Published: November 22, 2025 | Category: Personal Finance & Money | Reading Time: 18 minutes

Introduction

In today’s evolving economic landscape, passive income has transitioned from a luxury to a strategic necessity for those seeking financial resilience. Recent data indicates that over 36% of Americans now maintain some form of side hustle, with many focusing on income streams that generate revenue with minimal ongoing effort. The global gig economy has ballooned to a staggering $556.7 billion valuation, reflecting a fundamental shift in how people approach wealth building.

Contrary to popular misconception, passive income isn’t about “getting something for nothing,” as financial expert Todd Tresidder explains. Rather, it typically involves substantial work upfront with the goal of creating systems that generate cash flow along the way. This distinguishes truly passive ventures from active income, which requires continuous direct effort and stops when you do.

This comprehensive guide will explore 15 proven passive income strategies for 2025, organized by commitment level and potential returns. From low-barrier digital products to sophisticated investment approaches, these methods can help you build financial security and create more flexibility in your lifestyle. While not a get-rich-quick scheme, strategically implemented passive income can provide the extra cash flow needed to combat inflation, achieve financial goals, and ultimately gain greater control over your time and resources.

Why Passive Income Matters in 2025

The pursuit of passive income has accelerated beyond trend status to become a cornerstone of modern financial planning. Several powerful economic and social forces are driving this movement, making passive income strategies particularly relevant for 2025.

Economic Pressures and Inflation

Despite inflation cooling to 2.4% in late 2024, costs remain significantly elevated compared to previous years, squeezing household budgets. Passive income provides a crucial buffer against these persistent financial pressures, helping maintain purchasing power when traditional wages may not keep pace. This extra cash flow can mean the difference between merely surviving and genuinely thriving in today’s economic environment.

Work-Life Balance and Remote Work

The massive shift toward remote and flexible work arrangements has fundamentally changed how people view their professional lives. With 55% of full-time workers expressing interest in turning their hobbies into businesses, there’s growing recognition that time freedom is as valuable as financial security. Passive income streams support this paradigm by generating revenue without tethering you to a specific location or schedule, creating opportunities for geographic freedom and more autonomous daily routines.

The Financial Independence Movement

The FIRE (Financial Independence, Retire Early) movement continues to gain traction, particularly among younger generations. Nearly half of Gen Z (48%) and 44% of millennials currently maintain side hustles, the highest percentages of any generation. These demographics aren’t just seeking spare cash—they’re building diversified income portfolios to escape the traditional paycheck-to-paycheck cycle and achieve financial independence on an accelerated timeline.

Income Diversification as Security

In an era of economic uncertainty, multiple income streams provide crucial financial resilience. The data shows that 45% of side hustlers come from households earning over $100,000 annually, indicating that even those with comfortable incomes recognize the value of diversification. Whether as protection against unexpected job loss or as a means to reach savings goals faster, passive income creates a safety net that single-source earners lack.

The 15 Passive Income Strategies

Building passive income requires matching strategies to your current resources and risk tolerance. The following 15 approaches are organized into three tiers based on their barrier to entry, from low-investment digital methods to more capital-intensive ventures.

TIER 1 – LOW BARRIER TO ENTRY

These strategies require minimal financial investment, making them accessible to nearly everyone. The primary commitment is time and effort spent upfront creating assets or systems.

1. Dividend Stocks & ETFs

Dividend investing represents one of the most accessible entry points into passive income. By purchasing shares of companies that distribute a portion of their profits to shareholders, you can create a steady income stream regardless of market fluctuations. Established dividend payers with strong track records include blue-chip stocks like Procter & Gamble, Johnson & Johnson, and McDonald’s.

For beginners, dividend-focused ETFs such as SCHD (offering a competitive yield) provide instant diversification across multiple companies, reducing risk compared to individual stock selection. The power of this approach compounds when you reinvest dividends to purchase additional shares—a strategy that can potentially turn a $10,000 investment at a 5% annual rate into over $26,500 in 20 years without additional contributions.

2. Affiliate Marketing

Affiliate marketing involves promoting other companies’ products and earning commissions when purchases are made through your unique referral links. This strategy leverages your existing knowledge or audience, with successful affiliates reporting earnings of $150,000 annually in specialized niches like web hosting.

The key to success lies in selecting the right niche and platforms. Popular affiliate marketplaces include ShareASale (with over 15,200 brands) and Impact, which allow you to manage multiple partnerships through a single dashboard. For those starting out, focusing on niches with both high demand and limited quality content—such as specialized software tools or niche consumer products—can yield quicker results. A blogger focusing on “best budgeting apps” can earn $500/month with just 1,000 monthly visitors through strategic affiliate placements.

3. Digital Product Sales

Creating digital products represents an ideal passive income stream because once developed, these assets can be sold repeatedly without additional production costs. Popular digital products include e-books, templates, printables, and stock photography. The demand for these resources is growing, with platforms like Etsy and Gumroad reporting rising interest in digital planners and educational materials.

The economics make this approach particularly attractive. With potential earnings ranging from $500 to $5,000+ monthly, digital products scale efficiently without corresponding increases in workload. A teacher selling lesson plan templates on Teachers Pay Teachers, for instance, can earn $1,000+/month with consistent uploads. Success hinges on identifying underserved niches and creating high-quality solutions for those markets.

4. Create an Online Course

If you possess specialized knowledge, packaging it into an online course can generate significant passive income. The e-learning market continues to expand, with platforms like Udemy, Teachable, and Kajabi reporting millions of course enrollments annually. Popular categories include technical skills like coding and AI, along with personal development topics like personal finance and productivity.

While course creation requires substantial upfront effort—recording, editing, and structuring content—the long-term returns can be substantial, with potential earnings of $1,000 to $10,000+ monthly. One marketer shared how their “Freelance Writing 101” course on Teachable earns $3,000/month after six months of promotion. The key is selecting topics where you have genuine expertise and the target audience demonstrates willingness to pay for education.

5. Sell Stock Photography & Videos

The continuous demand for visual content across websites, advertisements, and social media creates ongoing opportunities for photographers and videographers. By uploading your work to platforms like Shutterstock, Getty Images, and Adobe Stock, you can earn royalties each time your content is downloaded.

This approach benefits from batch creation—developing multiple images around trending themes like remote work, sustainability, or diverse workplaces. A photographer uploading 100 images monthly can typically earn $300-500 after six months as downloads accumulate. While only a small percentage of submissions may generate significant revenue, the completely passive nature of earnings from successful content makes this approach worth the initial time investment.

TIER 2 – MODERATE INVESTMENT

These strategies require more substantial financial commitment or specialized skills, typically offering higher potential returns in exchange for increased complexity and management.

6. Real Estate Investment Trusts (REITs)

REITs allow you to invest in real estate without directly owning or managing properties. These companies own and typically operate income-producing real estate, and by law must distribute at least 90% of their taxable income to shareholders as dividends. This structure creates reliable income streams, with some REITs like Invesco Mortgage Capital (IVR) currently offering yields as high as 18.66%.

REITs come in various forms focusing on different property types—residential, commercial, healthcare, or mortgage-backed securities. While individual REITs like IVR can provide strong yields, ETFs that hold baskets of REITs offer instant diversification. The primary advantage is gaining exposure to the real estate market with the liquidity of stock trading and without the hands-on management requirements of physical properties.

7. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms like LendingClub and Prosper allow you to act as a bank by funding loans to individuals or small businesses. You earn income through the interest payments on these loans, which often exceeds returns from traditional fixed-income investments.

Successful P2P lending requires understanding risk assessment and implementing proper diversification across multiple borrowers to mitigate potential defaults. Platforms typically assign risk grades to loans, with higher-risk loans offering higher potential returns but increased chance of non-payment. This strategy works best as part of a broader passive income portfolio rather than as a standalone approach, with careful attention to platform selection and risk management protocols.

8. Create a Mobile App

Despite being a crowded market, mobile apps continue to offer passive income potential for those who identify unmet user needs or create compelling user experiences. The development process has been democratized through no-code platforms like Bubble and Adalo, reducing technical barriers.

Monetization strategies typically include in-app advertising, paid downloads, or subscription models. While the potential upside is significant if you create a popular app, the reality is that most apps generate minimal downloads. Success requires not just technical execution but thorough market research, thoughtful user experience design, and ongoing marketing effort—even if the revenue itself becomes passive after the initial development push.

9. License Photography/Videos

Beyond standard stock photography, specialized licensing of visual content can generate premium returns. This approach involves creating high-quality visual content targeted at specific market needs, such as unique landscapes, specialized technical subjects, or distinctive artistic styles.

While platforms like Shutterstock and Adobe Stock provide access to broad markets, specialized agencies often offer better terms for premium content. The passive income potential scales with your portfolio size—those who consistently produce and upload quality content typically see earnings grow as their library expands. A photographer with hundreds of quality images across multiple platforms can generate $100-2,000+ monthly.

10. Build a Niche Blog

While blogging requires significant upfront effort, established blogs can generate substantial passive income through advertising, affiliate marketing, and digital product sales. Mediavine and AdThrive, premium ad networks for content creators, pay $10-50 per 1,000 pageviews for qualified niche sites.

Success depends on selecting a viable niche with sufficient audience interest and limited competition, then creating comprehensive, SEO-optimized content that addresses specific reader needs. A travel blog with 20,000 monthly visitors, for instance, can earn $1,500/month from ads and affiliate links combined. The true passive income emerges after the content foundation is built and continues attracting organic search traffic with minimal ongoing maintenance.

TIER 3 – HIGHER CAPITAL/EXPERTISE

These strategies typically require more significant financial investment or specialized knowledge, often delivering higher returns and greater scalability in exchange for increased complexity and potential risk.

11. Rental Properties

Traditional rental real estate remains a powerful wealth-building tool, offering both ongoing cash flow and long-term appreciation potential. According to the IRS, rental property is one of the two primary sources of legally-defined passive income (along with businesses where you don’t actively participate).

While being a landlord traditionally involves substantial management responsibilities, you can automate many aspects through property management companies, creating truly passive income. Successful rental property investing requires careful market analysis, property selection, and cash flow calculations to ensure profitability after accounting for mortgages, taxes, insurance, maintenance, and vacancies.

12. Automated E-commerce (Dropshipping/Print-on-Demand)

These business models eliminate inventory management, the traditional barrier to e-commerce. With dropshipping, you create an online store and transfer customer orders to suppliers who handle fulfillment directly. Similarly, print-on-demand services like Printful or Teespring automatically print and ship products featuring your designs only when orders are placed.

Both models benefit from automation tools that handle product imports, order processing, and inventory updates. While not completely passive—success requires ongoing marketing effort—they eliminate the physical fulfillment aspects of traditional e-commerce. Profitability depends on effective niche selection, marketing efficiency, and creating products with sufficient margin to absorb both product and advertising costs.

13. Create a SaaS Product

Software-as-a-Service (SaaS) represents the pinnacle of scalable passive income due to its subscription-based revenue model. By developing a web-based tool that addresses a specific market need—such as productivity apps, business utilities, or specialized calculators—you can create recurring revenue that compounds as your user base grows.

While traditionally requiring significant programming expertise, no-code platforms have lowered technical barriers. The challenge lies in identifying genuine market gaps, creating solutions users will pay recurring fees to access, and implementing effective marketing funnels. Successful SaaS products often start by solving specific problems the creator themselves faced, then expanding to serve broader audiences with similar needs.

14. Rent Out Assets

The sharing economy has created opportunities to monetize underutilized assets, from vehicles and equipment to storage space. Platforms like Turo for cars and Fat Llama for equipment facilitate peer-to-peer rentals, generating income from assets you already own.

The income potential varies significantly by asset type and location. A Turo host in a tourist-heavy city, for instance, can earn $800/month renting out a spare car with minimal time investment. Similarly, platforms like Neighbor allow you to rent out unused storage space such as garages, basements, or driveways. Success requires proper insurance coverage, clear rental terms, and strategic pricing based on local market conditions.

15. High-Yield Dividend Stocks & ETFs

For those with more capital, focusing on high-yield dividend stocks and specialized ETFs can generate substantial passive income. While these investments often carry higher risk, they can provide impressive cash flow for those who properly diversify and monitor their holdings.

Examples include ZIM Integrated Shipping Services (ZIM) with a forward annual dividend yield of 40.48% and specialized ETFs like the Roundhill META WeeklyPay ETF (METW) with a 38.38% distribution rate. These ultra-high yields typically reflect market skepticism about sustainability, so they should represent only a small portion of a well-diversified income portfolio with thorough research into the underlying business fundamentals.

Strategy Comparison Table

| Strategy | Startup Cost | Time Investment | Monthly Income Potential | Risk Level |

|---|---|---|---|---|

| Dividend Stocks & ETFs | $100+ | Low | $100-$1,000+ (with significant capital) | Medium |

| Affiliate Marketing | $50-$500 (website setup) | Medium upfront | $100-$10,000+ | Low-Medium |

| Digital Product Sales | $50-$200 | Medium upfront | $500-$5,000+ | Low |

| Online Courses | $200-$1,000 (production costs) | High upfront | $1,000-$10,000+ | Medium |

| Stock Photography | $300-$1,000 (equipment) | Medium upfront | $100-$2,000+ | Low |

| REITs | $500+ | Low | Varies by investment | Medium-High |

| Peer-to-Peer Lending | $500+ | Low-Medium | 5-8% annual returns | Medium-High |

| Mobile App Development | $0-$5,000+ | High upfront | Highly variable | High |

| Niche Blog | $100-$500 | High upfront | $500-$10,000+ | Medium |

| Rental Properties | $10,000+ | Medium ongoing | Varies by property | High |

| Automated E-commerce | $500-$2,000 | Medium upfront | $500-$5,000+ | High |

| SaaS Product | $1,000-$10,000+ | High upfront | Highly scalable | High |

| Asset Rental | Varies by asset | Low ongoing | $200-$5,000+ | Medium |

| High-Yield Dividends | $500+ | Low | Varies by yield | High |

How to Get Started

Building passive income requires a systematic approach rather than random experimentation. Follow these steps to create your personalized passive income plan:

Step 1: Assess Your Resources

Honestly evaluate your available capital, time for upfront development, and relevant skills. Different strategies require different resource allocations—digital products need more time, while investment approaches require more capital. Understanding your starting position prevents overextension and helps select appropriate strategies.

Step 2: Choose 1-2 Initial Strategies

Resist the temptation to pursue multiple approaches simultaneously. Instead, select one or two strategies matching your resources and interests. Starting small allows you to focus your efforts and learn through implementation without spreading yourself too thin.

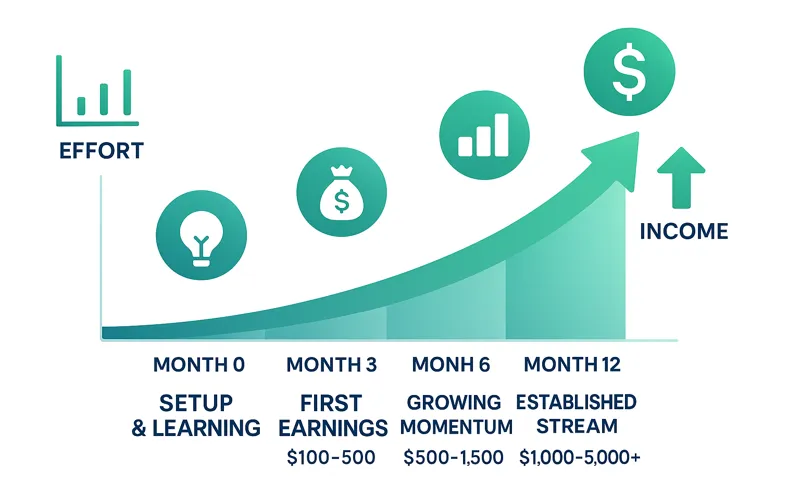

Step 3: Set Realistic Goals

Establish clear milestones for different time horizons: what you expect to achieve in 6 months, 1 year, and 5 years. Most passive income streams take months to become established—blogs typically need 6-12 months to gain traction, while digital products may find their market over several quarters.

Step 4: Implement Tracking Systems

Establish systems to monitor your progress from day one. This includes tracking time invested, expenses, revenue, and key performance metrics specific to your chosen strategy. Regular review of these metrics helps identify what’s working and where adjustments are needed.

Step 5: Diversify Over Time

Once your initial income streams become established, systematically expand into complementary strategies. A successful affiliate marketer might add digital products, while a dividend investor might allocate a portion to REITs. Strategic diversification creates a more resilient income portfolio.

Common Mistakes to Avoid

Learning from others’ missteps can dramatically improve your passive income journey. Be particularly mindful of these common pitfalls:

Spreading Too Thin Too Soon

Pursuing multiple strategies simultaneously divides your attention and reduces your effectiveness in any single area. The most successful passive income builders typically master one approach before expanding to others. Focus generates momentum; fragmentation leads to stalled progress.

Underestimating Upfront Time Requirements

Many aspiring passive income earners become discouraged when returns don’t materialize quickly. Remember the fundamental principle: most passive income requires significant work upfront before the passive returns begin. Building a blog, creating digital products, or establishing a YouTube channel typically requires months of consistent effort before generating meaningful revenue.

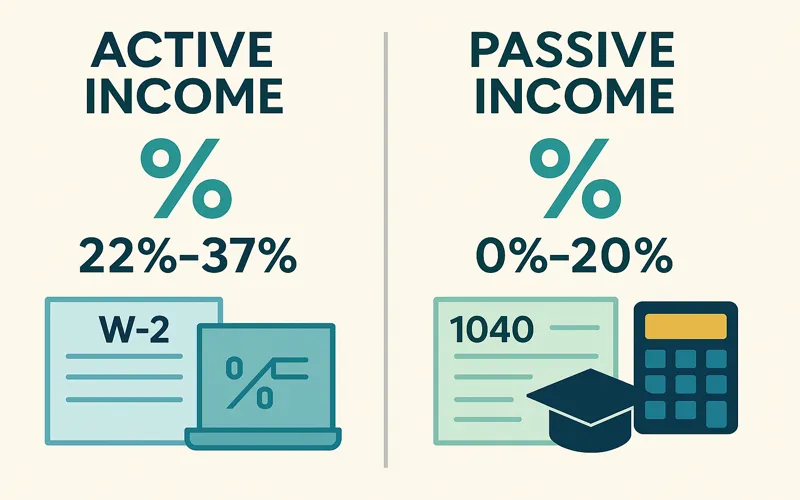

Neglecting Tax Implications

Different passive income streams receive different tax treatment. Active income is typically taxed at higher rates than passive sources like long-term capital gains and qualified dividends. Understanding these distinctions and planning accordingly can significantly impact your net returns.

Falling for Get-Rich-Quick Schemes

If an opportunity promises substantial returns with minimal effort, it’s likely either misleading or outright fraudulent. As financial coach Todd Tresidder emphasizes, passive income has a “get-rich-quick appeal… but in the end, it still involves work.”

Not Reinvesting Early Earnings

The compounding effect of reinvesting your initial returns dramatically accelerates portfolio growth. Whether reinvesting dividends to buy more shares or using affiliate marketing proceeds to fund digital product creation, this practice creates a virtuous cycle of expansion.

Tax Considerations

Understanding the tax implications of your passive income activities is crucial for accurate financial planning and compliance.

Passive income typically receives more favorable tax treatment than active income. Long-term capital gains and qualified dividends are generally taxed at lower rates than the ordinary income rates that apply to salaries and wages. This tax advantage represents one of the significant benefits of building passive income streams.

Different passive income types have different reporting requirements. Dividend income, for instance, is reported on Form 1099-DIV, while rental property income and expenses are reported on Schedule E. More complex activities like affiliate marketing or digital product sales may require additional forms and quarterly estimated tax payments.

As your passive income grows, consulting with a qualified tax professional becomes increasingly valuable. They can help you identify appropriate deductions, implement tax-efficient strategies, and ensure compliance with evolving regulations. Proper tax planning from the outset can save significant money and prevent complications during filing season.

Disclaimer: This article provides general information and should not be considered professional financial or tax advice. Consult with qualified financial advisors and tax professionals regarding your specific situation.

Conclusion

Building sustainable passive income in 2025 requires aligning strategies with your unique resources, skills, and risk tolerance. The approaches outlined—from accessible digital products to sophisticated investments—provide multiple pathways to creating earnings that continue generating returns regardless of your daily activities.

The journey toward meaningful passive income demands both patience and consistency. Most strategies require months of upfront development before generating substantial returns, contradicting the get-rich-quick narrative often associated with passive income. However, the financial security, flexibility, and autonomy that result make the initial investment worthwhile.

Your passive income journey begins with a single step. This week, select one strategy that matches your current resources, research it thoroughly, and commit to taking concrete action. Whether purchasing your first dividend stock, outlining a digital product, or starting a niche website, that initial momentum creates the foundation for future financial independence.

Continue your financial journey: Explore our comprehensive guides on retirement planning 2025 and investment strategies for long-term wealth to build a complete financial roadmap.

Frequently Asked Questions

How much money do I need to start generating passive income?

The startup costs vary dramatically by strategy. Dividend investing can begin with less than $100 using fractional shares, while digital product creation might require $50-200 for platform fees and design tools. Rental properties obviously require substantial capital, but REITs provide similar exposure starting with a few hundred dollars. The key is matching strategies to your current financial capacity.

How long before passive income becomes significant?

Most passive income streams take 6-12 months to generate meaningful revenue. Blogs typically need 6+ months to build SEO authority, while YouTube channels may require a year of consistent content creation before significant monetization. The timeline depends on your chosen strategy, implementation quality, and market conditions. Patience and persistence are essential.

What’s the best passive income for beginners?

Digital products and dividend investing represent excellent starting points. Digital products offer relatively low barriers to entry with potential monthly earnings of $500-5,000 once established. Dividend investing teaches fundamental principles of market investing while generating cash flow. Both provide learning opportunities with manageable risk profiles for newcomers.

Is passive income really passive?

Most passive income streams require substantial upfront work before becoming hands-off. As one financial expert notes, “You just give the work upfront.” Even established streams typically need occasional maintenance—updating digital products, rebalancing investment portfolios, or maintaining rental properties. The goal is minimizing ongoing effort, not eliminating it entirely.

How is passive income taxed?

Passive income typically receives favorable tax treatment compared to active income. Long-term capital gains and qualified dividends are generally taxed at lower rates than ordinary income. However, tax specifics vary by income type, amount, and jurisdiction. Consulting with a tax professional ensures proper planning and compliance.

Can I replace my full-time income with passive income?

While possible, replacing full-time income typically requires substantial time, strategic implementation, and often diversification across multiple streams. The average side hustler earns $891 monthly, though successful individuals in specific niches can achieve six-figure annual incomes. View passive income as a gradual wealth-building process rather than an immediate replacement for employment.

What are the biggest passive income mistakes?

The most common mistakes include spreading efforts across too many strategies simultaneously, underestimating upfront time requirements, neglecting proper tax planning, pursuing unrealistic get-rich-quick schemes, and failing to reinvest early earnings. Avoiding these pitfalls significantly increases your likelihood of building sustainable passive income.

About the Author: This article was researched and compiled by the Sezarr financial content team, drawing on current market data, expert insights, and proven passive income strategies for 2025.

Last Updated: November 22, 2025