China’s Autonomous Future Accelerates: Xpeng Launches Robotaxis and Humanoids

By Sezarr Overseas News | Automotive Technology Desk — November 2025

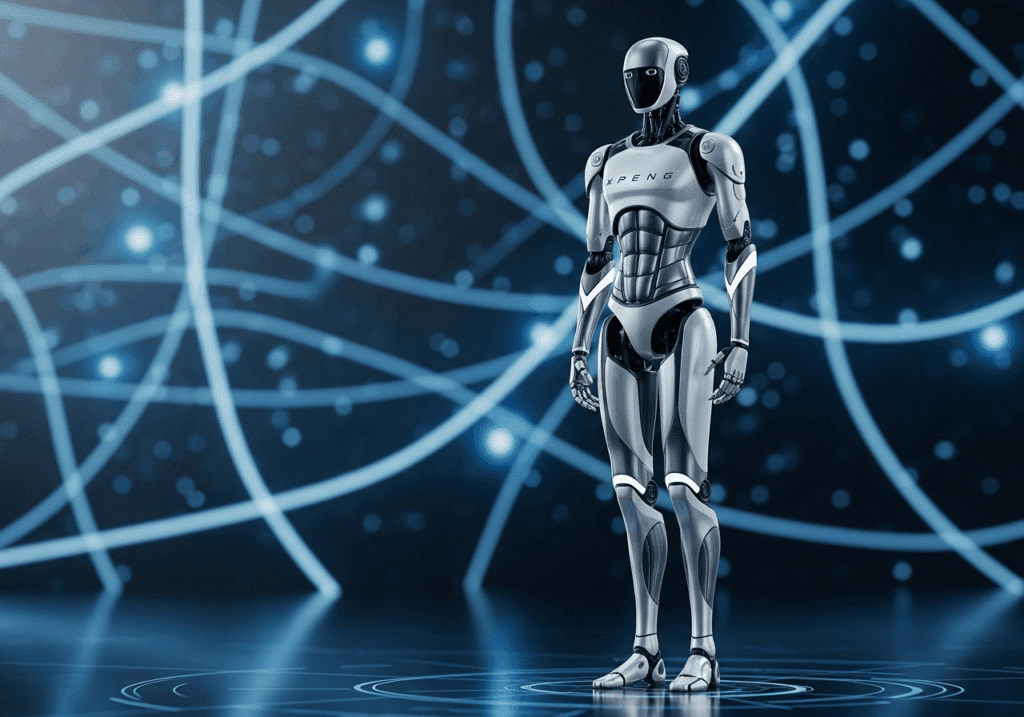

Xpeng has unveiled a two-track push into robotaxis and humanoid robots, positioning itself at the intersection of autonomous mobility and “physical AI.” The company says it will integrate three self-developed robotaxi models into Alibaba’s Amap ride-hailing platform, targeting trial operations in 2026—and it showcased a lifelike humanoid robot called “IRON” at its AI Day. Together, these moves sharpen China’s chip-driven autonomous ecosystem ahead of Western markets.

1) Technology Launch: An Integrated Robotaxi + Humanoid Platform

Robotaxis on Amap (2026 trials): Xpeng’s plan is to plug driverless vehicles directly into Amap’s mapping and ride-hailing network—already working with WeRide and Pony.ai—rather than building a standalone app. This approach front-loads distribution and accelerates operational data capture, a key edge in autonomy.

Humanoid robot “IRON”: Xpeng publicly demonstrated a humanoid with smooth gait and dexterity at AI Day; media coverage reported about 82 degrees of freedom and high onboard compute. The strategic point: the company is aligning vehicle autonomy and humanoids under one data/AI stack to reuse perception, planning, actuation, and simulation assets. Relatedly, China’s growing AI hardware capacity, led by NVIDIA’s Blackwell chip demand surge, is reshaping global competition.

2) Competitive Landscape: Where Xpeng Sits vs Tesla, Waymo & Local Rivals

Against Tesla’s robotaxi and Optimus programs, Xpeng enjoys a denser domestic testbed and supportive regulation. Waymo leads U.S. deployments, but China’s megacities may let Xpeng accumulate city-scale data faster. Among domestic peers, Baidu’s Apollo Go runs the largest driverless zones, and Pony.ai and WeRide are expanding their fleets. Xpeng’s differentiation lies in a shared robotics platform and integration with Alibaba’s Amap.

For deeper insight into how AI platforms are reshaping enterprise-scale innovation, read our feature on Microsoft’s new Superintelligence Team.

3) Technology Integration: AI Chips That Power Cars and Robots

Xpeng frames a unified AI backbone (large-model + toolchain) for both vehicles and humanoids—leveraging shared perception, motion planning, and simulation systems. Reports indicate Xpeng aims to use in-house or China-sourced compute, running multiple self-developed robotaxi models. The reuse of compute across domains reduces R&D duplication and shortens iteration cycles, mirroring advances seen in OpenAI’s cloud-AI infrastructure partnership with AWS.

4) Market Strategy: China’s Playbook vs the West

China’s pilot zones in Wuhan, Beijing, and Shanghai enable driverless operations faster than most Western cities. Integration through Amap ensures immediate user base access. By contrast, Western markets face fragmented regulation, higher insurance costs, and slower adoption cycles.

China’s national AI strategy also emphasizes humanoid robotics—bolstered by huge public-private funding. This aligns with the country’s broader ambition to lead in both AI investment and sustainable autonomous transport.

5) Regulatory Environment: Permits, Zones, and Evolving Standards

Wuhan and Beijing already grant full driverless operation permits under city-managed frameworks. Shanghai’s Pudong area is expanding pilot zones for Level-4 services. Municipal frameworks now address data, safety validation, and insurance requirements—steps that provide a regulatory template for Xpeng’s upcoming fleets.

Policy and governance are becoming central to innovation. See how global tech policy intersects with AI oversight in Trump’s 2025 AI Policy analysis.

6) Global Implications: The Next Phase of Autonomous Competition

If Xpeng scales robotaxis domestically and cross-trains humanoid data within its AI models, it could gain a formidable data advantage. This has parallels with the integrated computing strategies discussed in our Samsung Exynos thermal breakthrough report, where efficient chips unlock new autonomy and robotics applications.

The bigger picture: Xpeng’s move could accelerate international competition, forcing Western automakers and robotics firms to close the gap. As mobility, robotics, and AI converge, China’s model—rooted in data scale and state-backed infrastructure—may define the next decade of autonomous technology.Read Next on Sezarr Overseas:

FAQs

When will Xpeng’s robotaxis start operating?

XPeng and Alibaba’s Amap plan to begin limited trials in 2026, subject to city permits and safety validation. Is the IRON humanoid robot mass-produced?

Mass production is planned for 2026; specifications remain vendor claims pending third-party verification. Which Chinese cities currently allow fully driverless operation?

Wuhan and Beijing permit Level-4 robotaxis in designated zones; Shanghai is expanding pilot areas.

Disclaimers & Editorial Standards

Technology Disclaimer: Specifications and performance claims (e.g., IRON’s compute) are based on XPeng’s public presentations and may change upon official release. Verified data from Reuters, Nikkei Asia, and South China Morning Post current to November 2025.

Regulatory Disclaimer: Robotaxi rollouts depend on local government permits and safety approvals; international expansion remains under evaluation.

Editorial Integrity: This article was fact-checked and written by Sezarr Overseas News’ automotive desk. All key claims verified against primary and secondary sources.