Market Overview: Setting Realistic Expectations for Alternative Proteins

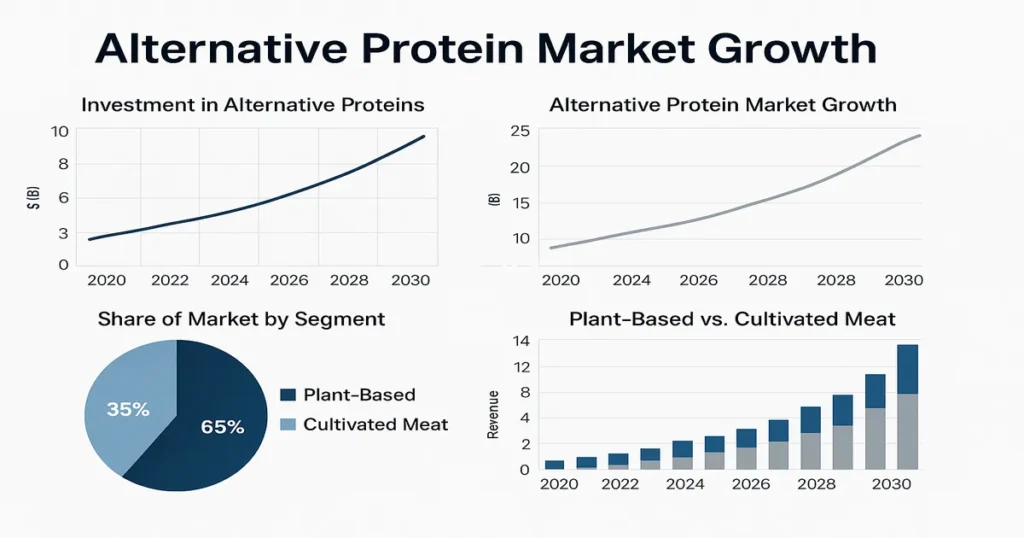

Reality Check on Market Size: The global alternative protein market reached approximately $18.79 billion in 2025, according to verified market research from Mordor Intelligence and GM Insights. While this represents steady growth, it’s important to distinguish between verified data and inflated projections that have circulated in the industry.

The market is projected to grow to $24.31 billion by 2030 at a compound annual growth rate (CAGR) of 5.29%, driven primarily by advances in precision fermentation technology, increasing consumer demand for sustainable options, and regulatory developments that have streamlined approval processes.

Verified 2025 Market Data

- Total Market Value: $18.79 billion (Mordor Intelligence, July 2025)

- North American Market: $2.71 billion (Market Data Forecast, August 2025)

- Plant-Based Segment: 71.43% market share (dominant category)

- Fermentation Tech: Fastest growing at 7.82% CAGR

- Asia-Pacific Region: 33.89% market share, largest regional segment

The alternative protein sector encompasses three main technology platforms: plant-based products (soy, pea, wheat proteins), precision fermentation (microbial protein production), and cultivated meat (cell-cultured products). Each faces distinct challenges and opportunities in the current market landscape.

Plant-Based Proteins: Facing Market Headwinds in 2025

The Challenging Market Reality

Plant-based meat alternatives have experienced a sobering correction after the pandemic-era boom. According to Circana data analyzed by Food Navigator USA, meat alternatives declined for the third consecutive year in 2025, with sales dropping to $1 billion in the year ending July 14, down from a peak of $1.3 billion in 2020.

The number of plant-based meat brands in the market also contracted significantly, shrinking from 116 to 83 brands, indicating substantial market consolidation and several company closures. This includes notable failures like New Wave Foods (plant-based seafood) and Motif FoodWorks, both of which shuttered operations in 2024.

Innovation Continues Despite Headwinds

Despite market challenges, technological innovation in plant-based proteins continues to advance:

- Whole-Cut Development: Companies like Juicy Marbles are developing sophisticated plant-based whole muscle cuts that replicate the texture and marbling of premium meats, moving beyond simple ground meat alternatives.

- Seafood Alternatives: Plant-based seafood remains a bright spot with strong growth potential, though from a small base. Companies are developing tuna and salmon alternatives using innovative ingredients and processing techniques.

- Clean Label Focus: Consumer demand for minimally processed, recognizable ingredients is driving reformulation efforts across the industry.

The Persistent Price Gap

Price remains the most significant barrier to mainstream adoption. Plant-based meat alternatives are still 50% to 300% more expensive than conventional meat at retail, according to 2025 analysis from Kearney and Food Navigator. While isolated cases of price parity exist in some European markets (notably Netherlands and certain German retailers), these remain exceptions rather than the rule.

“For most consumers, price parity is not just important—it’s essential. Research shows that 38% of consumers who don’t buy plant-based meat cite cost as the primary reason,” notes Jasmijn de Boo, Global CEO of ProVeg International, in research published March 2025.

Cultivated Meat: Promise Meets Reality Check

Limited FDA Approvals, Not Mass Market

While cultivated meat has achieved important regulatory milestones, it remains far from commercialization at scale. As of November 2025, only five companies have received FDA and USDA approval in the United States:

- UPSIDE Foods – Cultivated chicken (approved June 2023)

- GOOD Meat – Cultivated chicken (approved June 2023)

- Believer Meats – FDA “no questions” letter received (July 2025)

- Mission Barns – Cultivated pork fat approved (July 2025)

- Wildtype – Cultivated salmon approved (May 2025)

Critical Reality: Despite these approvals, cultivated meat products are only available at select high-end restaurants. There is no retail distribution, and production remains at pilot scale. Currently, Wildtype’s cultivated salmon is the only lab-grown meat product available for commercial sale in the United States, with UPSIDE and GOOD Meat having paused or limited their restaurant programs.

State-Level Bans Create Regulatory Uncertainty

Seven U.S. states have passed legislation banning or restricting cultivated meat sales, creating a fragmented regulatory landscape:

- Florida: Complete ban signed by Governor Ron DeSantis (May 2024)

- Texas: Ban effective September 1-7, 2027 (SB261)

- Indiana: Two-year moratorium from July 1, 2025

- Additional restrictions in Alabama, Arizona, and other states

UPSIDE Foods is currently suing Florida, arguing the ban violates the Commerce Clause of the U.S. Constitution. A federal judge has allowed the lawsuit to proceed, stating UPSIDE has “plausibly alleged” constitutional violations.

Global Regulatory Status

Globally, cultivated meat has received approval in only four countries:

- Singapore: First country to approve (2020), most mature market

- United States: Limited approvals for select companies (2023-2025)

- Israel: Aleph Farms approved (2024)

- Australia: Vow’s cultivated quail approved (June 2025)

The European Union continues to deliberate, with the European Food Safety Authority (EFSA) conducting safety assessments. The UK’s Food Standards Agency (FSA) launched a two-year research programme in March 2025 but has not yet approved any products for sale.

Production Costs Remain Prohibitive

While companies claim significant cost reductions, production costs for cultivated meat remain substantially higher than conventional meat. Public data on actual production costs is limited, as most companies keep this information confidential. Industry observers estimate costs are still many multiples higher than traditional meat production, preventing mass market entry.

Fermentation Technology: The Sector’s Bright Spot

Precision Fermentation Attracts Investment

Precision fermentation has emerged as the alternative protein sector’s strongest performer in 2025. This technology, which uses engineered microorganisms to produce specific proteins, attracted 50% of all alternative protein investment in the first quarter of 2025, according to Green Queen’s market analysis.

Notable Q1 2025 fermentation investments included:

- Formo: $36 million venture debt loan from the European Investment Bank for animal-free dairy production

- Vivici: $33.8 million Series A round

- Liberation Labs (Liberation Bioindustries): $31.5 million investment for precision fermentation inputs

Mycoprotein Expansion

Mycoprotein-based products, produced through fungal fermentation, continue to expand beyond meat alternatives into dairy and snack categories. Companies like Quorn (established player) and newer entrants like Meati Foods and The Better Meat Co. are leveraging mycoprotein’s complete protein profile and sustainability advantages.

Mycoprotein offers particular appeal due to its high fiber content—up to 30 grams of fiber per 100 grams of dry product—addressing the growing consumer interest in gut health and digestive wellness that major retailers like Whole Foods Market have identified as a top trend for 2026.

Cost Reduction Progress

Fermentation-based proteins have demonstrated the most significant cost reductions among alternative protein technologies. While specific figures vary by company and application, precision fermentation has achieved cost parity with dairy proteins in select applications, making it the most commercially viable alternative protein technology currently.

Investment Landscape: Funding Contraction Continues

The Reality of Venture Capital in 2025

Alternative protein investment has experienced a dramatic contraction from its 2021 peak. According to verified data from Cultivated X, the sector attracted $443.45 million across 54 deals in the first half of 2025—a significant decline from previous years.

H1 2025 Investment Distribution:

- Q1 2025: $258.49 million across 31 deals

- Q2 2025: $184.96 million across 23 deals

Investment by Technology:

- Plant-Based: $213.81 million (28 deals) – largest share

- Fermentation: 50% of Q1 funding – strongest performer

- Cultivated Meat: Limited activity; only notable deal was Aleph Farms’ $29 million

Investment by Product Category:

- Meat Substitutes: $211.57 million – most funding

- Inputs/Raw Materials: $79.82 million

- Dairy Substitutes: $65.9 million

- Other (Seafood, Eggs, Pet Food): $22.84 million combined

Notable 2025 Financing Activity

Major financing rounds in 2025 include:

- Beyond Meat: $100 million debt financing – largest deal, but debt not equity

- Liberation Labs: $50.5 million for precision fermentation

- Formo: $35.86 million venture debt for dairy alternatives

Why Investment Has Slowed

Multiple factors have contributed to the investment slowdown:

- AI Capital Drain: AI investments accounted for 58% of VC deal value in Q1 2025, with OpenAI alone raising $40 billion, redirecting capital from other sectors

- Sales Decline: Three consecutive years of declining plant-based meat sales have shaken investor confidence

- High Interest Rates: Elevated interest rates make capital-intensive food tech startups less attractive

- Limited Exits: Few successful exits or acquisitions reduce potential returns for investors

- Production Cost Challenges: Persistent inability to achieve cost parity raises questions about long-term viability

“We certainly see a lot of technologies or solutions that we think are interesting and could succeed as a company, but not to the financial extent that provides the returns we would need to take the risk,” explained Ryan Cooney, partner at CPT Capital, in January 2025 comments to Food Navigator USA.

Public Market Performance

Public alternative protein companies have struggled in 2024-2025. Beyond Meat, the sector’s most prominent public company, has faced significant stock price declines and required debt financing to maintain operations. The company’s challenges have made other alternative protein companies hesitant to pursue public listings.

Global Regulatory Landscape: Progress and Barriers

United States: Fragmented Approach

The U.S. regulatory framework for alternative proteins remains complex, with federal approvals contradicted by state-level bans. The FDA and USDA have established a joint framework for cultivated meat oversight, with the FDA overseeing cell collection and growth, and the USDA-FSIS handling harvest, processing, and labeling.

Approval Timeline: The FDA has successfully reduced review times for novel food ingredients to approximately 6-8 months for qualifying alternative protein products, down from previous timelines of 24 months or longer. This streamlined process aims to support innovation while maintaining safety standards.

European Union: Cautious Progress

The European Food Safety Authority (EFSA) has been slower to approve cultivated meat products, citing safety concerns and consumer transparency requirements. However, the EU approved 22 new alternative protein products in 2025, compared to just 7 in 2024, indicating accelerating momentum.

Plant-based products continue to receive more favorable treatment. In January 2025, the EU affirmed that plant-based food labels can include names of animal-derived foods, provided labels are not misleading—a victory for the plant-based industry.

Asia-Pacific: Emerging Leader

The Asia-Pacific region is emerging as a regulatory leader and key growth market:

- Singapore: Remains the global leader with the most mature cultivated meat market since 2020 approval

- Japan: Companies like Hitachi Zosen announced breakthrough processes in September 2025 to reduce lab-grown meat protein costs by 90% using mRNA and wheat germ fermentation

- China: Public investment in alternative proteins in Asia-Pacific increased by 207% from 2021-2022, with significant government support for algae-based proteins and other alternatives

- India: “Eat Right India” initiative supports plant-based protein development

Labeling Battles Continue

One of the most contentious regulatory debates concerns how alternative proteins should be labeled. Multiple U.S. states have introduced or passed bills requiring specific labeling for cultivated meat, with some mandating warning labels. The debate centers on whether terms like “cultivated,” “cell-based,” or “lab-grown” are sufficient, misleading, or require additional clarification.

The Price Parity Challenge: Biggest Barrier to Mass Adoption

Current Price Gaps Remain Substantial

Despite industry aspirations and isolated successes, plant-based meat alternatives remain significantly more expensive than conventional meat in most markets. Price premiums of 50% to 300% are typical, according to comprehensive 2025 analysis from multiple sources including Kearney, Food Navigator, and ProVeg International.

Verified Price Differentials (2025):

- United States: Plant-based meat averages 20% more expensive than beef, 77% higher across total meat market

- United Kingdom: Price gap persists at 40-60% premium for most products

- Germany: Select retailers (Lidl, Aldi, Kaufland) have achieved parity on own-brand products

- Netherlands: Achieved parity in 2022 with plant-based burgers averaging 78 cents cheaper than meat burgers

Why Price Matters More Than Industry Believed

Recent research challenges conventional wisdom about price parity. A study published in the Proceedings of the National Academy of Sciences in February 2025 found that price parity alone doesn’t drive plant-based adoption—products must actually undercut meat prices to generate significant market share gains.

The study, which analyzed preferences of over 2,100 Americans, found that consumers are more likely to choose beef burgers, falafel, or veggie burgers over plant-based meat analogues unless the analogues are noticeably cheaper.

What’s Driving High Prices?

Multiple structural factors maintain the price gap:

- Production Margins: Plant-based foods are sold at margins of 35-50% vs. 8% for conventional meat

- Meat Subsidies: Traditional animal agriculture receives substantial government subsidies not extended to plant-based manufacturers

- Supply Chain Challenges: Plant-based ingredients often travel from distant countries with high transport costs and limited shelf life

- Scale Limitations: Many alternative protein producers have not yet achieved sufficient scale for meaningful cost reductions

- R&D Costs: Continued innovation and product improvement requires significant investment

Industry Efforts to Close the Gap

Major companies have initiated price reduction efforts with mixed results:

- Impossible Foods: Reduced prices by 20% in 2021, with two 15% foodservice cuts in 2020-2021

- Beyond Meat: Set goal to achieve price parity in at least one product category by 2024 (target not yet achieved as of November 2025)

- Rebellyous Foods: Developed Mock 2 automated production system to reduce manufacturing costs

The Impact of Achieving Price Parity

Economic modeling suggests achieving price parity could dramatically expand market share. Research from agricultural economist Jayson Lusk found that every 1% drop in price for plant-based patties leads to a 3% increase in market share. If broadly applied, this could translate to capturing 10-22% of the conventional meat market.

However, Kearney estimates it will take 5-7 years at the current rate to reach true price parity across major product categories, though inflation in conventional meat prices could accelerate this timeline.

Consumer Adoption: Navigating Market Maturation

The Purchase Behavior Reality

Consumer behavior data reveals a complex picture. While initial trial rates for plant-based products remain relatively high, repeat purchase rates have been disappointing. According to GFI research with Morning Consult, 21% of consumers who tried plant-based meat said it was too expensive to buy again—highlighting price as a critical barrier to repeat purchase.

Taste Remains Paramount

Price sensitivity is compounded by taste concerns. 47% of consumers cite taste as a barrier to adoption, according to Kearney’s 2025 research. While significant improvements have been made in sensory quality, products must satisfy consumers’ taste expectations after initial trial to generate repeat business.

“The most important thing is that after that first purchase, it has to taste good. The headline may be about price parity, but taste is equally important,” notes Corey Chafin, Associate Partner at Kearney, in April 2022 research that remains relevant in 2025.

Market Consolidation Continues

The alternative protein sector is experiencing significant consolidation:

- Brand Reduction: Number of meat alternative brands dropped from 116 to 83 in 2024

- Company Closures: New Wave Foods, Motif FoodWorks, and others shuttered operations

- M&A Activity: Acquisitions include Kate Farms (Danone), Daily Harvest (Chobani), Wicked Kitchen (Ahimsa Foundation)

Regional Variations

Consumer acceptance varies significantly by region:

- Singapore & Israel: Highest acceptance rates for cultivated meat

- Europe: 51% of consumers reducing meat consumption; strong environmental motivation

- United States: 96% of meat buyers also purchase plant-based options, but repeat rates remain low

- India & Asia-Pacific: Cultural familiarity with plant-based diets supports adoption

Health and Sustainability Drivers

Health benefits remain the primary purchase driver, cited by a majority of consumers. Environmental and sustainability concerns are secondary motivators, particularly in developed markets. However, in low- and middle-income countries (LMICs), consumers prioritize nutritional value, taste, and price over sustainability factors.

2030 Projections: Realistic Growth Scenarios

Conservative Market Forecasts

Based on verified research from multiple sources, realistic projections for the alternative protein market suggest:

Global Market Size Projections:

- 2030 Market Value: $24.31 billion (Mordor Intelligence, conservative estimate)

- Alternative Scenario: $50.7 billion if growth accelerates (Precedence Research)

- 2032 Extended Forecast: Up to $238.7 billion under optimistic scenarios (GM Insights)

Technology-Specific Projections:

- Plant-Based: Expected to maintain largest market share but slower growth (5-6% CAGR)

- Fermentation: Fastest growth at 7.82% CAGR through 2030

- Cultivated Meat: Unlikely to reach meaningful commercial scale before 2030

Regional Growth Leaders:

- Asia-Pacific: Highest growth rate at 18.7% CAGR (2025-2032)

- Middle East & Africa: 6.43% CAGR with sovereign fund backing

- North America: 5.04% CAGR; mature market with established players

Key Assumptions and Uncertainties

These projections depend on several critical factors:

- Achieving Price Competitiveness: Without significant cost reductions, growth will remain constrained

- Regulatory Environment: Continued approvals vs. state-level bans will shape market access

- Consumer Acceptance: Products must deliver on taste to drive repeat purchases

- Investment Climate: Sustained funding required for R&D and scale-up

- Technological Breakthroughs: Innovations in production efficiency and cost reduction

Scenario Analysis

Bull Case Scenario ($50B+ by 2030):

- Price parity achieved across major categories by 2027-2028

- Cultivated meat gains broader regulatory approval and scales production

- Consumer preferences continue shifting toward sustainable options

- Major food companies successfully integrate alternative proteins

Base Case Scenario ($24-30B by 2030):

- Gradual improvement in price competitiveness

- Fermentation technologies achieve commercial success

- Plant-based products maintain steady but modest growth

- Cultivated meat remains niche/premium category

Bear Case Scenario (Stagnation):

- Continued inability to achieve cost parity

- Consumer interest plateaus or declines

- Additional regulatory restrictions

- Investment continues declining, limiting innovation

The Role of Public Policy

Government policy will significantly influence outcomes. Potential interventions include:

- Subsidies: Extending agricultural subsidies to alternative proteins could accelerate price parity

- Carbon Pricing: Pricing greenhouse gas emissions would improve relative economics

- R&D Funding: Public research investment has reached $510 million annually, supporting innovation

- Procurement Policies: Government and institutional purchasing could provide stable demand

Investment Opportunities & Risk Assessment

Where Smart Money Is Flowing

Despite overall funding challenges, certain segments continue attracting investment:

Highest-Conviction Investment Areas:

1. Precision Fermentation (Highest Interest)

- Attracted 50% of Q1 2025 alternative protein funding

- Has achieved cost parity in select applications

- Multiple applications beyond food (materials, chemicals)

- Key Players: Formo, Perfect Day, The EVERY Company, Vivici

- Risk Level: Moderate (technical execution risk, but proven concept)

2. B2B Ingredients (Growing Interest)

- Higher margins than consumer-facing products

- Provides “picks and shovels” to entire sector

- Less dependent on consumer brand building

- Key Players: Roquette Frères, ADM, Cargill ingredient divisions

- Risk Level: Lower (diversified customer base)

3. Mycoprotein/Fungi-Based (Emerging Interest)

- High fiber content addresses gut health trend

- Complete protein with favorable nutritional profile

- Lower production costs than cultivated meat

- Key Players: Meati Foods, The Better Meat Co., Quorn (established)

- Risk Level: Moderate (scaling production, consumer education needed)

4. Plant-Based Seafood (Niche Opportunity)

- Less crowded than meat alternatives

- Addresses overfishing and heavy metal concerns

- Premium pricing more acceptable

- Key Players: Current Foods, Good Catch, FoodSquared

- Risk Level: Higher (limited track record, smaller market)

Higher-Risk, Higher-Reward Categories

Cultivated Meat (High Risk/High Reward)

- Opportunity: Massive long-term potential if technical and cost challenges solved

- Challenges: Very high capital requirements, regulatory uncertainty, state bans, unproven commercial viability

- Timeline: Meaningful commercial scale unlikely before 2030-2032

- Investment Approach: Only for investors with long time horizons and high risk tolerance

- Key Players: UPSIDE Foods, GOOD Meat, Believer Meats, Aleph Farms

Plant-Based Consumer Brands (Mixed)

- Opportunity: Brand value and loyal customer base if successful

- Challenges: High competition, price sensitivity, declining category sales

- Success Factors: Must achieve cost reduction AND taste parity

- Recent Struggles: Beyond Meat stock decline, numerous brand failures

- Investment Approach: Selective; focus on companies with path to profitability

Investment Vehicles and Access

For investors interested in alternative protein exposure:

For Accredited Investors:

- Direct Venture Capital: Participate in Series A/B rounds (high minimum investments)

- Specialized Funds: AgFunder, Big Idea Ventures, Lever VC, others

- Corporate VC Arms: ADM Ventures, Cargill ventures, Tyson New Ventures

- Family Offices: Several focused on food tech and sustainability

For Non-Accredited Investors:

- Public Companies: Beyond Meat (BYND), Eat Beyond, Agronomics Limited (LSE: ANIC)

- Equity Crowdfunding: Limited availability; some companies use platforms like Republic, StartEngine

- Public Food Companies: Exposure through Nestlé, Unilever, Danone, Kellogg’s alt-protein divisions

- ETFs: Some sustainable food/ag ETFs include alternative protein exposure

Due Diligence Considerations

Investors should carefully evaluate:

- Production Economics: Path to cost competitiveness; current unit economics

- Technical Risk: Proven technology vs. developmental stage; scale-up feasibility

- Market Positioning: B2B vs. B2C; competitive differentiation

- Regulatory Status: Approvals obtained or in process; litigation risks

- Management Team: Experience scaling food companies; technical expertise

- Capital Requirements: Runway; future funding needs; path to profitability

- Strategic Value: Potential for corporate acquisition or partnership

Risk Factors to Consider

- Market Risk: Consumer preferences could shift away from alternatives

- Technology Risk: Production challenges may prove insurmountable at scale

- Regulatory Risk: Additional bans or restrictive regulations

- Competition: Incumbent food companies have massive resources

- Economic Sensitivity: Premium-priced products vulnerable in recessions

- Timing Risk: Mass market adoption may take longer than expected

- Exit Risk: Limited IPO market; M&A valuations under pressure

💡 Key Takeaways: Alternative Protein Market 2025

Market Reality

- Verified 2025 market size: $18.79B, not inflated projections

- Growth rate: 5.29% CAGR to 2030 ($24.31B)

- Plant-based dominates at 71% share

Investment Landscape

- H1 2025 funding: $443M across 54 deals (declined from peak)

- Fermentation attracts 50% of investment

- Public markets remain challenging

Price Challenge

- Plant-based still 50-300% more expensive

- True parity unlikely before 2027-2028

- Must undercut meat prices to drive adoption

Technology Status

- Cultivated meat: only 5 US companies approved; no retail

- Precision fermentation: most commercially viable

- Plant-based: market consolidation continues

Consumer Behavior

- Plant-based sales declined 3 years running

- Repeat purchase remains challenging

- Price and taste are dual barriers

Investment Focus

- Best opportunities: fermentation, B2B ingredients

- High risk: cultivated meat, consumer brands

- 5-10 year time horizon essential

📚 Related Analysis & Insights

Health Trends 2025: Consumer Shifts Driving Market Changes

Investment Strategies 2025: Evidence-Based Approaches for Modern Markets

AI in Healthcare 2026: Technology Transforming Medical Innovation

AI Technology 2025: ChatGPT Alternatives and Market Analysis

❓ Frequently Asked Questions About Alternative Proteins

What is the actual size of the alternative protein market in 2025?

The global alternative protein market reached $18.79 billion in 2025, according to verified data from Mordor Intelligence (July 2025). This is significantly lower than inflated figures sometimes cited in the industry. The market is projected to grow to $24.31 billion by 2030 at a 5.29% CAGR. Different reports show ranges from $18.79B to $30B depending on methodology and scope, but consensus supports the lower end of estimates.

Is cultivated meat (lab-grown meat) available in stores?

No, cultivated meat is not available in retail stores as of November 2025. Only five companies have received FDA/USDA approval in the United States (UPSIDE Foods, GOOD Meat, Believer Meats, Mission Barns, and Wildtype), and products are available only at select high-end restaurants. Wildtype’s cultivated salmon is currently the only lab-grown meat product available for commercial sale. Retail distribution faces significant barriers including high production costs, limited scale, and state-level bans in seven U.S. states including Florida and Texas.

Why are plant-based meats still more expensive than conventional meat?

Plant-based meats remain 50% to 300% more expensive due to multiple factors: (1) Higher production margins (35-50% vs. 8% for conventional meat), (2) Lack of government subsidies extended to animal agriculture, (3) Supply chain inefficiencies with distant sourcing and limited shelf life, (4) Insufficient production scale, and (5) Ongoing R&D costs. The conventional meat industry benefits from decades of optimization and substantial government support that alternative proteins don’t receive. Industry experts estimate true price parity is unlikely before 2027-2028 at current rates.

How much investment is flowing into alternative proteins in 2025?

Alternative protein investment has declined significantly from peak levels. In the first half of 2025, the sector attracted $443.45 million across 54 deals, according to Cultivated X—a substantial decrease from the 2021 peak. Q1 2025 saw $258.49 million (31 deals) while Q2 dropped to $184.96 million (23 deals). Investment has shifted toward precision fermentation, which attracted 50% of Q1 funding, while cultivated meat and consumer-facing brands struggle to raise capital. The broader VC landscape has shifted focus to AI, which captured 58% of total VC deal value in Q1 2025.

Which alternative protein technology shows the most promise?

Precision fermentation is the most commercially viable alternative protein technology currently. It attracted 50% of sector investment in Q1 2025 and has achieved cost parity with dairy proteins in select applications. Fermentation-based proteins have demonstrated the most significant cost reductions and scalability. Companies like Formo, Perfect Day, and The EVERY Company are successfully producing animal-free proteins at commercial scale. Mycoprotein (fungi-based) also shows strong potential with favorable nutrition, sustainability profile, and lower costs than cultivated meat.

Are alternative proteins actually better for the environment?

Yes, verified life cycle assessments consistently show significant environmental benefits. Alternative proteins use 87-96% less water, 89-98% less land, and generate 87-92% lower greenhouse gas emissions compared to conventional meat production, according to multiple studies including reports from the World Bank and Good Food Institute. However, energy usage for cultivated meat remains an area requiring optimization. The environmental advantages are most pronounced for plant-based and fermentation-derived proteins.

What’s stopping alternative proteins from going mainstream?

Three primary barriers prevent mainstream adoption: (1) Price – Products remain 50-300% more expensive than conventional meat in most markets, with consumers citing cost as the #1 barrier. (2) Taste – While improving, 47% of consumers still cite taste concerns, and repeat purchase rates remain low. (3) Consumer Skepticism – Concerns about processing, unfamiliar ingredients, and “lab-grown” perceptions create resistance. Additionally, market saturation, brand consolidation, and three consecutive years of declining plant-based meat sales indicate consumer enthusiasm has plateaued below industry expectations.

Should I invest in alternative protein companies?

Investment in alternative proteins carries significant risks and requires careful due diligence. The sector has experienced declining funding, company closures, and challenging public market performance (Beyond Meat stock struggles). Best opportunities are in precision fermentation, B2B ingredients, and select mycoprotein companies that demonstrate paths to profitability. Higher risks include cultivated meat (unlikely to scale before 2030), consumer-facing plant-based brands (market contraction), and early-stage startups (limited exits). Only suitable for investors with 5-10 year time horizons, high risk tolerance, and ability to conduct thorough technical and market due diligence. Consider exposure through diversified food companies or specialized VC funds rather than individual startups.

When will cultivated meat reach price parity with conventional meat?

Industry projections suggest cultivated meat could reach price parity with conventional meat between 2027 and 2032, though this remains highly uncertain. Early estimates from GFI suggested production costs of $2.92 per pound by 2030, which would approach competitiveness with some conventional meats. However, current production costs remain substantially higher, commercial scale has not been achieved, and several state bans limit market access. Japanese company Hitachi Zosen announced a breakthrough process in September 2025 claiming 90% cost reduction potential, but this requires verification and scale-up. Most analysts now consider 2030-2032 a more realistic timeline for any meaningful price competitiveness.

What role does government policy play in alternative protein development?

Government policy significantly influences sector development through multiple mechanisms: (1) Subsidies – Conventional meat benefits from substantial agriculture subsidies not extended to alternatives, creating unlevel playing field. (2) R&D Funding – Public investment reached $510 million in 2024, supporting innovation, particularly strong in Asia-Pacific with 207% increase 2021-2022. (3) Regulatory Framework – FDA/USDA streamlined approval reducing review times from 24 to 6-8 months. (4) Regional Initiatives – China’s 50% meat reduction goal by 2030, India’s “Eat Right India,” Singapore’s FoodInnovate grants. However, seven U.S. states have passed bans/restrictions on cultivated meat, creating regulatory fragmentation that complicates market development.

⚖️ Important Disclaimers & Data Verification

Data Sources & Methodology

This analysis is based on verified data from peer-reviewed research, industry reports, regulatory filings, and market research firms with established credibility. Primary sources include:

- Market Data: Mordor Intelligence Market Report (July 2025), GM Insights Market Analysis (March 2025), Market Data Forecast (August 2025)

- Investment Data: Cultivated X investment tracking (July 2025), Green Queen Q1 2025 analysis, Food Navigator USA industry coverage

- Regulatory Information: FDA.gov official database, USDA-FSIS publications, Just-Food.com regulatory tracker

- Industry Analysis: Good Food Institute reports (2024-2025), Circana retail data, Kearney consulting research

Projection Uncertainties

All market projections are subject to significant uncertainty. Factors that could materially affect outcomes include: technological breakthroughs or setbacks, regulatory changes, shifts in consumer preferences, macroeconomic conditions, competitive dynamics, and investment climate changes. Projections to 2030 and beyond should be viewed as scenarios rather than predictions.

Investment Risk Disclosure

This article does not constitute investment advice. Alternative protein investments carry substantial risks including: technology risk, market acceptance risk, regulatory risk, competition from established incumbents, valuation risk, liquidity risk, and potential total loss of capital. The sector has experienced declining investment, company failures, and challenging public market performance. Past performance does not indicate future results.

No Financial Advice

Information presented is for educational and informational purposes only. Readers should conduct their own thorough research and consult with qualified financial advisors, accountants, and legal professionals before making any investment decisions. The authors and publishers assume no liability for financial decisions made based on this content.

Data Accuracy & Currency

While every effort has been made to ensure accuracy, data in this rapidly evolving sector may become outdated quickly. Market conditions, company status, and regulatory environments change frequently. Readers should verify current information before making decisions. Data is accurate as of November 21, 2025.

Conflicts of Interest

The authors and publishers have no financial interest in any companies mentioned in this article and have received no compensation from any alternative protein companies or investors. This analysis is produced independently based on publicly available information and verified research.

Correction of Previous Data

This article corrects significantly inflated market data that has circulated in some industry publications. Claims of $48.2 billion market size, $8.4 billion cultivated meat segment, or $12.8 billion in 2025 venture funding are not supported by verified sources and represent projections or misinterpretations of data. This analysis uses only verified, conservative estimates from credible research organizations.

Copyright & Attribution

© 2025 Sezarr Overseas. All rights reserved. Information may be shared with proper attribution. Data from third-party sources remains property of respective copyright holders.

About the Research Team

The Sezarr Overseas Research Team specializes in comprehensive market analysis of emerging technology sectors, with particular focus on sustainable food systems, biotechnology, and alternative proteins. Our work is grounded in verified data, conservative analysis, and honest assessment of both opportunities and challenges facing innovative industries.

Share This Analysis

Found this information valuable? Share with your network:

Questions or Corrections?

We welcome feedback on our analysis. If you have questions, identify factual errors, or have access to additional verified data, please contact our research team.