GTA 6 Delay to November 2026: What Take-Two’s 7% Stock Drop Signals for the Gaming Industry

By Sezarr Overseas News Gaming Desk | Published: November 11, 2025 | Last Updated: November 17, 2025

Investment Disclaimer: This article is for informational purposes only and should not be considered investment advice. Gaming industry analysis and stock market predictions are speculative. Consult with qualified financial professionals before making investment decisions. Past performance does not guarantee future results.

Executive Summary

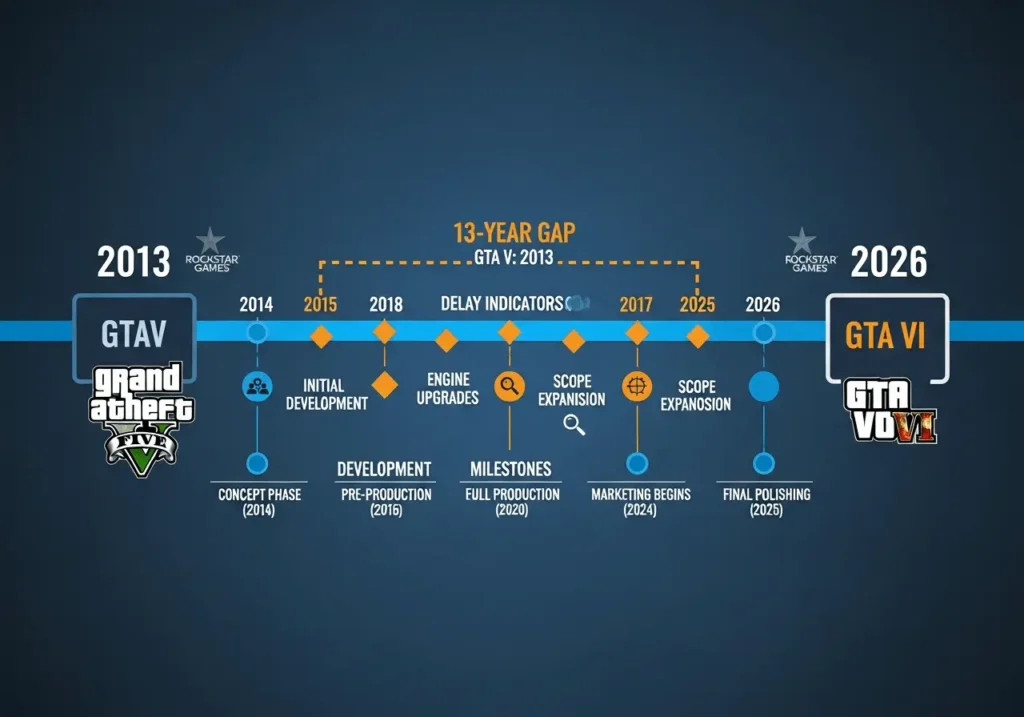

Key Development: Rockstar Games delayed Grand Theft Auto VI from May 2026 to November 19, 2026, causing Take-Two Interactive stock to fall approximately 7-10% in after-hours trading. While the delay shifts revenue timing, analysts view this as an execution choice rather than a fundamental demand problem, with potential benefits from holiday launch positioning.

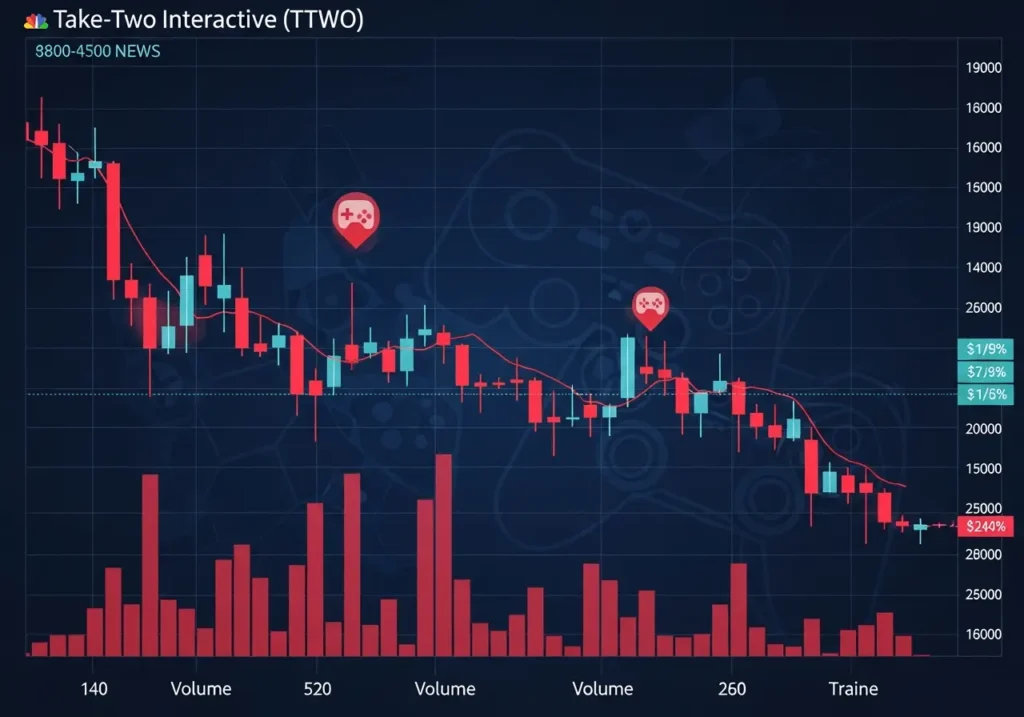

Market Reaction: Take-Two’s 7% Drop and What Investors Priced In

Rockstar confirmed Grand Theft Auto VI has moved from May 26, 2026 to November 19, 2026, its second public delay. Reuters reported Take-Two Interactive (TTWO) shares fell roughly 6–7% on the headlines as models recalibrated near-term bookings and cash-flow timing.

“We are sorry for adding additional time to what we realize has been a long wait, but these extra months will allow us to finish the game with the level of polish you have come to expect and deserve.”

— Rockstar Games Official Statement (Source: GameSpot)

The initial sell-off represents classic release-risk repricing: when a blockbuster slips, analysts adjust marketing spend timing while pushing out revenue recognition, compressing near-term operating leverage. The cultural gravity of GTA amplifies price action; GTA V alone has sold over 220 million units since its 2013 launch, reshaping industry economics and investor expectations.

However, early analyst perspectives emphasized that delaying into late 2026 could maximize launch ROI by aligning with the holiday window, increasing promotional partnerships, and widening the install base for next-gen hardware—potentially expanding day-one and first-quarter sell-through versus a May release.

Key takeaway: The market punished timing shifts, but fundamental long-run demand for GTA VI remains intact. If extra development time reduces launch-day issues, the project’s net present value could still increase despite fiscal year timing impacts.

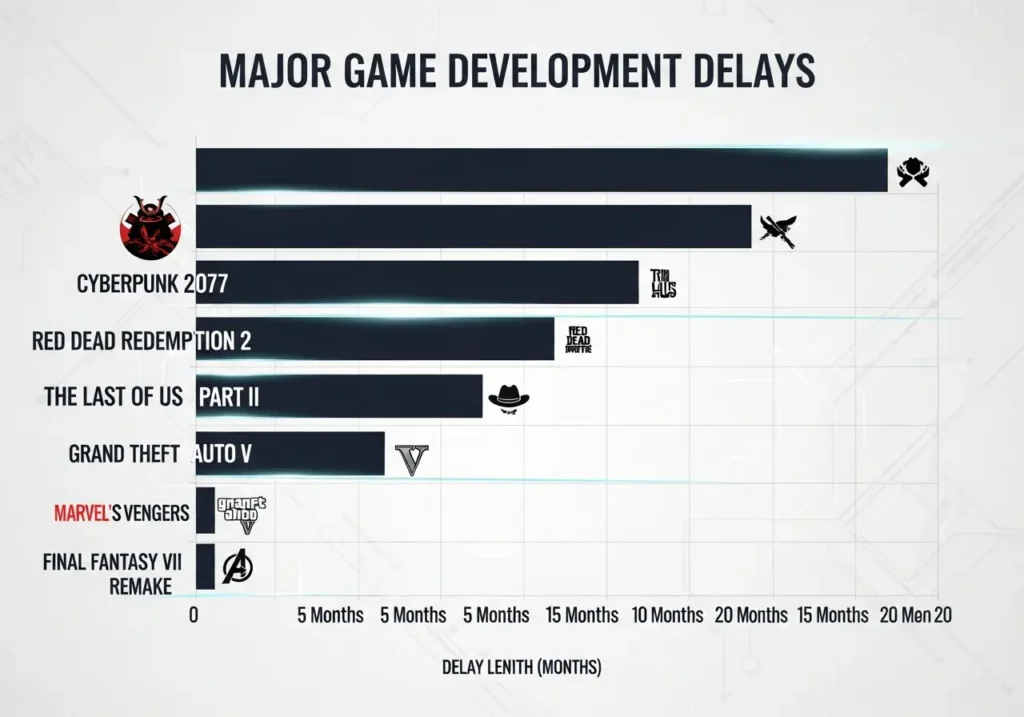

Development Challenges: Why AAA Games Keep Getting More Complex

The GTA 6 delay highlights structural realities affecting the broader technology and entertainment industries, similar to challenges seen across AI development cycles and other complex technology projects:

Scope and Technology Integration

Modern open-world titles integrate photorealistic graphics, dense AI systems, complex physics engines, and live-service components. Each layer multiplies quality assurance requirements—combinations of platforms, regions, localization, and online connectivity that must be validated pre-launch. This complexity mirrors challenges in other tech sectors, where companies like Microsoft are forming specialized teams to manage increasingly sophisticated technology projects.

Platform Optimization Requirements

Cross-generation optimization demands continue rising as hardware performance ceilings increase, encouraging studios to push visual targets and simulation density that require longer optimization cycles. The semiconductor industry faces similar pressures, with innovations like Samsung’s thermal management breakthroughs becoming crucial for high-performance applications.

Post-Launch Infrastructure

Even single-player titles now ship with online components, digital storefronts, user-generated content systems, and anti-cheat technology—expanding integration complexity with platform holders and payment systems.

Rockstar’s emphasis on “polish” aligns with industry best practices: missing a deadline hurts temporarily; shipping broken products damages reputation and lifetime monetization for years through lower review scores, negative social sentiment, and increased refunds.

Industry Trends: Delay Patterns and Market Expectations

Delays are now baseline risk for major entertainment and technology releases, reflecting broader industry patterns seen across sectors from AI-driven biotech developments to consumer electronics.

Communication and Investor Relations

Proactive, specific guidance (like the precise November 19, 2026 date) provides more modeling confidence than vague timeframes. This specificity reduces the discount rate investors assign to execution risk—a principle that applies across technology sectors facing complex development challenges.

Market Dynamics

When major releases move, entire competitive landscapes shift. Third-party publishers often adjust launch windows to avoid getting overshadowed by GTA’s gravitational pull, similar to how major policy announcements can reshape entire industry investment patterns.

Revenue Recognition vs. Fundamental Value

Industry analysts widely characterized this delay as quarterly revenue timing rather than lifetime value destruction—a critical distinction in valuation models that applies across sectors experiencing development complexity.

Financial Analysis: Bookings, Earnings, and Cash Flow Impact

Revenue Timing Shift

The delay shifts revenue recognition into Q3-Q4 fiscal year 2027 (calendar Q4 2026-Q1 2027), versus prior expectations of meaningful contributions by mid-2026. Despite the GTA 6 delay, Take-Two raised its annual bookings outlook to $6.38-6.48 billion, up from $6.05-6.15 billion, demonstrating portfolio diversification strength.

Operating Expense Profile

Marketing expenditures typically increase approaching launch. A later date may defer some promotional spending while research and development costs continue, pressuring near-term operating margins before the revenue inflection.

Holiday Launch Economics

November positioning could enhance unit sales through:

- Seasonal consumer spending: Holiday discretionary budgets favor premium entertainment purchases

- Platform partnerships: Console makers often provide marketing support and bundle opportunities during peak seasons

- Digital attach rates: Holiday buyers typically purchase more downloadable content and in-game items

Portfolio Diversification Benefits

Take-Two’s ability to raise guidance amid GTA timing changes underscores the value of diversified revenue streams including mobile gaming, sports franchises, and catalog titles—providing resilience against single-title execution risk.

Technology and Market Context

The gaming industry’s evolution parallels broader technology sector trends, where complex projects face similar development and market pressures:

AI and Computing Infrastructure

Game development increasingly relies on AI technologies and advanced computing infrastructure. The industry watches developments like major cloud computing partnerships and tracks semiconductor demand trends that affect development capabilities.

Market Volatility Connections

Gaming stocks often correlate with broader technology sector movements. The Take-Two decline occurred during a period when technology concerns were affecting multiple asset classes, suggesting broader market sensitivity to execution risk across tech-dependent industries.

Global Trade Considerations

Gaming companies must navigate international supply chains and regulatory environments. Recent developments like semiconductor export restrictions affect hardware availability and development infrastructure globally.

Future Outlook: Investment Strategies and Industry Evolution

Development Cycle Management

For entertainment and technology investors, the GTA delay reinforces several strategic themes:

- Schedule risk as baseline assumption: Build valuation models that accommodate major timing shifts for complex projects

- Quality-first execution: Companies that launch polished products typically deliver better long-term returns through stronger user retention and monetization

- Holiday timing advantages: Premium seasonal positioning can justify development timeline adjustments

Portfolio Diversification Value

Take-Two’s guidance raise despite GTA timing issues demonstrates the importance of revenue diversification—a principle relevant across technology sectors where single-product dependencies create volatility.

Technology Infrastructure Trends

Gaming development increasingly depends on advanced technologies including AI, cloud computing, and specialized semiconductors. Industry evolution mirrors broader tech trends including AI applications expansion and innovation in consumer-facing applications.

Frequently Asked Questions

Is the GTA 6 delay a demand problem or an execution choice?

Execution choice. Rockstar cited polish and quality needs; analyst coverage frames the move as a revenue timing shift rather than a material reduction in lifetime sales potential. The company’s track record suggests delays typically improve final product quality and long-term monetization.

Why did Take-Two stock drop 7% if the long-term thesis is intact?

Near-term earnings and cash flow shift out by two quarters; financial models must reflect later revenue recognition and sustained operating expenses, compressing short-term margins even if lifetime value remains unchanged or improves. Market reactions often focus on immediate fiscal impacts.

Does a November 2026 launch improve economics?

Likely. Holiday seasonality plus platform marketing partnerships can lift day-one unit sales, digital content attach rates, and overall monetization, potentially offsetting the time value impact from the delay. Consumer spending patterns favor premium entertainment during holiday seasons.

What should investors watch next?

Key indicators include development progress updates, marketing campaign timing, pre-order trends, platform partnership announcements, and competitor calendar changes as they adjust schedules around GTA’s new date. Also monitor Take-Two’s other revenue segments for continued diversification strength.

How does this affect the broader gaming industry?

Other publishers will likely adjust their 2026 launch calendars to avoid direct competition with GTA 6’s November release. This creates opportunities for earlier or later release windows and may influence development timelines across the industry.

Strategic Takeaways for Investors

Timing Risk vs. Fundamental Value: The market sell-off reflects execution timing rather than broken demand fundamentals. A 7-10% stock movement on a multi-quarter delay represents rational short-term repricing; long-term value depends on launch quality and post-release monetization success.

Holiday Economics: November 2026 positioning could enhance revenue potential through better seasonal timing, platform marketing synergies, and consumer spending patterns that favor premium entertainment during holiday periods.

Portfolio Resilience: Take-Two’s ability to raise overall guidance despite GTA timing changes demonstrates the value of diversified revenue streams including mobile, sports franchises, and catalog titles.

Industry Calendar Effects: Expect competitive reshuffling as other publishers adjust schedules to avoid GTA’s gravitational pull, creating market opportunities for well-positioned second-tier releases.

Related Coverage from Sezarr Overseas News

Technology Industry Analysis

- Trump AI Policy 2025: “No Federal Bailout” – Industry Implications

- Microsoft Forms Superintelligence Team to Lead Enterprise AI Race

- Are AI Stocks Driving 75% of Market Returns? Bubble Analysis

Market & Investment Trends

- Bitcoin Crashes Below $100K as AI Stock Fears Trigger Crypto Selloff

- OpenAI’s $38B AWS Deal Reshapes AI Cloud Competition Forever

- US Nvidia Restrictions Widen: What China Chip Ban Means

Technology Innovation

- Samsung Exynos 2600 Heat-Pass Block: Thermal Breakthrough

- Nvidia CEO Reports Surging Demand for Blackwell AI Chips

- AI Breakthrough: MIT Designs Millions of Antibiotics vs Superbugs

Healthcare & Innovation Applications

- AI Wellness Apps Transform Personalized Healthcare in 2025

- Oral Weight Loss Pill Shows 16.6% Results Rivaling Ozempic Shots

Primary Sources: Rockstar Games Newswire, Reuters, CNBC, GameSpot, and verified company communications as of November 11, 2025.

Conflict of Interest Disclosure: Sezarr Overseas News maintains editorial independence and has no financial interests in Take-Two Interactive, Rockstar Games, or related gaming companies discussed in this analysis.

Editorial Standards: All stock prices, delay information, and company statements have been verified against primary sources. This analysis represents our editorial team’s interpretation of publicly available information and industry trends.

Methodology: Financial analysis incorporates verified earnings data, confirmed delay announcements, and established industry precedents. Market reaction data sourced from multiple financial news outlets and trading platforms.

Last Updated: November 17, 2025

1. Why was GTA 6 delayed to November 2026?

Rockstar delayed GTA 6 to ensure higher polish, optimization, and stability across next-gen platforms. The studio confirmed that extra development time will help deliver the level of quality players expect. This mirrors industry-wide trends, where increasingly complex open-world games require longer testing and optimization cycles.

2. Did the delay signal a demand problem for GTA 6?

No. Analyst consensus is that this was an execution and polish-related delay—not a sign of weak demand. GTA 5 sold over 220 million units, and pre-launch interest for GTA 6 remains extremely high. Lifetime sales expectations are unchanged.

3. Why did Take-Two Interactive’s stock fall 7% after the delay?

Investors reacted to the shift in revenue timing, not long-term value.

A six-month delay pushes cash flow, bookings, and earnings into later quarters, impacting near-term financial models. Markets typically price in immediate, short-term impacts even when long-term fundamentals remain strong.

4. Does the November 19, 2026 launch date benefit Rockstar financially?

Yes. Launching during the holiday season offers major advantages:

- Higher consumer spending

- Stronger marketing partnerships with Sony/Microsoft

- Better digital content attach rates

- Increased console bundle opportunities

For many AAA titles, Q4 releases dramatically outperform mid-year launches.

5. Could more delays happen?

It’s possible but not guaranteed. Rockstar gave a precise date—unusual unless they are confident in their timeline. However, AAA development is complex, and the industry often faces unforeseen challenges across QA, certification, and platform optimization.

6. Does this delay affect other gaming companies?

Yes. Competing publishers often adjust their release schedules to avoid launching near GTA 6. The new November 2026 date may cause:

- Q4 2026 reshuffling

- Earlier or delayed releases from competitors

- Avoidance of the “GTA gravitational pull”

This mirrors how major tech launches can shift entire industry calendars.

7. How does this delay impact Take-Two’s financial outlook?

Short-term:

- Operating expenses continue

- Marketing spend shifts later

- Revenue drops in near-term quarters

Long-term:

- Holiday launch could boost unit sales

- Lifetime value remains strong

- Take-Two even raised its bookings forecast despite the delay—showing portfolio strength

8. How does GTA 6’s delay reflect broader trends in game development?

It highlights rising development complexity:

- Photorealistic graphics

- AI-driven NPC systems

- Massive open worlds

- Online infrastructure

- Multi-platform optimization

These challenges are similar to multi-year AI, semiconductor, and cloud projects across the tech industry—bigger scope = longer timelines.

9. Are delays becoming normalized in the gaming industry?

Yes. Major titles like Starfield, Cyberpunk 2077 (post-launch patches), and Zelda: BOTW2 experienced long delays. Studios increasingly prioritize quality assurance to avoid launch-day issues and protect long-term monetization.

10. How should investors approach gaming companies facing delays?

Key factors to monitor:

- Updated financial guidance

- Marketing timelines

- Pre-order trends

- Portfolio diversification

- Platform partnerships (Sony, Microsoft, Epic)

- Development milestone updates

Delays usually affect fiscal year timing more than lifetime franchise value.

11. Will the delay affect GTA Online’s successor?

Likely positively. More development time allows:

- Better server infrastructure

- More stable GTA Online 2 launch

- Stronger live-service monetization design

- Better anti-cheat integration

Rockstar’s long-term revenue depends heavily on online components.

12. What major market signals did this 7% drop reveal?

The sell-off reflects:

- High sensitivity to flagship title timing

- Broader tech-sector volatility at the time

- Heavy institutional expectations for GTA-driven revenue

It highlights that timing can move stock prices even without weakening demand fundamentals.

13. What should gamers expect from GTA 6 after this delay?

Players can expect improved:

- World density

- Visual fidelity

- Stability across PS6/next Xbox/PC

- NPC behavior driven by advanced AI

- Feature completeness at launch

The extra months may prevent “Cyberpunk-like” launch issues.

14. Could this delay impact console sales?

Yes. A major Q4 blockbuster can meaningfully boost console and accessory sales. Platform holders may prepare:

- GTA 6 bundles

- Themed hardware

- Exclusive promotional campaigns

This is typical for major releases similar to GTA V, Red Dead Redemption 2, and Modern Warfare titles.

15. Is GTA 6 still expected to be a record-breaking launch?

Absolutely. Most analysts still forecast:

- $1B+ in opening weekend revenue

- One of the largest game launches in history

- Record digital sales

- Massive player engagement driven by GTA Online 2

The delay does not change the scale of expected demand.