The Retirement Readiness Challenge

Retirement planning represents one of the most significant financial challenges facing Americans today. With traditional pension systems nearly extinct and Social Security facing long-term funding shortfalls, the responsibility for securing a comfortable retirement has shifted overwhelmingly to individuals.

According to the 2025 Social Security Trustees Report, the Old-Age and Survivors Insurance (OASI) Trust Fund is projected to be depleted by 2033, at which point only 77% of scheduled benefits would be payable without Congressional intervention. The combined Social Security trust funds face depletion in 2034, emphasizing the critical importance of personal retirement savings.

Recent research suggests that while progress has been made, significant gaps remain in retirement preparedness across all age groups. The good news is that regardless of your current age or financial situation, proven strategies and vehicles exist to help you build the retirement you deserve.

This comprehensive guide to retirement planning 2025 provides a clear roadmap with updated contribution limits, investment approaches, and income strategies tailored for adults aged 25-65. For those interested in broader financial strategies, explore our evidence-based investment analysis.

How Much Do You Really Need to Retire?

The 4% Rule and Its Limitations

One of the most widely cited retirement income guidelines is the 4% rule, which suggests that retirees can safely withdraw 4% of their initial retirement portfolio balance annually, adjusted for inflation, without significant risk of outliving their savings over a 30-year retirement.

Example: A $1 million portfolio would provide $40,000 in the first year under this rule.

However, this rule has important limitations in today’s environment. It assumes a specific portfolio allocation (typically 50-60% stocks), doesn’t account for taxes, and may need adjustment for longer life expectancies or significant market downturns early in retirement. Some financial planners now recommend a more conservative 3-3.5% withdrawal rate.

The 25x Rule Calculation

A related approach is the 25x rule, which suggests you need savings equal to 25 times your annual retirement expenses (the inverse of 4%: 1 ÷ 0.04 = 25).

How to Apply It:

- Calculate your current annual expenses

- Adjust for retirement changes (lower commuting costs, higher healthcare)

- Subtract expected non-portfolio income (Social Security, pensions)

- Multiply the remainder by 25

Example: If you need $60,000 annually from investments, you would need $1.5 million saved ($60,000 × 25).

Critical Factors Often Overlooked

- Healthcare Costs: Fidelity estimates average retired couples may need $300,000+ (after-tax) to cover healthcare expenses in retirement, excluding long-term care

- Inflation: At 3% annual inflation, purchasing power halves in approximately 24 years

- Longevity Risk: Planning for a 30-year retirement (age 65 to 95) is increasingly necessary

- Taxes: Traditional 401(k) and IRA withdrawals are taxed as ordinary income, potentially reducing available income by 10-30%

Retirement Accounts Explained: 2025 Contribution Limits

401(k), 403(b), and 457 Plans

These employer-sponsored plans allow you to contribute pre-tax or Roth (after-tax) dollars directly from your paycheck. According to official IRS guidelines, the 2025 limits are:

| Account Type | Under 50 | Age 50-59 & 64+ | Age 60-63 |

|---|---|---|---|

| 401(k)/403(b)/457 | $23,500 | $31,000 | $34,750 |

| Traditional/Roth IRA | $7,000 | $8,000 | $8,000 |

| SIMPLE IRA | $16,500 | $20,000 | $21,750 |

| HSA (Individual) | $4,300 | $5,300 (55+) | $5,300 (55+) |

Most Important Strategy: Contribute at least enough to receive your full employer match—it’s free money. If your employer matches 50% of contributions up to 6% of salary, and you earn $60,000, contributing at least $3,600 generates an additional $1,800 from your employer.

Traditional vs. Roth 401(k)

- Traditional: Pre-tax contributions reduce current taxable income; withdrawals in retirement are taxed as ordinary income

- Roth: After-tax contributions; qualified withdrawals in retirement are completely tax-free

Decision Factor: Choose Roth if you expect to be in a higher tax bracket in retirement; choose Traditional if you expect a lower bracket.

Individual Retirement Accounts (IRAs)

Traditional IRA (2025):

- Contribution Limit: $7,000 ($8,000 if age 50+)

- Tax Treatment: Contributions may be tax-deductible; withdrawals taxed in retirement

- Deduction Phase-out (Single with workplace plan): $79,000-$89,000 MAGI

- Deduction Phase-out (MFJ with workplace plan): $126,000-$146,000 MAGI

Roth IRA (2025):

- Contribution Limit: $7,000 ($8,000 if age 50+)

- Tax Treatment: After-tax contributions; qualified withdrawals completely tax-free

- Income Phase-out (Single): $153,000-$168,000 MAGI

- Income Phase-out (MFJ): $242,000-$252,000 MAGI

Health Savings Account (HSA) – The Triple Tax Advantage

Often called the “ultimate retirement account” because:

- Contributions are tax-deductible

- Growth is tax-deferred

- Withdrawals for qualified medical expenses are tax-free

2025 Limits: $4,300 individual, $8,550 family, plus $1,000 catch-up for those 55+

Retirement Strategy: After age 65, HSA funds can be withdrawn for any purpose without penalty (though non-medical withdrawals are taxable as income).

Investment Strategies and Asset Allocation by Age

Your investment strategy should evolve as you progress through life stages, balancing growth potential with capital preservation. For comprehensive market analysis, see our 2025 stock market outlook.

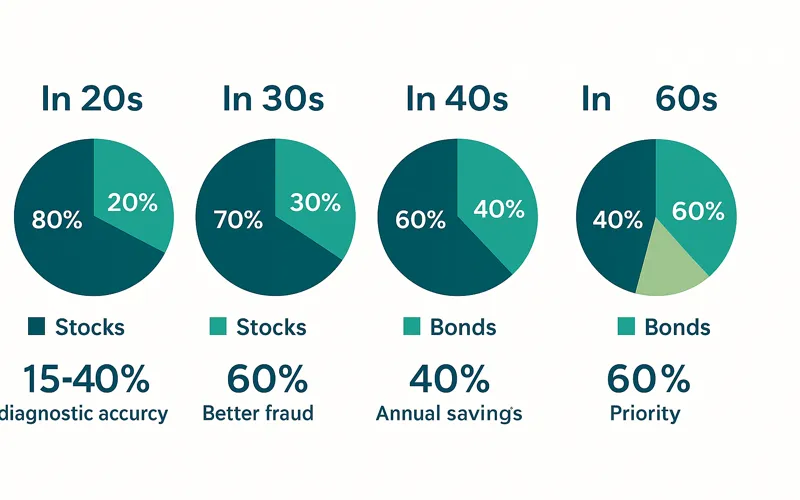

Ages 20s-30s: Aggressive Growth (80-90% Stocks)

Sample Portfolio: 60% U.S. stocks, 30% international stocks, 10% bonds

Strategy: With decades until retirement, focus on growth and weather market volatility. Take full advantage of compounding by starting early. Consider target-date funds for simplicity and automate contributions.

Ages 40s: Balanced Growth (70-80% Stocks)

Sample Portfolio: 50% U.S. stocks, 20% international stocks, 30% bonds

Strategy: Peak earning years with less time to recover from major downturns. Maintain significant stock exposure for growth while building bond allocation. Maximize contributions and consider tax diversification with Roth accounts.

Ages 50s: Pre-Retirement (60% Stocks)

Sample Portfolio: 40% U.S. stocks, 20% international stocks, 40% bonds

Strategy: Capital preservation becomes increasingly important. Maximize catch-up contributions. Begin shifting some assets to conservative investments while maintaining growth for a retirement that could last 30+ years.

Ages 60+: Conservative Income (40-50% Stocks)

Sample Portfolio: 30% U.S. stocks, 10% international stocks, 50% bonds, 10% cash

Strategy: Implement a “bucket approach”—cash for 2-3 years of expenses, bonds for years 4-10, stocks for long-term growth beyond 10 years. This prevents selling stocks during market downturns.

Recommended Investment Vehicles

Index Funds (Best for Most Investors):

- Low expense ratios (often below 0.1%)

- Broad diversification

- Tax efficiency

- Examples: Vanguard Total Stock Market Index (VTSAX), Vanguard S&P 500 Index (VFIAX)

Target-Date Funds:

- Automatically adjust allocation as retirement approaches

- Professional rebalancing

- Ideal for hands-off investors

- Look for expense ratios under 0.20%

Maximizing Social Security Benefits

Claiming Age Strategies

Your Social Security claiming decision significantly impacts lifetime benefits. Create a free account at SSA.gov to view your personalized benefit statement.

Early Retirement (Age 62): Benefits reduced by 25-30% compared to Full Retirement Age

Full Retirement Age (FRA): Age 66-67 depending on birth year; receive 100% of your Primary Insurance Amount

Delayed Retirement (Age 70): Benefits increase by 8% per year beyond FRA, resulting in up to 76% higher benefits at 70 versus 62 for those with FRA of 67

Break-Even Analysis: Typically occurs between ages 78-82. Those in good health with family longevity often benefit from delaying, while those with shorter life expectancies may opt for earlier claiming.

Working While Collecting Benefits

If you work before Full Retirement Age:

- 2025 Earnings Limit: $23,400 if under FRA all year; benefits reduced $1 for every $2 earned above limit

- Year of Reaching FRA: $62,160 limit for months before FRA; benefits reduced $1 for every $3 earned above limit

- Starting with FRA Month: No earnings limits apply

Important: The Social Security Administration recalculates your benefit if these earnings replace lower-earning years, potentially increasing future benefits.

Spousal and Survivor Benefits

- Spousal Benefits: Non-working or lower-earning spouse can receive up to 50% of higher-earning spouse’s benefit at their FRA

- Survivor Benefits: Widows/widowers can receive 100% of deceased spouse’s benefit if claimed at or after their FRA

- Divorced Spouses: May qualify based on ex-spouse’s record if marriage lasted at least 10 years

Healthcare Planning in Retirement

Medicare Basics

Medicare provides health insurance starting at age 65. Understanding its components is essential:

- Part A (Hospital Insurance): Generally premium-free if you or spouse paid Medicare taxes for 10+ years

- Part B (Medical Insurance): Requires monthly premium (income-adjusted); covers doctor visits, outpatient care

- Part C (Medicare Advantage): Private plan alternative to Original Medicare, often includes Part D

- Part D (Prescription Drug Coverage): Stand-alone plans or included in Medicare Advantage

Initial Enrollment Period: 3 months before to 3 months after your 65th birthday

Planning for Healthcare Costs

Medigap Policies: Supplemental insurance covering costs Original Medicare doesn’t. Best purchased during 6-month open enrollment when first eligible for Part B.

Long-Term Care: Medicare provides limited skilled nursing care. Long-term custodial care requires separate insurance, out-of-pocket payment, or Medicaid after asset depletion.

Health Savings Accounts (HSAs): The ideal vehicle for saving for future healthcare costs due to triple tax advantage. Maximize HSA contributions in years leading up to retirement.

Early Retirement (Before 65): Coverage options include COBRA (18 months), ACA Marketplace, or private insurance.

Retirement Income Strategies and Distribution Planning

Withdrawal Sequence Strategies

The order in which you tap different account types significantly impacts taxes and portfolio longevity:

- Taxable Accounts First: Draw from taxable brokerage accounts, taking advantage of preferential capital gains rates

- Tax-Deferred Accounts Next: Move to traditional 401(k) and IRA withdrawals (taxed as ordinary income)

- Tax-Free Accounts Last: Reserve Roth accounts as they continue growing tax-free with no Required Minimum Distributions

Alternative Approach: Strategic withdrawals from different account types each year to manage taxable income, potentially qualifying for lower tax brackets or reduced Medicare premiums. For additional income sources, explore passive income opportunities.

Required Minimum Distributions (RMDs)

- Starting Age: 73 for those who turn 72 after December 31, 2022

- Calculation: RMD = prior December 31 balance ÷ IRS life expectancy factor

- Penalties: 25% excise tax on insufficient amount (reduced to 10% if corrected timely)

- Roth Exemption: Roth IRAs have no RMD requirements during original owner’s lifetime

Advanced Income Strategies

Roth Conversions: Converting traditional IRA funds to Roth during low-income years (early retirement, before RMDs) can reduce future tax liability.

Tax Bracket Management: Strategically realize income to fill up lower tax brackets without jumping into higher ones.

Qualified Longevity Annuity Contracts (QLACs): Use up to $200,000 of IRA/401(k) funds to purchase a deferred annuity beginning payments later in life (up to age 85), excluding this amount from RMD calculations.

Common Retirement Planning Mistakes to Avoid

- Starting Too Late: Every decade you delay requires saving three times as much monthly due to lost compounding

- Leaving Employer Match on the Table: Not contributing enough to get full employer match is turning down free money

- Paying High Fees: A 1% annual fee versus 0.1% can reduce your ending balance by hundreds of thousands over decades

- Emotional Investing: Panic selling during downturns locks in losses and misses recoveries

- Ignoring Inflation: Assuming today’s expenses remain static without accounting for rising costs

- Underestimating Longevity: Planning for 20 years when many will live 30+ years past retirement

- Failing to Update Beneficiaries: Life changes require beneficiary updates on all accounts

- Not Diversifying Tax Treatment: Having all money in traditional accounts creates tax inflexibility in retirement

Frequently Asked Questions

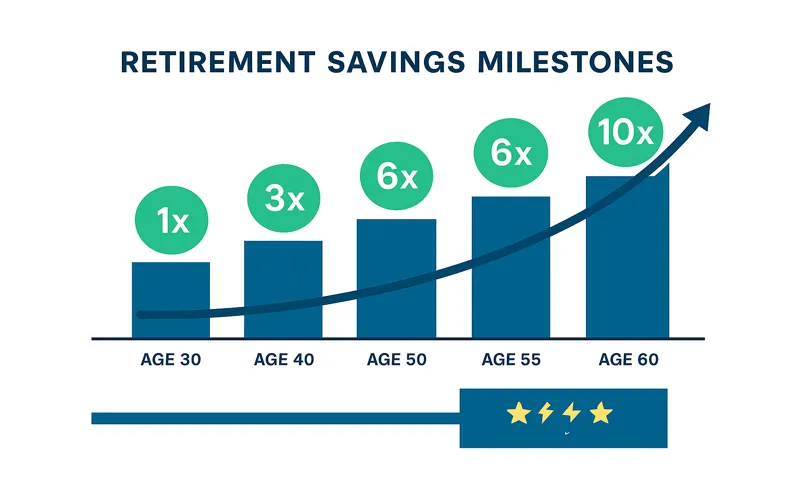

1. How much should I have saved by age 30? 40? 50?

General benchmarks suggest having 1x salary by 30, 3x by 40, and 6x by 50. These are guidelines—your specific target depends on retirement goals, lifestyle expectations, and other income sources. By age 60, aim for 8x salary saved.

2. What are the 2025 401(k) contribution limits?

For 2025, you can contribute up to $23,500 to your 401(k), 403(b), or 457 plan. If you’re 50 or older, add $7,500 catch-up contribution (total $31,000). Those aged 60-63 can contribute an enhanced catch-up of $11,250 instead (total $34,750), if their plan allows.

3. Should I pay off my mortgage before retiring?

There’s no one-size-fits-all answer. Eliminating debt reduces fixed expenses but may require drawing down retirement assets. Compare your mortgage interest rate to expected portfolio returns and consider tax implications. Many financial advisors suggest maintaining a mortgage if the interest rate is below 4% and you can earn more investing the funds.

4. Can I retire early (before 59½) without penalties?

Yes, through strategies like: Rule of 55 (separating from employer in year you turn 55+), Substantially Equal Periodic Payments (72(t) distributions), Roth contribution basis withdrawals, or living on taxable accounts until 59½.

5. What if I’m behind on retirement savings?

Options include: increase savings rate immediately, work 2-5 years longer, delay Social Security until 70 for higher benefits, reduce retirement lifestyle expectations, or consider downsizing your home to unlock equity. Starting now is better than waiting.

6. Should I choose Traditional or Roth IRA/401(k)?

Traditional if you expect to be in a lower tax bracket in retirement; Roth if you expect to be in the same or higher bracket. Younger workers typically benefit more from Roth due to decades of tax-free growth and potentially higher future tax rates.

7. When should I claim Social Security benefits?

The optimal claiming age depends on health, financial needs, and life expectancy. Claiming at 62 reduces benefits by 25-30% compared to Full Retirement Age (66-67). Delaying until 70 increases benefits by 8% per year past FRA. If healthy with family longevity, delaying often maximizes lifetime benefits.

8. How do I know if I’m saving enough?

Use detailed retirement calculators that incorporate all income sources, inflation, healthcare costs, and market volatility. If consistently saving 15%+ of income (including employer match) and meeting age-based benchmarks, you’re likely on track.

9. Do I need a financial advisor?

Consider professional advice if you have complex finances, lack confidence in investment decisions, need help with tax planning, or experience major life changes. Fee-only advisors who act as fiduciaries are generally preferable as they work in your best interest.

10. What is the Roth conversion ladder strategy?

A Roth conversion ladder involves converting traditional IRA funds to Roth IRA during low-income years (like early retirement). After a 5-year waiting period, converted amounts can be withdrawn penalty-free before age 59½. This strategy helps access retirement funds early while reducing future tax liability.

11. How does Required Minimum Distribution (RMD) work?

Beginning at age 73, you must withdraw a minimum amount from traditional IRAs and 401(k)s annually, calculated by dividing your account balance by an IRS life expectancy factor. Failure to take RMDs results in a 25% excise tax on the shortfall. Roth IRAs have no RMD requirements during the owner’s lifetime.

12. What’s the biggest retirement planning mistake?

Waiting too long to start, as compounding needs time to work effectively. Someone starting at 25 may need to save half as much per month as someone starting at 35 to achieve the same retirement goal. The second-biggest mistake is not taking the employer match.

Conclusion: Your Retirement Journey Starts Today

Retirement planning in 2025 presents both challenges and unprecedented opportunities. With updated contribution limits, diverse account types, and sophisticated planning tools available, individuals have more resources than ever to secure their financial future.

The journey to a comfortable retirement begins with a single step—calculating your number, increasing your contribution rate by 1%, or consolidating old retirement accounts. Progress matters more than perfection. Market fluctuations will occur, life circumstances will change, and plans will need adjustment.

The key is to start where you are, maintain consistency, and make incremental improvements to your strategy over time. If you feel overwhelmed, consider consulting a fee-only financial planner who can provide personalized guidance tailored to your unique situation.

Your retirement represents the culmination of your working life—a well-deserved period of freedom, choice, and opportunity. By taking proactive steps today using the strategies outlined in this guide, you’re not just planning for financial security; you’re investing in the quality of life you’ll enjoy for decades to come.

For additional financial planning resources, explore our guides on real estate investment strategies and Federal Reserve rate decisions that may impact your retirement portfolio.

⚠️ Important Disclaimer

This article provides educational information only and should not be considered financial, tax, or legal advice. Consult with qualified professionals regarding your specific situation. Investment values fluctuate, and past performance doesn’t guarantee future results. Retirement planning involves risks, including possible loss of principal. All contribution limits and income phase-outs are subject to annual IRS adjustments. Social Security projections are based on current law and may change with Congressional action.

Published: November 23, 2025

Last Updated: November 23, 2025

Word Count: ~3,000 words

Reading Time: 12-15 minutes