AI Stocks Drive 75% of Market Returns – Is a Bubble Forming?

Market Concentration Alert

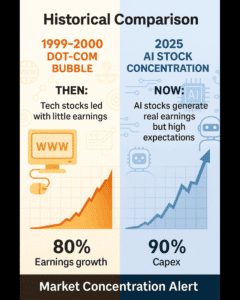

Since the launch of ChatGPT in November 2022, artificial intelligence-related stocks have powered approximately 75% of the S&P 500’s total returns, roughly 80% of its earnings growth, and around 90% of its capital-spending expansion, according to research from JPMorgan and Morgan Stanley.

This level of concentration in so few names is remarkable: a handful of tech titans — often grouped as the “Magnificent 7” — now account for nearly a third or more of index market-capitalization and dominate return generation.

For investors, this raises a hard question: when most returns are driven by a small cluster of companies, how exposed is one’s portfolio to a reversal in that cluster?

Market-Cap Concentration

The Magnificent 7 (Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta Platforms, Tesla) now collectively represent around 36.6% of the S&P 500 market cap as of October 2025. Recent analysis shows that AI-exposed companies have significantly outperformed the broader market, with technology leaders driving disproportionate growth compared to the remaining S&P 500 constituents.

This level of concentration is more reminiscent of the dot-com era than a broadly diversified market — which leads us to the next key question.

Historical Context: Echoes of the Dot-Com Bubble

During the 1999-2000 dot-com bubble, a small set of internet and tech companies disproportionately drove the Nasdaq and broader indices. The risk then, as now, was that if the leadership companies faltered or valuations compressed, the broader market would feel the full impact.

Today’s AI-stock concentration can be placed in historical context:

Then: Technology companies led returns and valuations soared with little earnings to justify them.

Now: AI-driven companies are generating real earnings and capital investment, but the pacing of expectation seems blistering, as evidenced by recent developments like Nvidia’s surging demand for Blackwell AI chips and OpenAI’s massive $38 billion AWS infrastructure deal.

The S&P 500’s performance since November 2022 has been largely carried by this small group; non-AI/tech stocks have lagged significantly. While structural differences exist (AI infrastructure, cloud transition, model scale-up), the sheer dominance of a few names invites comparison with previous market excesses.

This doesn’t guarantee a crash, but it elevates risk, as demonstrated by recent market volatility when Bitcoin crashed below $100k as AI stock fears triggered broader crypto selloffs.

Risk Analysis: What Happens if AI Momentum Reverses

When markets depend heavily on narrow leadership, a correction in that leadership can propagate broadly. Key risks include:

Valuation Risk: Many AI-linked companies trade at elevated multiples contingent on continuous growth and margin expansion. If those expectations falter, valuations could compress sharply.

Correlation Risk: When the Magnificent 7 stumble, their weight means the S&P 500 may collapse even if most constituents hold steady.

Rotation Risk: Institutional flows may rotate out of AI-heavy sectors into under-leveraged, broader market exposures — leaving early investors over-exposed.

Execution Risk: High spending (capex, R&D) in AI infrastructure may face diminishing returns or delayed monetization. Recent analysis indicates that multiple initiatives show uncertain ROI despite billions invested.

Liquidity Risk: With heavy flows into a small set of stocks, a trigger event (earnings miss, regulation, geopolitical shock) could amplify drawdowns via forced selling.

Market Concentration Statistics

Market Snapshot:

- Approximately 75% of S&P 500 returns driven by AI/tech since late 2022

- The Magnificent 7 account for roughly 36.6% of S&P 500 market cap; Nvidia alone accounts for approximately 7.2%

- AI-related companies contribute roughly 80% of index earnings growth and 90% of capex

Given these figures, risk is not broadly spread — it’s concentrated. A shock to one or more of the leading companies could meaningfully impact a supposedly diversified portfolio.

Portfolio Strategy: Managing AI-Heavy Portfolios

For investors, the mandate is clear: exposure to the AI theme can still be valid, but must be managed with strategy, discipline, and diversification in mind.

Diversification Recommendations

Limit Single-Stock Concentration — Check the weight of top-10 holdings in your portfolio; if it exceeds 30-40%, you may be effectively concentrated in the same risks as the S&P.

Consider Equal-Weight or Broad-Cap ETFs — These reduce exposure to mega-cap tech dominance. Standard S&P tracking funds may be skewed toward a handful of companies.

Add Non-AI/Tech Exposures — Sectors such as industrials, utilities, consumer staples, emerging markets may under-perform now but offer diversification and upside if leadership rotates.

Use Alternatives and Hedges — Strategies such as global equity (outside US tech), inflation-linked assets, or long/short technology strategies can offer balance.

Rebalance Cadence — With rapid gains in AI names, regular rebalancing helps lock in gains and manage risk.

Keep Thematic Exposure Modest — Instead of going “all-in” on AI, allow this theme to be part of the portfolio, not the whole portfolio.

Risk-Adjusted Returns and Strategy

AI-heavy portfolios have delivered recent outperformance, but at the cost of higher correlation and concentration risk. Historically, strategies that emphasize diversification — even at the cost of slightly lower returns in bull phases — often deliver better risk-adjusted outcomes in stress periods.

Expert Warnings: Wall Street Voices & Institutional Positioning

Prominent voices in finance are sounding alarms. For example, CEOs and analysts at major institutions note the risk of over-investment:

JPMorgan research indicates that AI-related stocks have accounted for 75% of returns and cautioned that “a lot of capital has been deployed that may not deliver the returns.”

Morgan Stanley’s Lisa Shalett warns of a “one-note narrative” and expresses concern about market reliance on AI capital expenditures.

Some senior executives at major tech firms suggest current spending dynamics resemble an “industrial bubble.”

Institutional flow data shows heavy allocations to the AI/tech side, creating less margin for error if that theme falters.

These warnings underscore the real risk: concentrated leadership works until it doesn’t.

Investment Outlook: Balanced AI Exposure and Timing

Timing Considerations

Late-Cycle Risk: As interest-rate easing prospects fade or growth disappointment surfaces, leadership stocks often become vulnerable.

Rotation Risk: Historically, after a dominant theme leads for multiple years, markets often rotate into undervalued sectors with fresh leadership — meaning those heavily exposed to the theme may lag.

Event Risk: Any major regulatory, earnings, or macro surprise hitting a large AI-leader could ripple across the index.

Balanced Exposure Strategy

Maintain Moderate Exposure to AI stocks (20–30% of equity allocation) rather than full immersion.

Ensure Diversification outside tech (40–50% of equities) to reduce single-theme dependency.

Use Tactical Allocation for emerging investment themes outside the AI bubble (e.g., value stocks, international markets, infrastructure).

Monitor Concentration Metrics: If top-5 or top-10 holdings account for >35% of your equity exposure, you’re likely over-concentrated.

International Diversification

Markets outside the U.S. may offer structural growth with less AI-theme dependence. Emerging markets, global value strategies, and non-tech sectors can offer balance and reduce correlation with the AI-led U.S. equity market.

Risk Assessment Framework

| Risk Factor | Potential Impact | Mitigating Strategy |

|---|---|---|

| Valuation compression in AI leaders | Broad market drawdown | Diversify holdings, limit theme weight |

| Leadership earnings miss | Index-weighted portfolio falls | Use equal-weight or non-tech exposures |

| Rotation away from tech | Underperformance for AI-heavy funds | Include value, cyclical, and global allocation |

| Liquidity crunch in concentrated names | Large drawdowns | Avoid excessive concentration; set stop-loss/hedge |

| Regulatory/macro shock to AI infrastructure | Drop in capex and earnings | Maintain flexible asset allocation, alternative assets |

Market Impact Insight

Current projections suggest that while AI innovation continues accelerating — from breakthrough chip technologies like Samsung’s Exynos 2600 to massive infrastructure investments — the concentration risk in public markets has reached concerning levels.

Key Market Metrics:

- Magnificent 7 market share: ~36.6% of S&P 500

- Expected market concentration to remain elevated through 2026

- Global diversification becoming increasingly important for risk management

Future Outlook: What Comes Next

The AI investment theme faces several potential catalysts that could either extend the rally or trigger a significant rotation:

Supportive Factors:

- Continued enterprise AI adoption

- Infrastructure scaling requirements

- Productivity improvements materializing

Risk Factors:

- Valuation compression if growth slows

- Regulatory intervention in tech sector

- Geopolitical tensions affecting supply chains

- Market rotation toward neglected sectors

The bigger story is whether current AI leaders can sustain their growth trajectories while the broader market catches up, or if concentration risks will ultimately force a more balanced distribution of returns across sectors.

Conclusion

The fact that AI-related stocks are responsible for approximately 75% of the S&P 500’s returns, alongside 80% of earnings growth and 90% of capex, signals both a remarkable success story and a pronounced risk of over-concentration. While many of these companies are well-funded with strong fundamentals, the narrowness of market leadership means that individual and portfolio risk is elevated.

For investors and financial advisors, the key takeaway is not to abandon the AI theme — it remains one of the most transformative forces in business and markets. But it requires discipline: exposure should be measured, diversified, and offset by broader exposures outside the tech/AI bubble.

In short: Investing in AI-led growth remains compelling, but the path is narrow and the margin for error is slim. Market-cap-weighted indexes are less diversified than many investors assume. Recognizing that fact, and building portfolios accordingly, may make the difference between participation in the next leg up — and exposure to disproportionate risk if momentum falters.

The recent market volatility, including spillovers into cryptocurrency markets and concerns about AI valuations, serves as a reminder that even the most promising technological revolutions can experience significant corrections. Smart investors will position for both the upside potential and the downside risks of this unprecedented market concentration.

Investment Disclosure: This article is for informational purposes only and does not constitute investment advice. Past performance is not indicative of future results. Investors should consult a qualified financial advisor before making investment decisions.

TAGS: AI stock concentration, S&P 500 bubble risk, tech investment strategy, Magnificent 7, portfolio diversification, institutional flows, global equities, market concentration

Related Articles: