Executive Summary

The global banking sector stands at an inflection point as artificial intelligence transitions from experimental deployments to operational necessity. Based on verified 2024-2025 data, the AI banking market reached $26.2 billion in 2024 and analysts project growth to $379.4 billion by 2034, representing a compound annual growth rate exceeding 30%. As we enter 2026, autonomous lending systems, AI-powered credit scoring, and real-time fraud prevention are moving from pilot programs to enterprise-scale implementation across North America, Europe, Asia-Pacific, and emerging markets.

This analysis examines how banks are deploying agentic AI—systems capable of reasoning, planning, and executing complex workflows autonomously—to transform core banking functions. Drawing from Bloomberg Intelligence surveys, Deloitte research, McKinsey analysis, and regulatory guidance from the SEC, FCA, ESMA, and MAS, this report provides a data-driven assessment of AI’s impact on lending, risk management, compliance, and customer service. Key findings include cost reductions of 20-40%, revenue increases of 10-30% among early adopters, and fraud detection improvements exceeding 90% accuracy rates. However, significant challenges remain around explainability, bias mitigation, regulatory alignment, and legacy system integration—issues that will define competitive positioning through 2030.

⚠️ Important Disclaimer

This article provides educational analysis and industry research for informational purposes only. It does not constitute financial advice, investment recommendations, or endorsements of specific technologies, companies, or strategies. The projections for 2026 and beyond are based on current industry trends, analyst forecasts, and publicly available data as of late 2025, but future outcomes may differ materially from these projections.

Readers considering AI implementations should consult qualified professionals including legal advisors, compliance officers, and technology experts. Regulatory frameworks continue to evolve, and institutions must ensure compliance with applicable laws in their jurisdictions. All statistics and data points are sourced from publicly available reports and regulatory filings. Financial institutions deploying AI systems bear full responsibility for risk management, regulatory compliance, and customer protection.

Section 1 — Why AI is Transforming Banking in 2026

The Shift from Automation to Autonomy

Banks have moved beyond simple task automation to embrace what Deloitte terms “agentic AI”—systems that can reason through complex scenarios, plan multi-step workflows, and execute decisions with minimal human intervention. According to research conducted between December 2024 and March 2025, agentic AI represents a fundamental shift from assistive tools to autonomous operations capable of handling end-to-end processes from loan origination to risk assessment.

Bloomberg Intelligence’s late-2024 survey reveals that nearly 50% of banks expect operational costs to decline by 5-10% over the next three to five years due to AI adoption, while agentic AI implementations may deliver productivity gains exceeding 5% annually. Real-world deployments at major institutions including HSBC, Citibank, UBS, DBS Bank, and ING demonstrate cost reductions ranging from 20-40% alongside revenue increases of 10-30% in AI-enabled business units.

Market Growth and Investment Momentum

The global AI banking market reached $26.2 billion in 2024, with multiple research firms projecting substantial expansion. Industry analysts estimate the market will grow to between $34.6 billion and $43.1 billion in 2025, maintaining a compound annual growth rate exceeding 30% through the end of the decade. North America currently dominates with approximately 45% market share, led by institutions like JPMorgan Chase, Bank of America, and Wells Fargo, though Asia-Pacific markets show the fastest regional growth trajectories.

Investment patterns underscore institutional commitment to AI transformation. Global banks are projected to invest $73.4 billion in AI technologies by end of 2025, representing a 21% year-over-year increase among top-tier institutions. AI startups serving financial services secured $9.2 billion in venture capital during the first half of 2025 alone. Notably, funding for AI agent startups nearly tripled from $1.3 billion in 2023 to $3.8 billion in 2024 across 162 deals, with mentions of autonomous AI agents on earnings calls increasing fourfold in Q4 2024 according to CB Insights analysis.

The strategic imperative extends beyond efficiency gains. As discussed in our comprehensive guide on AI Regulation in the U.S. 2025, regulatory pressures are accelerating adoption timelines. Financial institutions face mounting compliance costs—estimated at $270 billion annually for U.S. banks alone—driving 63% of institutions to increase AI investments in regulatory technology through 2025.

Competitive Pressure and Customer Expectations

The competitive landscape has fundamentally shifted. According to McKinsey analysis, customers no longer ask how banks use AI—they expect intelligent, real-time services as the baseline standard. Banks that fail to provide personalized, instant, multi-channel experiences face accelerating customer churn to digital-first competitors and AI-native fintech platforms. A 2024 survey found that 90% of financial services firms have incorporated AI to some extent, yet only 9% consider themselves ahead of the curve, indicating significant implementation challenges alongside universal strategic importance.

Section 2 — Autonomous Lending Systems

From Days to Minutes: The Speed Revolution

Traditional lending processes required analysts to spend hours or days manually reviewing financial documents, verifying data across disparate systems, and calculating risk scores. Industry research indicates that reducing loan approval times from days to under one hour can increase conversion rates by up to 34%, directly boosting lending revenue and customer satisfaction. AI-powered autonomous lending systems are making these speed improvements operational reality across multiple institution types.

According to ScienceSoft analysis, AI lending platforms enable up to 25 times faster loan processing compared to traditional methods, while reducing operational costs by 20-70%. Zest AI, a leading provider serving institutions including Citibank, Freddie Mac, and First National Bank of Omaha, offers over 250 proprietary AI underwriting models that have demonstrated the capability to increase loan approval rates by 15-30% while maintaining or reducing default risk.

Multi-Agent Agentic Systems

Bloomberg Intelligence research describes how agentic AI loan approval systems deploy specialized autonomous agents working collaboratively to automate end-to-end processes. A data aggregation agent collects financial information from multiple sources. A credit scoring agent applies predictive analytics to assess creditworthiness using both traditional and alternative data. A risk assessment agent evaluates income stability, debt ratios, and macroeconomic volatility. Finally, a decision agent synthesizes these inputs to approve or deny applications with full regulatory rationale documentation.

Platforms like Amazon Bedrock and Salesforce Agentforce (launched September 2024, with version 2.0 in May 2025) provide infrastructure for building and managing these multi-agent networks at enterprise scale. UK-based fintech implementations of AI-enabled lending platforms have reportedly unlocked new capital opportunities for small and medium-sized enterprises, contributing to growth rates approaching 150% in SME assets and employment increases exceeding 50% within three-year periods across small-business lending portfolios.

Alternative Data and Financial Inclusion

AI systems can analyze significantly larger and more diverse datasets than traditional credit models. According to ScienceSoft, AI platforms capture transactional histories, bill payment patterns, employment duration, and in some cases responsibly-sourced alternative data including online behavior patterns—all while maintaining compliance with fair lending regulations through built-in bias mitigation protocols.

Early adopters of advanced AI credit models report expanding qualified borrower pools by up to 20% without corresponding increases in default rates. This financial inclusion dimension opens new revenue streams while serving previously underbanked populations. Research indicates that AI-driven credit scoring can improve loan approval rates by 30% while keeping credit risks controlled, and can help identify creditworthy applicants among the estimated 26 million Americans who are “credit invisible” according to Consumer Financial Protection Bureau research.

For more context on how AI infrastructure developments support these capabilities, see our analysis of AI Infrastructure 2026 — Data Centers, Chips & Sustainability.

Section 3 — AI Credit Scoring Models

Beyond FICO: The Neural Network Revolution

Traditional credit scoring models rely on relatively limited data inputs—primarily credit history, outstanding debts, payment patterns, and length of credit relationships. AI-powered credit scoring fundamentally expands this framework by analyzing thousands of variables through machine learning algorithms including multilayer neural networks, gradient boosting machines, random forests, and logistic regression models.

Research published in 2025 indicates that multilayer neural networks and logistic regression demonstrate top performance in classifying loan repayment risk, with neural networks particularly effective at capturing complex, non-linear borrower behavior patterns that traditional models miss. According to McKinsey analysis, AI-driven credit scoring models can reduce default rates by up to 20% compared to conventional methods, while V7 Labs reports that modern AI models analyze thousands of variables and continuously learn from outcomes, achieving significantly higher accuracy than rules-based approaches.

Real-Time Risk Assessment and Dynamic Pricing

Advanced implementations enable continuous risk monitoring rather than point-in-time assessments. Upstart, an AI-focused lender in the United States, uses continuous AI-based risk assessment to dynamically adjust credit offers and pricing based on borrower behavior signals even after loan origination. The company reports this approach has reduced default rates by 53% compared to traditional FICO-based models.

Dynamic risk assessment allows lenders to flag potential repayment issues earlier—before they result in penalties or defaults—enabling proactive adjustment of repayment plans. This capability benefits both institutions through reduced losses and consumers through more flexible arrangements aligned with changing financial circumstances.

The Explainability Imperative

As AI credit models grow more sophisticated, regulatory and ethical requirements demand transparency in decision-making. The Consumer Financial Protection Bureau issued guidance in 2024 emphasizing that creditors must provide specific and accurate reasons when taking adverse actions, with no special exemption for AI-driven decisions. Simply pointing to “algorithmic decision” or using generic checklist items fails to meet Equal Credit Opportunity Act requirements.

This has accelerated adoption of Explainable AI (XAI) techniques. Methods including SHAP (SHapley Additive exPlanations), LIME (Local Interpretable Model-Agnostic Explanations), and counterfactual explanations help break down how AI systems reach specific conclusions. A major European bank reportedly reduced credit decision disputes by 30% after implementing SHAP models to provide personalized explanations for each denial. Investment in Explainable AI models increased 39% year-over-year through 2025, reflecting heightened compliance requirements and consumer expectations for transparency.

The European Union’s GDPR includes a “right to explanation” for algorithmic decisions affecting individuals, while the EU AI Act 2025 categorizes credit approval as a high-risk application requiring strict transparency and explainability standards. Financial institutions must balance model performance with interpretability—a technical challenge that becomes a competitive differentiator as trust emerges as banking’s most precious resource.

Section 4 — AI Fraud Prevention & AML Automation

Real-Time Threat Detection at Scale

Financial crime costs the global economy an estimated $2-3.1 trillion annually according to UN estimates, with U.S. consumers alone reporting losses exceeding $12.5 billion to fraud in 2024—a 25% increase from the prior year per Federal Trade Commission data. The sophistication of fraud schemes, money laundering networks, and cyberattacks has evolved faster than traditional rules-based detection systems can adapt.

AI-driven fraud detection systems are now deployed by 87% of global financial institutions according to 2025 industry data. These systems intercept approximately 92% of fraudulent activities before transaction approval, while reducing false positive alerts—a major pain point in legacy systems—by up to 80%. Real-time fraud detection capabilities have led to a 41% reduction in financial losses attributed to cyberattacks, with behavioral biometric analysis helping detect identity theft cases 28% faster than conventional methods.

AML Compliance and Productivity Gains

Anti-Money Laundering compliance represents a massive operational burden. According to PwC surveys, 62% of financial institutions already employed AI and machine learning for AML activities by 2023, with projections indicating 90% adoption by 2025. McKinsey research suggests agentic AI is driving productivity gains ranging from 200% to 2,000% in compliance domains including Know Your Customer (KYC) and AML by autonomously executing end-to-end workflows rather than merely assisting human analysts.

Standard Chartered Bank provides a concrete example, leveraging AI as a core component of its AML framework to perform continuous transaction monitoring. The bank’s systems move beyond simple rule-based alerts to identify broader behavioral patterns signaling illicit activity, dynamically building customer risk profiles that evolve in real-time based on transactional behavior and network relationships. AI also automates customer due diligence document reviews and sanctions screening, creating a more responsive and efficient compliance framework.

Platforms like FinCense and Hawk AI demonstrate the state of the art. Hawk’s solutions, recognized as a Strong Performer in Forrester’s Q2 2025 Anti-Money Laundering Solutions Wave report, combine transaction monitoring, payment screening, and perpetual KYC in unified platforms. The systems feature fully explainable AI decision-making, enabling compliance officers to understand and document the rationale behind every flagged transaction—critical for regulatory audits and investigations.

Regulatory Evolution and Global Standards

Regulatory frameworks are rapidly evolving to address both new threats and AI capabilities. The Financial Action Task Force (FATF) updated its National Risk Assessment guidance in 2024-2025 to emphasize emerging risks, public-private collaboration, and technology-driven approaches. Key developments include:

- European Union: The 6th Anti-Money Laundering Directive (6AMLD) stiffens penalties and mandates improved cross-border cooperation. The new AML Authority (AMLA), operational since 2024, oversees high-risk entities and works to standardize enforcement across member states. Beneficial ownership registries face stricter transparency requirements.

- United States: FinCEN’s modernization proposals call for real-time transaction monitoring, AI-based risk assessment tools, and expanded cryptocurrency oversight. The 2024 National Strategy for Combating Terrorist and Other Illicit Financing highlighted AI’s transformative potential for enhancing AML compliance through pattern analysis across vast datasets. Canada has expanded AML powers with higher penalties and criminal classification of certain infractions.

- Asia-Pacific: Singapore and Hong Kong have tightened rules for Virtual Asset Service Providers (VASPs), mandating robust KYC and transaction monitoring. FATF’s 5th round of mutual evaluations is providing comprehensive country-by-country assessments of money laundering and terrorism financing controls, driving regional harmonization.

Cryptocurrency and decentralized finance platforms face particular scrutiny. A 2024 Chainalysis report revealed that illicit cryptocurrency transactions surged over 80% year-over-year, prompting regulators to require stricter KYC/AML controls, transaction monitoring, and suspicious activity reporting aligned with FATF recommendations. For deeper analysis of cybersecurity dimensions, consult our report on AI Cybersecurity 2025.

Section 5 — Predictive AI Risk Models (Stress Tests, Macro Scenarios)

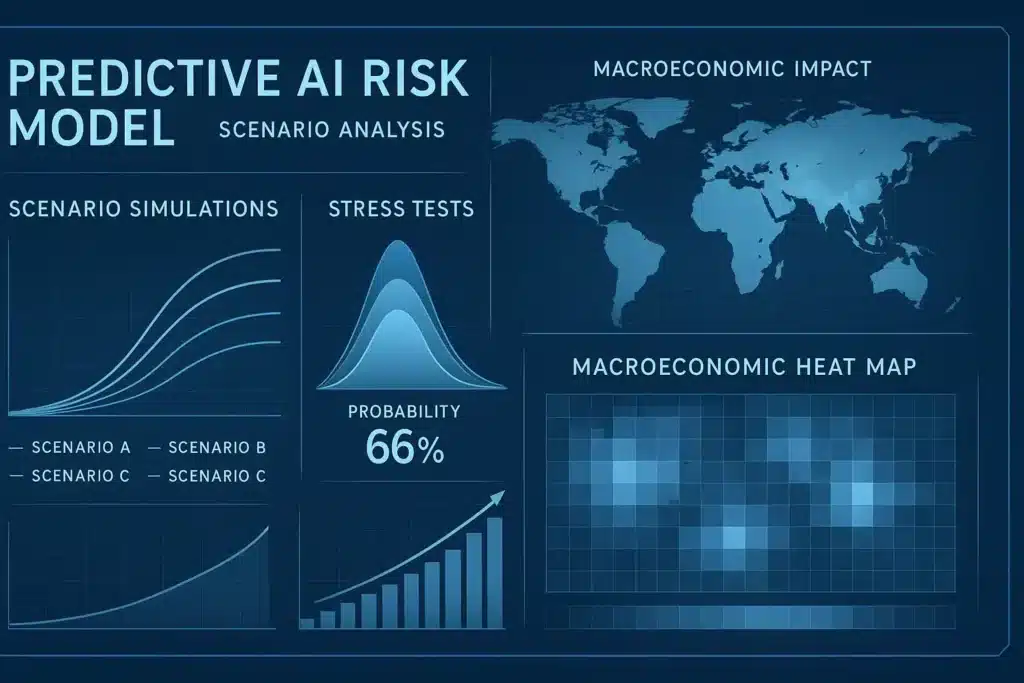

Beyond Historical Analysis: Scenario Simulation

Traditional risk management relies heavily on historical data and periodic stress testing against standardized scenarios. Predictive AI transforms this paradigm by enabling banks to simulate thousands of potential economic scenarios in real-time, assessing portfolio vulnerabilities across multiple dimensions simultaneously. Capgemini research highlights how banks are deploying AI-powered predictive liquidity forecasting and scenario modeling to gain clearer visibility into cash positions, reducing the need for large idle capital buffers while improving day-to-day liquidity planning.

Portfolio Optimization and Dynamic Hedging

Autonomous trading agents use reinforcement learning to rebalance investment portfolios within predefined guardrails, optimize tax-loss harvesting strategies, and adjust exposure levels instantly based on market conditions. Wealthfront’s automation suite exemplifies near-agentic capabilities: their systems monitor portfolios daily for tax-loss harvesting opportunities, automatically selling depreciated investments and replacing them with highly correlated alternatives to maintain risk/return profiles. Over 2024, Wealthfront harvested more than $145 million in tax losses for clients, with estimated savings exceeding advisory fees in approximately 96% of cases and generating over $1 billion in cumulative tax benefits.

Credit Portfolio Management

Research shows that banks fully integrating AI across the credit lifecycle can reduce credit losses by 20-30% while increasing revenue by 5-10%. Continuous risk monitoring enables institutions to identify deteriorating credit conditions earlier, adjust credit limits dynamically, and implement proactive workout strategies before defaults occur. This approach shifts risk management from reactive to predictive, fundamentally changing how banks approach portfolio construction and capital allocation.

The implications extend to regulatory capital requirements. More accurate risk prediction potentially allows for more efficient capital deployment under Basel III frameworks, though regulators are simultaneously scrutinizing AI model risk to ensure banks maintain adequate buffers against model error and systematic biases.

Section 6 — Blockchain Analytics & Behavioral Biometrics

Next-Generation Identity Verification

Behavioral biometrics analyze patterns in how users interact with banking systems—typing cadence, mouse movement patterns, touchscreen pressure, device angle during mobile usage, and navigation sequences. These behavioral fingerprints provide continuous authentication throughout sessions rather than relying solely on point-of-entry credentials like passwords or PINs.

By 2025, AI voice authentication has been adopted by approximately 67% of mobile-first banks to secure access and prevent fraud. Biometric authentication via chatbot interfaces was launched in 38% of mobile banking applications by mid-2025. This multi-layered approach significantly reduces account takeover fraud while improving user experience by reducing friction from repeated authentication challenges.

Blockchain Analytics for Transaction Transparency

The convergence of blockchain technology and AI analytics creates new capabilities for tracking illicit financial flows, especially in cryptocurrency markets. AI systems can analyze blockchain transaction patterns, identify wallet clustering indicative of coordinated activity, and flag suspicious flows for investigation. Research indicates blockchain-AI hybrid use cases saw a 27% funding increase in 2025, particularly for cross-border payment solutions.

The technology proves especially relevant as regulatory frameworks catch up to digital asset innovation. The Markets in Crypto-Assets Regulation (MiCA) in the European Union imposes bank-level AML rigor on stablecoin companies operating on fiat rails, requiring unified real-time monitoring capabilities. Institutions must screen transactions against evolving watchlists while balancing privacy considerations with regulatory mandates.

Payment networks are responding with AI-enabled infrastructure. Mastercard unveiled Agent Pay in April 2025, described as pioneering agentic payments technology to power commerce in the age of AI. PayPal released an agent toolkit in April 2025 to accelerate commerce capabilities, while Visa launched systems to enable AI agents to transact securely and seamlessly. These developments indicate that autonomous AI agents will soon require their own payment infrastructure—a fundamental shift in financial system architecture.

Section 7 — Regulatory Landscape (SEC, FCA, ESMA, MAS, GCC)

United States: Federal and State Dynamics

The U.S. regulatory environment for AI in banking remains fragmented between federal guidance and state-level legislation. The Consumer Financial Protection Bureau (CFPB) has taken an active stance, issuing guidance that existing consumer protection laws—including the Equal Credit Opportunity Act—apply fully to AI-driven lending decisions. The Bureau emphasized in 2024 guidance that creditors must explain specific reasons for adverse actions with no special exemption for algorithmic complexity.

The Treasury Department’s June 2024 Request for Information sought to understand how financial institutions use AI for AML compliance, signaling regulatory interest in shaping frameworks around industry practices. The Acting Chairman of the Office of the Comptroller of the Currency (OCC) stated in 2024 that AI tools are essential to combat evolving fraud typologies including deepfake-based attacks, while calling for robust AI governance and oversight frameworks including regular testing to prevent outcome bias.

At the state level, regulations vary significantly. California issued a legal advisory in January 2025 emphasizing that existing consumer protection laws including the California Consumer Privacy Act and Unfair Competition Law apply to AI-driven decisions. Illinois amended its Consumer Fraud and Deceptive Business Practices Act to expand oversight of predictive data analytics and AI in creditworthiness determinations, effective January 2026. Utah’s Artificial Intelligence Policy Act, effective May 2024, requires businesses using AI chatbots to clearly disclose when customers interact with AI rather than humans.

However, recent political developments may reshape this landscape. President Trump’s administration revoked President Biden’s comprehensive AI executive order in January 2025. The proposed One Big Beautiful Bill Act, which passed the House in May 2025, seeks a 10-year moratorium on new state and local AI regulations, creating regulatory uncertainty. For comprehensive analysis of these dynamics, see our detailed report on AI Regulation in the U.S. 2025: Federal vs. State Divide.

European Union: Comprehensive AI Act Framework

The European Union adopted the world’s first comprehensive AI regulatory framework in 2024, categorizing systems by risk level with corresponding obligations. Credit approval falls under the “high risk” category, triggering strict transparency and explainability requirements. The EU AI Act mandates that institutions deploying high-risk AI systems maintain technical documentation, implement risk management systems, ensure human oversight, and achieve appropriate levels of accuracy, robustness, and cybersecurity.

The phased implementation provides transition time but requires rigorous planning. Financial institutions must ensure AI credit models provide clear justification for decisions in accordance with GDPR’s “right to explanation” and new AI Act requirements. The 6AMLD additionally harmonizes AML enforcement across member states, with the AMLA providing centralized oversight of high-risk entities.

Asia-Pacific: Singapore and Hong Kong Leadership

The Monetary Authority of Singapore (MAS) has established comprehensive guidelines for AI and data analytics in financial services, emphasizing principles including fairness, transparency, explainability, and accountability. MAS Notice 626 provides specific AML/CFT requirements for financial institutions, increasingly incorporating expectations for AI-enabled monitoring systems.

Hong Kong’s financial regulators similarly emphasize technology-driven compliance while maintaining strict consumer protection standards. Both jurisdictions are working to position themselves as AI innovation hubs while ensuring robust regulatory oversight—a balance that has attracted significant fintech investment to the region.

Gulf Cooperation Council: Strategic AI Investment

GCC nations, particularly Saudi Arabia and the United Arab Emirates, are making massive strategic investments in AI infrastructure and adoption. Saudi Vision 2030 includes substantial technology transformation goals, with banking modernization as a key priority. For detailed analysis of regional AI investment patterns, see our report on Saudi Arabia & GCC AI Investment 2025.

Section 8 — Enterprise Adoption (US, EU, India, GCC, APAC)

North American Leadership and Implementation

North America maintains dominant market share at approximately 45% of the global AI banking market in 2024-2025, with the United States accounting for the majority of AI investment. According to Federal Reserve data, 76% of Americans used mobile banking applications by 2023, up from 65% in 2020, creating favorable conditions for AI-powered personalized services. The American Bankers Association reports that 71% of banks are employing or planning to deploy AI to enhance customer service.

Major U.S. institutions lead in deployment scale. JPMorgan Chase, Bank of America, and Wells Fargo are at the forefront of operational AI adoption for fraud prevention, credit decisioning, and customer experience optimization. Commerzbank projected €300 million in benefits from €140 million of AI investments—an ROI approaching 120%—with gains equivalent to approximately 25% of guided profit growth through 2028.

The Commonwealth Bank of Australia opened a new technology hub in Seattle in March 2025 specifically to advance AI capabilities, focusing on staff upskilling and developing solutions that improve customer service efficiency while protecting against online fraud. Royal Bank of Canada announced expectations in March 2025 to earn up to C$1 billion from AI investments, demonstrating executive confidence in concrete returns.

European Integration and Compliance Focus

European banks face the dual challenge of maximizing AI benefits while navigating the continent’s strictest regulatory frameworks. The combination of GDPR, 6AMLD, and the AI Act creates significant compliance requirements but also potentially sustainable competitive advantages for institutions that successfully implement explainable, fair, and transparent AI systems.

UniCredit implemented its AI-powered DealSync system in April 2025, utilizing advanced algorithms to identify small and medium-sized M&A opportunities—demonstrating how European banks are applying AI beyond traditional retail banking functions into corporate and investment banking domains.

Asia-Pacific: Fastest Growth Trajectory

The Asia-Pacific region shows the highest growth rates globally, driven by massive populations, rapid internet penetration, and government initiatives promoting technological advancement in financial services. According to the Asian Development Bank, 78% of regional banks plan to deploy AI-driven personalization by 2025. Asian-Pacific banks showed 79% chatbot adoption rates in 2025, outpacing North America.

India represents a particularly dynamic market, with Setu collaborating with Sarvam AI to develop India’s first Large Language Model specifically designed for the BFSI industry in May 2024. This localized approach addresses linguistic and cultural nuances critical for effective customer engagement across diverse populations. The developments mirror broader AI innovation trends across the African continent, as detailed in our analysis of The Rise of AI Startups in Africa.

Implementation Challenges Across Regions

Despite high adoption intentions, significant obstacles remain. Only 26% of companies have developed capabilities necessary to move beyond proofs of concept and generate tangible value from AI initiatives according to industry surveys. Bloomberg Intelligence research found that legacy systems still absorb approximately 60% of banks’ technology budgets, highlighting a key barrier to AI implementation.

Skills gaps present another persistent challenge. Effective AI deployment requires collaboration between business stakeholders, data scientists, and IT professionals—expertise that remains scarce. Data quality and accessibility issues compound these challenges, as AI models require clean, comprehensive, and real-time datasets often trapped in siloed legacy systems with inconsistent formats.

Section 9 — Global Economic Impact (Verified Data Only)

Market Size and Growth Projections

Based on verified market research from multiple sources, the global AI in banking market demonstrates robust and accelerating growth:

- Market valuation reached between $23.6 billion and $26.2 billion in 2024 across different research methodologies

- Projections for 2025 range from $31.3 billion to $43.1 billion depending on segmentation approaches

- Long-term forecasts estimate the market will reach $143.6 billion to $379.4 billion by 2030-2034

- Compound annual growth rates consistently exceed 30%, with some segments approaching 32-33% CAGR

The generative AI segment specifically grew from $1.16-$1.29 billion in 2024 to projected $1.43 billion in 2025, with forecasts reaching $21.57 billion by 2034 at a 31.64% CAGR. This reflects specialized applications in content generation, automated reporting, and conversational interfaces.

Cost Savings and Efficiency Gains

Operational impact data from verified implementations includes:

- Cost reductions of 20-40% reported by early adopters including HSBC, Citibank, UBS, DBS Bank, and ING

- Revenue increases of 10-30% in AI-enabled business units at leading institutions

- $7.3 billion in projected global operational cost savings for banks using AI chatbots in 2025

- Up to 75% elimination of manual credit decisioning tasks through automation

- 20-70% reductions in lending operational costs depending on implementation scope

McKinsey analysis suggests AI technologies could add up to $1 trillion in value annually to the global banking industry, with Asia-Pacific institutions positioned for significant benefits given regional growth dynamics and digital transformation momentum.

Fraud Prevention and Risk Reduction Impact

Quantifiable security and risk management outcomes include:

- 87% of global financial institutions now deploy AI-driven fraud detection systems

- 92% interception rate for fraudulent activities before transaction approval

- Up to 80% reduction in false positive fraud alerts, significantly improving customer experience

- 41% decrease in financial losses due to cyberattacks through real-time AI detection

- 53% reduction in default rates reported by Upstart compared to traditional FICO-based models

- 20-30% reduction in credit losses for banks fully integrating AI across credit lifecycles

Customer Experience Metrics

Customer-facing AI applications show measurable adoption and satisfaction:

- 73% of global banks now deploy at least one customer-facing chatbot

- 88% of U.S. Tier 1 banks have integrated AI chatbots across mobile and desktop platforms

- 3.1 billion banking interactions per month handled by chatbots in 2025, representing 28% YoY growth

- 84% customer satisfaction scores for chatbot interactions in banking in 2025

- 34% increase in loan conversion rates when approval times reduced from days to under one hour

Investment and Funding Patterns

Capital allocation reflects institutional confidence in AI transformation:

- $73.4 billion projected global bank investment in AI technologies by end of 2025

- 21% average year-over-year increase in AI budgets for top-tier U.S. banks

- $9.2 billion in venture capital secured by AI startups serving financial services in first half of 2025

- $3.8 billion in funding for AI agent startups in 2024, nearly triple the $1.3 billion in 2023

- 16% of bank IT budgets now dedicated to AI deployment and experimentation

- 27% increase in funding for blockchain-AI hybrid solutions, particularly for cross-border payments

- 39% increase in investment in Explainable AI models driven by compliance requirements

These figures represent current verified data and near-term projections based on publicly available information. Readers should note that economic conditions, regulatory changes, and technological breakthroughs may cause actual outcomes to differ from these projections.

Section 10 — Challenges, Bias, Explainability (XAI)

The Algorithmic Bias Problem

AI systems inherit and can amplify biases present in training data. According to a 2024 Urban Institute analysis of Home Mortgage Disclosure Act data, Black and Brown borrowers were more than twice as likely to be denied mortgage loans as white borrowers with equivalent credit profiles. A UC Berkeley study on fintech lending found that African American and Latinx borrowers are charged approximately 5 basis points higher interest rates than credit-equivalent white counterparts—translating to roughly $450 million in extra annual interest payments.

The technical challenge stems from how machine learning models optimize for patterns in historical data. If past lending decisions reflected discriminatory practices, AI models trained on that data risk perpetuating those patterns unless explicitly designed to detect and mitigate bias. Protected attributes like race and gender are often correlated with proxy variables in datasets, allowing algorithmic discrimination even when protected characteristics aren’t directly used as inputs.

A systematic literature review covering 2013-2024 research found that while some fairness interventions achieve gains exceeding 30% with minimal accuracy loss, significant methodological gaps persist including lack of standardized metrics, overreliance on legacy data, and insufficient transparency in model pipelines. Researchers emphasize the need for preprocessing, in-processing, and post-processing approaches to manage trade-offs between fairness, privacy, and accuracy.

Explainability as Regulatory and Competitive Requirement

The “black box” nature of complex AI models creates both regulatory and trust challenges. When credit decisions or fraud detection alerts lack explanation, consumers cannot effectively contest decisions, institutions struggle to conduct audits, and regulators face difficulties assessing compliance with fair lending laws.

The CFPB’s 2024 guidance makes clear that explanations like “algorithmic decision” or “risk score too low” fail to meet legal requirements. Institutions must identify and communicate specific factors driving outcomes—debt-to-income ratios, recent late payments, credit utilization rates, or other concrete elements. This requirement extends beyond credit to fraud alerts, account closures, and other automated adverse actions.

Explainable AI techniques including SHAP, LIME, and counterfactual explanations provide technical solutions, but implementation requires careful design. Research by Ribeiro, Doshi-Velez, and others emphasizes that black-box AI models—particularly deep learning architectures—often lack interpretability, making it difficult for institutions and regulators to justify automated decisions. Recent innovations like counterfactual explanations help borrowers understand what changes would improve their outcomes, enhancing both transparency and consumer empowerment.

For institutions, explainability serves multiple functions: regulatory compliance, consumer trust building, internal model validation, and continuous improvement through understanding model behavior. A major European bank reportedly reduced credit decision disputes by 30% through SHAP-based personalized explanations—demonstrating commercial benefits alongside compliance value.

Data Privacy and Security Concerns

AI systems require vast amounts of data, creating exposure to misuse, breaches, and privacy violations. Regulations including GDPR, California Consumer Privacy Act, and sectoral frameworks impose strict requirements for data collection, storage, processing, and deletion. The integration of alternative data sources—social media activity, online behavior, purchasing patterns—raises particular concerns about surveillance and the boundaries of appropriate data use in credit decisions.

Financial institutions must balance AI effectiveness against privacy principles. Techniques like federated learning enable collaborative model training across institutions without centralizing sensitive data, while differential privacy methods add mathematical noise to datasets to prevent identification of individuals. However, these privacy-preserving approaches often reduce model accuracy, creating tension between competing objectives.

Skills Gap and Implementation Complexity

Effective AI deployment requires scarce interdisciplinary expertise spanning data science, domain knowledge in banking, regulatory compliance, and ethical AI governance. Many institutions report difficulty recruiting and retaining talent with appropriate skill combinations. The pace of AI advancement further challenges workforce development, as techniques and best practices evolve faster than traditional training programs can adapt.

Cultural resistance presents another barrier. Successful AI transformation requires not just technology deployment but organizational change affecting workflows, decision-making authority, and role definitions. Lending officers who previously exercised judgment may resist systems that automate decisions, while risk managers accustomed to rules-based approaches must develop comfort with probabilistic, continuously-learning systems.

Model Risk and Systemic Concerns

As more institutions deploy similar AI approaches, correlated model risk emerges as a systemic concern. If major banks all rely on algorithms that respond identically to market signals, collective behavior could amplify market volatility or create procyclical lending patterns that exacerbate economic cycles. Regulators including the Bank for International Settlements and Federal Reserve are studying these systemic implications.

Model drift—the tendency for AI system performance to degrade over time as data distributions shift—requires continuous monitoring and retraining. Banks must establish robust model governance including validation, monitoring, documentation, and periodic review by independent parties. The rapid evolution of AI capabilities creates additional pressure, as institutions must continuously evaluate whether to adopt newer architectures that may offer performance gains but require re-establishing validation and compliance.

Related challenges in healthcare AI, particularly around ethical automation and patient trust, offer relevant parallels for banking institutions. Our analysis of AI in Healthcare 2026 — Ethical Automation & Patient Trust examines similar transparency and accountability frameworks.

Section 11 — The 2026–2030 Roadmap for AI Banking

Near-Term Evolution (2026-2027)

Industry analysts and institutional roadmaps suggest several developments likely to materialize by late 2026 and through 2027:

Expanded Agentic AI Deployment: Multi-agent systems are expected to move from pilot programs to production across major institutions for loan processing, compliance monitoring, and customer service. Bloomberg Intelligence analysis indicates that the path to full autonomy may require more than five years due to data governance, legacy system constraints, and regulatory scrutiny, but progressive capability expansion appears certain.

Real-Time Everything: Transaction monitoring, fraud detection, risk assessment, and credit decisions will increasingly operate in real-time rather than batch processes. The infrastructure investments underway in 2024-2025 position institutions to deliver instant lending decisions, immediate fraud interventions, and continuous risk updates throughout 2026-2027.

Embedded Finance Integration: Banking services delivered through non-bank platforms—e-commerce sites, software applications, automotive systems—will increasingly incorporate AI capabilities. The payment infrastructure for autonomous AI agents, currently being developed by Mastercard, Visa, and PayPal, suggests a future where AI systems transact directly on behalf of users within defined parameters.

Regulatory Maturation: Global regulatory frameworks will continue evolving throughout 2026-2027 as agencies observe implementation outcomes and address gaps. Expect more specific technical guidance on model validation, bias testing, explainability standards, and documentation requirements. The tension between innovation facilitation and consumer protection will drive ongoing policy debates.

Medium-Term Transformation (2028-2030)

Looking toward the end of the decade, several structural shifts appear probable based on current trajectories:

Autonomous Decision Authority: By 2028, industry forecasts suggest approximately 15% of work decisions will be made autonomously by agentic AI, up from essentially 0% in 2024. This implies that within banking, decisions currently requiring human judgment—credit approvals, trading strategies, compliance escalations—will increasingly fall within AI autonomous authority under defined parameters.

Hyper-Personalization at Scale: AI systems will deliver individualized financial products, pricing, advice, and experiences to hundreds of millions of customers simultaneously. The combination of comprehensive data analysis, real-time processing, and sophisticated behavioral modeling will enable true one-to-one banking relationships at scale—something impossible with human-only servicing models.

Integrated Risk Ecosystems: Traditional boundaries between fraud detection, AML compliance, credit risk, market risk, and operational risk will blur as unified AI platforms provide holistic risk views. Institutions will assess exposures across all dimensions simultaneously, enabling more sophisticated trade-offs and capital optimization.

AI-Native Banking Competition: Fully digital, AI-native banks unburdened by legacy systems will likely gain market share from traditional institutions that struggle with transformation costs and organizational change resistance. Competitive dynamics will increasingly separate AI leaders from laggards based on customer experience quality, operational efficiency, and risk management effectiveness.

Critical Success Factors

Institutions most likely to succeed through 2030 will demonstrate capabilities in several areas:

- Data Infrastructure Excellence: Clean, comprehensive, real-time data accessible across organizational silos provides the foundation for all AI capabilities. Successful institutions are investing now in data governance, quality, and integration.

- Talent and Culture: Organizations combining technical AI expertise with banking domain knowledge and ethical governance while fostering cultures that embrace continuous learning and adaptation will outperform peers.

- Strategic Regulatory Relationships: Proactive engagement with regulators to shape frameworks, demonstrate best practices, and build trust will prove valuable as agencies craft specific requirements.

- Explainability and Trust: Institutions that successfully implement transparent, explainable AI systems while maintaining high accuracy will gain consumer and regulator confidence critical for scaling deployments.

- Ecosystem Orchestration: Successful banks will act as platform orchestrators, effectively integrating capabilities from fintech partners, cloud providers, AI specialists, and data vendors rather than attempting to build all capabilities internally.

Uncertainties and Wildcards

Several factors could significantly alter trajectories:

Technological Breakthroughs: Fundamental advances in AI capabilities—particularly in reasoning, causal inference, or safety—could accelerate or reshape adoption patterns. Conversely, discovery of fundamental limitations or failure modes could slow deployment.

Regulatory Shocks: Major AI failures, discrimination scandals, or systemic risks could trigger restrictive regulations that limit capabilities or slow adoption. Alternatively, regulatory harmonization and clear standards could accelerate institutional confidence.

Economic Disruptions: Severe economic downturns could either accelerate AI adoption as institutions seek efficiency or slow investment during capital constraints. Macroeconomic conditions will influence the pace and pattern of transformation.

Competitive Dynamics: Entry of major technology companies into banking services—leveraging AI capabilities and existing user relationships—could dramatically reshape competitive structures and accelerate industry transformation.

Conclusion

The integration of artificial intelligence into banking operations represents one of the most significant structural transformations in financial services history. Evidence from 2024-2025 implementations demonstrates that AI capabilities have moved decisively beyond experimental pilots to deliver measurable operational improvements, cost reductions, and revenue enhancements at leading institutions globally.

Autonomous lending systems are reducing approval times from days to minutes while expanding access to credit for previously underserved populations. AI-powered credit scoring models achieve accuracy improvements of 20% or more compared to traditional approaches while enabling dynamic risk assessment throughout the credit lifecycle. Fraud detection systems intercepting over 90% of threats before transaction approval protect billions of dollars in potential losses annually. AML compliance automation delivers productivity gains ranging from 200% to 2,000% in specific workflows, addressing a compliance burden that costs the industry hundreds of billions annually.

The market dynamics underscore institutional commitment: from approximately $26 billion in 2024, the AI banking market is projected to exceed $379 billion by 2034, reflecting compound annual growth rates exceeding 30%. Investment patterns—$73.4 billion in bank AI spending projected for 2025, nearly $10 billion in fintech AI venture funding in just the first half of 2025—demonstrate that financial institutions view AI transformation as strategic imperative rather than optional enhancement.

However, significant challenges temper enthusiasm. Algorithmic bias remains a persistent concern, with research documenting discriminatory outcomes in lending that AI systems risk perpetuating or amplifying without careful design and monitoring. Explainability requirements create technical tensions between model performance and interpretability. Data privacy considerations constrain the use of alternative data sources that could enhance financial inclusion. Skills gaps, legacy system constraints, and organizational change resistance slow implementation even at well-resourced institutions.

The regulatory landscape continues evolving rapidly, with frameworks diverging across jurisdictions. The European Union’s comprehensive AI Act establishes strict requirements for high-risk applications including credit decisioning. U.S. federal agencies provide guidance under existing consumer protection laws while state-level regulations create compliance complexity. Asian markets balance innovation facilitation with consumer protection through principles-based approaches. This regulatory fragmentation creates challenges for global institutions but also opportunities for those who successfully navigate multiple frameworks.

Looking toward 2026 and beyond, several trends appear increasingly certain. Agentic AI systems capable of autonomous end-to-end workflow execution will expand from narrow applications to broader operational deployment. Real-time processing will become standard across transaction monitoring, lending decisions, and risk assessment. Embedded finance will incorporate AI capabilities into non-bank platforms, reaching customers through new touchpoints. Hyper-personalization will deliver individualized financial products and experiences at unprecedented scale.

By 2028-2030, the financial services landscape may look fundamentally different. Industry forecasts suggest approximately 15% of work decisions will be made autonomously by AI systems within that timeframe. Competitive dynamics will increasingly separate AI leaders who successfully transform operations from laggards constrained by legacy systems and organizational resistance. The most successful institutions will combine technological excellence with human expertise, ethical governance, regulatory collaboration, and customer trust—recognizing that AI augments rather than replaces human judgment in high-stakes decisions affecting economic opportunity and financial security.

For financial institutions, the question is not whether to adopt AI but how quickly and effectively to implement capabilities that are rapidly becoming table stakes for competitive positioning. For regulators, the challenge lies in establishing frameworks that protect consumers and systemic stability while enabling beneficial innovation. For consumers, the promise of faster access to credit, lower costs, and more personalized services must be balanced against concerns about algorithmic fairness, privacy, and the concentration of decision-making power in complex systems that few fully understand.

The AI transformation of banking is neither purely utopian nor dystopian—it is fundamentally reshaping one of society’s most critical industries with outcomes that will be determined by the choices institutions, regulators, and societies make in the coming years. The verified data from 2024-2025 implementations provides evidence of real value creation alongside real risks, offering a foundation for informed decision-making as the industry navigates this transformation through the remainder of the decade.

Frequently Asked Questions (FAQ)

1. How large is the AI in banking market currently and what is its projected growth?

Based on verified market research, the global AI in banking market reached approximately $26.2 billion in 2024 and is projected to grow to between $31.3 billion and $43.1 billion in 2025, depending on segmentation methodology. Long-term forecasts estimate the market will reach $143.6 billion to $379.4 billion by 2030-2034, with consistent compound annual growth rates exceeding 30%. This growth reflects accelerating adoption across lending, fraud detection, customer service, compliance, and risk management functions globally.

2. What are autonomous lending systems and how do they differ from traditional loan processing?

Autonomous lending systems use agentic AI—artificial intelligence capable of reasoning, planning, and executing multi-step workflows with minimal human intervention. Unlike traditional processes where analysts manually review documents and calculate risk scores over days, autonomous systems deploy specialized AI agents that collaboratively collect financial data, assess creditworthiness using predictive analytics, evaluate risks, and approve or deny applications in minutes to hours. Research indicates these systems can reduce loan approval times by over 90%, process loans up to 25 times faster than traditional methods, and increase approval rates by 15-30% while maintaining or reducing default risk.

3. How accurate are AI fraud detection systems compared to traditional methods?

Industry data from 2025 shows that AI-driven fraud detection systems are now deployed by 87% of global financial institutions and intercept approximately 92% of fraudulent activities before transaction approval. These systems have reduced false positive alerts—a major customer friction point—by up to 80% compared to rules-based legacy systems. Real-time AI fraud detection has led to a 41% drop in financial losses due to cyberattacks, while behavioral biometric analysis helps detect identity theft cases 28% faster than conventional methods. The improvement stems from AI’s ability to analyze millions of transactions simultaneously, identifying complex patterns that rules-based systems miss.

4. What is explainable AI (XAI) and why is it important for banking?

Explainable AI refers to techniques and frameworks that make AI decision-making transparent and understandable to humans rather than operating as inscrutable “black boxes.” In banking, XAI is critical for multiple reasons: (1) Regulatory compliance—the Consumer Financial Protection Bureau and other agencies require financial institutions to provide specific reasons for adverse actions like credit denials, with no exemption for AI complexity; (2) Consumer rights—individuals must be able to understand and contest automated decisions affecting their financial opportunities; (3) Bias detection—transparent models enable institutions to identify and mitigate discriminatory patterns; and (4) Trust building—customers and regulators require confidence that AI systems make fair, accurate decisions. Techniques like SHAP (SHapley Additive exPlanations) and LIME (Local Interpretable Model-Agnostic Explanations) provide this transparency, with some institutions reducing disputes by 30% through implementation of explainable models.

5. How does AI credit scoring differ from traditional FICO scores?

Traditional credit scoring relies primarily on credit history, outstanding debts, payment patterns, and length of credit relationships—typically five major factors. AI credit scoring expands this dramatically by analyzing thousands of variables through machine learning algorithms including neural networks, gradient boosting, and ensemble methods. AI models can incorporate alternative data like bank transaction patterns, bill payment history, employment duration, and in some cases responsibly-sourced behavioral data. Research shows AI-driven credit scoring can reduce default rates by up to 20% compared to traditional methods. Importantly, AI scoring can extend credit to “credit invisible” populations lacking traditional credit histories—the Consumer Financial Protection Bureau estimates 26 million Americans fall into this category. However, AI credit models must be carefully designed to avoid bias and meet explainability requirements under laws like the Equal Credit Opportunity Act.

6. What are the main regulatory frameworks governing AI in banking globally?

Regulatory frameworks vary significantly by jurisdiction: United States: The CFPB enforces the Equal Credit Opportunity Act requiring specific explanations for credit denials regardless of AI use. FinCEN provides AML guidance increasingly incorporating AI expectations. State-level regulations like California’s Consumer Privacy Act and Illinois’s amended Consumer Fraud Act add complexity. European Union: The comprehensive AI Act categorizes credit approval as “high risk” requiring strict transparency, explainability, and oversight. GDPR’s “right to explanation” applies to automated decisions. 6AMLD harmonizes AML enforcement. Asia-Pacific: Singapore’s MAS and Hong Kong regulators emphasize fairness, transparency, and accountability through principles-based approaches. International: FATF provides AML/CFT standards influencing global practices. This fragmented landscape creates compliance challenges for global institutions but also opportunities for those who successfully navigate multiple frameworks.

7. What is agentic AI and how is it being used in banking?

Agentic AI refers to systems that can autonomously reason through complex scenarios, plan multi-step actions, and execute decisions without continuous human oversight. Unlike assistive AI that augments human decision-making, agentic systems can independently complete end-to-end workflows. In banking, applications include: autonomous loan processing where specialized agents collaborate to collect data, score credit, assess risk, and approve applications; AML compliance systems that continuously monitor transactions, build dynamic risk profiles, and flag suspicious activity; trading systems that rebalance portfolios and optimize strategies within defined parameters; and customer service agents that resolve queries and execute transactions. Bloomberg Intelligence research indicates the path to full autonomy may require 5+ years due to governance and regulatory requirements, but progressive expansion of autonomous capabilities is accelerating. Industry forecasts suggest approximately 15% of work decisions will be made autonomously by AI by 2028.

8. How much are banks investing in AI and what returns are they seeing?

Investment levels reflect strategic priority: global banks are projected to invest $73.4 billion in AI technologies by end of 2025, representing a 21% year-over-year increase among top-tier institutions. Banks dedicate approximately 16% of IT budgets to AI deployment and experimentation in 2025. AI startups serving financial services secured $9.2 billion in venture capital in just the first half of 2025. In terms of returns, verified outcomes from leading institutions include: cost reductions of 20-40% (HSBC, Citi, UBS, DBS, ING); revenue increases of 10-30% in AI-enabled business units; Commerzbank projecting €300 million in benefits from €140 million investment (120% ROI); Royal Bank of Canada expecting up to C$1 billion from AI investments. Academic research suggests banks fully integrating AI across credit lifecycles can reduce credit losses by 20-30% while increasing revenue by 5-10%. McKinsey analysis indicates AI could add up to $1 trillion annually to the global banking industry.

9. What are the biggest challenges banks face in implementing AI systems?

Major implementation challenges include: Legacy systems: Bloomberg Intelligence found legacy systems absorb 60% of technology budgets, limiting resources for AI transformation and creating integration difficulties. Skills gaps: Only 26% of companies have developed capabilities to move beyond proofs of concept to value generation. Effective AI requires scarce interdisciplinary expertise in data science, banking, and compliance. Data quality: AI effectiveness depends on clean, comprehensive, real-time data, but many institutions struggle with siloed systems and inconsistent formats. Algorithmic bias: Training data reflecting historical discrimination risks perpetuating unfair outcomes requiring careful bias detection and mitigation. Explainability requirements: Balancing model performance with regulatory and consumer demands for transparency creates technical tensions. Regulatory uncertainty: Divergent frameworks across jurisdictions complicate compliance for global institutions. Organizational resistance: Cultural change and workflow redesign often prove more difficult than technology deployment itself.

10. How is AI addressing financial inclusion and expanding access to credit?

AI enables financial inclusion through several mechanisms: Alternative data analysis: By incorporating bank transaction patterns, bill payment history, employment stability, and other non-traditional factors, AI models can assess creditworthiness for the 26 million “credit invisible” Americans and billions globally lacking traditional credit histories. Bias reduction: Properly designed AI models with fairness constraints can reduce discriminatory patterns present in historical lending data, though this requires careful implementation. Expanded approval rates: Research shows AI can increase loan approval rates by 30% while maintaining controlled risk levels. Early adopters report expanding qualified borrower pools by 20% without corresponding default increases. Lower costs: Operational efficiency gains (20-70% cost reductions) enable profitable lending at smaller loan sizes, making credit viable for previously uneconomic segments. Speed and convenience: Reducing approval times from days to hours removes barriers that disproportionately affect underserved populations. However, institutions must balance inclusion goals with explainability requirements and vigilant monitoring to ensure AI systems achieve rather than undermine fairness objectives.

11. What role does AI play in Anti-Money Laundering (AML) compliance?

AI is transforming AML compliance from labor-intensive manual review to automated, continuous monitoring at scale. According to PwC surveys, 62% of financial institutions employed AI for AML by 2023, with projections indicating 90% adoption by 2025. McKinsey research suggests agentic AI drives productivity gains of 200-2,000% in AML workflows by autonomously executing end-to-end processes rather than merely assisting humans. Specific applications include: transaction monitoring that identifies suspicious patterns across millions of daily transactions; dynamic customer risk profiling that evolves in real-time based on behavior and network relationships; automated sanctions screening against continuously updated watchlists; behavioral pattern analysis detecting money mule networks and layering schemes; and enhanced due diligence document review using natural language processing. Real-world examples include Standard Chartered’s AI-powered AML framework and platforms like FinCense and Hawk AI providing explainable, auditable monitoring systems. Regulatory developments from FATF, FinCEN, the EU’s AMLA, and Asia-Pacific authorities increasingly expect and accommodate AI-enabled AML capabilities while requiring transparency and oversight.

12. How will AI in banking evolve between 2026 and 2030?

Based on industry analyses and institutional roadmaps, likely developments include: 2026-2027 near-term: Expansion of multi-agent agentic systems from pilots to production for loan processing, compliance, and customer service; real-time transaction monitoring and lending decisions becoming standard; embedded finance incorporating AI into non-bank platforms; regulatory frameworks maturing with more specific technical guidance. 2028-2030 medium-term: Approximately 15% of work decisions made autonomously by AI systems according to forecasts; hyper-personalization delivering individualized products to hundreds of millions simultaneously; unified AI platforms providing holistic risk views across fraud, AML, credit, market, and operational risk; competitive separation between AI leaders and laggards based on customer experience, efficiency, and risk management; potential entry of AI-native banks unburdened by legacy constraints. Critical success factors include data infrastructure excellence, talent and culture development, strategic regulatory relationships, explainability and trust building, and ecosystem orchestration. However, technological breakthroughs, regulatory shocks, economic disruptions, or competitive dynamics from technology companies could significantly alter trajectories.

References

- Deloitte Insights. (2025). “Agentic AI in banking.” Interviews with US banking executives, December 2024 – March 2025. https://www.deloitte.com/us/en/insights/industry/financial-services/agentic-ai-banking.html

- Bloomberg Intelligence. (2025). “Banks enter agentic AI era as tech race heats up, ROI in focus.” July 2025. Bloomberg Professional

- ScienceSoft. (2025). “Artificial Intelligence (AI) for Lending in 2025.” https://www.scnsoft.com/lending/artificial-intelligence

- McKinsey & Company. (2024-2025). AI in banking and financial services research. Referenced across multiple industry reports.

- Precedence Research. (2025). “Artificial Intelligence (AI) in Banking Market Size 2025 to 2034.” July 2025. https://www.precedenceresearch.com/artificial-intelligence-in-banking-market

- Straits Research. (2025). “Artificial Intelligence in Banking Market Size, Growth & Trends Report.” https://straitsresearch.com/report/artificial-intelligence-in-banking-market

- Consumer Financial Protection Bureau. (2024). “CFPB Issues Guidance on Credit Denials by Lenders Using Artificial Intelligence.” https://www.consumerfinance.gov/

- SymphonyAI. (2025). “What lies ahead for global financial crime prevention in 2025.” March 2025. https://www.symphonyai.com/

- Moody’s. (2025). “AML in 2025: How AI, real-time monitoring, and global regulation are transforming compliance.” https://www.moodys.com/

- Financial Action Task Force (FATF). (2024-2025). Updated National Risk Assessment guidance and AML/CFT recommendations.

- European Commission. (2024). EU AI Act implementation guidance. https://digital-strategy.ec.europa.eu/

- Monetary Authority of Singapore (MAS). (2024-2025). AI and data analytics guidelines for financial institutions.

- Grand View Research. (2025). “Artificial Intelligence In Banking Market Size Report, 2030.” https://www.grandviewresearch.com/

- American Bankers Association. (2025). “How AI provides an edge in lending.” September 2025. ABA Banking Journal

- Research and Markets. (2025). “Generative Artificial Intelligence (AI) in Banking and Finance Market Report 2025.” June 2025.

- MDPI Risks Journal. (2025). “Towards Fair AI: Mitigating Bias in Credit Decisions—A Systematic Literature Review.” April 2025. https://www.mdpi.com/

- Urban Institute. (2024). Home Mortgage Disclosure Act data analysis on lending discrimination.

- University of California, Berkeley. (2022). “Fintech lending and discriminatory pricing” research study.

- CB Insights. (2024-2025). AI agent startup funding analysis and earnings call mentions tracking.

- Verified Market Research. (2025). “AI In Banking Market Size, Share, Trends, Opportunities.” March 2025. https://www.verifiedmarketresearch.com/

- Bank for International Settlements (BIS). (2024-2025). Research on systemic risks from correlated AI model deployment.

- World Economic Forum (WEF). (2024-2025). Reports on AI transformation in financial services.

- Organisation for Economic Co-operation and Development (OECD). (2024-2025). AI policy and economic impact research.

- U.S. Securities and Exchange Commission (SEC). (2024-2025). Guidance on AI use in financial services.

- Financial Conduct Authority (FCA), UK. (2024-2025). AI and machine learning regulatory guidance.

- European Securities and Markets Authority (ESMA). (2024-2025). AI regulatory technical standards.