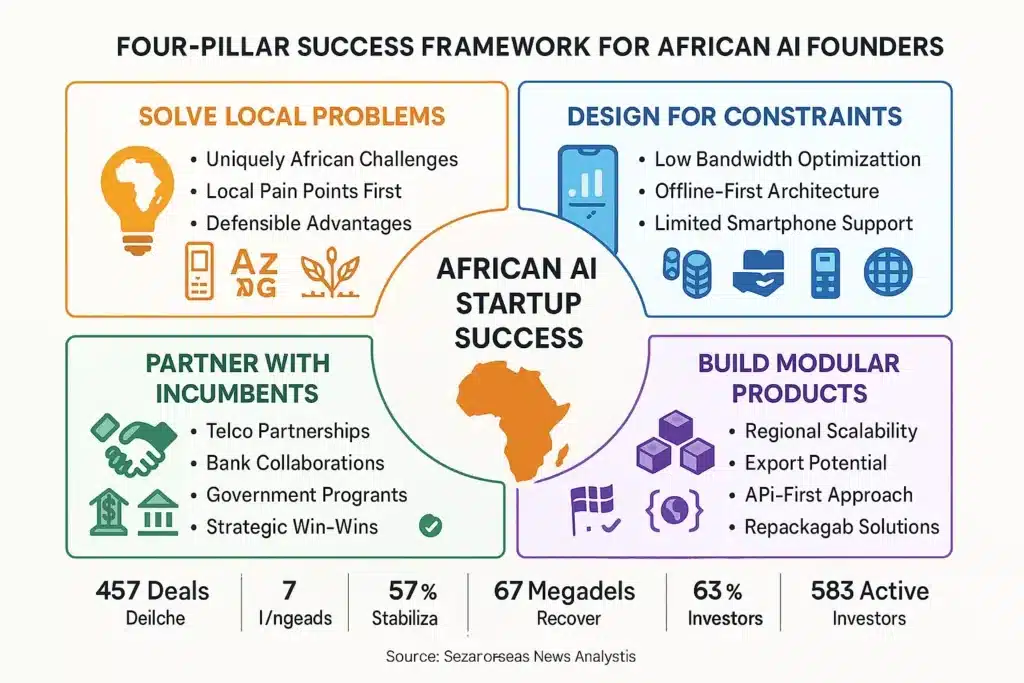

Executive Overview: Africa’s AI Moment

Africa’s artificial intelligence ecosystem has reached a critical inflection point, transitioning decisively from experimental pilots and proof-of-concepts to scalable startups solving uniquely African challenges. In 2024-2025, this transformation manifested through concrete metrics, sustained institutional investment, and demonstrated commercial traction that signals genuine momentum rather than speculative hype.

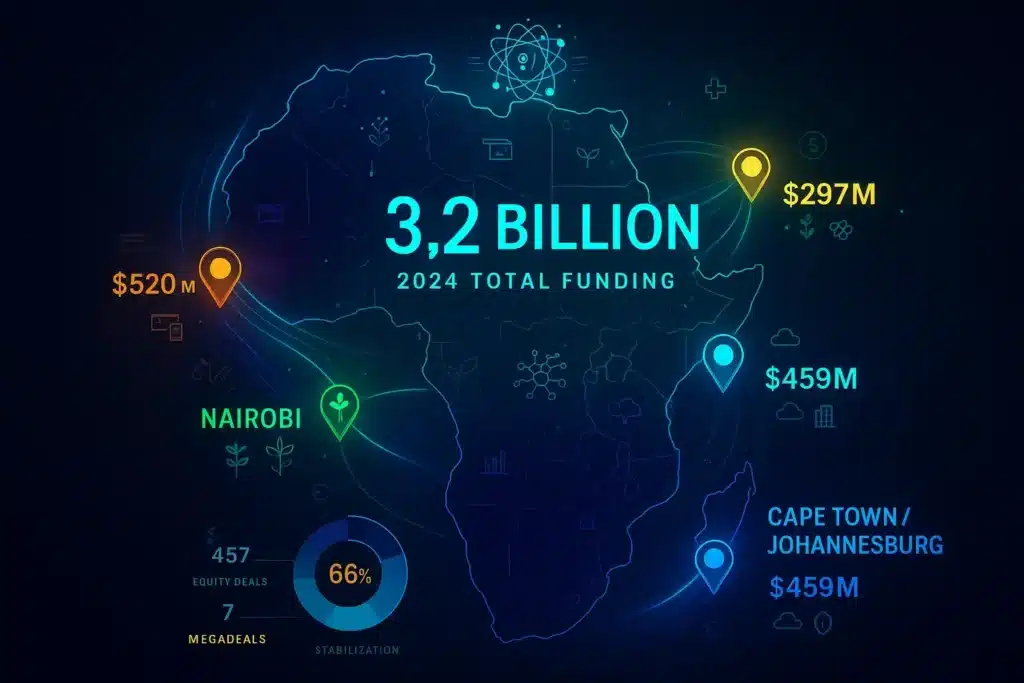

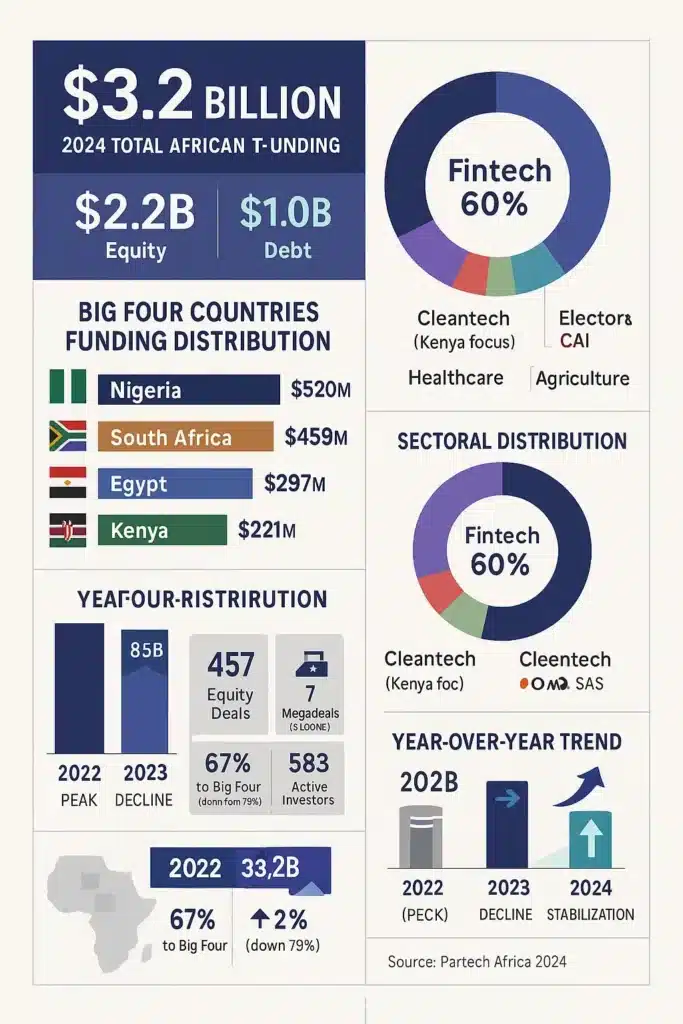

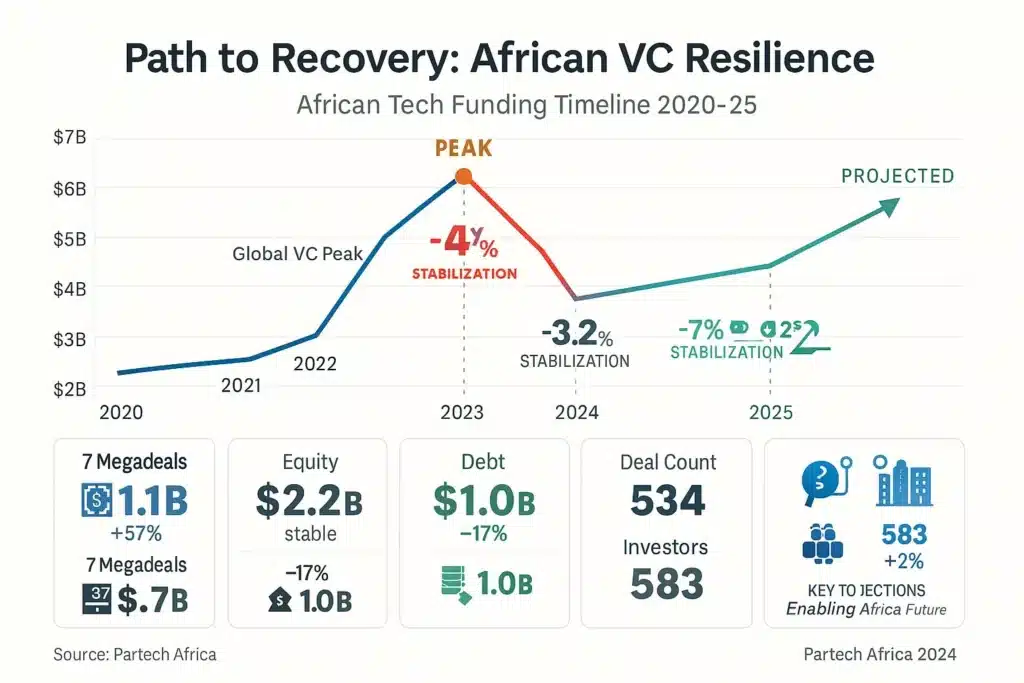

The numbers tell a compelling story. African tech startups raised $3.2 billion in combined equity and debt funding during 2024, comprising $2.2 billion in equity and $1 billion in debt, according to Partech Africa’s comprehensive annual report released in January 2025. While this represents a modest 7% decline from 2023’s $3.5 billion total, the stabilization after 2023’s steep 46% correction demonstrates ecosystem resilience. More importantly, equity funding remained remarkably stable year-over-year, and megadeals—transactions exceeding $100 million—increased 43% in count and 57% in value, with seven megadeals totaling $1.1 billion signaling continued investor confidence in high-potential African ventures.

McKinsey & Company’s May 2025 analysis, titled “Leading, not lagging: Africa’s gen AI opportunity,” projects that generative AI deployed at scale could unlock between $61 billion and $103 billion in additional annual economic value across African sectors including banking, retail, consumer packaged goods, telecommunications, insurance, mining, energy, and public services. When traditional AI and machine learning applications are included alongside generative AI capabilities, the total potential economic value exceeds $100 billion annually, with conventional AI contributing at least 60% of that combined impact.

This economic potential has catalyzed significant infrastructure and human capital investments from global technology leaders. Microsoft announced in March 2025 plans to invest ZAR 5.4 billion (approximately $280-300 million) by the end of 2027 to expand cloud and AI infrastructure in South Africa, building upon a previous ZAR 20.4 billion investment over three years that established enterprise-grade data centers in Johannesburg and Cape Town. The company’s AI skilling initiative aims to train one million South Africans by 2026 in AI and digital skills, with 50,000 free Microsoft certification vouchers for high-demand competencies including AI, data science, cybersecurity, and cloud architecture. In 2024 alone, Microsoft trained over 150,000 people, certified 95,000, and facilitated employment for 1,800 individuals through its Skills for Jobs program.

The International Finance Corporation (IFC), part of the World Bank Group, launched a $225 million venture capital platform in November 2022 specifically targeting early-stage startups across Africa, Middle East, Central Asia, and Pakistan. Beyond this platform, IFC has made multiple strategic investments of approximately $6 million each in African venture capital funds including Ventures Platform Pan-African Fund II, First Circle Capital focused on fintech infrastructure, and Catalyst Fund supporting climate tech—demonstrating commitment to building local investment capacity rather than merely deploying direct capital.

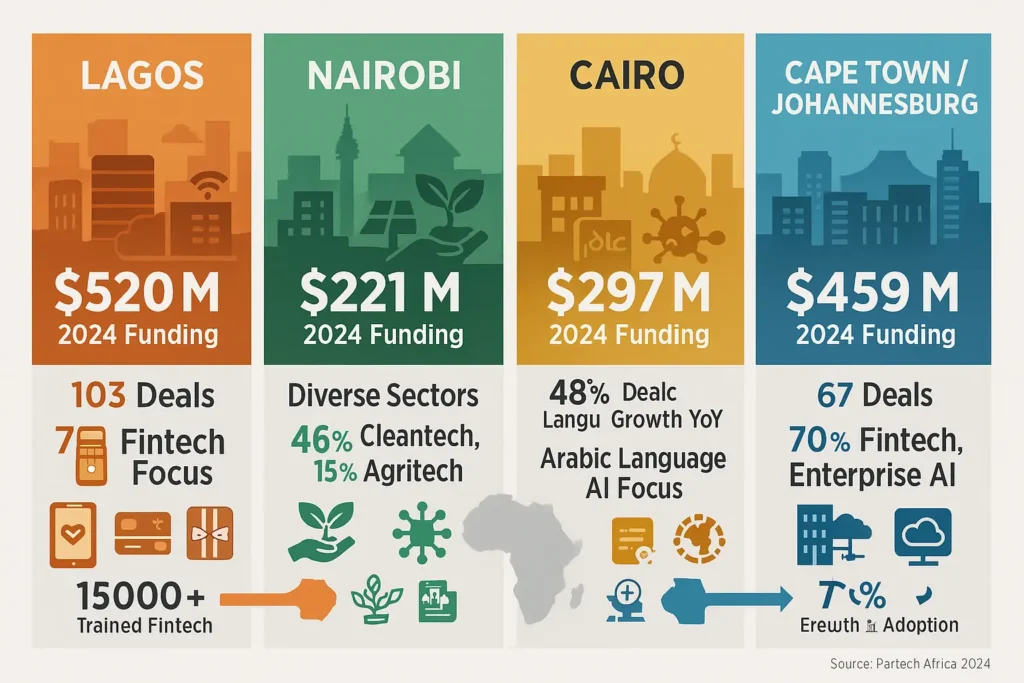

Four major hubs anchor Africa’s AI startup ecosystem: Lagos (Nigeria) leads West African fintech innovation with $520 million in 2024 equity funding; Nairobi (Kenya) drives mobile-first solutions particularly in agriculture and clean technology with $221 million; Cairo (Egypt) establishes North African tech leadership with focus on Arabic language processing and regional healthcare solutions with $297 million and impressive 48% year-over-year growth in deal count; and Cape Town/Johannesburg (South Africa) serves enterprise AI markets with $459 million in funding and deep capital market access. Together, these “Big Four” countries captured 67% of Africa’s total equity funding in 2024, though this represents declining concentration from 79% in 2023, indicating healthy investment diversification across the continent.

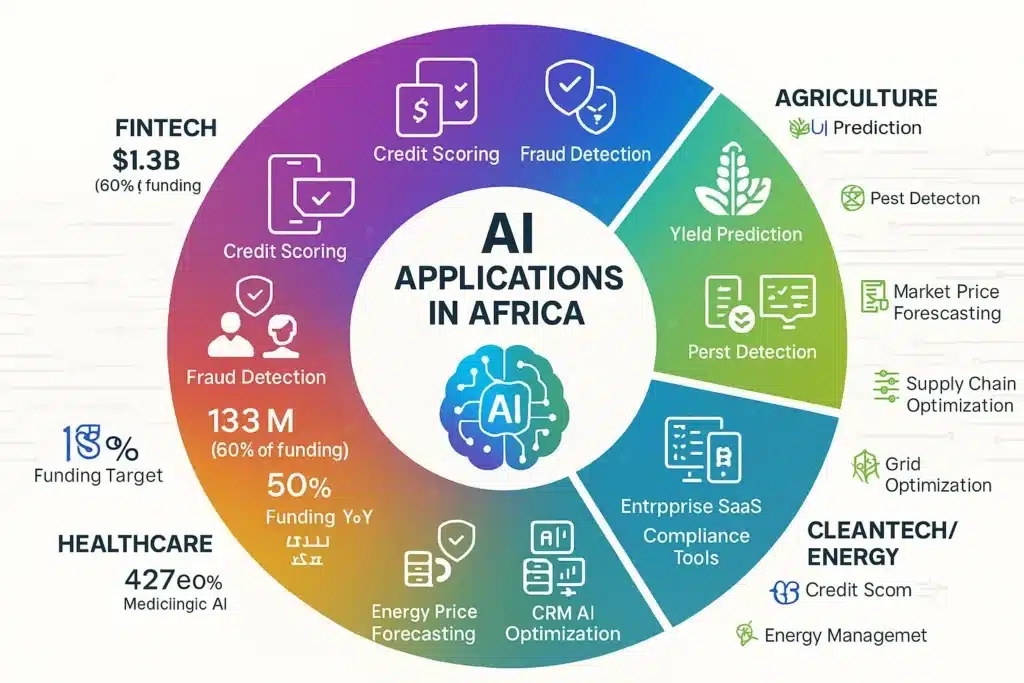

Fintech continues to dominate the AI application landscape, securing approximately $1.3 billion—equivalent to 60% of total equity funding across 131 deals in 2024. This sector experienced impressive 16% year-over-year growth in deal counts and 59% growth in total funding, making it the only sector to grow simultaneously in both metrics. The dominance stems from AI applications addressing massive financial inclusion opportunities, with alternative credit scoring using mobile usage patterns, fraud detection protecting digital transactions, and automated customer service through multilingual chatbots.

Yet challenges persist. Talent depth remains constrained despite growing AI skill supply from bootcamps, university programs, and corporate initiatives. Demand for experienced machine learning engineers, data scientists, and product managers significantly outpaces supply. Data and cloud infrastructure present ongoing obstacles including fragmented labeled datasets, cloud latency affecting real-time applications, and cross-border data governance rules complicating regional operations. Local investor density for late-stage funding creates exit challenges, with approximately 70% of capital originating from Europe and North America rather than African sources.

Still, the trajectory points upward. The 2024-2025 resilience in funding, McKinsey’s substantial valuation potential for generative AI applications, and increasing AI infrastructure investments across the continent suggest Africa could produce regional AI leaders—particularly in fintech, insurtech, and healthtech—within the next 3-5 years. Continued investment in talent development, data infrastructure, and crucially, building deeper local capital markets will determine whether this opportunity converts into sustainable scale.

This comprehensive analysis maps Africa’s AI startup landscape, profiles the main drivers, examines sectoral traction, analyzes funding patterns, identifies constraints, and shows how founders are building globally competitive yet locally relevant AI products that solve real African challenges.

1. Why Africa — and Why Now?

The African AI narrative diverges fundamentally from Silicon Valley’s playbook—this isn’t replication but rather geographically and economically tailored emergence. Three converging trends explain the acceleration visible throughout 2024-2025, creating conditions where AI adoption moves from interesting experiments to revenue-generating implementations.

Economic Potential of Generative AI

McKinsey & Company’s May 2025 report “Leading, not lagging: Africa’s gen AI opportunity” provides the most comprehensive analysis of generative AI’s economic potential across African markets. The analysis estimates that at-scale deployment of generative AI could unlock $61 billion to $103 billion in additional annual economic value across multiple sectors, based on methodology developed by McKinsey Global Institute’s report “The economic potential of generative AI: The next productivity frontier” and adjusted for African market conditions and implementation realities.

The sectors showing highest immediate potential include retail trade ($6.6 billion to $10.4 billion annually), where generative AI enables virtual shopping assistants, personalized marketing content generation, store operations optimization, and supply chain improvements. Telecommunications ($6 billion to $9.6 billion) benefits from improved customer service through chatbots and agent assistants, network management tools, and automated operations. Consumer packaged goods ($5.4 billion to $8.9 billion) gains through hyperpersonalized marketing, revenue growth management support, and internal virtual assistants for strategic decisions.

Mining, heavy industry, and energy sectors ($5.3 billion to $8.5 billion) see opportunities in predictive maintenance, resource optimization, and safety monitoring. Banking ($4.7 billion to $7.9 billion) captures value through hyper-personalized marketing, risk and credit operations enhancement, fraud detection, and legacy system modernization. Public sectors including healthcare and education benefit from learner assessment, personalized educational content, streamlined clinical documentation, and citizen service engagement improvements.

This economic valuation has focused both public and private attention on AI opportunities, similar to global AI investment patterns driving market growth worldwide. However, McKinsey’s analysis emphasizes that reaching the upper range requires addressing critical barriers: improving digital infrastructure, developing better-prepared talent pools, enhancing data quality and availability, establishing regulatory clarity, and building robust frameworks to manage risks including privacy breaches, cyberattacks, and job displacement.

The report highlights that over 40% of African institutions have either started experimenting with generative AI or already implemented significant solutions—demonstrating that adoption isn’t theoretical but actively underway. Organizations showing leadership share common traits: focusing on one high-impact use case end-to-end before scaling across multiple pilots, combining generative AI with traditional AI and analytics rather than treating them as separate, organizing transformation by domains so gains in data infrastructure and workflows in one area feed others, and embedding risk, legal, and compliance functions from the outset to avoid delays and trust issues.

Resilient Venture Funding Baseline

Partech Africa’s comprehensive 2024 report, released January 23, 2025, documents the venture capital landscape with granular analysis of equity and debt funding across the continent. The data shows African tech funding held steady in 2024 with equity funding at $2.2 billion (matching 2023 exactly) and total funding including debt at approximately $3.2 billion (down 7% from 2023’s $3.5 billion). This stabilization follows 2023’s severe 46% funding decline, representing significant recovery momentum.

Deal activity remained remarkably stable with 457 equity deals (down just 3%) and 77 debt deals (up 4%), demonstrating that while individual deal sizes may have contracted in some stages, investor engagement with African startups remained consistent. More encouragingly, the number of unique equity investors rose 2% to 583 active participants, marking a strong contrast to 2023’s steep 50% investor decline and suggesting renewed confidence in the ecosystem’s fundamentals.

Megadeals—transactions exceeding $100 million—provide particularly strong signals. In 2024, there were three megadeals in debt financing and four in equity, totaling $1.1 billion and representing a 43% increase in deal count and 57% increase in deal value compared to 2023 (which saw three debt megadeals and only one equity megadeal totaling $700 million). This megadeal resilience indicates that despite broader market headwinds, investors remain willing to deploy substantial capital behind high-conviction opportunities.

The venture funding activity concentrated heavily in late 2024 and early 2025, with deal flow resuming after the first two quarters of 2024 showed tentative growth. While momentum shifted somewhat in Q3 and Q4, several fintech megadeals—including Moniepoint’s $110 million round that helped establish Nigeria’s newest unicorn, and Moove Africa’s $100 million raise—steadied the market and demonstrated sector-specific strength.

These funding patterns create capital pools specifically for AI-focused ventures, though AI represents a relatively small slice of total African tech investment compared to global patterns where AI companies captured approximately 30% of worldwide venture capital in 2024. African startups have not yet experienced the AI-driven investment surge visible in developed markets, suggesting significant room for growth as AI applications prove commercial viability.

Debt financing, while declining 17% from $1.2 billion to $1 billion, still represented 31% of total 2024 funding (compared to 35% in 2023), confirming growing access to debt capital as an alternative funding source for African tech startups. However, most available debt remains denominated in US dollars with high interest rates, and comprehensive transformation of debt offerings to meet African startups’ unique requirements remains incomplete. Rising interest rates and dollar strengthening against African currencies increased loan costs and repayment burdens, contributing to debt funding decline.

Global and Local Investment & Skills Programs

International players including IFC, Microsoft, and Mastercard Foundation are funding ecosystem programs, cloud infrastructure, and training initiatives that build crucial foundations for AI productization. These investments address multiple bottlenecks simultaneously: talent development through structured training programs, infrastructure provision via cloud data center expansion, and capital mobilization through venture fund support.

Microsoft’s investment in South Africa exemplifies this comprehensive approach. The March 2025 announcement of ZAR 5.4 billion ($280-300 million) through 2027 expands existing cloud and AI infrastructure to meet growing Azure services demand. This builds upon ZAR 20.4 billion invested over the previous three years establishing South Africa’s first enterprise-grade data centers in Johannesburg and Cape Town, which now serve as regional hubs providing low-latency access to cloud services and AI capabilities for startups across Southern and East Africa.

The infrastructure investment enables organizations ranging from startups to large multinationals and government entities to access cloud and AI solutions, improving operational efficiency, optimizing service delivery, and driving innovation across the South African economy. But infrastructure alone proves insufficient without skilled workers to leverage these capabilities.

Microsoft’s AI skilling initiative addresses the talent gap comprehensively. The commitment to train one million South Africans by 2026 in AI and digital skills represents one of the continent’s most ambitious workforce development programs. In 2024 alone, more than 150,000 people received training in digital and AI skills, 95,000 achieved certifications, and 1,800 secured employment opportunities through Microsoft’s Skills for Jobs program. The initiative now extends funding for 50,000 people to achieve “Microsoft Certified” status in high-demand fields including AI, data science, cybersecurity analysis, and cloud solution architecture over the next 12 months, directly addressing the World Economic Forum’s finding that 60% of companies in the Global South identify critical skills gaps as key barriers to digital transformation by 2030.

Similar skilling commitments extend to Kenya and Nigeria, with Microsoft pledging to train one million people in each country—representing a combined three million Africans across the three largest tech ecosystems. These programs combine breadth (getting baseline AI literacy across large populations) with depth (providing industry-recognized certifications for job-ready skills), creating a pipeline from awareness to employment.

IFC’s venture capital ecosystem approach complements Microsoft’s infrastructure and skilling investments. The $225 million venture capital platform launched in November 2022 makes direct equity and “equity-like” investments in early-stage startups to grow them into scalable ventures capable of attracting mainstream financing. Beyond direct capital deployment, IFC works closely with World Bank colleagues to champion regulatory reforms, conduct sector analyses, and implement changes that strengthen venture capital ecosystems in target regions.

IFC’s multiple $6 million investments in African venture funds demonstrate catalytic capital deployment designed to build sustainable local investment capacity. Ventures Platform Pan-African Fund II received $6 million to support pre-seed through Series A investments across Nigeria and broader African markets, backing over 90 companies since inception including successful fintechs like Moniepoint, Piggyvest, and Paystack (acquired by Stripe). First Circle Capital secured $6 million to build a concentrated portfolio of 24 fintech startups solving foundational financial infrastructure challenges, with 30% of portfolio companies led or co-founded by women. Catalyst Fund received $6 million to support climate tech startups building solutions for climate-vulnerable communities. P1 Ventures Fund II closed $35 million with IFC participation, focusing on high-potential African entrepreneurs operating beyond traditional tech hubs.

These institutional investments create demonstration effects showing that African startups can generate returns, provide capacity-building for fund managers learning to deploy capital effectively in African contexts, and establish enabling frameworks including legal structures, data standards, and best practices that reduce friction for subsequent investors.

Mastercard Foundation’s work, while less publicized than Microsoft or IFC, focuses on financial inclusion and youth employment—complementary goals to AI adoption. By supporting digital payment infrastructure, financial literacy programs, and entrepreneur training, Mastercard Foundation creates conditions where AI-powered fintech solutions find receptive markets and skilled operators.

These combined global and local investment forces, infrastructure development programs, and comprehensive skilling initiatives turn Africa from a region of potential into one of demonstrated momentum for AI solutions that must be built with African data, African context, and African users in mind to work effectively. The alignment between infrastructure availability, talent development, and capital access creates rare conditions where multiple bottlenecks ease simultaneously rather than one constraint simply replacing another.

This mirrors broader AI regulation trends as governments worldwide establish frameworks for AI development, though African regulators generally adopt more permissive stances focused on enabling innovation rather than restricting applications—a regulatory posture that may prove advantageous as entrepreneurs test AI solutions across multiple use cases.

2. Where AI Startups Cluster — The Regional Hubs

Regional specialization has emerged clearly across Africa’s AI startup ecosystem, with Lagos leading fintech AI development, Nairobi driving mobile innovation particularly in agriculture, Cairo establishing Arabic language processing capabilities, and Cape Town/Johannesburg serving enterprise solutions markets. This geographic distribution reflects each region’s structural advantages, existing industry strengths, talent concentrations, and capital availability.

Nigeria (Lagos): West Africa’s Financial Hub

Lagos stands as Africa’s most dynamic tech ecosystem and West Africa’s undisputed financial technology capital. In 2024, Nigeria secured $520 million in equity funding across 103 deals, marking 11% year-over-year growth and reclaiming its position as Africa’s top venture capital destination after temporarily falling behind South Africa in 2023. This recovery was driven substantially by fintech megadeals including Moniepoint’s $110 million round at $1+ billion valuation (establishing Nigeria’s newest unicorn) and Moove Africa’s $100 million raise for vehicle financing.

Fintech’s dominance in Lagos is overwhelming—the sector captured 72% of Nigeria’s total equity funding in 2024, reflecting the ecosystem’s deep specialization in financial services innovation. This concentration stems from several reinforcing factors. Nigeria’s population of over 220 million provides massive domestic market scale, with approximately 60% remaining unbanked or underbanked, creating enormous addressable opportunity for digital financial services. The country’s early mobile money adoption, led by operators like MTN and accelerated by Central Bank of Nigeria policies encouraging cashless transactions, established digital payment infrastructure that fintech startups build upon.

Lagos-based AI fintech startups focus heavily on alternative credit scoring, using machine learning models trained on mobile usage patterns, airtime purchase behavior, social connection analysis, and transaction histories to assess creditworthiness for populations lacking traditional credit bureau records. Companies like FairMoney, Carbon, and Branch pioneered these approaches, while newer entrants apply increasingly sophisticated AI models including natural language processing of customer communication, computer vision for document verification, and graph analysis of transaction networks to detect fraud and assess risk.

The ecosystem benefits from mature supporting infrastructure including Interswitch (Africa’s first unicorn, providing payment switching services), Paystack (acquired by Stripe for over $200 million, validating Nigerian fintech globally), and Flutterwave (unicorn valued at $3 billion, processing billions in annual payment volume). These success stories created experienced operators, angel investors, and acquirers—forming a virtuous cycle where exits generate capital and mentorship for subsequent entrepreneur generations.

Lagos also hosts robust accelerator and incubator networks including CcHub (Co-Creation Hub) providing workspace, mentorship, and connections; Ventures Platform offering pre-seed funding and value-creation services; Launch Africa supplying early-stage capital; and international players like Y Combinator, Techstars, and 500 Global maintaining active scouting and investment in Nigerian startups. This concentration of support infrastructure reduces barriers for first-time founders and increases probability of successful scaling.

Talent availability in Lagos combines computer science and engineering graduates from institutions like University of Lagos, Covenant University, and the African University of Science and Technology with self-taught developers trained through coding bootcamps like Andela, Decagon, and AltSchool Africa. The city’s technology community includes active developer meetups, AI study groups, and hackathons that facilitate knowledge sharing and network building.

Regulatory environment in Nigeria presents both opportunities and challenges. The Central Bank of Nigeria demonstrates openness to financial innovation, having issued Payment Service Bank licenses enabling fintechs to offer basic banking services and establishing Open Banking frameworks requiring banks to share customer data (with permission) with licensed third parties. However, foreign exchange restrictions, multiple exchange rate regimes, and periodic policy uncertainty create operational complexity for startups, particularly those with international investors or revenue streams.

Beyond fintech, Lagos startups increasingly apply AI to logistics and delivery (leveraging Gokada, MAX, and other mobility platforms), healthcare diagnostics (with companies like 54gene applying AI to genomic analysis), and education technology (platforms using AI for personalized learning in Nigerian curricula). However, these remain smaller compared to fintech’s dominance.

Looking ahead, Lagos benefits from several structural advantages likely to sustain its leadership: largest African economy by GDP, deepest pool of both technical and business talent, most developed venture capital ecosystem with both local and international firms active, proven exit opportunities demonstrated by acquisitions and late-stage financings, and strong diaspora connections providing capital, expertise, and international market access.

Kenya (Nairobi): Mobile Innovation Leader

Nairobi established itself as East Africa’s innovation hub, with Kenya securing $221 million in equity funding across multiple sectors in 2024. Unlike Nigeria’s fintech concentration, Kenya demonstrates remarkable sectoral diversity: cleantech attracted 46% of funding, agritech captured 15%, while fintech represented only 13%—making Kenya unique among the Big Four countries for its non-fintech focus.

This sectoral distribution reflects Kenya’s distinct innovation trajectory and structural conditions. The country pioneered mobile money through M-Pesa, launched in 2007 by Safaricom (Kenya’s largest mobile operator, a joint venture with Vodafone). M-Pesa’s transformation of financial access—enabling person-to-person transfers, bill payments, and merchant transactions via basic mobile phones—provided proof-of-concept for mobile-first digital services in emerging markets. This legacy creates both opportunity (demonstrating Kenyans’ willingness to adopt digital solutions) and constraint (M-Pesa’s entrenchment makes competing in pure payments challenging, pushing innovators toward adjacent opportunities).

Kenyan startups increasingly apply AI to agriculture, addressing challenges faced by the country’s large smallholder farmer population. Companies like FarmDrive use machine learning for agricultural credit scoring, analyzing weather patterns, crop types, land size, and market access to extend loans to farmers lacking collateral. Apollo Agriculture combines satellite imagery analysis with agronomist knowledge to provide farmers with customized seed, fertilizer, and insurance packages financed through harvest-linked repayment. Twiga Foods leverages AI for agricultural supply chain optimization, predicting demand across its network of informal retailers and optimizing logistics for fresh produce distribution from farmers to urban markets.

The cleantech sector’s prominence reflects Kenya’s renewable energy leadership—the country generates over 90% of electricity from renewable sources including geothermal, hydro, wind, and solar. Startups like M-KOPA pioneered pay-as-you-go solar home systems, using AI for credit scoring of off-grid customers, predicting payment behavior, and optimizing field agent routing for installations and collections. M-KOPA’s success (serving over 2 million customers and raising hundreds of millions in equity and debt) validated cleantech business models and attracted substantial investor attention to the sector.

Nairobi’s ecosystem benefits from strong university linkages, particularly Strathmore University’s @iLabAfrica (supporting tech entrepreneurship), University of Nairobi’s computing programs, and Jomo Kenyatta University of Agriculture and Technology (JKUAT) producing engineering talent. These institutions increasingly emphasize AI and data science curriculum, creating skilled graduate pipelines. International tech companies including Microsoft, Google, and IBM maintain African research and development centers in Nairobi, providing employment for top talent and demonstrating technical feasibility of complex engineering work from African locations.

The regulatory environment in Kenya demonstrates progressive technology policy. The Central Bank of Kenya maintains relatively innovation-friendly fintech regulation, having licensed multiple mobile network operators and fintechs for payment services. The Kenya National Data Protection Act (implemented 2019) provides clear data privacy rules that, while requiring compliance investment, offer regulatory certainty valuable for AI development. The government’s digitization initiatives including Huduma Centres (one-stop government service centers) and e-Citizen portal create demand for AI applications streamlining public service delivery.

Nairobi hosts extensive accelerator infrastructure including GSMA Innovation Fund for Digitisation of Agricultural Value Chains (supporting agritech startups), Catalyst Fund (backing climate tech ventures with catalytic capital), Sankalp Africa Summit (connecting impact investors with entrepreneurs), and iHub (providing workspace and community for tech innovators). These programs specifically target the agriculture, climate, and financial inclusion sectors where Kenyan startups concentrate.

Kenya’s 38% share of Africa’s debt funding in 2024 (highest among Big Four countries) reflects mature cleantech business models’ ability to access debt financing. Pay-as-you-go solar companies generate predictable cash flows from customer repayments, making them attractive to debt investors including development finance institutions, commercial banks, and impact funds. This debt availability enables growth without excessive equity dilution, an advantage for capital-intensive businesses.

Challenges facing Nairobi’s ecosystem include relatively smaller domestic market (Kenya’s 55 million population vs. Nigeria’s 220+ million), political uncertainty particularly around election cycles, and infrastructure constraints despite improvements. However, Kenya’s strategic position as East Africa’s commercial hub, strong English language skills facilitating international engagement, and proven track record of mobile innovation position Nairobi as a continued AI startup center focused particularly on mobile-first solutions for agriculture, energy access, and financial services.

Kenyan founders increasingly think pan-African from inception, designing solutions for regional rather than purely domestic markets. This orientation, combined with AI-powered healthcare diagnostics applications emerging from Nairobi-based healthtechs, positions Kenya as an innovation exporter to surrounding East African markets including Uganda, Tanzania, Rwanda, and Ethiopia.

Egypt (Cairo): North Africa’s Tech Capital

Cairo has rapidly emerged as North Africa’s dominant AI hub, with Egypt securing $297 million in equity funding in 2024 while notably experiencing 48% year-over-year growth in deal count—the fastest activity increase among the Big Four countries. This growth signals renewed momentum in Egypt’s venture capital ecosystem after several years of slower development compared to Sub-Saharan African hubs.

Egypt’s strategic advantages for AI startups include substantial domestic market scale (over 105 million population—Africa’s third largest), geographic position bridging Africa and the Middle East (providing access to Gulf Cooperation Council markets), and strong technical education infrastructure producing engineering and computer science graduates from institutions including Cairo University, American University in Cairo, and the German University in Cairo. The country’s large, educated, Arabic-speaking population creates unique opportunities for AI applications requiring natural language processing in Arabic—a capability that Western AI models often handle poorly given limited Arabic training data.

Cairo-based startups focus heavily on Arabic language processing and localization, developing large language models (LLMs) and natural language processing (NLP) tools tailored for regional dialects and cultural contexts. Widebot, which raised $3 million in pre-Series A funding, develops AQL Mind—a large language model tailored for Arabic dialects and hosted in Saudi Arabia, aligning with Saudi Vision 2030 goals for AI localization. This addresses the digital underrepresentation of Arabic language online and in AI training data, creating opportunities for startups that can build culturally and linguistically appropriate AI tools.

Healthcare AI represents another growing focus area, with Egyptian startups applying AI for diagnostic triage, medical imaging analysis, and healthcare operations optimization. The country’s large public hospital system and rising private healthcare sector create substantial addressable markets, while medical school affiliations at Cairo’s major universities facilitate clinical validation partnerships for AI diagnostic tools. Companies emerging in this space benefit from lower regulatory barriers compared to Western markets while building solutions addressing diseases and conditions prevalent in North African and Middle Eastern populations.

Fintech remains significant in Cairo though less dominant than in Lagos, with 60% of Egypt’s equity funding directed to financial services in 2024. Egyptian fintech startups focus particularly on payment digitization (addressing high cash usage), remittances (serving Egypt’s large diaspora), and SME lending (targeting underserved small businesses). AI applications include fraud detection for digital transactions, credit scoring for businesses lacking formal financial statements, and customer service automation for banks and fintechs serving millions of customers.

Egypt’s venture capital ecosystem has matured substantially in recent years with both local and regional investors active. Sawari Ventures and Algebra Ventures represent leading homegrown VCs, while Gulf-based investors including BECO Capital, Wamda Capital, and regional family offices provide Series A and later-stage capital. Egyptian startups increasingly attract international VCs from Europe and North America, validating the ecosystem’s maturation and startups’ quality.

The regulatory environment presents complexities. Egypt’s Central Bank maintains relatively cautious fintech regulation, requiring partnerships with licensed entities for many financial services activities. Data localization requirements mandate that certain data types remain stored within Egypt, affecting cloud infrastructure decisions for AI companies processing sensitive data. However, government initiatives including the Financial Regulatory Authority’s fintech sandbox and Ministry of Communications’ support for technology sector development demonstrate recognition of tech sector importance to economic diversification goals.

Cairo benefits from lower operational costs compared to Lagos or Nairobi, particularly for engineering talent and office space, enabling startups to extend runway and reach milestones with smaller funding rounds. The city’s position as regional headquarters for many multinational corporations creates enterprise sales opportunities and potential acquirers for successful startups.

Challenges include foreign exchange restrictions affecting dollar-denominated funding and international payments, periodic political uncertainty, and infrastructure gaps despite improvements in recent years. However, Egypt’s combination of scale, talent availability, strategic location, and growing investor interest positions Cairo as an increasingly important AI startup hub, particularly for companies targeting Arabic language markets across North Africa, the Levant, and the Gulf region.

Egyptian founders demonstrate sophistication in building for regional expansion from inception, recognizing that domestic success alone may limit exit opportunities. This pan-regional orientation aligns with AI in healthcare applications focused on ethical automation and patient trust, where Egyptian startups serve markets across multiple countries simultaneously.

South Africa (Cape Town & Johannesburg): Enterprise Focus

South Africa raised $459 million in equity funding across 67 deals in 2024, marking a 16% decrease compared to 2023’s $548 million but maintaining position as Africa’s second-largest tech funding destination. The funding would have declined significantly more (approximately 69%) without one major megadeal that helped stabilize the market—illustrating both opportunity and challenge in South Africa’s concentration of capital in fewer, larger rounds.

South Africa’s AI startup ecosystem demonstrates distinct characteristics shaped by the country’s unique economic structure. The economy includes large, sophisticated enterprises across mining, financial services, telecommunications, retail, and manufacturing sectors—providing rich opportunities for B2B AI solutions addressing corporate pain points. Companies like Standard Bank, MTN, Shoprite, Anglo American, and Sasol operate at scale comparable to multinational corporations, creating addressable markets for enterprise AI platforms that can command premium pricing and achieve significant contract values.

Cape Town and Johannesburg function as complementary hubs. Cape Town attracts lifestyle-oriented entrepreneurs, benefits from university talent pipelines (University of Cape Town, Stellenbosch University), and hosts growing numbers of international remote workers bringing global networks and expertise. Johannesburg serves as financial and corporate headquarters location, providing proximity to enterprise decision-makers, and connects to Pretoria’s government institutions and research centers including the Council for Scientific and Industrial Research (CSIR).

South African startups focus heavily on enterprise SaaS and AI tools, developing platforms for customer relationship management enhanced with predictive analytics, human resources optimization using AI for recruiting and retention, supply chain management applying machine learning for demand forecasting, and compliance automation leveraging natural language processing for regulatory document analysis. This enterprise orientation reflects the sophistication and scale of potential customers but requires different sales approaches, longer sales cycles, and more complex implementations compared to consumer fintech prevalent in Nigeria.

The ecosystem benefits substantially from Microsoft’s infrastructure investments. The $280-300 million announced in March 2025 builds upon previous investments establishing South Africa’s first enterprise-grade cloud data centers in Johannesburg and Cape Town. These facilities provide low-latency access to Azure services, enabling AI startups to build compute-intensive applications without prohibitive costs or latency constraints. The data centers also help address data localization requirements under South Africa’s Protection of Personal Information Act (POPIA), allowing companies to store sensitive data within national borders while accessing global cloud capabilities.

Financial services remain a significant focus, with South African fintechs capturing 70% of the country’s equity funding in 2024. However, compared to Nigeria’s consumer-focused fintech, South African financial services startups often target B2B opportunities including payment processing for enterprises, trade finance for importers/exporters, and embedded finance enabling non-financial companies to offer financial products. AI applications include fraud detection for complex transaction networks, anti-money laundering compliance using pattern recognition, and automated credit assessment for business lending.

Healthtech represents a growing opportunity area, with South Africa’s mix of public healthcare system and substantial private health insurance market creating multiple customer segments. Startups apply AI for medical imaging analysis (particularly radiology and pathology), chronic disease management using predictive analytics, and healthcare administration optimization. These solutions address both domestic needs and position for export to other markets with similar healthcare structures.

South Africa’s capital markets provide advantages unavailable elsewhere on the continent. The Johannesburg Stock Exchange offers exit opportunities through listings, while pension funds, insurance companies, and asset managers provide pools of institutional capital that can invest in later-stage private companies. This mature financial ecosystem supports larger funding rounds and provides clearer paths to liquidity for investors—attracting international VCs and growth equity funds evaluating African opportunities.

Talent availability combines strong university programs producing computer science and engineering graduates with experienced professionals from large corporate technology departments and multinational tech company offices. Brain drain remains a challenge, with skilled South Africans frequently emigrating to developed markets for higher compensation and opportunities. However, remote work trends enable some diaspora members to contribute to South African startups while residing abroad, partially mitigating this challenge.

Regulatory environment presents both benefits and constraints. POPIA provides clear data protection rules comparable to GDPR, offering regulatory certainty valuable for AI development but requiring compliance investment. The South African Reserve Bank maintains sophisticated financial services regulation that, while protecting consumers, creates higher barriers to entry for fintech startups compared to less regulated African markets. However, the South African Reserve Bank’s Intergovernmental Fintech Working Group demonstrates willingness to engage with innovators and adapt regulation.

Political and economic uncertainties including electricity supply challenges (load shedding), crime rates affecting business operations, and policy debates around issues like expropriation without compensation create risk perceptions that may deter some investors. However, the country’s democratic institutions, rule of law, and established business infrastructure continue attracting substantial capital relative to African peers.

South African founders increasingly recognize the limitations of purely domestic focus given the country’s 60 million population and competition from well-resourced incumbents. Many design solutions for pan-African deployment or target developed market export opportunities, leveraging South Africa’s proximity to Western business culture and English language proficiency. This orientation connects to broader AI in education applications using smart tutors and personalized learning that South African edtech companies develop for both African and international markets.

3. Sectors Gaining Traction: Real Impact Examples

AI use-cases across Africa increasingly move beyond proof-of-concept to revenue-generating implementations addressing real customer pain points. While sectors show varying maturity levels, the common thread is focus on practical applications delivering measurable value rather than technology for technology’s sake.

Finance & Payments

Fintech’s overwhelming dominance—capturing $1.3 billion or 60% of African AI startup equity funding in 2024—reflects the sector’s combination of massive addressable market, clear value propositions, and proven revenue models. The sector experienced impressive growth with 16% year-over-year increase in deal counts and 59% growth in total funding, making fintech the only sector to grow simultaneously in both metrics. Four fintech megadeals in 2024 reinforced this dominance and demonstrated sustained investor confidence.

Alternative credit scoring represents the most impactful AI application in African fintech, addressing the fundamental challenge that approximately 60% of Sub-Saharan Africans remain unbanked or underbanked, lacking traditional credit histories that banks require for lending decisions. AI-powered credit scoring models analyze alternative data sources including mobile phone usage patterns (call frequency, data consumption, consistency), airtime purchase behavior (amounts, regularity, payment methods), mobile money transaction histories (transfers, bill payments, merchant purchases), social network analysis (connection patterns, community associations), and even smartphone sensor data (location stability, app usage indicating employment).

Companies like Branch, Tala, and FairMoney pioneered this approach, demonstrating that machine learning models trained on alternative data could predict loan repayment with accuracy comparable to traditional credit bureau scores. These platforms typically offer small initial loans (often $20-100), use AI to assess repayment behavior, and automatically increase credit limits for responsible borrowers—creating credit histories from scratch for previously “invisible” populations.

More sophisticated AI models now incorporate natural language processing of customer communication (analyzing SMS and WhatsApp messages for sentiment and patterns), computer vision for identity verification and document authentication (reducing fraud from fake IDs or employment letters), and graph analysis of transaction networks (identifying fraud rings and verifying genuine economic activity). These multi-modal approaches improve default prediction while maintaining accessibility.

Fraud detection and prevention represents another critical AI application, protecting digital financial platforms from increasingly sophisticated attacks. Nigerian fintech fraud losses reportedly exceed 5% of transaction volume industry-wide, creating strong economic incentives for effective AI solutions. Machine learning models analyze transaction patterns in real-time, flagging anomalies including unusual transfer amounts or recipients, rapid sequences of transactions indicating account takeover, geographic impossibilities (transactions from multiple locations simultaneously), and device fingerprint mismatches.

Behavioral biometrics—analyzing how users type, swipe, and navigate apps—provide continuous authentication without user friction. Startups like Smile Identity and Youverify apply AI to identity verification, using facial recognition, liveness detection, and document verification to prevent account creation fraud. These capabilities prove particularly valuable in Kenya, Nigeria, and South Africa where identity fraud rates create significant losses for financial services providers.

Customer service automation through AI-powered chatbots and virtual assistants reduces operational costs while improving response times for fintech platforms serving millions of customers. Natural language processing models handle common queries about balances, transactions, and products in multiple African languages including English, Swahili, Hausa, Yoruba, and Zulu. Companies like Moniepoint report that AI chatbots now handle over 60% of customer service inquiries without human agent escalation, freeing support staff for complex issues requiring judgment.

Regulatory technology (regtech) applications help fintechs navigate complex and frequently changing financial services regulations across multiple African jurisdictions. AI systems monitor regulatory updates, automate compliance reporting, and flag potential violations before they occur. Anti-money laundering (AML) and know-your-customer (KYC) processes leverage AI for document verification, beneficial ownership analysis, and transaction monitoring—reducing compliance costs while improving effectiveness.

Embedded finance, enabled by AI-powered risk assessment and automated underwriting, allows non-financial companies to offer financial services. Ride-hailing platforms provide drivers with instant earnings access and vehicle financing; e-commerce platforms offer merchants working capital loans; and telecommunications companies embed insurance and savings products into mobile money services. These integrations expand financial services access while creating new revenue streams for platforms.

Looking ahead, generative AI applications are emerging including personalized financial advice generation, automated content creation for financial literacy education, and conversational interfaces making complex financial products accessible to low-literacy populations. The combination of massive unmet demand, proven business models, and continuous AI capability improvements suggests fintech will maintain dominance in African AI startup funding for the foreseeable future.

Healthcare & Life Sciences

Healthcare AI startups apply artificial intelligence for diagnostic triage, remote screening, and clinical trial acceleration—addressing critical healthcare access and quality challenges across Africa where physician-to-population ratios often fall below 1:10,000 (versus 3-4:1,000 in developed countries) and geographic disparities leave rural populations with minimal healthcare access.

Diagnostic triage applications help overstretched healthcare workers prioritize patients and identify conditions requiring urgent specialist attention. AI systems analyze symptoms reported through mobile apps or USSD, combining this information with patient history and vital signs to recommend care pathways. Platforms like Ada Health and Babylon Health have deployed Africa-adapted versions of their global AI diagnostic tools, while African-developed systems like Hoji and mPharma’s digital health platform build solutions specifically for African disease profiles and healthcare delivery contexts.

Medical imaging AI addresses radiologist shortages particularly acute in Africa. Chest X-ray interpretation for tuberculosis screening, malaria diagnosis from blood smear microscopy images, and retinal imaging for diabetic retinopathy detection all leverage computer vision models that can match or exceed human expert performance. Organizations including PATH (Program for Appropriate Technology in Health) and research collaborations between African universities and global tech companies have deployed these tools in pilot programs across multiple countries.

Maternal and child health represents a high-impact focus area where AI applications show promise. Predictive models identify high-risk pregnancies requiring additional monitoring, natural language processing analyzes community health worker notes to flag potential complications, and computer vision assesses ultrasound images for fetal abnormalities in settings where trained sonographers are scarce. South African startup Pelebox deploys AI-powered smart lockers for chronic medication dispensing, reducing clinic wait times for patients with HIV, tuberculosis, and non-communicable diseases.

Clinical operations optimization uses AI to improve healthcare facility efficiency. Appointment scheduling algorithms reduce wait times and no-shows, inventory management systems prevent stockouts of critical medications, and patient flow optimization maximizes facility utilization. Public hospitals in Kenya and South Africa pilot these systems, with early results showing 20-30% improvements in operational efficiency.

Mental health AI applications address the massive unmet need for psychological services across Africa. Chatbots providing cognitive behavioral therapy techniques, sentiment analysis of text communication to identify individuals at risk of depression or self-harm, and remote patient monitoring for medication adherence all leverage AI to extend limited specialist capacity. The stigma often associated with mental healthcare in many African contexts makes anonymous, app-based interventions particularly valuable.

Clinical trial acceleration through AI helps pharmaceutical companies and research organizations conduct African-based research more efficiently. Machine learning models identify suitable trial participants from electronic health records, predict trial enrollment challenges, and monitor safety signals from trial data. This capability becomes increasingly important as drug developers recognize the need for African population inclusion in trials, given genetic diversity and disease exposure profiles differing from developed market populations.

Telemedicine platforms enhanced with AI serve remote populations, with systems providing clinical decision support to nurses or community health workers delivering care in areas without doctors. Companies like mPharma combine telehealth with AI-powered prescription management and medication delivery, while 54gene builds AI tools for genomic analysis applied to drug development targeting African populations.

Challenges persist including regulatory clarity (many African countries lack specific AI healthcare regulations), data availability and quality (electronic health records remain uncommon in many settings), infrastructure constraints limiting telemedicine effectiveness, and clinical validation requirements necessitating partnerships with hospitals and health ministries. However, IFC case studies show AI-enabled healthtech projects piloting with local clinics and improving screening and care in low-resource settings, demonstrating practical impact.

This sector benefits from global AI healthcare advances being adapted for African contexts, connecting to broader ethical implementation of healthcare AI discussions around algorithm transparency, bias mitigation, and maintaining patient trust while deploying powerful but imperfect AI tools.

Agriculture & Supply Chains

AI applications in agriculture deliver practical, revenue-driving implementations that increase yield predictability and help smallholder farmers access market data, extension services, and financing. Agriculture employs over 50% of Africa’s workforce and contributes 15-25% of GDP in many countries, making improvements to agricultural productivity economically consequential.

Yield prediction models combine satellite imagery analysis, weather data, soil conditions, and historical patterns to forecast crop production at field, regional, and national levels. Startups like Gro Intelligence and Apollo Agriculture provide farmers with planting recommendations, fertilizer application guidance, and pest management advice based on AI analysis of local conditions. These predictions help farmers optimize inputs, reduce waste, and improve revenues while enabling agricultural lenders and insurers to better assess risk.

Pest and disease detection leverages computer vision applied to smartphone photos of crops. Farmers photograph affected plants, AI models identify the pest or disease with high accuracy, and the system recommends treatment options. Plantix, developed by German startup PEAT but operating extensively in Africa, has built training datasets including African crops and pests often absent from global agricultural databases. Local adaptations require collection of region-specific labeled data, creating opportunities for African AI companies to build specialized models.

Market price forecasting helps farmers time sales to maximize revenues and negotiate with middlemen from positions of greater information. Machine learning models analyze historical price patterns, supply-demand dynamics, transportation costs, and market connectivity to predict pricing trends. Platforms like Twiga Foods in Kenya use these forecasts to optimize their aggregation and distribution operations while sharing price information with farmer suppliers.

Precision agriculture—applying variable rate inputs across fields based on detailed condition assessment—remains relatively limited in smallholder contexts given machinery costs, but AI-powered advisory services increasingly provide precision recommendations farmers can implement manually. Satellite imagery identifies areas of fields showing stress, enabling targeted intervention rather than blanket treatments.

Supply chain optimization applies AI to agricultural logistics, reducing post-harvest losses that can exceed 30% for perishable crops in Africa due to poor transportation and storage. Predictive models optimize truck routing, cold storage allocation, and delivery schedules. Companies like TradeBuza and Farmdrive leverage AI to match buyers and sellers more efficiently, reducing intermediaries and transaction costs while improving farmer revenues.

Agricultural credit scoring represents a crucial AI application enabling farmers to access financing for inputs, equipment, and operations. Traditional banks view smallholder farmers as too risky and expensive to serve profitably given lack of collateral, credit histories, and formal financial records. AI models assess creditworthiness using alternative data including satellite imagery showing farm size and crop type, weather patterns affecting yield potential, market access indicators, mobile phone usage demonstrating economic activity, and social network connections within farming communities.

Climate resilience planning increasingly incorporates AI, with models helping farmers adapt to changing precipitation patterns, temperature increases, and extreme weather events. Early warning systems for droughts, floods, and heatwaves enable proactive responses rather than reactive crisis management. Index insurance products triggered by objective measurements (rainfall, temperature, vegetation indices) rather than field assessments leverage AI for pricing and claims processing.

Extension services traditionally delivered through government agricultural officers increasingly supplement or replace face-to-face interactions with AI-powered chatbots, voice interfaces (important for low-literacy farmers), and SMS-based advisory systems. These platforms answer farming questions, provide seasonal guidance, and connect farmers with input suppliers, all at scales impossible through purely human delivery.

Challenges include smartphone and internet penetration limitations (particularly in rural areas), data collection difficulties requiring extensive field work to gather training data, and farmer trust given traditional agricultural practices’ deep cultural embedding. However, McKinsey points to retail and agricultural value opportunities in generative AI applications, with continued innovation addressing these obstacles.

Enterprise & SaaS

Companies building localized AI platforms including language models understanding African languages, compliance tools addressing regional regulatory requirements, and enterprise software adapted for African business contexts represent a growing opportunity area, particularly in South Africa where proximity to larger enterprise buyers and connections to global enterprise AI trends create conducive conditions.

Language model localization addresses the reality that major large language models (LLMs) like GPT-4, Claude, and Gemini perform poorly on African languages given limited training data. Startups develop models for Swahili, Hausa, Yoruba, isiZulu, isiXhosa, Amharic, and other languages spoken by millions but underrepresented in AI training corpora. These models enable natural language interfaces for customer service, document processing, voice assistants, and translation services that major providers cannot match for quality and cultural appropriateness.

Lalela, a South African startup, builds voice AI for African languages, enabling call centers and customer service operations to automate interactions in local languages. This proves particularly valuable for telecommunications companies, banks, and government services serving linguistically diverse populations. The technical challenges include collecting sufficient labeled data, handling dialects and code-switching (mixing multiple languages in conversation), and maintaining cultural context awareness.

Compliance and regulatory technology tailored for African contexts addresses the complexity of operating across multiple jurisdictions with different legal frameworks, tax regimes, and reporting requirements. AI systems help enterprises navigate these complexities through automated regulatory monitoring, compliance reporting generation, and risk flagging. This proves especially valuable for Pan-African businesses operating in multiple countries simultaneously.

Human resources AI applications help enterprises optimize recruiting, employee retention, and performance management. South African startups build tools including resume screening systems that reduce hiring bias while improving candidate matching, predictive models identifying employees at high risk of attrition, and learning management systems using AI to personalize training content. These solutions address challenges like skills shortages and high turnover affecting African enterprises.

Customer relationship management (CRM) platforms enhanced with AI predict customer churn, identify upsell opportunities, and automate lead scoring. African CRM startups adapt global best practices while accommodating local business contexts including high mobile usage, preference for WhatsApp and SMS communication over email, and relationship-based sales approaches.

Enterprise resource planning (ERP) systems incorporating AI improve inventory management, demand forecasting, and operations optimization. While international ERP vendors including SAP, Oracle, and Microsoft dominate large enterprise markets, African SaaS startups target mid-market companies with solutions offering African-specific features including multiple currency support, mobile-first interfaces, and integration with local payment systems.

Cybersecurity AI addresses growing threats as African enterprises digitize operations. Machine learning models detect anomalous network traffic, identify phishing attempts, and flag potential data breaches. South African cybersecurity startups serve both domestic enterprises and expand across the continent, benefiting from the country’s relatively mature IT security market and experienced practitioners.

Enterprise AI adoption, including AI copilot adoption in African enterprises, grows faster than expected in South African corporates, with large banks, retailers, and telecommunications companies implementing productivity tools, code assistance for developer teams, and analytical capabilities across operations.

Generative AI applications for enterprises include automated report generation, presentation creation, contract analysis and drafting, market research synthesis, and customer communication personalization. African startups localizing these capabilities for regional languages, cultural contexts, and specific industry verticals (mining, agriculture, retail) create defensible positions versus generic international tools.

Challenges include longer enterprise sales cycles requiring patient capital, difficulty displacing incumbent vendors with strong customer relationships, and need for substantial post-sale support and customization. However, successful enterprise SaaS companies can achieve high customer lifetime values, strong retention, and predictable revenue—attractive characteristics for investors evaluating exit potential.

4. Funding & Investor Landscape — Facts, Numbers, and Trends

Understanding African AI startup funding requires examining both aggregate trends and underlying dynamics shaping capital deployment. The 2024 data reveals patterns of resilience, sectoral concentration, geographic distribution, and investor behavior that collectively define opportunities and constraints for founders building AI companies.

2024 Investment Data and Trends

Partech Africa’s comprehensive 2024 report, analyzing fully disclosed, partially disclosed, and confidential deals, documents that African tech startups raised $3.2 billion in total funding (equity and debt combined) during 2024, representing a 7% decline from 2023’s $3.5 billion but demonstrating significant stabilization after 2023’s severe 46% correction from 2022’s peak of $6.5 billion. This stabilization indicates the African tech ecosystem weathered global venture capital headwinds relatively well compared to other emerging markets.

Equity funding remained remarkably stable at $2.2 billion in 2024, exactly matching 2023’s figure despite continued global VC challenges including rising interest rates, geopolitical uncertainties, and investor risk aversion. This stability contrasts with debt funding’s 17% decline from $1.2 billion to $1.0 billion, attributed to rising interest rates increasing debt costs, dollar strengthening against African currencies raising repayment burdens, and more conservative lending amid economic uncertainty.

Deal activity showed marginal changes with 457 equity deals (down 3% from 471 in 2023) and 77 debt deals (up 4% from 74 in 2023), resulting in 534 total deals (down 2% from 545 in 2023). This relative stability in transaction volume despite funding amount fluctuations indicates that average deal sizes contracted in some stages, particularly Series A (down 18%) and Series B (down 27%), while Seed stage ticket sizes grew 26%. The pattern suggests investors deployed capital more cautiously, writing smaller checks but maintaining deal flow.

Megadeals—defined as transactions exceeding $100 million—provided crucial ecosystem support in 2024. Seven megadeals occurred (three debt, four equity) totaling $1.1 billion, representing 43% more deals and 57% more value compared to 2023’s four megadeals (three debt, one equity) totaling $700 million. These large transactions included Moniepoint’s $110 million Series C at over $1 billion valuation (establishing Nigeria’s newest unicorn), Moove Africa’s $100 million growth equity round for vehicle financing expansion, and several cleantech debt facilities supporting pay-as-you-go solar companies’ expansion.

The megadeal concentration means a small number of high-conviction bets accounted for over one-third of total 2024 funding. This concentration can create illusions of health when aggregate numbers mask underlying weakness in early and mid-stage funding availability, but it also demonstrates that investors remain willing to deploy substantial capital behind proven business models and exceptional founders—a positive signal for ecosystem maturation.

Investor participation showed encouraging trends. The number of unique equity investors rose 2% to 583 active participants in 2024, marking a strong contrast to 2023’s steep 50% decline (from 1,149 to 569 investors) and suggesting renewed confidence in African opportunities. However, 2024 investors concentrated activity at Seed and Seed+ stages, being less involved in Series A and Series B compared to previous years. This pattern indicates investors remain cautious about deploying larger checks for growth-stage companies, contributing to the “missing middle” problem where promising startups struggle to raise Series A and B rounds despite strong Seed performance.

Debt investor participation increased 71% in 2024, demonstrating growing sophistication in debt capital provision for African tech startups and validation of asset-based and revenue-based lending models. Development finance institutions including IFC, FMO, CDC Group, and Proparco continue providing substantial debt capital, while commercial banks in Kenya, South Africa, and Nigeria increasingly lend to tech companies with proven cash flows.

Quarterly trends within 2024 showed momentum shifted during the year. The first two quarters demonstrated growth in deal count for the first time since the downturn began, creating optimism about market recovery. However, momentum slowed in Q3 and Q4 even though several fintech megadeals helped steady overall numbers. This deceleration suggests continued caution among investors, with catalysts needed to restore consistent deal flow and return to growth trajectory.

Stage-wise analysis reveals funding decreased across most stages except Growth stage, which captured increased capital through megadeals. Pre-seed and Seed rounds remained active, with numerous small tickets supporting early experiments and validation. However, the Series A and Series B challenges—where ticket sizes declined 18% and 27% respectively—create significant scaling obstacles for startups that successfully validate product-market fit but need capital to expand operations, enter new markets, and build infrastructure.

Extension rounds and down rounds increased in 2024 as startups unable to raise at higher valuations took additional capital from existing investors or accepted lower valuations to continue operations. While these represent pragmatic solutions to funding constraints, they create challenges including increased dilution for founders, longer timelines to liquidity for early investors, and potential team morale impacts from down rounds.

Investor Mix and Challenges

African tech investment capital originates predominantly from international sources, with approximately 70% coming from Europe and North America. International development finance institutions including IFC, FMO, Proparco, CDC Group, and AfDB provide catalytic capital targeting early-stage ecosystems, often accepting lower returns and longer time horizons than purely commercial investors. These institutions played crucial roles in African VC ecosystem development, demonstrating that viable investment opportunities exist and helping establish fund management capabilities.

International venture capital firms increasingly allocate dedicated Africa funds or maintain active scouting and investment in African opportunities. Notable firms active in 2024 included Partech (operating dedicated Africa fund), TLcom Capital (focused on West and East Africa), Norrsken22 (backing African entrepreneurs), Atlantica Ventures (generalist Africa fund), E3 Capital (enterprise focus), and P1 Ventures (underserved markets emphasis). These firms bring not only capital but also network access, operational expertise, and connections to potential customers, partners, and subsequent investors.

Global accelerators including Y Combinator, Techstars, and 500 Global maintain active African deal flow, with Y Combinator backing numerous African startups that went on to raise significant follow-on funding. These accelerators provide initial capital, intensive mentorship, and access to extensive alumni networks—proving valuable for first-time founders navigating early-stage challenges.

Regional investors from the Middle East, particularly Gulf Cooperation Council (GCC) based funds and family offices, increasingly deploy capital in African tech startups. This reflects both GCC investors’ search for return diversification beyond regional markets and strategic interest in commercial connections between Gulf markets and Africa. The Saudi Arabia and GCC AI investment strategy demonstrates regional commitment to technology leadership that extends to African opportunities.

Local African investors remain underrepresented relative to the continent’s economic size and entrepreneurial activity. Notable exceptions include successful entrepreneurs reinvesting proceeds into subsequent generations (Paystack founders supporting Nigerian startups, Flutterwave early employees angel investing, Interswitch alumni backing fintech ventures) and family offices from established business families diversifying into tech. However, limited local late-stage capital means most startups must seek international investors for growth rounds—introducing currency risk, cross-border legal complexity, and potential misalignment between investor expectations and local market realities.

Persistent challenges shaping the investor landscape include:

Limited late-stage funding availability: The scarcity of Series B, C, and growth-stage capital creates bottlenecks for promising companies, forcing them either to remain capital-constrained and grow slowly, accept lower valuations from international growth equity funds, or pursue premature exits before reaching full potential.

Geographic concentration concerns: International investors often concentrate on the Big Four countries (Nigeria, Kenya, Egypt, South Africa), leaving startups in smaller markets struggling to access capital despite potentially attractive opportunities. Francophone African countries saw increased investor interest in 2024, accounting for 55% of equity funding outside the Big Four, but deal counts and amounts remain smaller.

Sector concentration risks: Fintech’s dominance (60% of equity funding) creates both opportunity for fintech founders and challenge for entrepreneurs in other sectors. Healthcare, education, logistics, and manufacturing tech startups report difficulty attracting investor attention despite addressing large problems, as capital gravitates toward proven fintech models.

Currency and foreign exchange challenges: Most African currencies depreciated against the dollar in recent years, affecting dollar-denominated funding. Startups raising dollars face currency risk on local-currency revenues, while investors worry about returns diminishing through adverse exchange rate movements. This creates preferences for startups with dollar revenue streams or those serving export markets.

Exit uncertainty: Limited historical exits in African tech create uncertainty about liquidity pathways for investors. While Stripe’s acquisition of Paystack, Worldline’s Bambora acquisition including African operations, and several unicorn valuations demonstrate exit potential, the overall number of successful exits remains small relative to investment activity. This exit uncertainty constrains fund-raising for VC funds, as limited partners (institutional investors providing capital to VC funds) require confidence in liquidity potential.

Due diligence complexity: Operating across multiple African markets with different legal systems, accounting standards, and regulatory frameworks complicates investor due diligence. Startups often lack audited financials, customer contracts follow informal structures, and intellectual property protection varies by jurisdiction. These factors increase investor perceived risk and lengthen fundraising timelines.

The Big Four’s Funding Dominance

Nigeria, South Africa, Egypt, and Kenya—the “Big Four”—maintained their dominance of African tech funding in 2024, capturing 67% of total equity raised. However, this represents declining concentration from 79% in 2023 and 72% in 2022, indicating gradual investment diversification as other countries develop viable ecosystems.

Nigeria reclaimed its position as Africa’s top VC destination with $520 million in equity funding across 103 deals, marking 11% year-over-year growth driven primarily by fintech megadeals. The country’s large domestic market, proven fintech models, experienced entrepreneur pool, and active investor community create self-reinforcing advantages. Challenges include foreign exchange restrictions, policy uncertainty, and infrastructure gaps, but Nigeria’s momentum continues.

South Africa secured $459 million across 67 deals (down 16% from 2023), maintaining its position as the second-largest funding recipient. The country’s mature financial services sector, enterprise AI opportunities, and capital markets depth provide unique advantages, though economic challenges including electricity constraints and political uncertainties create headwinds. One megadeal prevented significantly steeper funding decline, illustrating both opportunity (investors will deploy large checks for exceptional opportunities) and challenge (fewer mid-sized rounds).

Egypt raised $297 million across 60 deals, with the notable achievement of 48% year-over-year growth in deal count signaling renewed energy in Cairo’s VC ecosystem. The country’s large population, strategic location, and growing investor interest position it well, though foreign exchange restrictions and regulatory complexities require navigation.

Kenya secured $221 million in equity funding across deals concentrated in cleantech (46%) and agritech (15%) rather than fintech (just 13%). This sectoral differentiation reflects Kenya’s innovation strengths but also M-Pesa’s entrenchment making payment competition challenging. Kenya led debt funding with 38% of total Africa debt and 31% of debt deals, demonstrating cleantech companies’ ability to access non-equity capital.

Beyond the Big Four, only Ghana ($50+ million), Morocco ($50+ million), and Tanzania ($52 million, including Nala’s $40 million round—a 1,150% increase from 2023) surpassed $50 million in equity funding. Francophone African countries collectively attracted significant capital, accounting for 55% of equity funding in the broader “rest of Africa” group, though this represented a decline from 68% in 2023. This demonstrates both progress (multiple francophone markets attracting investment) and challenge (concentration persists despite diversification efforts).

The geographic concentration stems from network effects: early investment success attracts more investors creating deeper talent pools and more experienced operators, which enables more startup success attracting additional investment. Breaking this cycle requires sustained ecosystem development in emerging markets, often catalyzed by diaspora entrepreneurs, government support programs, and dedicated investors willing to accept pioneer risks.

5. Talent, Data & Infrastructure — The Main Constraints

Three structural gaps consistently emerge as primary constraints limiting African AI startup scaling: talent depth, data and cloud infrastructure, and local investor density. While each has shown improvement, comprehensive solutions require sustained multi-year development and coordinated action across private and public sectors.

Talent Depth and Skills Gap

Growing AI skill supply exists across Africa through university programs, coding bootcamps, online courses, and corporate training initiatives. Institutions including Strathmore University (Kenya), University of Lagos (Nigeria), Cairo University (Egypt), University of Cape Town (South Africa), and Carnegie Mellon University Africa (Rwanda) offer computer science and data science programs producing qualified graduates. Bootcamps including Andela, AltSchool Africa, Decagon, and 10 Academy provide intensive training converting career changers into developers and data analysts within months.

Microsoft’s skilling initiatives represent the largest coordinated AI training effort, aiming to train three million Africans (one million each in South Africa, Kenya, and Nigeria) by 2026 in AI and digital skills. The programs provide free coursework, certification exam funding, and connection to employment opportunities. In 2024, over 150,000 South Africans received training in digital and AI skills, 95,000 achieved certifications, and 1,800 secured employment through Microsoft’s Skills for Jobs program. Similar programs roll out across Kenya and Nigeria, creating substantial talent pipelines.

However, demand outpaces supply particularly for experienced machine learning engineers, data scientists with industry experience, and product managers understanding both AI capabilities and African market contexts. Entry-level graduates may understand algorithms and frameworks but lack practical experience deploying AI systems in production, managing data pipelines at scale, and navigating real-world constraints including incomplete data, changing requirements, and resource limitations.

The skills gap manifests in several ways:

Salary competition: Large technology companies (Google, Microsoft, Meta), international startups, and well-funded African unicorns compete aggressively for top AI talent, driving compensation to levels difficult for early-stage startups to match. Senior machine learning engineers in Lagos or Nairobi can command $60,000-120,000 annually plus equity, compared to $30,000-50,000 for experienced software engineers without AI specialization. This premium reflects scarcity and creates recruiting challenges for startups constrained by limited funding.