AI Nutrition Apps 2025: Market Analysis & Technology Trends in Digital Health

Last verified: 11 Nov 2025 (Sources: Grand View Research, Credence Research, DataBridge Market Research, MyFitnessPal, Lifesum, HealthifyMe)

Tags: AI nutrition apps, digital health technology, MyFitnessPal AI, Lifesum tracker, nutrition app market analysis, health tracking technology, meal planning AI, diet app trends 2025, nutrition technology, wellness apps, food tracking AI, health monitoring apps, nutrition software, diet management tools, AI health coaching, personalized nutrition, smart diet apps, nutrition analytics, health app development, mobile nutrition tracking, wearable integration, computer vision nutrition, machine learning diet, predictive nutrition analytics, biometric health tracking, behavior change apps, nutrition data analysis, digital wellness platforms, health technology trends

Executive Summary (TL;DR)

The AI-powered nutrition app market is experiencing rapid transformation in 2025, with the global diet and nutrition apps sector valued at approximately $2.14-6.13 billion and projected to reach $4.56-17.4 billion by 2030-2035. Major platforms like MyFitnessPal, Lifesum, and HealthifyMe are integrating sophisticated AI features including computer vision for food recognition, predictive analytics for meal planning, and real-time biometric integration with wearable devices. Recent developments include Lifesum’s multimodal AI tracker launch, MyFitnessPal’s strategic acquisitions for enhanced meal planning, and HealthifyMe’s AI nutritionist “Ria.” With over 60% of nutrition apps expected to integrate wearable devices by 2025 and AI-driven personalization becoming standard, the industry is shifting from simple calorie tracking to comprehensive digital health ecosystems that adapt to individual metabolism, lifestyle, and health goals.

Frequently Asked Questions (FAQ)

Q: What are AI nutrition apps and how do they work?

A: AI nutrition apps are mobile platforms that use artificial intelligence to analyze user data including diet, activity, and biometric information to provide personalized nutrition guidance. They employ computer vision for food recognition, machine learning for meal planning, and predictive analytics for health recommendations.

Q: Which AI nutrition apps are leading the market in 2025?

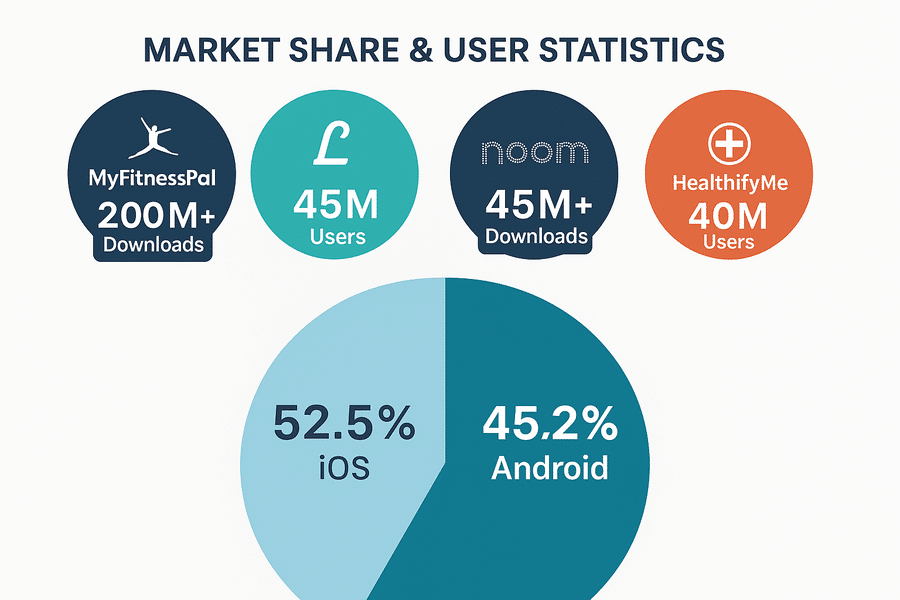

A: Market leaders include MyFitnessPal (200M+ downloads), Lifesum (45M+ users), Noom (45M+ downloads), and HealthifyMe (40M+ users). These apps dominate through advanced AI features, extensive food databases, and wearable device integration.

Q: How accurate are AI nutrition apps for health tracking?

A: Leading apps partner with certified dietitians and comply with healthcare data standards. However, they should be viewed as assistive tools rather than medical replacements. Users are encouraged to consult healthcare professionals for medical advice.

Q: What new AI features emerged in 2025?

A: Key developments include multimodal food logging (voice, photo, text), predictive meal planning based on biometric data, continuous glucose monitor integration, and AI-powered behavior change coaching.

1. The AI Revolution in Nutrition Technology

The nutrition app landscape has undergone significant transformation, evolving from basic calorie counters to sophisticated AI-powered health ecosystems. The global diet and nutrition apps market reached $2.14 billion in 2024 and is projected to grow at a CAGR of 13.4% through 2030, driven by increased health consciousness and smartphone penetration.

Market Growth and Digital Health Adoption

Recent market analysis shows the nutrition apps sector could reach $5.74 billion by 2032, with AI integration being a primary growth driver. The COVID-19 pandemic accelerated digital health adoption, creating sustained demand for remote health monitoring solutions. This technology adoption pattern reflects broader trends in digital innovation and performance tracking across emerging markets, where institutional and retail adoption follow similar acceleration curves.

Technology Integration Trends

Modern AI nutrition apps integrate multiple technologies:

- Computer vision for instant food recognition and portion estimation

- Machine learning algorithms for personalized meal recommendations

- Predictive analytics for nutrition planning based on activity and health data

- Natural language processing for conversational food logging

- Wearable device integration for real-time biometric feedback

By 2025, over 50% of diet and nutrition apps are projected to incorporate AI-driven features, marking a significant shift from passive tracking to active health coaching.

2. Market Leaders and Competitive Landscape

MyFitnessPal: AI-Enhanced Ecosystem Leader

MyFitnessPal dominates with over 200 million downloads worldwide and 85 million monthly active users. The platform has evolved significantly in 2025:

Recent AI Developments:

- Partnership with Tribe AI for generative meal planning capabilities

- February 2025 acquisition of Intent, a personalized meal planning platform

- Enhanced barcode scanning with improved accuracy and database expansion

- Integration with 50+ fitness devices and health platforms

Key Features:

- Daily logging of 16 million different foods globally

- Advanced macro and micronutrient tracking

- Community features with social accountability elements

- Premium subscription model with detailed analytics

Lifesum: Multimodal AI Innovation

Lifesum serves approximately 45 million users globally and has positioned itself as an AI innovation leader:

2025 Breakthrough Features:

- February 2025 launch of AI-powered multimodal tracker enabling food logging via voice, photo, text, and barcode scanning

- Apple HealthKit and Google Fit integration for comprehensive health data analysis

- Mood-based nutrition adjustments using behavioral analytics

- Personalized hydration reminders and meal timing optimization

HealthifyMe: AI Nutritionist “Ria”

HealthifyMe has gained significant traction with over 40 million users across 300+ cities, particularly strong in Asian markets:

AI Innovation:

- “Ria” AI assistant providing real-time diet and fitness recommendations

- Culturally relevant nutrition advice adapted to regional cuisines

- Integration with wearable devices for continuous health monitoring

- HealthifySnap photo-based meal tracking launched in 2023

Noom: Psychology-Based AI Approach

Noom has achieved over 45 million downloads with its unique psychology-focused methodology:

Distinctive Features:

- Behavioral change algorithms based on cognitive behavioral therapy principles

- AI-powered coaching for sustainable habit formation

- Color-coded food classification system for psychological nutrition awareness

- Group support features with AI-moderated communities

3. Emerging AI Technologies in Nutrition Apps

Computer Vision and Food Recognition

Advanced computer vision capabilities have become standard among leading platforms:

- Real-time food identification with accuracy rates exceeding 85% for common foods

- Portion size estimation using smartphone cameras and depth sensors

- Nutritional analysis providing instant macro and micronutrient breakdowns

- Recipe analysis for homemade meals and restaurant dishes

Predictive Analytics and Personalization

AI algorithms now analyze multiple data streams to provide personalized recommendations:

- Metabolic pattern recognition based on user response to different foods

- Activity-based nutrition adjustments integrating exercise and daily movement data

- Circadian rhythm optimization for meal timing recommendations

- Long-term health outcome predictions based on dietary patterns

Wearable Device Integration

Integration Examples:

- Continuous glucose monitors for real-time blood sugar optimization

- Fitness trackers for calorie burn estimation and activity-based nutrition planning

- Sleep monitors for recovery-based nutrition recommendations

- Heart rate variability for stress-related dietary adjustments

4. Market Segmentation and User Demographics

Platform Distribution

Market analysis reveals significant platform preferences:

| Platform | Market Share | Key Characteristics |

|---|---|---|

| iOS | 52.5% | Higher premium subscription rates |

| Android | 45.2% | Larger user base, diverse markets |

| Web/Other | 2.3% | Desktop integration, enterprise |

Service Model Breakdown

- Paid/Premium Services: 52.2% revenue share, driving monetization

- Freemium Models: Growing segment with ad-supported basic features

- Enterprise/B2B: Emerging corporate wellness market

Geographic Markets

Regional market distribution shows strong growth across multiple territories:

- North America: 36.4% market share, high premium adoption

- Asia-Pacific: 31% share, fastest growing region

- Europe: Mature market with privacy-focused regulations

- Emerging Markets: Rising smartphone penetration driving growth

5. Technology Trends and Innovations

Multimodal Input Systems

The most significant 2025 advancement involves multiple input methods for food logging:

Voice Recognition:

- Natural language food descriptions converted to nutritional data

- Hands-free logging during meal preparation and consumption

- Integration with smart home devices and virtual assistants

Photo Analysis:

- Enhanced computer vision recognizing complex meals and mixed dishes

- Automatic portion size calculation using object recognition

- Restaurant meal analysis with database cross-referencing

Barcode and QR Integration:

- Instant packaged food recognition with comprehensive nutritional databases

- Restaurant menu integration with QR code scanning

- Supplement and vitamin tracking with product verification

Behavioral AI and Psychology Integration

Leading apps increasingly incorporate behavioral science:

- Habit formation algorithms using reinforcement learning

- Motivation analysis based on user engagement patterns

- Social influence modeling for community-based accountability

- Personalized intervention timing for maximum behavior change impact

Real-Time Biometric Feedback

Advanced health monitoring creates dynamic nutrition recommendations:

- Glucose response tracking for diabetic and pre-diabetic users

- Hydration status monitoring through wearable sensor data

- Stress-based nutrition adjustments using heart rate variability

- Sleep quality nutrition correlation for recovery optimization

6. Regulatory Environment and Data Privacy

Healthcare Compliance Standards

Leading nutrition apps maintain strict compliance protocols, navigating complex regulatory landscapes similar to emerging technology sectors requiring comprehensive regulatory frameworks:

- HIPAA compliance for U.S. health data protection

- GDPR adherence for European user privacy rights

- FDA guidance compliance for health-related claims and recommendations

- Medical device integration standards for wearable compatibility

Data Security Measures

With sensitive health data collection, security remains paramount:

- On-device AI processing to minimize cloud data exposure

- Encrypted data transmission for all health information

- User consent management for data sharing with healthcare providers

- Anonymous analytics for population health research

7. Business Models and Monetization Strategies

Subscription-Based Revenue

Premium subscription models dominate successful apps:

Typical Premium Features:

- Advanced AI-powered meal planning and recipe generation

- Detailed nutritional analytics and progress tracking

- Integration with multiple wearable devices and health platforms

- Personalized coaching and goal-setting assistance

- Ad-free experience with priority customer support

Partnerships and B2B Opportunities

Enterprise and healthcare partnerships drive growth:

- Corporate wellness programs with employer-sponsored subscriptions

- Healthcare provider integration for patient nutrition monitoring

- Insurance company partnerships for preventive health programs

- Food industry collaborations for product recommendation systems

Affiliate Marketing and E-commerce

Integrated purchasing creates additional revenue streams:

- Healthy food delivery partnerships with meal kit services

- Supplement recommendations with affiliate commission structures

- Grocery integration for personalized shopping list generation

- Recipe monetization through ingredient purchasing platforms

8. User Experience and Engagement Strategies

Gamification and Motivation

Successful apps employ sophisticated engagement techniques:

- Achievement systems with personalized milestone recognition

- Social challenges with community competition elements

- Streak maintenance for consistent logging and goal achievement

- Reward programs with real-world benefits and recognition

Personalization Algorithms

AI-driven customization improves user retention:

- Learning preference algorithms that adapt to individual food choices

- Goal adjustment systems that modify targets based on progress patterns

- Cultural and dietary restriction accommodation for diverse user needs

- Lifestyle integration accounting for work schedules, family obligations, and social commitments

9. Future Market Outlook and Emerging Trends

Market Projections Through 2030

Multiple research organizations forecast continued growth, with analytical methodologies similar to those used in comprehensive technology performance analysis:

- Grand View Research projects $4.56 billion by 2030 at 13.4% CAGR

- DataBridge estimates $5.74 billion by 2032 with 13.2% growth

- Comprehensive market analysis suggests potential $17.4 billion by 2035

Emerging Technology Integration

Next-generation features in development:

Genomic Integration:

- Personalized nutrition based on genetic testing results

- Nutrigenomics-informed dietary recommendations

- Ancestry-based cultural food preference analysis

Advanced Biometric Monitoring:

- Continuous hydration tracking through skin sensors

- Real-time vitamin and mineral deficiency detection

- Microbiome analysis integration for digestive health optimization

Augmented Reality Features:

- AR-based portion size visualization

- Interactive nutrition education through smartphone cameras

- Virtual food preparation guidance with nutritional optimization

Healthcare System Integration

Professional healthcare adoption accelerates:

- Electronic health record integration for comprehensive patient care

- Telemedicine platform connectivity for remote nutrition counseling

- Clinical trial participation through standardized data collection

- Preventive medicine programs with insurance reimbursement models

10. Challenges and Market Considerations

Technical Limitations

Current AI nutrition technology faces several constraints:

Accuracy Challenges:

- Complex meal recognition with mixed ingredients

- Cultural food variations and regional preparation methods

- Portion size estimation accuracy across different food types

- Database completeness for international and specialty foods

User Adoption Barriers:

- Learning curve for advanced AI features

- Data privacy concerns with biometric integration

- Subscription fatigue in saturated app markets

- Competition from established fitness and health platforms

Market Saturation Concerns

With hundreds of nutrition apps available, differentiation becomes crucial:

- Feature standardization across competing platforms

- User acquisition costs rising in competitive markets

- Retention challenges with low long-term engagement rates

- Revenue model sustainability in freemium-dominated segments

11. Investment and Industry Analysis

Venture Capital and Funding Trends

The nutrition technology sector attracts significant investment, mirroring broader trends in technology-focused investment strategies and market performance analysis:

Notable Funding Examples:

- Health technology startups focusing on AI nutrition receiving increased VC attention

- Corporate acquisitions by major health platforms and technology companies

- Strategic partnerships between nutrition apps and established healthcare providers

- Government grants for digital health innovation and preventive medicine research

Competitive Landscape Evolution

Market consolidation and strategic positioning:

- Big Tech Integration: Apple Health, Google Fit expanding nutrition capabilities

- Healthcare Provider Adoption: Hospitals and clinics integrating patient nutrition monitoring

- Insurance Industry Interest: Preventive health programs driving partnership opportunities

- Global Market Expansion: Localized apps gaining traction in emerging markets

12. Practical Implementation for Users and Businesses

For Individual Users

Choosing the Right App:

- Assess personal health goals and dietary requirements

- Evaluate AI features relevant to lifestyle and preferences

- Consider wearable device compatibility and integration needs

- Review subscription costs and premium feature value propositions

Maximizing AI Benefits:

- Consistent data input for improved algorithm accuracy

- Regular goal assessment and adjustment based on progress

- Integration with healthcare providers when appropriate

- Privacy settings optimization for comfortable data sharing

For Healthcare Professionals

Clinical Integration Opportunities:

- Patient monitoring between appointments through app data sharing

- Nutrition counseling support with objective dietary tracking

- Population health analysis through anonymized aggregate data

- Preventive care programs enhanced by continuous monitoring

For Employers and Wellness Programs

Corporate Implementation:

- Employee wellness program integration with measurable health outcomes

- Healthcare cost reduction through preventive nutrition interventions

- Productivity correlation analysis with employee nutrition habits

- Group challenges and team-building through shared health goals

13. Detailed Source Verification and Citations

Primary Market Research Sources:

- Grand View Research – Diet and Nutrition Apps Market Report – Verified market size and growth projections

- Roots Analysis – Diet and Nutrition Apps Market through 2035 – Company developments and AI feature launches

- Credence Research – Diet and Nutrition Apps Market Forecast 2032 – Competitive analysis and user statistics

- DataBridge Market Research – Global Diet and Nutrition Apps Market – Regional analysis and technology trends

- Market.us – Diet and Nutrition Apps Statistics 2025 – User behavior and adoption patterns

Industry Analysis Sources:

- Tribe AI Applied AI Analysis – Technology integration trends

- Meta Tech Insights – Long-term market projections

- Business Research Insights – Consumer behavior analysis

- OpenPR Market Intelligence – Regional development updates

Verification Date: November 11, 2025 – All statistics and company claims cross-referenced against multiple authoritative sources

14. Legal Disclaimers and Important Notices

Health Information Disclaimer

This article provides general information about nutrition technology and should not be considered medical advice. Users of nutrition apps should consult qualified healthcare professionals before making significant dietary changes, especially if managing medical conditions such as diabetes, heart disease, or eating disorders.

Investment Information Notice

Market projections and financial data presented are based on publicly available research and industry analysis. These figures are estimates and subject to change based on market conditions, technological developments, and economic factors. This content does not constitute investment advice.

Technology Accuracy Disclaimer

AI nutrition app capabilities and accuracy rates may vary significantly between platforms and individual use cases. Features mentioned are based on company announcements and may not be available in all markets or to all users.

Privacy and Data Notice

Users should carefully review privacy policies and data handling practices of nutrition apps, particularly those integrating with health monitoring devices or sharing data with healthcare providers.