Ethereum ETF Performance 2024-2025 — Market Impact & Investment Analysis

Last verified: 11 Nov 2025 (Sources: SEC filings, SoSoValue, Farside Investors, BlackRock, Fidelity)

Executive Summary (TL;DR)

Six months after their July 23, 2024 launch, U.S. spot Ethereum ETFs have established themselves as a significant force in crypto markets, attracting over $2 billion in net institutional inflows despite initial skepticism. Led by BlackRock’s ETHA and Fidelity’s FETH, these investment vehicles have provided traditional investors regulated access to Ethereum exposure while driving meaningful on-chain activity. Recent developments in 2025 include SEC approval for options trading and ongoing discussions about in-kind redemptions, signaling continued institutional adoption. However, Ethereum ETFs have underperformed their Bitcoin counterparts in total flows, highlighting investor sentiment differences between the two largest cryptocurrencies. This analysis reviews performance metrics, adoption patterns, and what data reveals about the future of crypto ETF investing.

Frequently Asked Questions (FAQ)

Q: When did Ethereum ETFs launch and how are they performing?

A: U.S. spot Ethereum ETFs launched on July 23, 2024. Despite net outflows from Grayscale’s conversion, the sector has seen approximately $2+ billion in net inflows, with BlackRock’s ETHA leading at over $3 billion in cumulative inflows.

Q: Which Ethereum ETFs are available and who leads the market?

A: Eight Ethereum ETFs currently trade: BlackRock (ETHA), Fidelity (FETH), Grayscale (ETHE), Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton. BlackRock and Fidelity dominate with the highest AUM and daily flows.

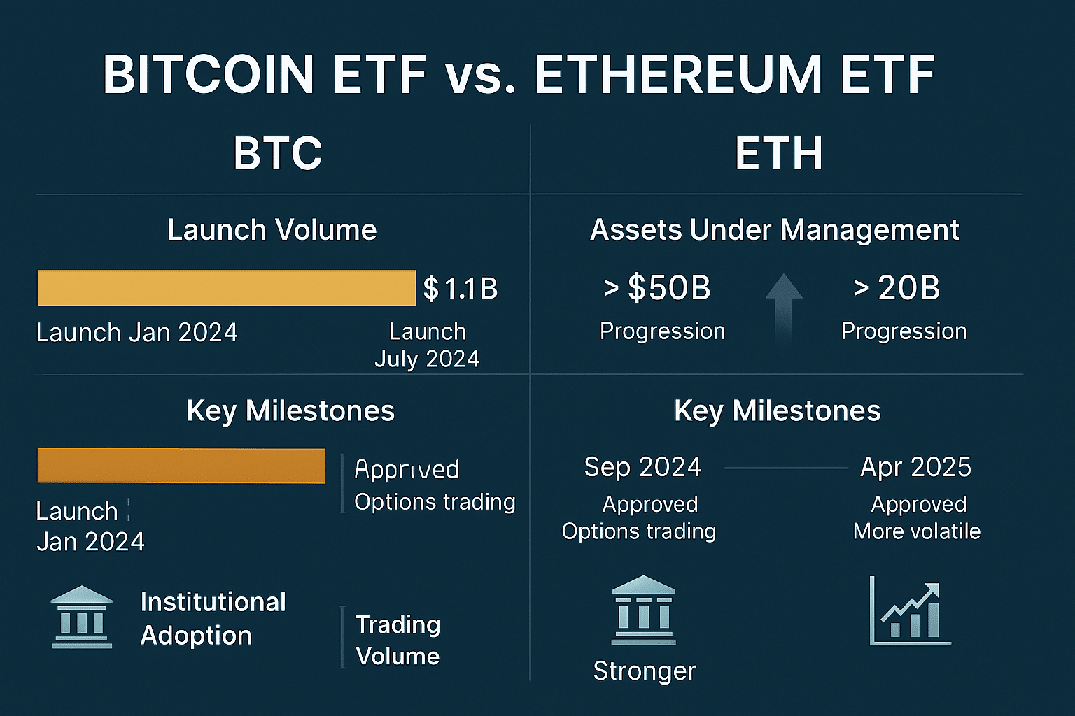

Q: How do Ethereum ETFs compare to Bitcoin ETFs?

A: Ethereum ETFs have attracted significantly less capital than Bitcoin ETFs, capturing about 10–15% of Bitcoin ETF demand, reflecting different institutional perspectives on the two cryptocurrencies. See our coverage of Bitcoin ETF volatility and market reactions for comparison.

1. Launch Performance: July 2024 Through Early 2025

When spot Ethereum ETFs launched on July 23, 2024, they generated $1.07 billion in first-day trading volume—a strong debut, though well below Bitcoin ETFs’ record-breaking launch earlier that year. Grayscale’s Ethereum Trust (ETHE) led initial volume with $450 million in trades, primarily from conversions of its legacy trust.

Approval followed months of regulatory scrutiny, with the SEC greenlighting eight issuers in May 2024, including BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton.

Performance Metrics: Ethereum ETFs now manage over $21 billion in combined assets (as of Nov 2025). Flow volatility remains higher than Bitcoin’s due to differences in investor profiles and market maturity.

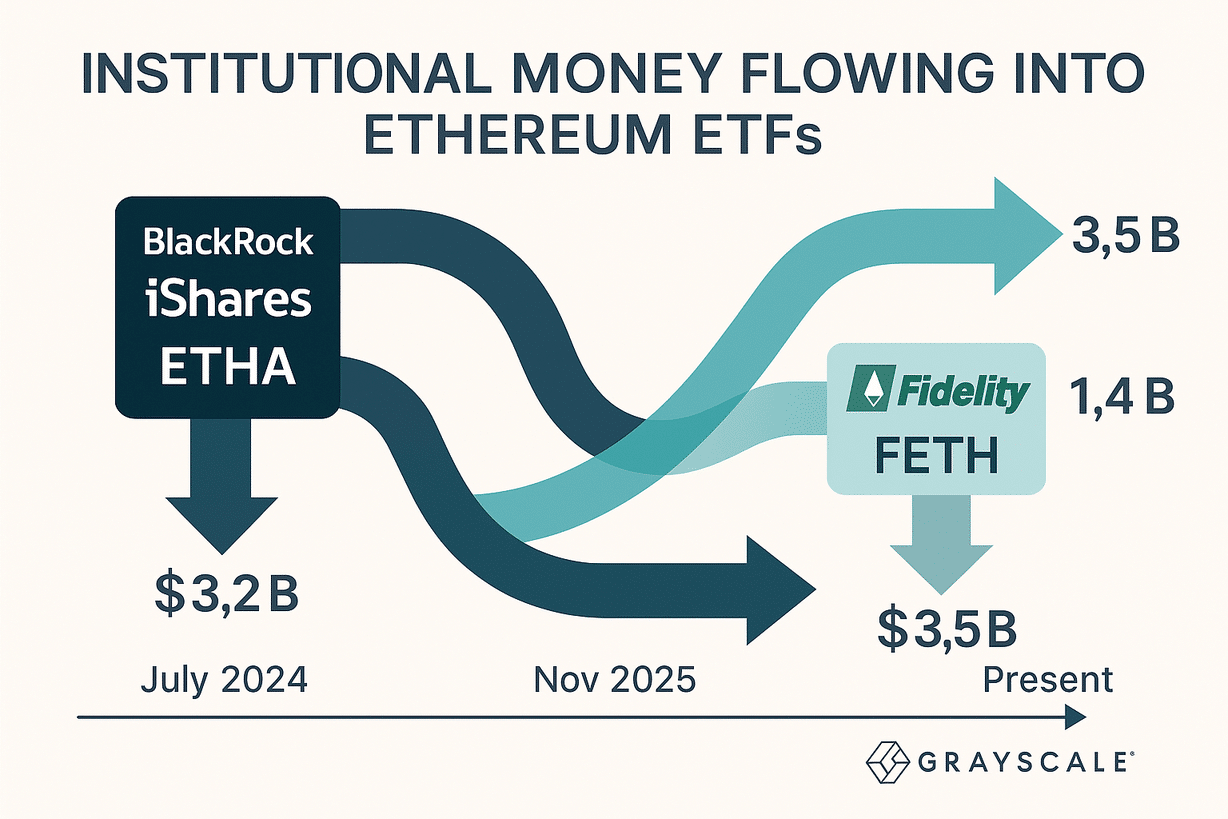

2. Market Leaders: BlackRock ETHA vs. Fidelity FETH

BlackRock iShares Ethereum Trust (ETHA)

- Record single-day inflow: $266 million (Aug 2025)

- Expense ratio: 0.25%

- Average daily volume: 1.8M shares

- Net inflows: $3.2 billion since inception

Fidelity Ethereum Fund (FETH)

- Net inflows: $1.4 billion cumulative

- Expense ratio: 0.25%

- Strong retail adoption via Fidelity brokerage

- Recent daily inflows: $31.8M (Oct 2025)

Grayscale’s ETHE, converted from its trust, has seen ~$3.5B outflows, similar to its Bitcoin counterpart. Broader investor sentiment aligns with macro trends explored in AI market impact coverage.

3. 2025 Regulatory and Product Developments

The SEC approved options trading for ETHA and FETH in April 2025, expanding institutional hedging strategies — part of a wider regulatory evolution discussed in AI and technology policy frameworks.

In-kind redemption reviews are ongoing, allowing potential direct ETH redemptions that could improve tracking efficiency and liquidity. Bloomberg Intelligence expects approval by late 2025.

4. Market Impact and Institutional Adoption

Flow trends mirror global market sentiment. In August 2025, ETFs saw $4B in inflows (77% of total crypto inflows), while November recorded $219M outflows during volatility spikes. Institutional adoption remains steady, with high retail engagement via Fidelity and Schwab.

On-chain data indicates rising staking participation and growth in Layer-2 networks. Broader sentiment also tracks tech-sector innovation — such as the TSMC and Samsung race toward 1.4nm chips — reflecting how semiconductor and AI infrastructure advancements can indirectly bolster blockchain performance. Read further on enterprise AI innovation trends shaping financial markets.

5. Performance Comparison: ETH vs. Bitcoin ETFs

| Metric | Ethereum ETFs | Bitcoin ETFs | Ratio |

|---|---|---|---|

| Launch Date | July 23, 2024 | Jan 11, 2024 | – |

| First-Day Volume | $1.07B | $4.6B | ~23% |

| Total Net Inflows | $2B+ | $25B+ | ~8-10% |

| Largest ETF | ETHA (~$3.2B) | IBIT (~$45B+) | ~7% |

6. Risk Factors and Market Considerations

- Regulatory: Ethereum’s classification remains a gray zone between SEC and CFTC jurisdictions.

- Staking complexity: Future ETFs may integrate yield-bearing mechanisms.

- Volatility: Large daily outflows mirror crypto price swings; investors should diversify.

- Technology risk: Ethereum’s evolving roadmap and Layer 2 scaling add technical exposure.

7. Global Market Context and Future Outlook

U.S. Ethereum ETF success has catalyzed international adoption. European Ethereum ETPs now trade with expanding liquidity, while Hong Kong and Singapore regulators prepare regional launches. Market analysts expect next-wave approvals for Solana and XRP ETFs in 2026.

Meanwhile, semiconductor and AI infrastructure innovation — highlighted by OpenAI’s $38B AWS deal — demonstrates how technology investments and financial markets are increasingly intertwined.

8. Investment Considerations

Institutional Investors: Gain regulated Ethereum exposure without direct crypto custody. Options trading supports advanced hedging.

Retail Investors: Access Ethereum ETFs through major brokerages including Fidelity, Schwab, TD Ameritrade, and Robinhood.

Strategic Tip: Compare AUM, volume, and expense ratios to ensure efficient exposure.

9. Verified Data Sources

- SEC 19b-4 ETF filings, 2024–2025

- BlackRock iShares ETHA and Fidelity FETH reports

- SoSoValue & Farside Investors ETF flow dashboards

- Bloomberg Intelligence, CoinDesk Markets, and Reuters, Nov 2025

Legal Disclaimer

This content is for informational purposes only and not financial advice. Cryptocurrency ETFs involve risk of loss. Data verified as of November 2025, subject to market fluctuations. Always consult professional advisors before investment decisions.

© Sezarr Overseas News · Published: 11 Nov 2025 · All Rights Reserved.