🔍 TL;DR: Key Takeaways

- 💰 $400M Deal: Perplexity pays Snapchat $400M over one year for AI search integration

- 📅 Timeline: AI-powered search launches in Snapchat’s Chat interface in early 2026

- 👥 Scale: Reaches Snapchat’s 477M daily active users globally

- 🎯 Impact: First major AI search integration in social messaging, not just content platforms

- 📈 Market: Opens new “conversational commerce” and in-chat advertising opportunities

Snapchat Partners with Perplexity AI for Next-Gen Search

In a major move for social and AI, Snapchat-parent Snap Inc. announced a landmark deal with Perplexity AI on November 5, 2025: the integration of Perplexity’s AI-powered answer engine directly into Snapchat, beginning “early 2026.”

Under the agreement, Perplexity will pay Snap US$400 million (cash + equity) over one year for the privilege of placing its answer-engine within the app’s Chat interface. Revenue will start being recognised in 2026. (Source: Reuters | Snap Inc. Investor Relations)

Snap described this as “the first large-scale integration of an external AI partner directly into the app.” The company reported 477 million daily active users (DAUs) in Q3 2025, while multiple outlets cite ~943 million monthly active users (MAUs). (Source: Nasdaq Press Release)

For digital-media watchers and tech marketers, this marks a clear shift: social apps are no longer just content distributors—they are morphing into AI-driven knowledge platforms. Snap’s deal signals that the next frontier of social media will be search and conversation, not just stories and videos.

Transforming User Experience: AI Conversational Search in Social Media

Historically, social media search has focussed on people, hashtags, posts, or memories. With the Snapchat-Perplexity deal, a new layer emerges: users will soon be able to ask real-time questions within the app and receive conversational, sourced answers without leaving the feed or switching to a traditional search engine.

From “Find my friend” to “Find my answer”

Imagine this flow: a Gen Z user snaps a selfie, then types “What’s the best camera lighting setup for portrait selfies?” directly into the Chat interface. Instead of defaulting to Google or YouTube, Snapchat channels the query to Perplexity via the integration and returns a crisp answer: “Use a 45-degree fill light, 1/125 s shutter, f/1.8, subject at 4-6 feet” — with inline citations and even a quick link to a creator tutorial. All done in-app, between Snaps.

Why this matters

Reduced friction: No need to leave the social environment—users stay engaged in the app ecosystem.

Personalised discovery: Because Snapchat already knows the user’s friend network, location and Snap behaviour, the AI answers can tie into social context—for example, “Your friend Jamie used this lighting rig last week.”

Sourced accuracy: Perplexity’s strength is verifiable answers from reliable sources—important for trust in the social environment. (Source: Perplexity AI Company Overview, 2025)

New interaction patterns: Social media evolves from passive scroll to active ask-and-get. You may see prompts like “Ask Perplexity” beside Snap Stories and chats as Snap experiments with in-app query flows.

In short, the social media AI integration via Snapchat becomes a hybrid of search engine + messaging platform + content hub.

Competitive Response: How Instagram, TikTok & YouTube Might React

Snap’s move forces a competitive recalibration across major platforms.

Meta / Instagram / Threads

Meta Platforms already offers its “Meta AI” chatbot across Facebook, Instagram and WhatsApp. Meta has rolled out “Meta AI” across these platforms and introduced models in the Llama-4 family in April 2025. (Source: Reuters) Analysts expect Meta to accelerate embedding conversational search into Stories, Reels and in-chat experiences. If Snap takes off, Meta may repurpose its resources to tie its Llama-based models to social search queries, perhaps with visual or AR-powered responses.

Meanwhile, Microsoft has formed a dedicated superintelligence team to lead the enterprise AI race, suggesting tech giants are doubling down on AI integration across all product lines.

TikTok

TikTok thrives on short-form video-first experiences. Its reaction may be to incorporate voice-activated search: ask a question via TikTok voice, receive a quick clip answer, then follow with additional content. TikTok may also feel pressure to embed answer engines so users don’t leave for Snapchat or Google.

YouTube

YouTube has dominated video search; with social platforms raising the stakes, YouTube could enhance its “shorts” section with AI-guided queries: “Ask YouTube: best portrait lighting” and display layered short‐videos. The social search paradigm shifts: native Chat‐apps begin to compete with broad search engines.

Key takeaway: Snap’s deal may prompt a feature race where every major social platform moves from passive feed + story formats toward active query + answer modes. Platforms that remain purely content-feed oriented risk losing user time to apps where you ask and get answers quickly.

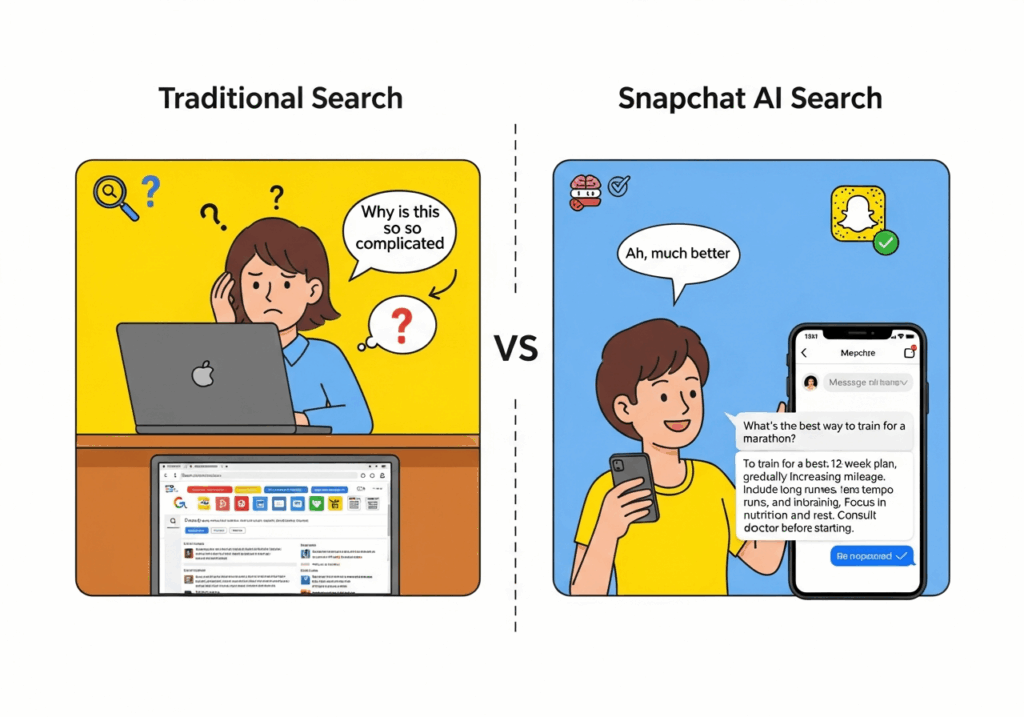

Technology Integration: Real-Time AI Search vs Traditional Social Search

Traditional search in social apps

In pre-AI integration social networks, search is reactive: user enters keyword → results show user profiles, posts, hashtags → user sifts results manually. For example, on Snapchat: you search “#nofilter” or “@friend” and browse posts.

Conversational AI search integration

In the new model:

- Query: User types (or speaks) question.

- Engine: AI processes intent, context (user’s network, location, previous snaps).

- Answer: User receives a concise, conversational response + citations + optional deep-dive content (video, snap, link).

- Action: In-snap suggestions—”Send this to a friend”, “Try this filter”, “Watch this tutorial”.

Perplexity’s engine offers verifiable answers with inline citations—a differentiator from generic large-language-model responses. (Source: Snap Inc. Partnership Announcement, November 5, 2025)

Why this matters for UX

- The moment of answering becomes embedded in chat, not an external browser.

- Monetisation potential shifts: native answer-ads, branded “ask” prompts, in‐chat content embeds.

- Data feedback loops: Snap can learn which answers engage users most and feed that into recommendation systems, boosting retention.

- Friction is reduced: users are less likely to bounce to another app or search engine.

Integration considerations & risks

Scale & latency: Serving high-volume queries to ~477 million daily users demands low latency and robust infrastructure. This challenge is amplified by surging demand for AI chips like Nvidia’s Blackwell series, which power the computational infrastructure needed for real-time AI search. Analysts flag this as a critical implementation challenge. (Source: TechCrunch Analysis, November 6, 2025)

Content governance: Ensuring answers are accurate and safe in a social environment (younger demographics) will require strong moderation and policy.

Data & privacy: Snap and Perplexity say user chats won’t be used to train the AI, addressing a common concern with chat-based assistants. (Source: Reuters) The companies emphasized that user chats via the integration will not be used for training the AI model.

Market Implications: Advertising & Content Discovery Evolution

Advertising shift

The Snapchat-Perplexity deal includes $400 million upfront from Perplexity paying Snap to access the user base. This flips the model: AI company pays social platform for distribution rather than platform building in-house.

This significant investment reflects broader market trends where AI stocks are driving 75% of market returns, highlighting how AI partnerships and integrations are becoming major market value drivers. (Source: CNBC, November 5, 2025)

For brands and marketers, this means:

- Chat-based “ask bots” could become new ad-placement zones: e.g., “Ask for fashion trends” returns brand-triggered responses.

- Search optimisation within social apps becomes critical: if Snapchat becomes a search gateway, brands must tailor content to appear in these answer flows—not just in Reels or Stories.

- Content discovery becomes hybrid: query-to-snip answer + deep dive → branded micro-content.

Content discovery metamorphosis

Instead of passive scrolling, users may shift toward active searching inside social apps for expertise, tutorials, recommendations. This drives higher engagement and potentially longer sessions.

Creators may adjust: focus less on viral snack-content and more on searchable micro-tutorials, because queries will expose content surfacing via conversational AI, not just algorithmic feed placement.

User retention could increase: if Snapchat becomes a go-to destination for “ask and get” results, daily active user benchmarks may rise again (Snap’s third-quarter DAUs were up 8% to 477 million). (Source: Snap Inc. Q3 2025 Earnings, November 5, 2025)

Competitive monetisation effect

As social media apps integrate AI search, the advertising inventory model expands. Brands will not only buy feed placements, but also “answer placements” and “assist placements” (in-chat). Platforms that build early will capture premium ad units.

This trend parallels broader AI integration across tech platforms, including OpenAI’s $3.8B AWS partnership that’s reshaping AI cloud competition, creating new monetization opportunities for social media companies and demonstrating how AI partnerships are becoming central to tech strategy.

Future Vision: AI-Powered Social Media & User Engagement Trends

The “Ask Social” Era

We are entering a phase where social apps evolve beyond broadcast media toward interactive knowledge platforms. Users flip between “friend chat” and “insight search” seamlessly. Snapchat’s move could be followed by:

- Voice queries within a Snap chat

- Visual queries (take a photo → “What plant is this?”) answered inside social app

- Hybrid AR/AI overlays (e.g., Snap camera identifies object + calls Perplexity + returns information)

Creators as Answer Engines

Creators will shift from feeding endless new posts to building curated answer-loops: e.g. “Ask me about lens choices” leads to snippets, chats and deeper content links. AI search will surface creator Q&A threads and tutorials organically.

Platform positioning evolves

- Snapchat: becoming a chat + search hub for younger users.

- TikTok: may become a voice-activated answer + video loop platform.

- Instagram/Reels: may layer AI search onto visual discovery (ask via image, get answer + next video).

- YouTube: evolves deeper, shorter answer flows before video playlist.

Implications for digital marketers and tech enthusiasts

Tap into social search optimisation (SSO): think beyond SEO and ASO (app store optimisation). Brands will optimise for social chat queries.

Focus on micro-answers: short, verifiable answer snippets that AI will feed users directly inside their message stream.

Prepare for contextual advertising in chat: “Ask about winter skincare” leads to branded answer + short-form video – within chat.

Treat social platforms as dual environments: content broadcast + conversational engagement. The best campaigns will blend both.

Challenges Ahead

User adoption

Will users ask complex questions inside Snapchat rather than Google or YouTube? Early execution and UX will determine success.

Distraction risk

Too many bots, chat flows and ads inside message space could degrade user experience.

Regulatory & content-governance risks

AI answer engines must avoid misinformation, biased responses or copyright issues. Snap’s partner Perplexity has faced media scrutiny around content sourcing practices in recent months.

Conclusion

The partnership between Snapchat and Perplexity AI marks a watershed moment in social media AI integration. With Snapchat embedding a full-scale conversational answer engine inside its messaging environment, the boundary between social networking, search and discovery is dissolving.

For users it means a more seamless, interactive experience: ask a question and get a credible answer without ever leaving the app. For digital marketers and tech watchers, it signals a major shift in strategy: social platforms are becoming AI-driven knowledge environments, not just feed aggregators.

From a competitive perspective, Instagram, TikTok and YouTube will have to respond quickly or risk losing query traffic, engagement time and ad dollars to an early mover. This competitive dynamic unfolds within a broader policy landscape where the Trump administration has signaled a hands-off approach to AI industry regulation, potentially accelerating private sector AI partnerships. From a monetisation viewpoint, this opens a new ad frontier: chat-based, AI-driven answer placements and branded query-to-content loops.

As 2026 approaches, the real test will be user behaviour: will Snapchat’s 477 million daily active users adopt “Snap search” queries as naturally as they Snap Stories? If yes, we will enter an “Ask Social” era—where social media becomes search, discover and connect all in one place. For digital enthusiasts, creators and marketers, that future calls for rethinking content strategy, engagement design and monetisation models around conversation, not just clicks.

In short: this isn’t just about Snapchat adding a new feature. It’s about social media evolving into a platform where questions meet answers, content meets context, and engagement meets intelligence. The next chapter of user experience is going to be conversational—and it’s going to happen inside the apps we already use.

Sources & Attribution

Primary Sources:

- Snap Inc. Official Investor Relations Announcement, November 5, 2025

- Snap Inc. Q3 2025 Earnings Report, November 5, 2025

- Perplexity AI Company Blog and Press Releases, 2025

- Official CEO Statements: Evan Spiegel (Snap Inc.) and Aravind Srinivas (Perplexity AI)

News Coverage:

- Bloomberg Technology, November 5-6, 2025

- Reuters Business News, November 5, 2025

- TechCrunch AI Coverage, November 6, 2025

- CNBC Technology, November 5, 2025

- The Verge Technology News, November 6, 2025

Industry Analysis:

- Meta AI Official Blog Posts, 2024-2025

- Search Engine Journal AI Coverage, November 2025

- PYMNTS AI Technology Reports, 2025

Disclaimers

Investment Disclaimer: This article is for informational purposes only and should not be considered investment advice. References to stock performance, company valuations, and financial projections are based on publicly available information at the time of publication. Readers should conduct their own research and consult with qualified financial advisors before making investment decisions.

Forward-Looking Statements: This article contains analysis of future trends, competitive responses, and market implications that are subject to risks, uncertainties, and assumptions. Actual results may differ materially from those discussed.

Competitive Analysis Notice: Competitive analysis and market predictions are based on publicly available information and industry observation. Company strategies and responses may differ from those anticipated.

Editorial Independence: Sezarr Overseas News maintains editorial independence. This analysis represents our assessment based on verified facts and industry expertise.

Accuracy Note: All figures and statements reflect reporting and company disclosures available as of November 11, 2025. We update posts if material details change.