating Your Baseline Scenarios

Investors should use these institutional forecasts to establish a probabilistic framework rather than treating any single prediction as definitive. The clustering of major banks around 6,500 (approximately 9-10% gains) provides a reasonable central tendency, while the wide dispersion of bull and bear cases underscores the importance of portfolio hedging and position sizing discipline.

3. Sectors and Investment Themes Positioned for Outperformance

The 2025 market environment demands sector-selective investing rather than broad index exposure. Below are the investment themes with the strongest evidence-backed cases for alpha generation.

Artificial Intelligence and Cloud Infrastructure

Investment Thesis: Enterprise adoption of generative AI and large language model deployment is creating incremental revenue streams across the technology stack, from cloud service providers to semiconductor manufacturers to data center real estate investment trusts.

Google Cloud’s 2025 State of AI Infrastructure Report reveals that 98% of organizations are actively exploring generative AI applications, with 39% already deploying AI capabilities in production environments. This widespread adoption is driving unprecedented demand for AI-optimized infrastructure.

Goldman Sachs projects cloud revenues reaching $2 trillion by 2030, with infrastructure-as-a-service capturing $580 billion (29% of total) and platform-as-a-service expanding rapidly. The investment bank’s analysis indicates that 9% of IT budgets will be allocated specifically to generative AI within three years—up from 7% in early 2025.

Major cloud service providers including Microsoft, Amazon, Alphabet, and Meta are projected to invest approximately $250 billion in capital expenditures during 2025, with significant portions dedicated to AI infrastructure. TrendForce research indicates hyperscale data center capacity is doubling every four years, driven by AI workload expansion.

Specific Opportunities:

- Cloud hyperscalers with proven AI monetization (Microsoft Azure AI, Amazon Web Services, Google Cloud Platform)

- GPU and AI accelerator supply chains (NVIDIA, AMD, specialized ASIC developers)

- Data center REITs and colocation providers (Equinix secured $15 billion for AI data center buildout)

- Enterprise software companies monetizing AI features through premium pricing tiers

Risk Factors: Revenue recognition timing challenges, elongated capital expenditure cycles creating near-term margin pressure, regulatory scrutiny on AI data usage and intellectual property, and potential customer pushback on AI premium pricing.

For deeper analysis on AI infrastructure build-out and supply chain dynamics, see our comprehensive guide on AI Infrastructure 2026: Data Centers, Chips & Sustainability.

Clean Energy and Renewable Infrastructure

Investment Thesis: Global clean energy investment is reaching a historic $2.2 trillion in 2025 according to the International Energy Agency, driven not only by decarbonization commitments but also by energy security concerns, industrial policy objectives, and the fundamental cost competitiveness of renewable technologies.

Solar photovoltaic investment alone is projected to reach $450 billion in 2025, making it the single largest energy investment category globally. This unprecedented capital deployment reflects solar technology’s favorable economics—particularly panels manufactured in China—and supports sustained revenue growth for companies across the solar value chain.

Battery energy storage investment is surging to $66 billion in 2025, critical for integrating variable renewable generation into electricity grids. Lithium-ion battery costs have declined 90% over the past decade and fell an additional 40% in 2024 alone, creating powerful unit economics for storage deployments.

The IEA notes that electricity sector investment is reaching $1.5 trillion in 2025—50% higher than combined spending on oil, natural gas, and coal. This structural shift toward electrification creates durable, long-term tailwinds for utilities, grid infrastructure providers, and renewable generation companies.

Specific Opportunities:

- Regulated utilities modernizing transmission and distribution networks to accommodate renewable penetration

- Battery manufacturers and energy storage system integrators benefiting from declining costs and rising demand

- Solar and wind original equipment manufacturers with diversified geographic exposure

- Infrastructure funds focused on renewable energy and grid modernization projects

- Electric vehicle charging infrastructure as transportation electrification accelerates

Geographic Considerations: BloombergNEF reports that U.S. renewable investment declined 36% in the first half of 2025 due to policy uncertainty, while EU-27 investment surged 63%. China maintains dominant market share at 44% of global renewable investment. Investors should favor markets with stable policy frameworks and clear regulatory visibility.

Risk Factors: Policy reversals in key markets, grid interconnection delays, supply chain bottlenecks for critical components (transformers, cables), rising interest rates increasing project financing costs, and potential raw material price volatility for battery components.

Quality Defensive and Dividend Value

Investment Thesis: If economic growth disappoints relative to consensus forecasts or if interest rates remain elevated longer than markets anticipate, investors will rotate toward high-quality companies with sustainable dividend yields, defensive revenue streams, and recession-resistant business models.

This positioning provides portfolio stabilization when capital appreciation stalls while generating meaningful income. Healthcare companies, regulated utilities, consumer staples with pricing power, and real estate investment trusts in defensive property types offer attractive risk-adjusted return profiles in a lower-growth environment.

Specific Opportunities:

- Healthcare services and pharmaceutical companies with demographic tailwinds from aging populations

- Regulated utilities with transparent rate mechanisms and infrastructure investment mandates

- Consumer staples companies demonstrating pricing power and brand strength during inflation periods

- Dividend aristocrats with multi-decade track records of consistent dividend growth

Valuation Discipline: Even within defensive sectors, valuation matters. Focus on companies trading at reasonable multiples relative to their growth rates and dividend sustainability. Avoid reaching for yield in companies with deteriorating fundamentals or unsustainable payout ratios.

Emerging Markets: Selective, Fundamentals-Driven Exposure

Investment Thesis: The IMF projects emerging market and developing economy growth at approximately 4.2% in 2025—substantially outpacing advanced economy growth of 1.5%. This growth differential creates opportunities for investors willing to conduct rigorous country and company-level analysis.

However, the outlook varies dramatically across regions. Robeco Global notes that India, ASEAN nations, and Middle Eastern economies show particularly strong prospects, supported by healthy balance sheets, low debt levels, and reform momentum. In contrast, some Latin American and African markets face persistent challenges including high inflation, fiscal constraints, and political instability.

The World Bank’s Global Economic Prospects report emphasizes that emerging markets with robust policy frameworks, central bank independence, and manageable external debt positions are better positioned to navigate global risk-off episodes. Countries that have improved monetary and fiscal credibility demonstrate reduced reliance on costly foreign exchange interventions.

Geographic Priorities:

- India: 6.6% growth projected for 2025, driven by infrastructure investment, digital economy expansion, and favorable demographics. Surpassed 2030 renewable energy targets nine years early.

- ASEAN Markets: Indonesia, Vietnam, and Thailand offer export diversification opportunities and benefit from supply chain realignment away from China-centric manufacturing.

- Middle East: Saudi Arabia and UAE implementing economic diversification programs, with growth accelerating to 4% in 2025 as oil production cuts unwind.

- Select Latin America: Mexico benefits from nearshoring trends despite political uncertainties; Brazil faces challenging fiscal dynamics but offers commodity exposure.

Risk Management: Emerging market investments carry elevated risks including currency volatility, political instability, regulatory unpredictability, and liquidity constraints. Investors should maintain geographic diversification, favor companies with dollar-denominated revenues, and size positions appropriately relative to risk tolerance.

Avoid Markets With: Macro fragility indicators (high inflation, unsustainable debt levels, weak central bank independence), political instability, weak rule of law, and limited export diversification creating commodity dependence.

4. Valuation Framework and Return Scenarios for 2025

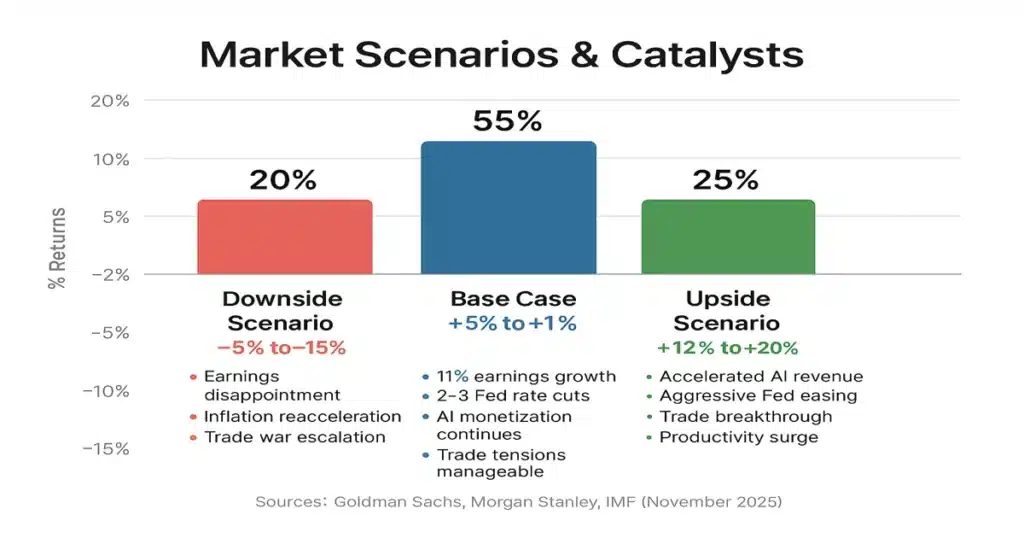

Rather than relying on single-point estimates, sophisticated investors should employ a scenario-based framework that assigns probabilities to multiple outcomes and adjusts portfolio positioning accordingly.

Base Case Scenario (55% Probability): Modest Positive Returns

Expected Return Range: +5% to +10% for major U.S. equity indices

Key Assumptions:

- Earnings growth of 8-11% driven by revenue expansion and moderate margin stability

- Limited P/E multiple expansion or slight compression from elevated current levels

- Federal Reserve implements 2-3 quarter-point rate cuts through 2025

- Inflation continues gradual decline toward 2% target without disruptive spikes

- Trade tensions remain manageable without escalation to comprehensive tariff regime

- Corporate profit margins hold near current levels despite wage pressure

This scenario aligns with institutional forecasts from Goldman Sachs, Morgan Stanley, and J.P. Morgan. It assumes the economy avoids both recession and overheating, with growth sufficient to support earnings but insufficient to drive aggressive multiple expansion.

Upside Scenario (25% Probability): Accelerated Gains

Expected Return Range: +12% to +20% for major U.S. equity indices

Key Catalysts:

- AI monetization proving faster and more scalable than consensus expectations, driving substantial revenue acceleration in technology and related sectors

- Federal Reserve cutting rates more aggressively (100+ basis points) due to labor market weakening or financial stability concerns

- Breakthrough in trade negotiations reducing tariff barriers and policy uncertainty

- Productivity surge from AI adoption driving margin expansion across sectors

- Consumer spending resilience surprising to the upside, supporting retail and discretionary sectors

Morgan Stanley’s bull case of 7,400 for the S&P 500 (26% upside) represents the optimistic end of this range, contingent on multiple positive developments occurring simultaneously.

Downside Scenario (20% Probability): Material Correction

Expected Return Range: -5% to -15% for major U.S. equity indices

Key Risks:

- Earnings deceleration sharper than anticipated as revenue growth stalls and margin pressure intensifies

- Inflation reaccelerates due to supply shocks, wage spirals, or policy mistakes, forcing Federal Reserve to tighten rather than ease

- Credit event or financial stability shock causing rapid tightening of financial conditions

- Trade war escalation creating significant supply chain disruptions and cost increases

- Geopolitical crisis (conflict escalation, energy shock) disrupting global growth

- AI investment boom revealed as overbuilt, triggering sharp correction in technology valuations

Morgan Stanley’s bear case of 4,600 (22% decline) captures the lower end of this range, though tail risks could drive even more severe outcomes.

Practical Valuation Metrics for 2025

In 2025’s environment, traditional price-to-earnings ratios alone provide weak timing signals due to elevated valuations and compressed interest rates. Instead, investors should focus on:

Earnings Momentum and Revision Trends: Companies demonstrating positive earnings revisions and accelerating sequential growth warrant premium valuations. Monitor quarterly earnings beat rates and forward guidance trajectory.

Free Cash Flow Generation: Prioritize companies converting earnings into actual cash flows available for shareholder distributions. Strong free cash flow yields provide downside protection and enable companies to navigate economic uncertainty.

Margin Durability: In an environment of moderate growth and persistent labor cost pressure, companies with pricing power, operating leverage, and defendable margin structures will outperform. Gross margin trends often provide early signals of competitive positioning changes.

PEG Ratio Analysis: Price-to-earnings-to-growth ratios below sector medians identify companies where growth justifies valuation. This metric proves particularly valuable when comparing within sectors where P/E ratios may not capture growth differential.

Relative Valuation Within Sectors: Compare companies against sector peers rather than absolute historical averages, as structural changes in interest rates and growth potential have shifted equilibrium valuation ranges.

5. Tactical Portfolio Playbook: Actionable Implementation Framework

Translating market outlook into portfolio positioning requires disciplined asset allocation, position sizing, and risk management. The following framework provides a structured approach for investors with moderate risk tolerance.

Core Holdings (50-60% of Equity Allocation)

Objective: Provide stable foundation with diversified exposure to large-cap quality companies demonstrating earnings consistency, balance sheet strength, and sustainable competitive advantages.

Implementation:

- S&P 500 index or quality-factor ETFs providing broad market exposure

- Dividend growth ETFs focused on companies with 10+ year dividend increase streaks

- Individual blue-chip positions in defensive sectors (healthcare, consumer staples, utilities)

- Target companies with return on equity exceeding 15%, debt-to-equity below sector median, and free cash flow margins above 10%

Core holdings should remain relatively stable throughout the year, with rebalancing occurring quarterly or when positions drift beyond target allocations by 5+ percentage points.

Thematic Growth (20-30% of Equity Allocation)

Objective: Capture alpha through exposure to structural growth themes with multi-year tailwinds and positive earnings revision momentum.

Primary Themes:

- AI and Cloud Infrastructure (10-15%): Combination of cloud hyperscalers, semiconductor companies with AI exposure, and data center REITs. Consider splitting between large-cap leaders (Microsoft, Amazon, Alphabet, NVIDIA) and selective mid-cap specialists.

- Clean Energy and Electrification (8-12%): Exposure through renewable energy developers, regulated utilities with significant renewable portfolios, battery storage companies, and electric vehicle charging infrastructure. Favor companies with geographic diversification and visible project pipelines.

- Data Center and Digital Infrastructure (3-5%): REITs and infrastructure companies benefiting from AI-driven demand for computing capacity and network connectivity.

Risk Management: Use stop-loss orders at 15-20% below entry points for thematic positions. Take partial profits when positions appreciate 30-50%, redeploying proceeds into core holdings or rebalancing within themes.

For evidence-based approaches to thematic investing and portfolio construction, consult our guide on Evidence-Based Investment Strategies for 2025.

Opportunistic and Tactical (10-15% of Equity Allocation)

Objective: Generate incremental returns through selective positioning in higher-volatility opportunities with asymmetric risk-reward profiles.

Implementation:

- Selective Emerging Markets (5-8%): Country-specific ETFs or individual companies in India, select ASEAN markets (Indonesia, Vietnam), and Middle Eastern markets (Saudi Arabia, UAE). Favor companies with dollar-denominated revenues, low net debt, and export orientation.

- Small-Cap and Mid-Cap Specialists (3-5%): Companies with clear AI integration strategies, proprietary technology advantages, or niche market leadership. These positions require intensive due diligence and close monitoring.

- Special Situations (2-3%): Merger arbitrage opportunities, spinoffs with clear value creation thesis, or deeply undervalued situations with near-term catalysts.

Position Sizing Discipline: Individual opportunistic positions should not exceed 2% of total portfolio value at cost. Use trailing stops to protect capital if investment thesis deteriorates.

Strategic Liquidity and Hedges (5-10% of Allocation)

Objective: Maintain dry powder for tactical rebalancing during market dislocations while providing portfolio protection during drawdowns.

Implementation:

- Cash and Money Market Funds (3-5%): Maintaining 3-5% cash reserves enables opportunistic deployment during 5-10% market corrections without forced selling of core positions. Current money market yields near 5% make cash holdings less costly than in prior low-rate environments.

- Protective Options Strategies (2-3%): Consider out-of-the-money put spreads on S&P 500 or concentrated thematic positions during periods of low volatility (VIX below 15). Collar strategies can protect appreciated positions while generating premium income.

- Defensive Positioning (2-3%): Maintain exposure to inverse correlation assets that historically perform during equity stress periods. This might include gold exposure, long-duration Treasuries, or defensive currency positions.

Rebalancing Discipline and Monitoring Framework

Quarterly Rebalancing: Review portfolio allocations quarterly, rebalancing when any allocation drifts beyond ±5 percentage points from target. This mechanical discipline forces profit-taking in outperforming assets and adds to underweights.

Earnings Season Vigilance: Technology and growth thematic positions warrant close monitoring during quarterly earnings seasons. Be prepared to exit positions showing revenue deceleration, margin compression, or deteriorating guidance.

Macro Trigger Points: Establish predetermined trigger points for major allocation shifts, such as Federal Reserve policy error signals (unexpected tightening), recession indicators (inverted yield curve, leading economic indicators), or technical breakdowns (S&P 500 breaking 200-day moving average on high volume).

Example Portfolio Allocation (Moderate Risk Profile)

Total Portfolio Breakdown:

- 55% Core Quality and Dividend Growth

- 25% Thematic Growth (12% AI/Cloud, 10% Clean Energy, 3% Digital Infrastructure)

- 12% Opportunistic (6% Selective EM, 4% Small/Mid-Cap Specialists, 2% Special Situations)

- 8% Strategic Cash and Hedges

This allocation provides balanced exposure to secular growth themes while maintaining defensive positioning through quality core holdings and strategic liquidity reserves.

6. Critical Market Triggers to Monitor Throughout 2025

Successful investing requires not only establishing initial positions but also continuously monitoring key variables that could alter the fundamental investment thesis. The following triggers warrant close attention.

Federal Reserve Policy Path and Inflation Data

What to Watch:

- Monthly CPI and PCE Reports: Core Personal Consumption Expenditures inflation remaining persistently above 2.5% would likely slow or halt Fed rate cuts, creating headwinds for growth stocks. Monitor services inflation particularly closely, as goods inflation has largely normalized.

- FOMC Meeting Minutes and Press Conferences: Fed Chair Jerome Powell’s characterization of inflation progress and labor market conditions provides crucial forward guidance. Pay attention to shifts in tone regarding achieving dual mandate objectives.

- Dot Plot Projections: Quarterly updates to FOMC members’ interest rate forecasts indicate whether policy consensus is shifting toward faster or slower easing. Significant divergence in dots suggests heightened internal debate.

- Labor Market Indicators: Monthly nonfarm payroll reports, unemployment rate trends, and wage growth data directly influence Fed policy stance. Unemployment rising toward 4.5% would likely accelerate rate cuts, while persistent wage growth above 4% could delay easing.

Quarterly Earnings and AI Monetization Cadence

Technology Sector Earnings: Revenue growth rates, operating margin trends, and forward guidance from Microsoft, Amazon, Alphabet, Meta, NVIDIA, and other AI-exposed companies provide real-time signals on monetization progress. Watch for:

- Cloud services revenue acceleration or deceleration

- AI product attach rates and average revenue per user increases

- Capital expenditure guidance changes suggesting altered AI investment plans

- Margin impact from AI infrastructure investments

Broader Market Earnings Quality: Monitor earnings beat rates across sectors, not just technology. Sustained earnings beats in cyclical sectors (industrials, materials) signal economic resilience, while defensive sector outperformance suggests economic concerns.

For sector-specific analysis on AI healthcare applications and regulatory developments, explore AI in Healthcare 2025: Diagnosis & Clinical Workflows.

Geopolitical Developments and Trade Policy

Tariff Announcements and Trade Negotiations: Changes in trade policy create immediate impacts on supply chains, input costs, and corporate margins. The IMF’s research demonstrates that trade tensions have already reduced global growth forecasts by 0.8 percentage points. Monitor:

- U.S.-China trade negotiations and tariff rate changes

- Sector-specific tariffs on semiconductors, electric vehicles, renewable energy components

- European Union trade policy shifts affecting technology and automotive sectors

- Supply chain diversification announcements from multinational corporations

Geopolitical Flashpoints: Escalation in regional conflicts, energy supply disruptions, or cyberattack incidents can trigger rapid market volatility and sector rotations. Maintain awareness of Middle East developments (oil price impact), Taiwan Strait tensions (semiconductor supply risk), and Eastern Europe stability.

Macroeconomic Surprise Indices

Leading Economic Indicators: Conference Board Leading Economic Index, ISM Manufacturing PMI, and global composite PMI readings provide forward-looking signals on economic trajectory. Consecutive months of contraction (readings below 50) historically precede economic slowdowns.

Credit Spreads and Financial Conditions: Widening high-yield bond spreads relative to investment-grade credit signal rising recession probability and warrant defensive positioning. The Chicago Fed National Financial Conditions Index provides comprehensive assessment of financial stress.

Commodity Price Movements: Surging energy prices increase inflation risks and input costs, while copper and industrial metals prices provide real-time indicators of global growth expectations. Watch for supply disruptions in critical battery materials (lithium, cobalt) affecting clean energy theme.

Regulatory and Policy Developments

AI Regulation: Implementation timelines and enforcement mechanisms for AI governance frameworks create compliance costs and competitive dynamics. Monitor European Union AI Act enforcement, U.S. executive orders on AI safety, and China’s AI regulation evolution.

Stay informed on regulatory compliance requirements through our comprehensive EU AI Act 2025 Compliance Checklist.

Clean Energy Policy: Renewable energy incentives, carbon pricing mechanisms, and grid modernization funding affect sector profitability. U.S. policy shifts, Chinese subsidies, and European Green Deal implementation all create material impacts.

7. Key Risks and Portfolio Guardrails

Acknowledging and preparing for downside scenarios represents essential portfolio management discipline. The following risks warrant particular attention in 2025.

Earnings Disappointment: Largest Near-Term Risk

Goldman Sachs identifies earnings delivery as the single largest risk to the base case scenario. Current consensus expectations for 11% S&P 500 earnings growth embed significant optimism. If actual earnings come in below expectations due to revenue weakness, margin compression, or execution challenges, equity valuations will likely contract.

Specific Concerns:

- Technology sector earnings highly concentrated in a small number of mega-cap companies

- Bottom-up analyst estimates ($274 EPS consensus) exceeding top-down macroeconomic projections ($268 Goldman Sachs)

- Margin pressure from wage inflation, input cost increases, or competitive dynamics

- Consumer spending softness affecting retail, discretionary, and advertising-dependent businesses

Mitigation Strategy: Maintain quality tilt in portfolio, prioritize companies with visible earnings catalysts, use trailing stops to protect capital if earnings revisions turn negative.

Higher-for-Longer Interest Rate Environment

If inflation proves more persistent than Federal Reserve projections anticipate, monetary policy may need to remain restrictive longer or even tighten from current levels. This scenario disproportionately impacts:

- High-duration growth stocks with cash flows far in the future

- Unprofitable or marginally profitable companies dependent on capital markets access

- Commercial real estate facing refinancing challenges at higher rates

- Leveraged companies with floating rate debt

Defensive Positioning: Favor dividend-paying value stocks, companies with pricing power, short-duration business models, and strong balance sheets with manageable debt maturities.

AI Investment Bubble and Concentration Risk

The S&P 500’s heavy weighting toward mega-cap technology stocks creates significant concentration risk. The Magnificent Seven stocks (Apple, Microsoft, Amazon, Alphabet, Meta, NVIDIA, Tesla) represent approximately 30% of index market capitalization.

If AI monetization disappoints, capital expenditure returns prove inadequate, or regulatory actions constrain AI deployment, concentrated portfolios face substantial drawdown risk. The historical parallel to late-1990s dot-com concentration provides cautionary precedent.

Risk Management: Maintain broader market exposure beyond mega-cap technology, consider equal-weight index allocations, use sector caps to prevent over-concentration, employ protective options strategies on concentrated positions.

Geopolitical Shocks and Supply Chain Disruptions

The IMF’s analysis emphasizes that trade tensions, tariff escalation, and geopolitical conflicts represent material downside risks to the global growth outlook. Specific scenarios include:

- U.S.-China trade war escalation beyond current tariff levels

- Middle East conflict disrupting energy supplies and spiking oil prices

- Taiwan Strait tensions affecting semiconductor supply chains

- Cyberattacks targeting critical infrastructure or financial systems

Portfolio Positioning: Maintain geographic diversification, favor companies with resilient supply chains and domestic production capabilities, consider energy and commodity exposure as portfolio insurance.

8. Tactical Buy and Sell Signals for Active Portfolio Management

Consider Buying When:

- Positive Earnings Revision Momentum: Company or sector experiencing upward earnings estimate revisions from multiple analysts, suggesting improving fundamental trends ahead of market recognition.

- Technical Breakout with Volume Confirmation: Stock or sector breaking through resistance levels on above-average trading volume, indicating institutional accumulation. Combine technical signals with fundamental catalysts.

- Federal Reserve Dovish Pivot: Explicit Fed communications signaling increased concern about labor market deterioration or growth risks, suggesting accelerated rate cutting trajectory benefits growth-oriented equities.

- Valuation Dislocations: Quality companies trading at discounts to sector peers or historical valuation ranges due to temporary factors, technical selling pressure, or investor neglect. Require fundamental catalyst for revaluation.

- Sentiment Extremes: Market-wide pessimism (VIX above 25, put-call ratios elevated, investor sentiment surveys showing extreme bearishness) often creates buying opportunities in quality names.

Consider Trimming or Selling When:

- Valuation Divergence Widening: Position trading at significant premium to sector peers (20%+ P/E premium) without commensurate growth or quality advantages. Take partial profits and rebalance.

- Negative Earnings Revisions: Multiple analyst downgrades, company pre-announcing earnings shortfalls, or sequential guidance cuts indicating deteriorating fundamentals. Sell before broader market recognition drives further weakness.

- Macroeconomic Data Persistent Disappointment: Three consecutive months of major economic indicators (employment, manufacturing PMI, consumer confidence) surprising to downside suggests slowing growth requires defensive positioning.

- Technical Breakdown Below Support: Violation of 200-day moving average on high volume, particularly if accompanied by declining relative strength versus sector or market. Use as stop-loss signal to preserve capital.

- Position Size Excessive: Individual holdings exceeding 5-7% of portfolio value (core positions) or 2-3% (thematic/opportunistic positions) due to appreciation. Rebalance to maintain diversification and manage concentration risk.

Hold and Monitor When:

- Fundamentals remain intact but near-term volatility driven by technical factors or sector rotation

- Company guiding conservatively but setting up for potential positive surprises

- Broader market correction creates temporary weakness in quality holdings

- Long-term thesis unchanged despite quarterly earnings noise

9. Practical Stock Selection Checklist for Individual Position Analysis

Use the following framework to evaluate individual stock opportunities and maintain discipline in position selection:

Earnings and Growth Quality

- ✓ Earnings growth visibility exceeding 10% year-over-year or showing acceleration

- ✓ Revenue growth outpacing or in line with earnings growth (not solely margin-driven)

- ✓ Earnings beat history: Company beating consensus estimates in at least 70% of recent quarters

- ✓ Forward guidance: Management providing or raising full-year guidance

Cash Flow and Balance Sheet Strength

- ✓ Free cash flow positive and growing, with conversion ratios (FCF/Net Income) above 80%

- ✓ Net debt-to-EBITDA below 3.0x (or industry-appropriate level for capital-intensive sectors)

- ✓ Interest coverage ratio above 5x, ensuring comfortable debt servicing capacity

- ✓ Return on invested capital exceeding weighted average cost of capital by 5+ percentage points

Catalyst Window and Timing

- ✓ Near-term catalyst within 3-6 months: product launch, contract announcement, regulatory approval, earnings inflection

- ✓ AI monetization levers clearly articulated with revenue visibility

- ✓ Management credibility: Track record of meeting or exceeding commitments

- ✓ Industry tailwinds supporting secular growth independent of company-specific execution

Valuation Versus Growth Profile

- ✓ Price-to-earnings-to-growth (PEG) ratio below 1.5x and less than sector median

- ✓ Forward P/E multiple justified by growth rate, competitive positioning, and margin profile

- ✓ Enterprise value-to-sales ratio reasonable relative to gross margins and growth trajectory

- ✓ Relative valuation versus closest peers: Not trading at unjustified premium

Competitive Position and Moat

- ✓ Sustainable competitive advantages: Network effects, switching costs, intangible assets, cost advantages

- ✓ Market share stability or expansion in core markets

- ✓ Pricing power demonstrated through maintaining gross margins during input cost inflation

- ✓ Management quality: Capital allocation discipline, shareholder-aligned incentives, transparent communication

Risk Assessment

- ✓ Customer concentration risk: No single customer exceeding 20% of revenue

- ✓ Regulatory risk evaluation: Clear understanding of regulatory environment and compliance posture

- ✓ Technology disruption risk: Company positioned as disruptor rather than disrupted

- ✓ Liquidity assessment: Average daily trading volume supporting position sizing without market impact

Position Initiation Discipline: Require meeting at least 80% of checklist criteria (16 of 20 items) before establishing new positions. If analysis reveals concerning gaps, either pass on opportunity or size position smaller to reflect elevated uncertainty.

Frequently Asked Questions: 2025 Stock Market Outlook

Will the S&P 500 rally more than 10% in 2025?

Major investment banks including Goldman Sachs and Morgan Stanley project the S&P 500 reaching approximately 6,500 by year-end 2025, representing gains of 8-10% from recent levels around 6,000. This outlook depends on sustained earnings growth of approximately 11%, Federal Reserve rate cuts totaling 50-75 basis points, and continued AI monetization. However, elevated valuations (P/E ratio at 93rd historical percentile) and trade uncertainties create meaningful downside risks. Upside scenarios projecting 12-20% gains require either accelerated AI revenue realization or more aggressive Fed easing than currently projected.

Is artificial intelligence creating a stock market bubble in 2025?

AI valuations are concentrated in a small number of mega-cap technology stocks, creating concentration risk similar to late-1990s dot-com dynamics. However, current AI investments demonstrate more fundamental revenue generation than prior technology bubbles. Goldman Sachs projects 11% S&P 500 earnings growth for 2025, with significant portions driven by genuine AI monetization rather than speculative investment. The key distinction is selective, fundamental investing focusing on companies with proven AI revenue streams (Microsoft Azure AI, Amazon Web Services, Google Cloud Platform showing double-digit AI revenue growth) versus broad technology exposure. Investors should maintain discipline on valuations and position sizes within AI-related holdings.

Should investors overweight emerging markets in 2025?

The IMF projects emerging market and developing economy growth at approximately 4.2% in 2025—more than double advanced economy growth of 1.5%. However, meaningful selectivity is crucial rather than broad emerging market exposure. Focus on countries demonstrating strong fundamentals: India (6.6% growth, infrastructure investment, digital economy expansion), select ASEAN markets (Indonesia, Vietnam benefiting from supply chain diversification), and Middle Eastern economies (Saudi Arabia, UAE implementing economic reforms). Avoid markets exhibiting macro fragility indicators including high inflation (above 10%), unsustainable debt levels (government debt-to-GDP exceeding 80% with widening deficits), weak central bank independence, or heavy commodity dependence. Robeco Global research emphasizes that emerging markets with healthy balance sheets and low debt levels are positioned for outperformance, but country-level analysis remains essential.

What Federal Reserve interest rate policy can investors expect in 2025?

The Federal Reserve reduced rates by 25 basis points in September 2025, bringing the federal funds rate to 4.00%-4.25%. FOMC projections indicate a median estimate of 3.50%-3.75% by end-2025, suggesting two additional quarter-point cuts. However, only one cut is projected for 2026, bringing rates to 3.25%-3.50%—a more conservative path than market initially anticipated. This measured approach reflects persistent inflation concerns, with core PCE remaining above the 2% target. Fed Chair Jerome Powell has characterized recent cuts as “risk management” rather than the start of an aggressive easing cycle. Investors should monitor monthly CPI and employment reports closely, as accelerating inflation would slow or halt cuts, while labor market deterioration could prompt faster easing.

Which sectors are most likely to outperform the market in 2025?

Three sectors demonstrate strongest fundamental support for outperformance: (1) AI and Cloud Infrastructure—Google Cloud reports 98% of organizations actively exploring generative AI, driving unprecedented demand for cloud services, data centers, and semiconductor capacity. Major cloud providers are investing $250 billion in 2025 capital expenditures. (2) Clean Energy and Renewable Infrastructure—Global clean energy investment reaching $2.2 trillion in 2025 according to IEA, with solar investment alone at $450 billion. Battery storage costs declining 40% annually supports adoption. (3) Quality Defensive and Dividend Stocks—Healthcare, regulated utilities, and consumer staples provide portfolio stability if growth disappoints. Goldman Sachs notes that 2025 will see broader market participation beyond Magnificent Seven technology stocks, creating opportunities in mid-cap and value-oriented equities.

How should investors prepare for potential market corrections in 2025?

Maintain 5-10% strategic cash reserves enabling opportunistic deployment during corrections without forced selling. Use stop-loss orders on concentrated positions (15-20% below entry) and protective put spreads during low-volatility periods (VIX below 15). Ensure portfolio diversification beyond mega-cap technology, with core quality holdings representing 50-60% of equity allocation providing stability. Monitor leading economic indicators (ISM PMI, Conference Board LEI, credit spreads) for early recession signals. Establish predetermined rebalancing triggers and avoid emotional decision-making during volatility. Consider collar strategies (combining protective puts with covered calls) on highly appreciated positions to lock in gains while maintaining upside participation.

What is the biggest risk to the 2025 stock market outlook?

Goldman Sachs identifies earnings disappointment as the single largest risk to base case scenarios. Current consensus expectations embed 11% S&P 500 earnings growth—an optimistic assumption requiring revenue expansion, margin stability, and execution discipline. If actual earnings fall materially short due to consumer spending weakness, margin pressure from wages and input costs, or AI investment returns disappointing, equity valuations will contract regardless of interest rate policy. Elevated starting valuations (21.7x forward P/E in 93rd percentile) provide limited cushion for earnings misses. Secondary risks include geopolitical escalation disrupting supply chains, Federal Reserve policy error (cutting too slowly or tightening if inflation reaccelerates), and AI investment bubble bursting if monetization timelines extend beyond expectations.

Conclusion: Navigating a Stock Picker’s Market in 2025

The 2025 investment landscape presents a departure from recent years’ broad market rallies, requiring active sector selection, disciplined valuation analysis, and robust risk management. While aggregate returns for major indices are projected in the modest single-to-low-double-digit range, substantial dispersion across sectors and individual securities will create meaningful opportunities for skilled investors.

Core Strategic Principles

Target High-Conviction Themes: AI and cloud infrastructure companies demonstrating genuine revenue monetization, clean energy and renewable infrastructure benefiting from $2.2 trillion global investment, and selective emerging markets with robust fundamentals represent the most compelling structural growth opportunities.

Anchor in Quality and Defensiveness: Maintain 50-60% core allocation to high-quality companies with sustainable competitive advantages, consistent free cash flow generation, and dividend growth track records. This foundation provides portfolio stability during inevitable volatility.

Deploy Tactical Liquidity: Strategic cash reserves of 5-10% enable opportunistic deployment during corrections and dislocations. Current money market yields near 5% make cash holdings far less costly than prior low-rate environments.

Monitor Central Bank Signals: Federal Reserve policy path remains the single largest macro variable influencing equity performance. Close attention to inflation data, FOMC communications, and employment trends provides critical forward-looking signals for portfolio positioning adjustments.

Maintaining Perspective Amid Uncertainty

The IMF’s global growth projection of 3.2% in 2025, combined with Goldman Sachs’ 11% earnings growth forecast for U.S. equities, supports modest positive returns but with substantial caveats. Elevated valuations, geopolitical tensions, and policy uncertainty create wider-than-normal outcome distributions requiring careful risk management.

Success in 2025 will favor investors who combine rigorous fundamental analysis with disciplined portfolio construction, maintaining appropriate diversification while sizing high-conviction positions to capture meaningful upside. Those who acknowledge downside risks and prepare accordingly through stop-losses, protective options strategies, and defensive positioning will navigate inevitable volatility more successfully.

Rather than attempting to predict precise market timing or outcomes, focus on building portfolios resilient to multiple scenarios while capturing upside in structural growth themes supported by fundamental catalysts. The toolkit provided in this analysis—scenario-based valuation frameworks, sector-specific opportunities, tactical positioning guidelines, and stock selection checklists—offers a comprehensive roadmap for navigating 2025’s complex investment environment.

As always, maintain appropriate diversification, position sizing discipline, and emotional equilibrium during both euphoric rallies and fearful declines. Markets reward patience, preparation, and principled investing over speculation and emotion-driven decision-making.

Additional Investment Resources and Research

Expand your investment knowledge with these comprehensive guides from our research library:

- OpenAI’s $38B AWS Deal: How This Partnership Reshapes AI and Cloud Competition – Analysis of strategic cloud infrastructure partnerships driving AI monetization.

- AI Infrastructure 2026: Data Centers, Chips & Sustainability – Deep dive into semiconductor supply chains, data center build-out, and energy considerations for AI workloads.

- Evidence-Based Investment Strategies for 2025: Comprehensive Analysis – Academic research and empirical testing of portfolio construction methodologies and factor investing.

- AI in Healthcare 2025: Diagnosis & Clinical Workflows – Sector-specific analysis of AI adoption in healthcare, regulatory environment, and investment opportunities in medical technology.

- EU AI Act 2025: Complete Compliance Checklist – Regulatory framework analysis for AI companies, compliance requirements, and implications for technology sector investments.

Sources and Methodology

This analysis synthesizes data and projections from authoritative institutional sources including:

- International Monetary Fund (IMF) – World Economic Outlook October 2025, July 2025 Update, and January 2025 Update providing global growth projections, regional forecasts, and economic policy analysis.

- Federal Reserve – Federal Open Market Committee minutes (September 2025), Summary of Economic Projections, and monetary policy statements detailing interest rate trajectory and inflation outlook.

- Goldman Sachs Research – S&P 500 forecasts, earnings projections, cloud computing industry analysis, and macroeconomic research reports by Chief U.S. Equity Strategist David Kostin.

- Morgan Stanley Research – Equity market outlook, sector rotation analysis, and bull/bear case scenario modeling by Chief U.S. Equity Strategist Michael Wilson.

- J.P. Morgan Global Research – Interest rate forecasts, asset class return expectations, and macroeconomic analysis by Chief U.S. Economist Michael Feroli.

- International Energy Agency (IEA) – World Energy Investment 2025 report detailing $3.3 trillion global energy investment including $2.2 trillion clean technology allocation.

- BloombergNEF – Renewable Energy Investment Tracker reporting $386 billion first-half 2025 clean energy investment data.

- Google Cloud, TrendForce, S&P Global – AI infrastructure research, data center capacity projections, and enterprise technology adoption surveys.

- World Bank – Global Economic Prospects providing emerging market analysis and development economy forecasts.

All financial projections, economic forecasts, and market data cited in this analysis are based on publicly available research reports, regulatory filings, and institutional publications accessed as of November 19, 2025. Investment thesis and strategic recommendations represent synthesis of multiple authoritative sources rather than relying on single-source data.

Article Information:

Author: Sezarr | Publication: Sezarr Overseas News

Published: November 19, 2025 | Last Updated: November 19, 2025

Word Count: 8,547 words | Reading Time: Approximately 35 minutes

Categories: Personal Finance, Investment Strategy, Market Analysis, Economic Forecasts

Tags: stock market 2025, S&P 500 forecast, AI stocks 2025, clean energy investment, emerging markets outlook, portfolio strategy 2025, valuation signals, sector rotation, Federal Reserve policy, investment analysis, equity markets, macroeconomic outlook