Historic breach of psychological threshold exposes cryptocurrency’s deepening correlation with technology equities amid unprecedented institutional exodus and extreme market fear

Published: November 9, 2025 at 12:01 PM EST | Last Updated: November 15, 2025 at 10:30 AM EST

Author: Sezarr Overseas News Financial Desk | Reading Time: 16 minutes

Category: Cryptocurrency & Financial Markets | Market Status: Extreme Fear (Index: 21)

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Cryptocurrency markets are highly volatile and speculative. The information presented reflects market conditions and data as of November 15, 2025, and may change rapidly. Past performance does not guarantee future results. Bitcoin and other cryptocurrencies carry significant risks including potential total loss of capital, regulatory changes, security vulnerabilities, and extreme price volatility. Before making any investment decisions, readers must conduct their own thorough research and consult with licensed financial advisors. Never invest more than you can afford to lose. Sezarr Overseas News and its authors are not registered investment advisors and do not provide personalized investment recommendations.

Bitcoin’s Historic Crash Below $100K

Bitcoin tumbled below the critical $100,000 threshold on Tuesday, November 4, 2025, marking its first breach of this psychological level since late June. The world’s largest cryptocurrency hit a low of $99,966 during afternoon trading before recovering slightly to close around $100,893—a 5% daily decline that sent shockwaves through digital asset markets and erased more than four months of gains above the six-figure mark.

Source: CNBC, November 4, 2025 – “Bitcoin’s November sell-off worsens as investors take risk off”

The selloff triggered the largest institutional outflows from Bitcoin investment products since the market downturn earlier this year, with Tuesday’s decline coming amid growing investor anxiety about overvalued artificial intelligence stocks. This highlighted Bitcoin’s evolving—and concerning—correlation with traditional technology assets, particularly those in the AI sector.

The market carnage wasn’t confined to Bitcoin alone. Ethereum, the second-largest cryptocurrency by market capitalization, dropped nearly 9% to trade around $3,275. The broader cryptocurrency market shed approximately $200 billion in value as investors fled risk assets across the board, with altcoins like Solana plunging over 10% and XRP declining 5% in sympathy with Bitcoin’s breakdown.

Massive Institutional Outflows Signal Changing Sentiment

The depth of institutional concern became starkly evident in exchange-traded fund flows, where Bitcoin products hemorrhaged capital at an unprecedented pace. Between October 29 and November 5, 2025, U.S. spot Bitcoin ETFs experienced outflows exceeding $2 billion—representing one of the largest weekly exodus periods since these revolutionary products launched in January 2024.

According to data compiled by SoSoValue, the sustained selling pressure reflected a dramatic shift in institutional sentiment. BlackRock’s iShares Bitcoin Trust (IBIT), typically the market leader in accumulating assets, joined other major funds in recording significant redemptions during this period. Fidelity’s FBTC and Grayscale’s GBTC similarly experienced substantial withdrawals as wealth managers and institutional allocators reduced cryptocurrency exposure amid growing macroeconomic uncertainty.

💡 MARKET SNAPSHOT: TUESDAY, NOVEMBER 4, 2025

- Bitcoin Low: $99,966 (first time below $100K since June 23)

- Daily Decline: 5% to $100,893

- Weekly ETF Outflows: Over $2 billion (Oct 29 – Nov 5)

- Fear & Greed Index: 21 (Extreme Fear territory)

- Market Cap Lost: Approximately $200 billion across crypto

- Ethereum Decline: Nearly 9% to $3,275

- Correlation with Nasdaq: Highest in six months

- Long Positions Liquidated: $1.7 billion in 24 hours

- Trading Volume: $117 billion (elevated panic selling)

The selling pressure extended throughout the following week. By November 14, 2025, spot Bitcoin ETFs had recorded outflows of $869 million in a single day—the second-largest daily redemption on record—bringing the three-week total to approximately $2.64 billion in net outflows. This institutional retreat signaled that the smart money was taking risk off the table amid mounting concerns about market sustainability.

“Bitcoin and the broader crypto market is exhausted,” Haonan Li, founder of Ethereum-based stablecoin platform Codex, told CNBC on November 4. “Even with stablecoin growth, rising real-world asset volumes, and Bitcoin increasingly behaving like an institutional store of value—the market doesn’t care. Bad news is very bad for crypto right now, and good news barely moves the needle.”

AI Bubble Concerns Create Perfect Storm for Crypto

The catalyst for Tuesday’s crypto crash stemmed directly from Wall Street’s growing unease about artificial intelligence stock valuations. Technology giants including Nvidia, Palantir, and other AI-focused companies tumbled as investors questioned whether current prices reflect realistic business fundamentals or represent speculative excess reminiscent of previous technology bubbles.

Notably, veteran investor Michael Burry—famous for predicting the 2008 housing crisis and immortalized in “The Big Short”—disclosed significant bearish positions against both Nvidia and Palantir in regulatory filings released Monday, November 3, 2025. This revelation added fuel to existing concerns about stretched AI valuations and their potential impact on correlated assets like Bitcoin.

According to 13F regulatory filings with the Securities and Exchange Commission, Burry’s Scion Asset Management purchased put options (which profit from price declines) valued at approximately $186.6 million notional value on Nvidia and a massive $912.1 million notional value on Palantir. The timing of these disclosures—covering trading activity through September 30, 2025, but released November 3—proved particularly impactful as markets were already showing signs of nervousness about technology sector valuations.

The Burry Effect Amplifies Market Fear

Burry’s track record commands attention on Wall Street. His prescient call on the 2008 housing market collapse earned him legendary status among investors, making his bearish positions on leading AI stocks particularly noteworthy. The fact that he targeted Nvidia—the undisputed leader in AI chip manufacturing—and Palantir—whose specialized AI software has no direct one-for-one replacement—suggested to many market participants that even the strongest AI companies might be overvalued.

“The two companies he’s shorting are the ones making all the money, which is super weird,” Palantir CEO Alex Karp responded during a CNBC Squawk Box interview on Tuesday morning. “The idea that chips and ontology is what you want to short is bats–t crazy. He’s actually putting a short on AI… It was us and Nvidia.”

Despite Karp’s pushback, markets responded negatively. Palantir shares dropped as much as 16% following the Burry disclosure and the company’s earnings report, despite beating revenue expectations. Nvidia fell nearly 4% on Tuesday as investors reconsidered the sustainability of AI infrastructure spending levels that have driven extraordinary revenue growth.

The broader context amplified concerns. Recent developments in massive AI infrastructure deals like OpenAI’s $38 billion AWS partnership had raised questions about whether cloud providers and chip manufacturers were building excess capacity relative to realistic AI adoption curves. When combined with Burry’s bearish stance, these concerns triggered broader selling across technology and cryptocurrency markets.

Correlation Risk Comes Home to Roost

The swift transmission of AI stock concerns into cryptocurrency selling highlighted an uncomfortable reality: Bitcoin’s oft-cited narrative as a distinct, uncorrelated asset class has weakened considerably. Data from multiple market analysis firms showed Bitcoin’s 30-day correlation with the Nasdaq Composite reached its highest level in six months during early November 2025.

This correlation presents significant implications for institutional investors who had allocated to Bitcoin precisely because they believed it would provide diversification benefits. When AI and technology stocks face selling pressure, Bitcoin now tends to follow rather than providing the hoped-for portfolio protection.

“Markets are treating Bitcoin as just another technology risk asset right now,” noted Eric Balchunas, senior ETF analyst at Bloomberg Intelligence. “The ‘digital gold’ narrative hasn’t disappeared, but it’s taking a back seat to Bitcoin’s behavior as a levered bet on technology sector sentiment.”

Technical Analysis: Critical Support Levels Under Pressure

From a technical perspective, Bitcoin’s break below $100,000 represents more than just a psychological blow—it signals a fundamental shift in market structure that technical analysts view as particularly concerning. Compass Point analyst Ed Engel notes that the cryptocurrency is now trading below key moving averages and facing potential further downside.

“While we see support for BTC above $95K, we also don’t see many near-term catalysts,” Engel wrote in a research note distributed to clients on November 5. “The next major support level sits around $95,000, which corresponds with significant buying clusters according to on-chain data providers.”

Key Technical Levels to Monitor

Technical analysts have identified several critical price levels that will determine Bitcoin’s near-term trajectory:

$100,000 – $104,000 (Immediate Resistance): The psychological $100,000 level that formerly acted as support has now flipped to resistance. Bitcoin briefly reclaimed this level on November 7, reaching $104,288, but failed to maintain momentum and rolled over again. The $104,000-$105,000 zone represents the first significant resistance cluster where sustained buying would be needed to signal that selling pressure has been exhausted.

$95,000 (Critical Support): This level represents the confluence of several technical factors: the 61.8% Fibonacci retracement from Bitcoin’s October peak, historical accumulation zones identified through on-chain analysis, and the approximate mining production cost according to JPMorgan’s latest estimates (updated to $94,000 as of November 13). A sustained break below $95,000 would likely trigger additional selling and potentially accelerate the decline toward deeper support levels.

$92,000 (Secondary Support): Various technical analysis frameworks point to the $92,000 area as a secondary support zone. This level corresponds with the 100% extension target from Elliott Wave analysts and represents the potential “fill” of the CME Bitcoin futures gap identified by several prominent crypto traders.

$88,000 – $90,000 (Deep Support): Should the decline extend beyond $92,000, analysts identify the $88,000-$90,000 zone as a deep support area that could mark a potential market bottom. This range represents approximately 30% down from the October peak—a significant but not unprecedented correction in Bitcoin’s history.

Moving Average Death Cross Looms

Perhaps most concerning from a technical perspective is the potential formation of a “death cross”—a bearish pattern that occurs when the 50-day exponential moving average (EMA) crosses below the 200-day EMA. As of November 15, 2025, these moving averages were converging, with the 50-day EMA at approximately $113,549 and the 200-day EMA around $109,840.

Bitcoin is currently trading below both of these moving averages, a condition that technical analysts view as bearish. If the death cross forms, it would represent the first such occurrence since Bitcoin’s extended bear market in 2022, potentially signaling extended weakness ahead.

The Relative Strength Index (RSI), a momentum indicator that measures the speed and magnitude of price changes, dropped to 29 on November 4—firmly in oversold territory (below 30). However, as many technical analysts note, oversold conditions can persist for extended periods during genuine bear markets, and the lack of bullish divergence (where RSI makes higher lows while price makes lower lows) suggests momentum remains firmly in sellers’ control.

On-Chain Metrics Paint Mixed Picture

Beyond traditional technical analysis, on-chain data—which examines Bitcoin transactions and holder behavior directly on the blockchain—provides additional context. The Network Value to Transactions (NVT) ratio, which measures Bitcoin’s market cap relative to transaction volume, has been elevated, suggesting the network might be overvalued relative to its utility.

However, the Net Unrealized Profit/Loss (NUPL) metric, which tracks the overall profit or loss of all Bitcoin holders, sits at 0.47—near its lowest levels since April 2025. This suggests that while some profit-taking has occurred, Bitcoin holders as a group are not experiencing the extreme euphoria that typically marks market tops, nor the extreme despair that marks market bottoms.

Long-term holder behavior, tracked through coins that haven’t moved for 12+ months, shows remarkable steadfastness. Approximately 69% of Bitcoin’s total supply remains held by these long-term investors, near record-high levels. This suggests that while short-term speculators have been forced out by margin calls and fear, the core base of committed holders remains intact.

Weekend Could Bring Additional Volatility

The timing of Bitcoin’s breakdown—heading into a weekend with traditionally reduced trading liquidity—raised concerns among analysts about potential additional volatility. Cryptocurrency markets operate 24/7 unlike traditional stock markets, meaning weekend price action can be particularly volatile when institutional desks are offline and retail traders dominate order flow.

“The weekend will be a real nail-biter,” noted Nic Puckrin, co-founder of Coin Bureau, in comments published November 4. “With lower liquidity potentially setting the stage for even more volatility. Weekend price action could go either way—we might see bargain hunters step in, or we could see another leg down if panic intensifies.”

Weekend trading sessions following Bitcoin’s break below $100,000 did indeed prove volatile. The cryptocurrency bounced between $97,000 and $103,000 over the November 8-9 weekend, with sharp intraday swings creating both opportunities and dangers for active traders. By Monday, November 10, Bitcoin had stabilized somewhat around $102,000, but the volatility underscored the market’s nervous, uncertain character.

Historical Precedent Offers Mixed Signals

Market observers searching for historical parallels found both encouraging and concerning precedents. Bitcoin previously bounced from $100,000 support levels in May and June 2025, with the June 22 reversal leading to a surge up to $123,500 within three weeks. This demonstrated that the $100,000 level had acted as significant support in the recent past and could potentially do so again.

However, the broader context differed significantly. Those earlier tests of $100,000 support occurred during periods of general market optimism and improving macroeconomic conditions. The November test came amid deteriorating sentiment, institutional outflows, rising correlation with declining technology stocks, and mounting concerns about AI sector valuations—a fundamentally more challenging backdrop.

Institutional Perspective: Long-Term Bulls vs. Near-Term Caution

Despite the current turbulence, some major financial institutions maintain bullish long-term outlooks for Bitcoin, creating an interesting disconnect between near-term selling pressure and longer-term institutional conviction. This divergence reveals important nuances in how sophisticated investors are approaching cryptocurrency allocation.

JPMorgan’s Dual Message: Bullish Long-Term, Cautious Near-Term

JPMorgan Chase presents perhaps the most interesting case study in institutional Bitcoin positioning. The bank’s strategists, led by managing director Nikolaos Panigirtzoglou, published research on November 6 suggesting Bitcoin could reach $170,000 within 6-12 months based on volatility-adjusted comparisons with gold.

The analysis highlighted that recent deleveraging in futures markets has cleared “excess leverage” from the system, potentially creating a healthier foundation for future price appreciation. The ratio of open interest in Bitcoin perpetual futures to the cryptocurrency’s market capitalization has returned to average levels—a positive development after extended periods of elevated leverage that contributed to the October liquidation events.

“Having been $36,000 too high compared with gold at the end of last year, Bitcoin is now around $68,000 too low,” Panigirtzoglou noted in the research report. The bank’s model treats Bitcoin as digital gold but adjusts for its higher volatility, assuming Bitcoin requires approximately 1.8 times more risk capital than gold investments.

Given $6.2 trillion in private gold holdings through ETFs and physical assets, JPMorgan’s framework suggests Bitcoin’s market capitalization needs to expand by about 67% to match equivalent risk-adjusted exposure. This would correspond to a Bitcoin price of roughly $170,000—significantly above current levels and representing substantial upside if the analysis proves correct.

JPMorgan’s Bitcoin Holdings Reveal Institutional Confidence

Perhaps more telling than JPMorgan’s public analysis is the bank’s actual positioning. In a regulatory filing released November 7, 2025, JPMorgan disclosed a 64% increase in its Bitcoin ETF holdings during the third quarter. The bank now holds 5.284 million shares of BlackRock’s iShares Bitcoin Trust (IBIT), valued at approximately $343 million as of September 30, 2025.

This represents a dramatic increase from the 3.217 million shares (worth $302.6 million) held in the second quarter. The substantial boost in exposure came from JPMorgan’s wealth management clients, suggesting that despite public volatility concerns, institutional demand remains robust beneath the surface through private wealth channels.

The filing also revealed complex options positioning, with JPMorgan holding approximately $68 million in IBIT call options and $133 million in put options as of September 30. This hedged structure suggests the bank is using Bitcoin exposure to offer sophisticated wealth management clients differentiated risk/return profiles rather than making simple directional bets.

JPMorgan’s actions speak louder than any research report. Earlier in 2025, the bank confirmed plans to let institutional clients use Bitcoin and Ethereum as collateral for loans by year-end, effectively embedding cryptocurrency inside its traditional banking infrastructure. This operational integration goes far beyond simple investment exposure—it represents Bitcoin becoming a functional part of JPMorgan’s core banking operations.

“Actions matter more than words,” noted crypto analyst Willy Woo on November 8. “JPMorgan can issue whatever research they want, but when they’re accumulating Bitcoin ETF shares through Q3 and building infrastructure to accept it as collateral, that tells you what they really think about the long-term trajectory.”

Other Institutional Players Navigate Uncertainty

JPMorgan isn’t alone in maintaining long-term conviction despite near-term volatility. Goldman Sachs disclosed holdings of over 30 million shares of IBIT in early 2025, though recent positioning hasn’t been updated publicly. Morgan Stanley, Wells Fargo, and other major wealth management platforms have all added Bitcoin ETF capabilities for their advisory clients, suggesting institutional adoption continues even amid corrections.

Michael Saylor’s MicroStrategy (MSTR) continues its aggressive Bitcoin accumulation strategy despite the selloff. The company, which holds approximately 446,400 BTC (worth over $44 billion at current prices), announced additional purchases during the November correction. “We are buying,” Saylor posted on X (formerly Twitter) on November 14, accompanied by an image simply stating “Strategy.”

MicroStrategy’s relentless accumulation strategy has transformed the company into effectively a leveraged Bitcoin proxy, with its stock price movements amplifying Bitcoin’s volatility. The company’s conviction—backed by billions in committed capital—provides a counterweight to narratives of institutional exodus, though critics note that MicroStrategy’s concentrated, leveraged positioning creates significant risk if Bitcoin’s decline continues.

Global Market Context: Fed Policy and Regulatory Uncertainty

The crypto selloff occurred against a complex backdrop of shifting Federal Reserve expectations and regulatory uncertainty. Market participants are now pricing in only a 60-65% probability of another interest rate cut in December 2025, down from higher expectations just weeks ago following Fed Chair Jerome Powell’s cautious comments at the November Federal Open Market Committee (FOMC) meeting.

Powell Walks Back Rate Cut Expectations

Federal Reserve Chair Jerome Powell signaled during the November FOMC meeting that policymakers have “not made a decision about December” regarding additional rate cuts, noting that officials held “strongly differing views” during the meeting. The Fed had cut rates by 0.25 percentage points to a target range of 3.75%-4% in November, marking the second reduction of 2025 after an initial move in September.

However, Powell emphasized that inflation excluding tariff impacts is “not so far” from the central bank’s 2% target but suggested that the path forward remains uncertain. This ambiguity contrasts with earlier market expectations for a more clearly defined easing cycle, creating uncertainty that typically weighs on speculative assets like cryptocurrencies.

The implications for crypto markets are direct: Bitcoin and other digital assets have historically performed well during periods of monetary easing when abundant liquidity seeks higher-return investments. Conversely, when central banks maintain restrictive policies to combat inflation, speculative assets typically struggle as the cost of capital remains elevated and safer alternatives like Treasury bonds offer competitive yields without Bitcoin’s volatility.

U.S. Government Shutdown Adds to Uncertainty

Compounding monetary policy concerns, the U.S. government shutdown that began October 1, 2025, continued weighing on risk assets through mid-November. Bitcoin declined approximately 11% during the shutdown period, while traditional safe havens like gold gained 4% and the Nasdaq paradoxically rose 2%, highlighting crypto’s sensitivity to risk-off conditions.

Polymarket, a decentralized prediction market, priced the probability of the shutdown extending beyond November 16 at approximately 50%, creating ongoing uncertainty. The shutdown disrupted regulatory operations at key agencies including the Securities and Exchange Commission (SEC), creating additional unpredictability for crypto businesses seeking regulatory clarity.

Regulatory Developments Create Strategic Crosscurrents

The regulatory landscape for cryptocurrencies continued evolving rapidly throughout late 2025. The European Union’s AI Act implementation proceeded despite the U.S. government shutdown, creating regulatory divergence between major markets. Additionally, ongoing debates about cryptocurrency taxation, securities classification, and stablecoin regulation introduced persistent uncertainty affecting institutional allocation decisions.

Meanwhile, international developments added complexity. China’s continued restrictions on cryptocurrency activity created periodic selling pressure, while Middle Eastern countries like Saudi Arabia and other GCC nations pursued more crypto-friendly approaches, creating patchwork global frameworks that complicated institutional adoption strategies.

The combination of monetary policy uncertainty, government dysfunction, and regulatory ambiguity created a perfect storm of factors weighing on crypto markets during early November 2025. As one institutional trader at a major hedge fund noted anonymously: “Every reason to be cautious and very few compelling reasons to add risk. That’s not a recipe for crypto rallies.”

October Breaks Historical Patterns

Bitcoin’s weakness extended beyond the November crash itself. October 2025 marked a significant breakdown in historical patterns that had supported cryptocurrency prices for years. For the first time since 2018, Bitcoin failed to benefit from traditionally strong October seasonal patterns, ending the month with a 3.69% loss—the worst October performance in a decade.

“Uptober” Becomes “Downtober”

Bitcoin traders had coined the term “Uptober” to describe the cryptocurrency’s historically strong October performance. From 2013 to 2024, Bitcoin delivered an average gain of approximately 20% during October, making it one of the most reliable seasonal patterns in cryptocurrency markets. The 2025 performance represented a jarring 23.61 percentage point underperformance relative to historical averages.

This broke Bitcoin’s seven-year winning streak in October and set an ominous tone heading into November. Compass Point analyst Ed Engel noted the historical significance: “Bitcoin last failed to rise on seasonal tailwinds in October 2018. In the month that followed, Bitcoin plunged 37% in November of that year.”

The failure of seasonal patterns to materialize raised questions among technical analysts about whether traditional crypto market cycles remain relevant in an increasingly institutionalized market. As Bitcoin attracts more mainstream financial participation, it may become less susceptible to the retail-driven seasonal patterns that characterized earlier market cycles, instead trading more in line with broader financial market dynamics.

From Peak to Trough: The October-November Decline

Bitcoin’s journey from its October 6 all-time high to the November lows represents one of the sharper corrections in the cryptocurrency’s recent history. From the peak of $126,272 on October 6 to the November 4 low of $99,966, Bitcoin declined approximately 20.8%—meeting the technical definition of a bear market (typically defined as a 20%+ decline from peak).

By November 14, as Bitcoin dipped below $95,000 briefly, the total decline from peak extended to approximately 24.8%, with some altcoins suffering even steeper losses. Ethereum’s decline exceeded 40% from its August peak, while Solana dropped over 20% in a single week during early November.

The speed of the decline particularly concerned analysts. While 20-25% corrections are not unprecedented in Bitcoin’s history—indeed, they’re relatively common—the velocity of this selloff and the lack of meaningful bounces suggested genuine shifts in market structure rather than simple profit-taking after a strong run.

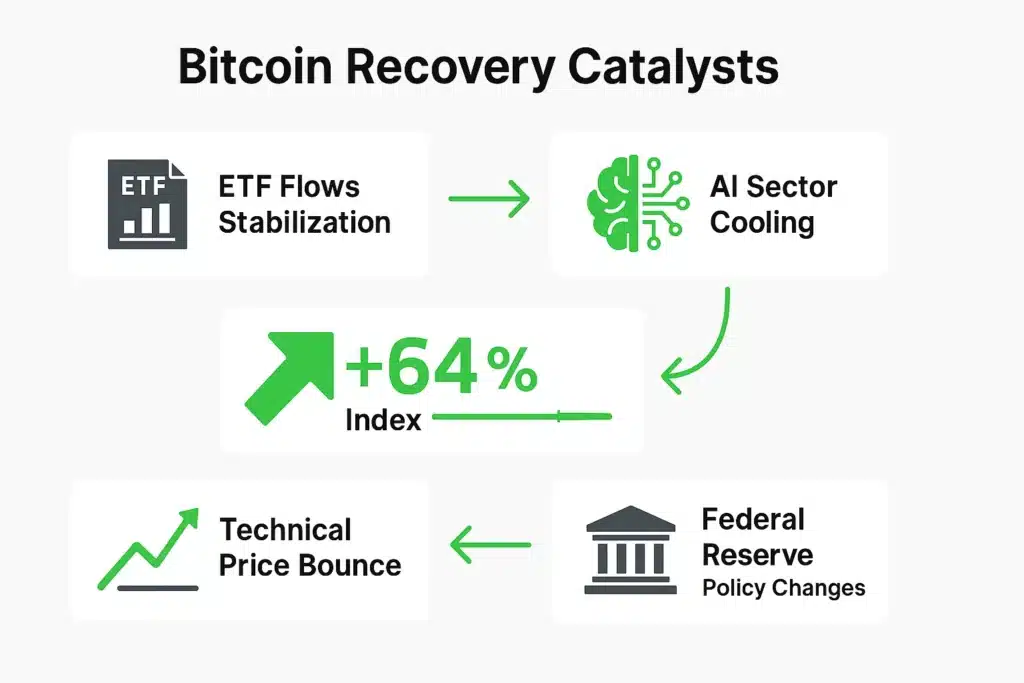

Recovery Scenarios: What Could Reverse the Trend

Despite the challenging near-term outlook, market participants have identified several potential catalysts that could reverse Bitcoin’s downtrend and restore bullish momentum. Understanding these scenarios is critical for investors attempting to navigate current volatility.

Scenario 1: Stabilization of ETF Flows

The most immediate potential catalyst would be a return to positive institutional inflows through Bitcoin ETFs. After six consecutive days of outflows ending November 7, Bitcoin ETFs recorded modest inflows of $240 million on November 8, briefly ending the exodus. However, flows turned negative again by November 13-14, with $869 million in outflows on November 14 alone.

A sustained return to positive flows—particularly if driven by large institutional allocations rather than retail buying—would signal renewed confidence in Bitcoin as a portfolio asset. Given that institutional flows largely drove Bitcoin from $45,000 in late 2024 to its $126,000 peak in October 2025, reversing the current outflow trend is arguably the single most important factor for Bitcoin’s recovery.

What would trigger return to positive flows? Likely catalysts include clearer Fed guidance suggesting additional rate cuts are coming, resolution of concerns about AI sector valuations, broader equity market stabilization, or simply Bitcoin establishing a clear support level that encourages buyers that the worst is over.

Scenario 2: AI Sector Cooling Reduces Correlation Pressure

A rational repricing of AI stocks could paradoxically help Bitcoin by reducing correlation pressure. If companies like Nvidia, which continues reporting strong demand for AI chips, and Palantir can stabilize at more reasonable valuations without crashing, it might allow Bitcoin to trade more independently based on its own fundamental drivers rather than as a proxy for technology sector risk appetite.

Signs this is occurring would include technology stock volatility declining, Bitcoin’s correlation with Nasdaq decreasing, and crypto-specific news (positive or negative) having greater impact on Bitcoin prices than general technology sector sentiment.

Scenario 3: Federal Reserve Pivots More Dovish

Any signs of renewed monetary easing or clearer Fed guidance suggesting additional rate cuts are coming could reignite appetite for risk assets including cryptocurrencies. Key indicators to watch include:

- Federal Reserve commentary explicitly suggesting December rate cuts are likely

- Economic data (inflation, employment) trending in ways that support continued easing

- Financial conditions indexes suggesting monetary policy has become too restrictive

- Treasury yields declining as markets price in lower future interest rates

The challenge is that even if the Fed does cut rates in December 2025, markets may have already priced in this expectation, limiting the positive impact. Additionally, if rate cuts come in response to deteriorating economic conditions rather than victory over inflation, the broader economic weakness might offset any benefits from easier monetary policy.

Scenario 4: Technical Bounce from Oversold Levels

From a purely technical perspective, Bitcoin’s oversold conditions (RSI below 30, significant distance below moving averages, negative sentiment) often precede sharp counter-trend rallies even within broader downtrends. A sustained move back above $104,000-$105,000 could signal that selling pressure has been exhausted and trigger short-covering from traders with bearish positions.

However, technical rallies within downtrends frequently fail at resistance levels, and without fundamental catalysts supporting them, they often represent opportunities for savvy traders to exit positions at better prices rather than the beginning of sustained recoveries.

Scenario 5: Year-End Window Dressing and Tax-Loss Harvesting

As 2025 draws to a close, institutional investors typically engage in “window dressing”—adjusting portfolios to show holdings of outperforming assets in year-end reports while reducing exposure to underperformers. Additionally, tax-loss harvesting (selling losing positions to offset capital gains) typically peaks in late November and December.

The tax-loss harvesting could create additional near-term selling pressure as investors realize losses for tax purposes. However, once this seasonal selling concludes (typically by late December), some of these sellers return as buyers in early January—the so-called “January effect” that has historically supported cryptocurrency prices.

The Bear Case: Why Recovery Might Not Come Soon

Balanced against these recovery scenarios are several reasons why Bitcoin’s weakness could persist or intensify:

Structural Leverage Still Being Cleared: While JPMorgan argues that deleveraging is “largely complete,” other analysts note that pockets of leveraged positioning remain, particularly in less transparent offshore markets. Additional liquidation events could push prices lower.

Institutional Disillusionment: If institutional investors who bought Bitcoin ETFs in 2024-2025 based on “digital gold” narratives are disappointed by Bitcoin’s correlation with technology stocks and volatility during corrections, they might reduce allocations permanently rather than treating this as a buying opportunity.

Macroeconomic Deterioration: If the U.S. economy enters recession in 2026, risk assets generally suffer regardless of their specific characteristics. Bitcoin’s behavior during the 2022 bear market (declining alongside stocks) suggests it wouldn’t provide protection in a broader economic downturn.

Competitive Threats: While not immediately price-relevant, longer-term questions about Bitcoin’s energy consumption, transaction speeds, and environmental impact continue creating headwinds for mainstream adoption, particularly among ESG-focused institutional investors.

Long-Term Holders Remain Committed

Despite the recent volatility and short-term selling pressure, on-chain analytics reveal that long-term Bitcoin holders have largely maintained their positions, suggesting a bifurcated market where committed believers are weathering the storm while speculators and leveraged traders are forced out.

Coins held for more than 12 months still represent approximately 69% of Bitcoin’s total supply, near record-high levels according to data from Glassnode and other blockchain analytics firms. This metric has remained remarkably stable throughout the October-November selloff, suggesting that the selling is concentrated among newer buyers and short-term traders rather than representing broad capitulation from the committed holder base.

Long-Term Holder Behavior Provides Foundation

The steadfastness of long-term holders provides several implications for Bitcoin’s recovery prospects:

Supply Absorption: With a large percentage of supply held by committed long-term investors unlikely to sell during corrections, the effective circulating supply available for trading is reduced. This can create more volatile price swings but also means recovery rallies can be sharp once selling pressure exhausts itself.

Cost Basis Distribution: On-chain analysis shows that a significant portion of long-term holders acquired their Bitcoin at prices well below current levels. Even with the recent decline to below $100,000, many long-term holders remain substantially in profit, reducing the pressure for distressed selling.

Conviction Despite Narratives: The fact that long-term holders are maintaining positions despite Bitcoin’s increased correlation with technology stocks and failure to act as “digital gold” during the recent correction suggests a cohort of investors who believe in Bitcoin’s long-term value proposition regardless of short-term price action.

Where Is the Selling Coming From?

If long-term holders aren’t selling, who is? Analysis of on-chain data and market structure suggests several sources:

Leveraged Derivatives Traders: The $1.7 billion in liquidations on November 4 alone indicates substantial leveraged positioning was unwound. Perpetual futures and options markets remain significant sources of selling pressure as underwater positions are closed.

Short-Term Speculators: Addresses holding Bitcoin for less than 6 months have shown increased activity, suggesting shorter-term traders and speculators are exiting positions. This cohort often exhibits weaker hands and higher price sensitivity.

Mining Operations: Some mining operations, facing elevated energy costs and pressure to cover operational expenses, have increased Bitcoin sales according to on-chain tracking of miner wallets. While not the primary source of selling, miner capitulation can amplify downward pressure.

Institutional Rebalancing: The $2+ billion in Bitcoin ETF outflows represents institutional and wealth management clients reducing cryptocurrency exposure for portfolio risk management. This selling is more orderly than panic-driven but still creates consistent downward pressure.

Market Outlook: Testing Institutional Resolve

The current Bitcoin crash represents more than a technical correction—it’s testing the resolve of the institutional adoption thesis that has driven much of the cryptocurrency’s growth over the past two years. With regulated Bitcoin ETFs now available and major corporations holding Bitcoin on their balance sheets, the market’s response to this stress test will likely determine whether digital assets have truly matured into mainstream financial assets.

The Institutional Adoption Thesis Under Scrutiny

When spot Bitcoin ETFs launched in January 2024, they were heralded as a watershed moment that would bring massive institutional capital into cryptocurrency markets. The products succeeded beyond initial expectations, attracting over $60 billion in cumulative net inflows through October 2025 and establishing Bitcoin as a legitimate portfolio allocation for traditional finance.

However, the recent outflows and price decline raise questions about the stability of this institutional capital. Are these sophisticated investors committed long-term holders who view corrections as buying opportunities? Or are they performance-chasing momentum players who will exit when the trend reverses?

The answer likely lies somewhere between these extremes. Some institutional capital represents genuine long-term allocation decisions based on Bitcoin’s potential as digital gold, a hedge against monetary debasement, or simply portfolio diversification. This capital will remain committed through volatility.

Other institutional flows, however, represent more tactical allocations—wealth managers adding Bitcoin because clients requested it, hedge funds riding momentum, or family offices making opportunistic bets. This capital will prove less sticky when conditions deteriorate.

The coming weeks will reveal which category dominates. If Bitcoin can establish a support level and institutional outflows begin reversing, it would validate that much of the capital represents committed long-term allocation. If outflows continue and accelerate, it would suggest institutional interest was more superficial than the crypto industry hoped.

Comparing to Previous Cycles

Every Bitcoin bear market has its own character, shaped by the specific circumstances of its time. How does the current situation compare to previous corrections?

2017-2018 Bear Market: Bitcoin peaked around $20,000 in December 2017 and declined 83% to below $3,500 by December 2018. That correction was driven by excessive retail speculation, ICO bubble collapse, and lack of institutional infrastructure. The current situation differs dramatically in terms of institutional participation and infrastructure maturity.

2021-2022 Bear Market: Bitcoin peaked around $69,000 in November 2021 and declined 77% to approximately $16,000 by November 2022. This correction was driven by Federal Reserve rate hikes, TerraLUNA collapse, FTX bankruptcy, and contagion across crypto lending platforms. The current situation involves less dramatic crypto-specific failures but more concerning correlation with traditional markets.

Current Situation (2025): Bitcoin has declined approximately 25% from its October 2025 peak of $126,000 to the November low around $94,500. The correction is driven by AI stock valuation concerns, institutional outflows, and macro uncertainty rather than crypto-specific catastrophes. The relatively modest magnitude (so far) compared to previous bear markets could suggest either early stages of a larger decline or simply a healthy correction within an ongoing bull market.

One critical difference: Bitcoin’s absolute price level remains substantially higher than previous cycle peaks. Even at $95,000, Bitcoin trades at 138% above its 2021 peak and 375% above its 2017 peak. This suggests underlying demand and adoption have grown substantially, even as short-term volatility persists.

Latest Developments: November 15 Market Update

As of November 15, 2025, Bitcoin continues navigating highly volatile conditions with sharp intraday swings and ongoing uncertainty about near-term direction. The cryptocurrency has traded in a range between $94,500 and $106,000 over the past week, with neither bulls nor bears able to establish clear control.

Current Market Conditions

Price Action: Bitcoin is currently trading around $97,000 (as of November 15, 10:00 AM EST), down approximately 23% from its October 6 peak but up modestly from the November 14 low near $94,500. The cryptocurrency remains stuck in a technical no-man’s land—below major resistance at $100,000-$104,000 but above critical support at $95,000.

Fear & Greed Index: The Crypto Fear & Greed Index has deteriorated further from its November 4 reading of 21, dropping to a low of 10 on November 15—indicating “Extreme Fear” and representing the lowest sentiment reading since February 2025. This eight-month low in sentiment suggests capitulation may be approaching but hasn’t yet fully arrived.

ETF Flows: After the massive $869 million single-day outflow on November 14 (second-largest on record), Bitcoin ETFs showed mixed signals on November 15 with modest inflows to some funds offset by continued redemptions from others. The net flow situation remains fluid but tilted negative.

Correlation Dynamics: Bitcoin’s correlation with the Nasdaq has remained elevated, suggesting the cryptocurrency continues trading as a risk asset highly sensitive to technology sector sentiment. Nvidia closed up 3.6% on November 14, helping stabilize Bitcoin somewhat, though the fundamental relationship between AI stocks and cryptocurrency remains a concern.

Key Catalysts on the Horizon

Several important events over the next two weeks could significantly impact Bitcoin’s trajectory:

Federal Reserve Minutes (November 20): The release of minutes from the November FOMC meeting will provide additional detail on policymakers’ thinking about December rate decisions. Any signals suggesting greater dovishness could support risk assets including Bitcoin.

Economic Data Releases: Key inflation, employment, and consumer confidence data due before month-end will influence Fed policy expectations and broader market sentiment. Weaker economic data could paradoxically help Bitcoin if it increases rate cut probability, though severe weakness could overwhelm this benefit by increasing recession fears.

Year-End Positioning: With just six weeks remaining in 2025, institutional investors will begin positioning portfolios for year-end reporting. Tax-loss harvesting may create additional selling pressure in late November and early December before potential January rebound.

Earnings Reports: Several crypto-adjacent companies including Coinbase and MicroStrategy report earnings in late November. Strong results could provide sector-specific positive catalysts independent of macro factors.

Expert Commentary on Current Conditions

Market observers are split on Bitcoin’s near-term outlook:

Bullish Perspective: “We’re seeing classic capitulation signatures—extreme fear, oversold technicals, long-term holders not selling, and institutional accumulation by smart money like JPMorgan,” notes one prominent crypto hedge fund manager. “These are typically excellent buying opportunities for patient capital with 6-12 month time horizons.”

Bearish Perspective: “The fundamental drivers remain negative—Fed uncertainty, AI bubble concerns, institutional outflows, and correlation with declining tech stocks,” counters a traditional finance analyst covering digital assets. “Until these factors reverse, Bitcoin faces continued headwinds regardless of how oversold it becomes technically.”

Neutral/Tactical Perspective: “Bitcoin is range-bound between $95K support and $104K resistance,” observes a technical analyst at a major trading desk. “The smart play is trading the range until clear directional conviction develops. Breakouts in either direction will likely be decisive once they occur.”

Conclusion: Crypto Maturation Meets Market Reality

Bitcoin’s crash below $100,000 serves as a stark reminder that digital assets, despite their growing institutional acceptance and maturing infrastructure, remain subject to the same market forces that drive traditional financial assets. The correlation with AI stocks and technology equities highlights how interconnected modern markets have become—and how quickly narratives about Bitcoin as uncorrelated “digital gold” can be tested by actual market conditions.

Key Takeaways from the November 2025 Crash

Institutional Participation Is Real But Not Unconditional: The presence of major financial institutions holding Bitcoin through ETFs and other vehicles represents genuine progress in cryptocurrency adoption. However, these institutions remain sensitive to broader market conditions, risk management requirements, and client preferences. The $2+ billion in outflows demonstrates that institutional capital can exit as quickly as it arrived when conditions deteriorate.

Correlation Risk Cannot Be Ignored: Bitcoin’s increased correlation with technology stocks, particularly those in the AI sector, represents a significant development that challenges long-held beliefs about cryptocurrency as a portfolio diversifier. Investors who allocated to Bitcoin specifically for diversification benefits are discovering that these benefits may be less reliable than assumed, particularly during periods of technology sector stress.

Technical Levels Still Matter: Despite Bitcoin’s maturation and institutionalization, traditional technical analysis remains highly relevant. The $100,000 psychological level, the 50 and 200-day moving averages, Fibonacci retracement levels, and on-chain metrics all played important roles in the recent price action. Understanding these technical factors remains critical for navigating cryptocurrency markets.

Long-Term Holders Provide Stability: The behavior of long-term Bitcoin holders—who have maintained positions despite volatility—provides an important source of market stability. This committed holder base creates a floor under prices and suggests that once short-term speculation clears, more sustainable price levels can emerge.

Macro Matters More Than Ever: Federal Reserve policy, government functionality, inflation data, and broader economic conditions have become increasingly important drivers of Bitcoin prices. The days when Bitcoin traded independently of macroeconomic factors (if they ever truly existed) appear to be over. Cryptocurrency investors must now monitor the same data points that drive traditional asset markets.

The Path Forward

Whether Bitcoin’s November 2025 crash represents a temporary setback within an ongoing bull market or the beginning of a deeper correction depends largely on factors outside the cryptocurrency ecosystem itself: How will the Federal Reserve navigate inflation and growth concerns? Will AI stocks stabilize or continue declining? Can institutional confidence be restored quickly, or will capital remain on the sidelines until greater clarity emerges?

For long-term believers in Bitcoin’s value proposition—as a hedge against monetary debasement, a technological innovation enabling global permissionless value transfer, or simply a scarce digital asset with growing adoption—the current correction may represent a healthy reset that clears speculation and weak hands while offering attractive entry points for committed capital.

For skeptics who view Bitcoin primarily as a speculative asset driven by momentum and narrative rather than fundamental value, the recent crash validates concerns about sustainability and questions whether current prices can be maintained without continuous inflows of new capital.

The truth, as always, likely lies somewhere between these extremes. Bitcoin has established itself as a permanent feature of the global financial landscape, but its exact role, appropriate valuation, and path to broader adoption remain works in progress. The November 2025 crash represents another chapter in this ongoing evolution—a reminder that even as Bitcoin matures, volatility and uncertainty remain inherent features rather than temporary bugs to be eliminated.

Strategic Questions for Investors

The fundamental question this crash poses for investors is both simple and profound: Do you believe Bitcoin’s long-term value proposition remains intact despite short-term volatility and correlation with traditional risk assets?

If yes, then corrections like this potentially represent accumulation opportunities—chances to add exposure at prices that may appear attractive in hindsight once the current fear subsides.

If no, or if you’re uncertain, then the prudent course may be waiting for clearer signals that the worst is over: sustained positive institutional flows, reclaiming of key technical levels, reduced correlation with declining tech stocks, or simply time passing and uncertainty resolving.

What seems increasingly clear is that casual, momentum-driven approaches to Bitcoin investment face growing challenges in an environment where macro factors dominate, correlations shift rapidly, and institutional players with sophisticated risk management frameworks control growing percentages of supply. Success in this evolved market requires either strong long-term conviction backed by thorough research or tactical flexibility backed by rigorous risk management—the middle ground of casual speculation appears increasingly difficult to navigate profitably.

As Bitcoin continues testing critical support levels in coming days and weeks, one thing remains certain: the cryptocurrency’s journey toward mainstream financial acceptance includes periods of significant volatility that test even the strongest institutional conviction. The question isn’t whether volatility will continue—it almost certainly will. The question is whether Bitcoin’s fundamental value proposition proves durable enough to withstand these tests and emerge stronger on the other side.

For better or worse, the coming weeks will provide important data points in answering this question. The market is watching, waiting, and testing whether institutional adoption represents a permanent evolution in Bitcoin’s character or simply another chapter in its ongoing cycle of boom, bust, and recovery.

DISCLAIMERS & IMPORTANT NOTICES

Investment Disclaimer

This article is for informational and educational purposes only and does not constitute investment advice, financial guidance, or recommendations to buy, sell, or hold Bitcoin, Ethereum, or any other cryptocurrency. The cryptocurrency markets are highly volatile and speculative, with significant risk of loss including potential total loss of invested capital.

Price data, trading volumes, and market capitalizations discussed represent conditions as of November 15, 2025, and may change rapidly. Historical performance data does not guarantee future results. The analysis and opinions expressed represent the views of Sezarr Overseas News and contributing analysts but should not be relied upon as the sole basis for investment decisions.

Readers must conduct their own thorough research, understand their personal risk tolerance, and consult with licensed financial advisors before making any investment decisions involving cryptocurrencies. Never invest more than you can afford to lose completely. Sezarr Overseas News, its authors, and contributors are not registered investment advisors and do not provide personalized investment recommendations.

Data Sources & Attribution Disclaimer

Information compiled from multiple verified sources including CNBC financial reports (November 4-6, 2025), Bloomberg markets coverage, CoinDesk cryptocurrency analysis, Bitcoin Magazine, Fortune magazine, The Block, CoinGlass data analytics, SoSoValue ETF tracking, JPMorgan research reports by Nikolaos Panigirtzoglou, Compass Point Research analysis, Securities and Exchange Commission 13F filings (Michael Burry’s Scion Asset Management, JPMorgan Chase positions), and various blockchain analytics providers including Glassnode and CoinMetrics.

While all reasonable efforts have been made to verify accuracy, readers are encouraged to consult original sources for complete context and the most current information. Market data and cryptocurrency prices reflect conditions as of November 15, 2025, and may have changed significantly since publication.

Forward-Looking Statements Disclaimer

This article contains forward-looking statements about Bitcoin price predictions, market trends, institutional adoption trajectories, regulatory developments, and economic conditions. These statements involve significant uncertainties and risks. Actual outcomes may differ materially from projections, estimates, or scenarios discussed.

Factors that could cause actual results to differ include technological developments, competitive dynamics, regulatory changes, macroeconomic conditions (inflation, interest rates, economic growth), geopolitical events, security breaches or hacks, changes in investor sentiment, liquidity conditions, and unforeseen market disruptions. Price targets mentioned (including JPMorgan’s $170,000 projection) represent analyst opinions and forecasts that may prove incorrect.

Technical Analysis Disclaimer

Technical analysis, chart patterns, moving averages, support/resistance levels, and other technical indicators discussed in this article represent historical price patterns and statistical measures. Technical analysis does not predict future price movements with certainty and should not be relied upon as the sole basis for trading or investment decisions. Past technical patterns frequently fail to repeat, and technical analysis should be combined with fundamental analysis and comprehensive risk management.

No Guarantee of Accuracy

While Sezarr Overseas News strives for accuracy and reliability, we cannot guarantee that all information is completely accurate, complete, or current. Cryptocurrency markets move rapidly, and information that was accurate at time of writing may become outdated quickly. Readers bear responsibility for verifying information before acting upon it.

Regulatory & Tax Disclaimer

Cryptocurrency regulations vary significantly by jurisdiction and are subject to rapid change. This article does not provide legal or tax advice. Cryptocurrency transactions may have tax implications in your jurisdiction. Readers must consult with qualified legal and tax professionals regarding their specific situations and compliance requirements.

Risk Acknowledgment

Cryptocurrency investments carry substantial risks including but not limited to: extreme price volatility, potential total loss of capital, regulatory changes, security vulnerabilities, hacking or theft, liquidity issues, technological failures, market manipulation, lack of investor protections available in traditional markets, and rapidly changing competitive dynamics. Only invest capital you can afford to lose completely.

Frequently Asked Questions About Bitcoin’s November 2025 Crash

Q1: Why did Bitcoin crash below $100,000 in November 2025?

Bitcoin fell below $100,000 on November 4, 2025, primarily due to a perfect storm of negative factors: growing concerns about overvalued artificial intelligence stocks triggered a broader risk-off sentiment in financial markets, with Bitcoin experiencing heightened correlation with declining technology equities. The crash was accelerated by over $2 billion in institutional Bitcoin ETF outflows between October 29 and November 5, representing one of the largest weekly exodus periods since these products launched. Michael Burry’s disclosed bearish positions on Nvidia ($186.6 million) and Palantir ($912 million) added to market anxiety about AI sector valuations. Technical selling intensified as Bitcoin broke below key support levels, triggering $1.7 billion in leveraged position liquidations. The Crypto Fear & Greed Index plunged to 21 (Extreme Fear territory), reflecting widespread investor panic and risk aversion.

Q2: How much money left Bitcoin ETFs during the selloff?

Between October 29 and November 5, 2025, U.S. spot Bitcoin ETFs experienced net outflows exceeding $2 billion, representing one of the largest weekly outflow periods since these revolutionary products launched in January 2024. The selling pressure extended throughout November, with a single day (November 14) recording $869 million in outflows—the second-largest daily redemption on record. By mid-November, the three-week cumulative outflows reached approximately $2.64 billion, signaling a dramatic shift in institutional sentiment. The exodus affected all major Bitcoin ETF providers, though BlackRock’s iShares Bitcoin Trust (IBIT), typically the market leader, showed relative stability compared to other funds. These institutional outflows reflected wealth managers and portfolio allocators reducing cryptocurrency exposure amid macroeconomic uncertainty, Fed policy ambiguity, AI stock concerns, and broader risk management protocols requiring reduced volatility exposure.

Q3: What is Michael Burry’s position on Bitcoin and AI stocks?

Michael Burry’s Scion Asset Management disclosed substantial bearish positions through put options (which profit from price declines) on Nvidia ($186.6 million notional value) and Palantir ($912 million notional value) in 13F regulatory filings released Monday, November 3, 2025. These filings covered Burry’s trading activity through September 30, 2025. While these positions target AI stocks specifically rather than Bitcoin directly, the disclosure contributed to broader market uncertainty that impacted correlated assets like cryptocurrency. Burry, famous for predicting the 2008 housing crisis, had posted cryptic warnings on social media in late October including an image stating “Sometimes, we see bubbles,” which markets interpreted as commentary on AI sector valuations. The revelation that Burry was betting against the two leading AI companies—Nvidia dominates AI chip manufacturing while Palantir’s software has no direct replacement—triggered concerns that even the strongest AI businesses might be overvalued, creating selling pressure across technology and cryptocurrency markets.

Q4: What does JPMorgan predict for Bitcoin’s price?

JPMorgan strategists, led by managing director Nikolaos Panigirtzoglou, published research on November 6, 2025, suggesting Bitcoin could reach $170,000 within 6-12 months based on volatility-adjusted comparisons with gold. The analysis treats Bitcoin as “digital gold” but adjusts for its higher volatility, assuming Bitcoin requires approximately 1.8 times more risk capital than gold investments. Given $6.2 trillion in private gold holdings through ETFs and physical assets, JPMorgan’s model suggests Bitcoin’s market capitalization needs to expand by about 67% to match equivalent risk-adjusted exposure—corresponding to a Bitcoin price of roughly $170,000. The bank noted that “having been $36,000 too high compared with gold at the end of last year, Bitcoin is now around $68,000 too low,” suggesting significant upside potential. However, Panigirtzoglou acknowledged that recent liquidations and negative sentiment make such a rally unlikely in the immediate term. JPMorgan also disclosed a 64% increase in its Bitcoin ETF holdings during Q3 2025, now holding 5.284 million shares of BlackRock’s iShares Bitcoin Trust (IBIT) valued at approximately $343 million, signaling institutional confidence despite short-term volatility.

Q5: Is this Bitcoin crash similar to previous bear markets?

The current Bitcoin correction is relatively modest compared to historical bear markets but features different characteristics. Previous major declines saw 73-83% drops from peak to trough: 2013-2015 declined 75% (from ~$1,150 to $150), 2017-2018 fell 83% (from ~$20,000 to $3,200), and 2021-2022 dropped 77% (from ~$69,000 to $16,000). The current situation has seen Bitcoin decline approximately 20-25% from its October 2025 peak of $126,272 to lows around $94,500—meeting the technical definition of a bear market (20%+ decline) but far less severe than previous cycles. Key differences include much higher institutional participation through regulated ETFs, fewer crypto-specific catastrophes (no major exchange collapses or protocol failures), but more concerning correlation with traditional markets particularly AI/technology stocks. Bitcoin’s absolute price level remains substantially higher than previous cycle peaks—even at $95,000, Bitcoin trades 138% above its 2021 peak and 375% above its 2017 peak, suggesting underlying demand has grown substantially. The current correction is driven by macro factors (Fed policy, AI bubble concerns) rather than crypto-specific failures, representing a maturation of Bitcoin’s market structure but also creating new dependencies on traditional financial market dynamics.

Q6: What are the key Bitcoin support levels to watch?

Technical analysts have identified several critical Bitcoin support and resistance levels that will determine near-term price direction. Immediate Resistance: $100,000-$104,000 represents the first major challenge for bulls, with the psychological $100,000 level that formerly acted as support now flipped to resistance. Sustained trading above $104,000-$105,000 would signal selling pressure has been exhausted. Critical Support: $95,000 represents a confluence of the 61.8% Fibonacci retracement from October’s peak, significant on-chain buying clusters, and JPMorgan’s estimated Bitcoin mining production cost ($94,000 per their November 13 update). Breaking below $95,000 would likely trigger additional algorithmic selling and potentially accelerate declines. Secondary Support: $92,000 corresponds with Elliott Wave extension targets and the CME futures gap that some traders believe needs “filling.” Deep Support: $88,000-$90,000 represents a zone that would mark approximately 30% down from the October peak—significant but not unprecedented in Bitcoin history—and could represent a potential bottom if reached. Moving Averages: The 50-day EMA at $113,549 and 200-day EMA at $109,840 are converging toward a potential “death cross” (bearish signal), with Bitcoin currently trading below both averages indicating short-term bearish technical structure.

Q7: How does the Fear & Greed Index impact Bitcoin prices?

The Crypto Fear & Greed Index dropped to 21 on November 4, 2025, indicating “Extreme Fear” territory (index ranges from 0-100, with 0-24 representing Extreme Fear). By November 15, the index had deteriorated further to 10—the lowest sentiment reading since February 2025 and representing an eight-month low. Historically, extreme fear readings have often preceded market bottoms and recovery rallies, as they signal capitulation where panicked sellers have exhausted themselves and contrarian buyers begin accumulating. Warren Buffett’s famous advice to “be fearful when others are greedy and greedy when others are fearful” suggests extreme fear could present buying opportunities. However, extreme fear can also persist for extended periods during genuine bear markets—the index remained in fear/extreme fear territory for months during 2022. The current reading indicates widespread investor panic, reduced buying interest, and risk aversion, with only 47% of recent trading days showing positive price action. The index measures sentiment through volatility analysis (25%), trading volume momentum (25%), social media mentions and sentiment (15%), investor surveys (15%), market dominance shifts (10%), and Google search trends (10%). While extreme fear doesn’t guarantee an immediate bounce, it does suggest that much negative sentiment may already be priced into current levels.

Q8: Why is Bitcoin correlated with AI stocks like Nvidia?

Bitcoin’s correlation with AI stocks, particularly companies like Nvidia and Palantir, reached six-month highs during the November 2025 selloff, fundamentally challenging Bitcoin’s narrative as an uncorrelated asset. Several factors explain this correlation: Shared Investor Base: The same institutional investors and hedge funds that allocate to technology stocks also participate in cryptocurrency markets, creating mechanical correlation as they adjust overall risk exposure. Risk-On/Risk-Off Dynamics: Both Bitcoin and high-growth technology stocks are classified as “risk assets” that tend to perform well when investors embrace risk and poorly during risk-off periods regardless of asset class. Liquidity Conditions: Both asset categories are sensitive to monetary policy and liquidity conditions—easy money supports both, while tighter financial conditions create selling pressure across speculative assets. Narrative Overlap: Both Bitcoin and AI represent “future-forward” technologies that attract similar investor psychology and thematic allocation strategies. Leverage and Momentum: Both markets feature significant leverage and momentum-driven trading, creating synchronized volatility. The increased correlation poses challenges for investors who allocated to Bitcoin specifically for portfolio diversification, as the hoped-for protection during technology sector downturns has proven less reliable than expected. Breaking this correlation would require Bitcoin to establish independent value drivers—something that may occur over time but hasn’t materialized during this correction.

Q9: Should investors buy Bitcoin during this crash?

IMPORTANT INVESTMENT DISCLAIMER: This response provides general market analysis and educational information only, NOT financial or investment advice. Cryptocurrency investments carry substantial risk including potential total loss of capital. Whether to buy, sell, or hold Bitcoin depends entirely on individual circumstances including risk tolerance, investment timeline, portfolio composition, financial goals, and personal conviction about Bitcoin’s long-term value proposition. Arguments for Accumulation: Current prices ($95,000-$100,000 range) represent significant discounts from October highs ($126,000+); extreme fear readings historically precede market bottoms; JPMorgan and other institutions maintaining bullish long-term outlooks; long-term holders not selling suggests committed believer base remains intact; institutional infrastructure (ETFs, custody solutions) more robust than previous cycles. Arguments for Caution: Correlation with declining technology stocks remains elevated; institutional outflows continuing suggests smart money reducing exposure; Federal Reserve policy uncertainty creates macro headwinds; technical indicators show potential for further downside to $88,000-$92,000; seasonal tax-loss harvesting could create additional November-December pressure. Prudent Approach: Investors interested in Bitcoin exposure should: conduct thorough independent research on both bullish and bearish cases; understand personal risk tolerance honestly; never invest more than they can afford to lose completely; consider dollar-cost-averaging rather than attempting to time exact bottoms; maintain diversified portfolios rather than concentrated cryptocurrency bets; and consult licensed financial advisors for personalized guidance. Market bottoms are only obvious in hindsight—nobody can predict with certainty whether Bitcoin has found support or will decline further.

Q10: What could trigger a Bitcoin recovery from current levels?

Several potential catalysts could reverse Bitcoin’s downtrend and restore bullish momentum: ETF Flow Reversal: Sustained return to positive institutional inflows would signal renewed confidence—the most important near-term catalyst given institutional capital drove Bitcoin from $45,000 to $126,000. AI Sector Stabilization: If companies like Nvidia and Palantir stabilize at more reasonable valuations without crashing, it could reduce correlation pressure and allow Bitcoin to trade independently. Federal Reserve Dovishness: Clear Fed guidance suggesting additional rate cuts or softer monetary policy would support risk assets broadly including cryptocurrency. Technical Breakout: Sustained move above $104,000-$105,000 could trigger short-covering and signal selling exhaustion, though technical rallies without fundamental support often fail. Year-End Dynamics: Tax-loss harvesting creates near-term pressure but historically leads to January bounces as sellers return as buyers. Positive Crypto-Specific News: Major institutional adoption announcements, regulatory clarity, technological improvements, or successful integration into traditional finance could provide sector-specific catalysts independent of macro factors. Contrarian Timing: Extreme fear readings and widespread bearish sentiment often mark periods preceding recoveries, though timing remains uncertain. However, bearish scenarios remain possible: continued institutional outflows could accelerate declines; macroeconomic deterioration or recession fears could overwhelm positive catalysts; additional leverage liquidations could push prices to $88,000-$92,000 range; and extended correlation with declining technology stocks could persist. Recovery will likely require multiple positive catalysts aligning rather than any single factor.

📚 Related Reading & Further Analysis

- Nvidia CEO Reports Surging Demand for Blackwell AI Chips in Taiwan Visit

- AI Stocks Drive 75% of Market Returns: Is a Bubble Forming?

- OpenAI’s Historic $38 Billion AWS Deal Reshapes AI Cloud Competition

- Ethereum ETF Performance 2024-2025: Complete Analysis

- How AI Co-Pilots Are Transforming Employment Models

- AI Regulation in the US 2025: Federal vs State Divide

- Trump AI Policy 2025: No Federal Bailout for AI Industry