Introduction: A Fed at a Crossroads

The Federal Reserve finds itself in unfamiliar territory as it approaches its December 2025 meeting: deeply divided, operating with incomplete economic data due to the government shutdown, and facing a coin-flip decision on whether to cut interest rates for a third consecutive time. What was once viewed as a near-certainty by markets has transformed into one of the most uncertain Fed decisions in recent memory.

After cutting rates by 25 basis points in both September and October 2025, bringing the federal funds rate to its current range of 3.75-4.00%, the Federal Open Market Committee (FOMC) is now split on the appropriate next move. As Fed Chair Jerome Powell stated following the October meeting, “A further reduction in the policy rate at the December meeting is not a foregone conclusion—far from it.”

This uncertainty is reflected in market pricing. According to CME Group’s FedWatch tool, the probability of a December rate cut has plummeted from 95% just a month ago to approximately 50% as of mid-November 2025. The dramatic shift underscores how rapidly the Fed’s outlook has changed—and how investors must adapt their strategies accordingly.

⚠️ Critical Context: This analysis is based on the most recent official data available as of November 2025. Due to the federal government shutdown that began in September, several key economic reports—including the October employment situation—have been delayed or will not be published. This data gap is a significant factor in the Fed’s current uncertainty.

The Fed’s Current Position: Two Cuts Down, One Uncertain

What the Fed Has Done So Far

The Federal Reserve has already cut interest rates twice in 2025:

- September 2025: First rate cut since December 2024, reducing the federal funds rate by 25 basis points

- October 29, 2025: Second consecutive 25 basis point cut, bringing the target range to 3.75-4.00%

These cuts represent a shift in Fed policy from the higher-for-longer stance that dominated 2024. The moves came in response to what the Fed described as “job gains that have slowed this year” and an unemployment rate that “has edged up but remained low.” However, the committee also noted that “inflation has moved up since earlier in the year and remains somewhat elevated.”

The October Decision: A 10-2 Vote Revealing Deep Divisions

The October rate cut was far from unanimous. The 10-2 vote included two dissents—highly unusual for a Fed that traditionally prizes consensus:

- Stephen Miran (Fed Governor): Dissented in favor of a LARGER 50 basis point cut, citing concerns about labor market weakness

- Jeffrey Schmid (Kansas City Fed President): Dissented in favor of NO CHANGE, warning that rates at the current level are “barely restraining the economy”

According to minutes from the October meeting released November 19, 2025, “many participants were in favor of lowering the target range for the federal funds rate at this meeting, some supported such a decision but could have also supported maintaining the level of the target range, and several were against lowering the target range.”

This language reveals a committee that’s anything but aligned on the path forward.

Inside the Divided FOMC: Hawks vs. Doves

The Fed’s internal debate centers on a fundamental question: Is inflation or employment the bigger risk? This division has crystallized into two distinct camps.

The Hawkish Case: Inflation Risks Remain Elevated

Several regional Fed presidents have stepped up warnings about premature easing, forming what Bloomberg described as a “faction” arguing that “inflation progress could slow or stall.”

Key hawks include:

- Susan Collins (Boston Fed): “The current level of policy rates, in my view, leaves policy well positioned to address a range of potential outcomes… I see several reasons to have a relatively high bar for additional easing in the near term.”

- Jeffrey Schmid (Kansas City Fed): “When I talk to contacts in my district, I hear continued concern over the pace of price increases.”

- Alberto Musalem (St. Louis Fed): Voiced similar concerns about persistent inflation pressures

- Raphael Bostic (Atlanta Fed): In a November 12 speech, argued that “despite shifts in the labor market, the clearer and urgent risk is still price stability”

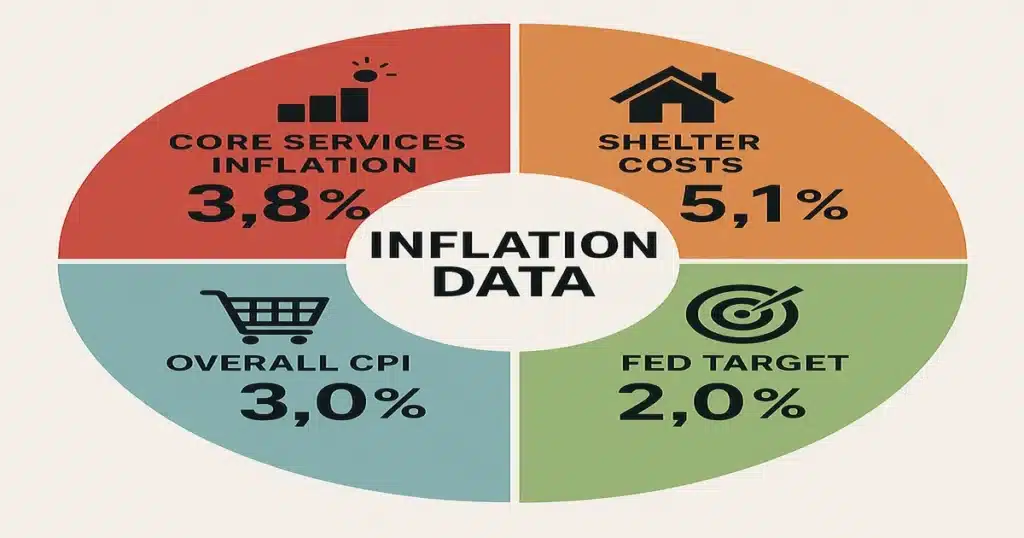

The hawks point to several data points supporting their concerns:

- Core services inflation (excluding housing) remains at 3.8% annually

- Shelter costs continue rising at 5.1% per year

- Headline CPI inflation stands at 3.0% (September 2025)

- Core PCE inflation estimated at approximately 2.7-2.9%

Collins specifically noted that “keeping the Fed’s key rate at its current level of about 3.9% would help bring inflation down” and that “the economy has been holding up quite well even with interest rates where they are.”

The Dovish Case: Labor Market Weakness Demands Action

On the other side, a group of policymakers emphasizes that the labor market is showing clear signs of softening that could worsen if the Fed doesn’t provide additional support.

Key doves include:

- Stephen Miran (Fed Governor): His dissent in favor of a 50bp cut signals deep concern about employment risks

- Christopher Waller (Fed Governor): Has advocated for continued cuts to support the labor market

- Michelle Bowman (Fed Governor): Aligned with dovish concerns about employment

The dovish case rests on troubling labor market trends:

- Rising unemployment: The rate increased from 4.1% in June to 4.4% in September 2025

- Weak job growth: Only 22,000 jobs added in August (the last official report before the shutdown)

- Surging long-term unemployment: Workers unemployed for 27+ weeks now represent 25.7% of all jobless workers—the highest since February 2025 and a level historically associated with recessions

- Slowing hiring: September showed only 119,000 new jobs, with revisions showing July and August were 33,000 jobs weaker than initially reported

According to the Federal Reserve Bank of Minneapolis, the jump in long-term unemployment from 21.5% in August 2024 to 25.7% in August 2025 is “the fastest 12-month increase since the pandemic” and historically, “a breach of the 25% threshold has coincided with or preceded recessions.”

The Data Fog: Making Policy Without Clear Vision

Complicating matters further, the 44-day federal government shutdown has created a significant data gap. The Bureau of Labor Statistics was unable to compile October employment data, and some metrics may never be published for that period. Chair Powell compared this situation to “driving in the fog,” though some officials, like Governor Waller, have pushed back on this characterization.

According to the FOMC minutes: “The meeting minutes indicated the decision-making was complicated by a lack of government data during the federal government shutdown. Reports on the labor market, inflation and a host of other metrics were not compiled or released during the impasse.”

The Inflation Picture: Why 3% Matters

While the Fed’s target is 2% inflation, the current reality is notably higher—and that gap is at the heart of the policy debate.

Current Inflation Snapshot (November 2025)

| Measure | Current Level | Fed Target | Gap |

|---|---|---|---|

| Headline CPI | 3.0% (Sept 2025) | 2.0% | +1.0% |

| Core PCE (est.) | 2.7-2.9% (Aug 2025) | 2.0% | +0.7-0.9% |

| Shelter Costs | 5.1% | ~3.0% | +2.1% |

| Core Services (ex-housing) | 3.8% | 2.0-2.5% | +1.3-1.8% |

What’s Keeping Inflation Elevated?

1. Sticky Services Inflation

Services inflation—which makes up about 70% of the U.S. economy—remains stubbornly high at 3.8% (excluding housing). This reflects continued wage pressures and strong consumer demand for services. As Atlanta Fed President Bostic noted in his November speech, “core services prices, those excluding energy services, have defied most forecasters’ expectations and remained above prepandemic levels.”

2. Housing Costs

Shelter costs, which represent approximately one-third of the CPI basket, continue climbing at 5.1% annually. The combination of limited housing supply, high mortgage rates keeping homeowners in place, and strong rental demand creates persistent upward pressure.

3. Tariff Effects

According to the Atlanta Fed’s Business Inflation Expectations survey, firms assign nearly 40% of their total unit cost growth in 2025 and 2026 to tariffs. Importantly, “expectations for operating costs continue to climb” beyond just tariff-related pressures. Businesses expect to raise prices “well into 2026, and by substantially more than 2 percent.”

4. Five-Year Streak Above Target

Perhaps most concerning to hawks: inflation has now exceeded the Fed’s 2% target for nearly five consecutive years. This prolonged period of elevated inflation risks “de-anchoring” inflation expectations—causing businesses and consumers to expect higher inflation permanently, which becomes self-fulfilling.

Business Inflation Expectations

The Atlanta Fed’s November 2025 Business Inflation Expectations survey provides some encouraging news: firms’ inflation expectations for the coming year decreased to 2.2%—the lowest reading in recent months and close to the Fed’s target. However, this represents expectations, not current reality, and the survey also revealed that “sales levels and profit margins compared to ‘normal times’ increased,” suggesting businesses retain pricing power.

Labor Market Signals: Strength or Weakness?

The labor market is sending mixed signals—and different Fed officials are reading the same data very differently.

The Concerning Trends

Rising Unemployment Rate

The unemployment rate has climbed from 4.1% in June to 4.4% in September 2025. While still historically low, the direction of change matters. This represents the highest unemployment level since October 2021.

Weak Job Creation

The most recent official data showed concerning weakness:

- September 2025: Only 119,000 jobs added

- August 2025: Originally reported as 22,000 jobs, revised DOWN to -4,000 (a job loss)

- July 2025: Revised down from 79,000 to 72,000

Surge in Long-Term Unemployment

This may be the most alarming signal. As of August 2025 (the most recent data), 25.7% of unemployed workers have been jobless for 27 weeks or longer. This is the highest since the pandemic and represents a 4.2 percentage point increase in just one year.

Research shows long-term unemployment is particularly damaging. According to studies cited by the Minneapolis Fed, “only 11% of individuals who are long-term unemployed in a given month managed to secure steady, full-time employment a year later.” These workers often face “earnings losses that can linger for a decade after a long jobless spell.”

Demographic Disparities

The burden isn’t evenly distributed:

- Workers aged 20-24: 9.2% unemployment rate

- African American workers: 7.5% unemployment rate

- Overall unemployment: 4.4%

As Fed Governor Lisa Cook noted, “This is sometimes called a ‘two-speed’ economy, when the well-off are doing well, while [lower-income families] and vulnerable households are not.”

The Counter-Arguments for Labor Market Strength

Hawks point to several factors suggesting the labor market remains reasonably healthy:

- Still-low unemployment: At 4.4%, unemployment remains below its long-term average

- Demographic factors: Some weakness reflects structural changes—10,000 baby boomers retire daily, and reduced immigration has constrained labor supply

- Solid economy: GDP growth remains positive, and consumer spending is holding up

- Resilient activity: Collins and other hawks note that “the economy has been holding up quite well” even with current rates

The “Two-Speed Economy” Reality

The truth may be that both camps are correct—for different segments of the population. High-income, college-educated workers continue to find opportunities, while lower-income and younger workers face increasing headwinds. This disparity makes crafting appropriate monetary policy exceptionally difficult.

What This Means for Different Asset Classes

📊 Equities: Volatility Ahead

Stock markets reached record highs during Q3 2025, but the uncertain Fed path creates headwinds:

Positive Factors:

- Lower rates support equity valuations

- Strong corporate earnings growth continues

- AI and technology sectors remain robust

Negative Factors:

- Policy uncertainty increases market volatility

- Persistent inflation pressures margins

- Labor market weakness could impact consumer spending

- December Fed decision could surprise markets in either direction

Sector Implications:

- Financials: Net interest margins compressed as rates fall, but loan demand may increase

- Technology/Growth: Lower discount rates support valuations, but recession fears could hurt

- Utilities/Staples: Defensive positioning benefits from uncertainty

- Real Estate: Mixed signals—lower rates help, but economic uncertainty hurts

💵 Fixed Income: The Sweet Spot?

Bond investors face an interesting environment:

Current Yields (November 2025):

- 10-year Treasury: Approximately 4.00%

- 2-year Treasury: Approximately 3.90%

- Money market funds: 5.0-5.2%

- Investment-grade corporate bonds: 5.0-5.5%

With inflation at 3%, real yields on 10-year Treasuries are around 1%—positive but modest. The relatively flat yield curve (10-year vs. 2-year) suggests markets expect the Fed to cut rates further but remain uncertain about the pace.

Bond Strategy Considerations:

- If Fed cuts more aggressively → Bond prices rise, locking in current yields becomes attractive

- If Fed pauses → Current yields remain available, but opportunities to benefit from price appreciation diminish

- If inflation reaccelerates → Bonds face price pressure, making inflation-protected securities more appealing

🏠 Real Estate: Tale of Two Markets

Residential Real Estate:

- National house prices up 4.5% year-over-year

- Mortgage rates around 6.5-7.0% (30-year fixed)

- Supply constraints continue supporting prices

- Shelter inflation at 5.1% benefits existing homeowners

- Transaction volumes remain depressed due to “lock-in effect”

Commercial Real Estate:

- Office sector faces structural challenges (remote work)

- Industrial/logistics properties remain strong

- Multifamily showing stress in overbuilt markets

- Cap rates still adjusting to higher rate environment

💰 Cash and Money Markets: Attractive but Time-Limited

Money market funds yielding 5%+ represent one of the best risk-adjusted returns available currently. However, these yields will decline if the Fed continues cutting. The strategic question: How much cash should investors hold?

- Conservative approach: 15-20% in cash/money markets

- Moderate approach: 10-15%

- Aggressive approach: 5-10%

The key is maintaining enough liquidity for opportunities while recognizing that 5% yields are likely temporary.

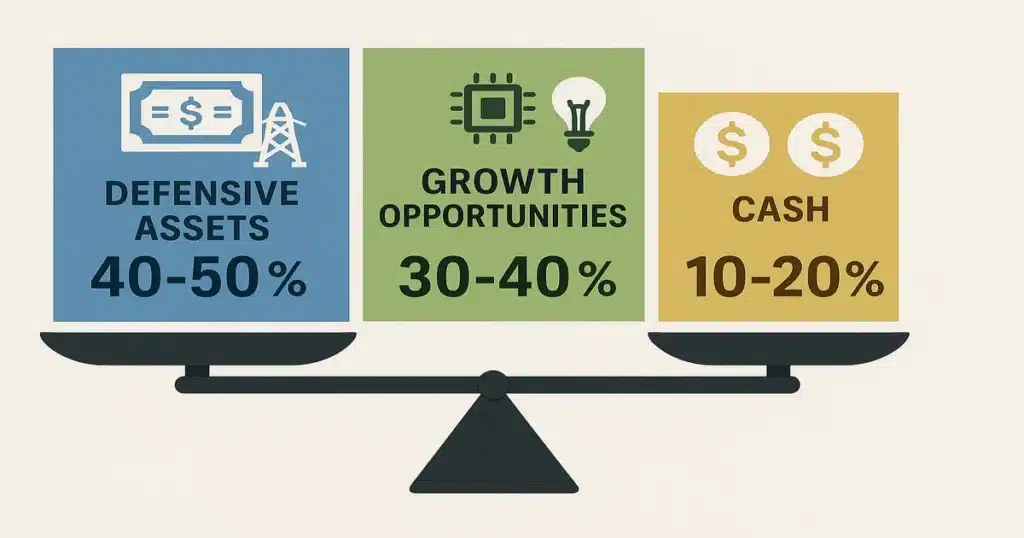

7 Investment Strategies for Navigating Fed Policy Uncertainty

In an environment where the Fed’s next move is genuinely uncertain and economic data is incomplete, investors need strategies that work across multiple scenarios.

Strategy 1: Build a Barbell Portfolio

Combine high-quality defensive assets with select growth opportunities:

Defensive Side (40-50%):

- Investment-grade bonds (duration 4-6 years)

- Dividend aristocrats (companies with 25+ years of dividend increases)

- Utilities and consumer staples

- Treasury Inflation-Protected Securities (TIPS)

Growth Side (30-40%):

- Quality growth stocks with strong balance sheets

- Select technology leaders with pricing power

- Healthcare innovation

- Infrastructure beneficiaries

Cash (10-20%):

- Money market funds

- Short-term Treasuries

- High-yield savings accounts

Strategy 2: Focus on Real Assets as Inflation Hedge

With inflation still running above 3%, consider assets that maintain purchasing power:

- TIPS: Treasury Inflation-Protected Securities provide explicit inflation protection

- Commodities: Energy, industrial metals, and agricultural products

- Real estate investment trusts (REITs): Focus on those with inflation-indexed leases

- Infrastructure stocks: Toll roads, utilities, pipelines often have inflation escalators

- Precious metals: Gold as portfolio insurance (5-10% allocation)

Why this matters now: If the Fed cuts too aggressively and inflation reaccelerates, these assets provide protection. If inflation continues moderating, the downside is limited.

Strategy 3: Implement a Bond Ladder

Rather than trying to time the bond market, create a ladder of maturities:

Example Structure:

- 1-year Treasury: 10% of bond allocation

- 2-year Treasury: 15%

- 3-year Corporate Investment Grade: 15%

- 5-year Treasury: 20%

- 7-year Corporate Investment Grade: 20%

- 10-year Treasury: 20%

Benefits:

- Captures current attractive yields

- Provides regular opportunities to reinvest at potentially different rates

- Reduces reinvestment risk

- Creates predictable cash flow

Strategy 4: Quality Over Everything

In uncertain environments, focus on companies with:

- Strong balance sheets: Low debt-to-equity ratios, high interest coverage (5x+)

- Pricing power: Ability to pass costs to customers without losing volume

- Sustainable cash flow: Free cash flow yield of 5%+

- Recession resilience: Essential products/services, diversified customer base

- Dividend safety: Payout ratios below 60%, history of maintaining dividends through downturns

These companies can weather multiple scenarios—continued Fed cuts, a pause, or even rate hikes if inflation surges.

Strategy 5: Sector Rotation Based on Economic Indicators

Position for different scenarios by monitoring key data:

If labor market weakens further (dovish scenario):

- Overweight: Technology, Consumer Discretionary, Financials

- Underweight: Commodities, Energy

- Rationale: Fed cuts aggressively, supporting growth stocks and rate-sensitive sectors

If inflation reaccelerates (hawkish scenario):

- Overweight: Energy, Materials, Financial SELECT (banks), Real Estate with inflation protection

- Underweight: Long-duration bonds, Growth stocks with high valuations

- Rationale: Fed pauses or even raises rates, benefiting inflation beneficiaries

If soft landing continues (muddle-through scenario):

- Maintain balanced exposure across sectors

- Focus on quality within each sector

- Emphasize dividend growers

Strategy 6: International Diversification

Don’t limit yourself to U.S. markets:

- Emerging Markets: Many EM central banks are further along in rate-cutting cycles; select countries with strong fiscal positions and commodity exports

- Europe: European Central Bank easing cycle may be ahead of Fed’s; opportunities in quality European multinationals

- Japan: Unique situation with Bank of Japan potentially tightening while others ease

- Currency considerations: If Fed cuts more than expected, dollar weakness could benefit international investments

Recommended allocation: 20-30% of equity portfolio in international stocks for diversification

Strategy 7: Tactical Opportunism with Dry Powder

Maintain 10-15% in highly liquid assets to capitalize on volatility:

Watch for these opportunities:

- Post-Fed announcement selloffs: Markets often overreact to Fed decisions

- Sector dislocations: When good companies get caught in sector-wide selloffs

- Credit spread widening: If spreads widen beyond fundamentals, high-quality corporate bonds become attractive

- Volatility spikes: VIX above 25-30 often presents buying opportunities

The December Fed decision—whatever it is—will likely create short-term volatility and potential entry points.

Looking Ahead: Three Scenarios for 2026

The path of monetary policy in 2026 will depend largely on how the competing risks of inflation and unemployment evolve. Here are three plausible scenarios:

Scenario 1: Continued Cuts (40% Probability)

The Setup:

- Labor market continues weakening through early 2026

- Unemployment rises to 4.7-5.0%

- Inflation moderates to 2.5% by mid-2026

- No recession, but growth slows to 1.5-2.0%

Fed Response:

- Cuts in December 2025, followed by 2-3 more cuts in 2026

- Federal funds rate reaches 3.00-3.25% by end-2026

- Focus shifts to supporting growth

Investment Implications:

- Winners: Growth stocks, long-duration bonds, real estate

- Losers: Dollar, money market yields, defensive sectors

- Strategy: Increase equity exposure, extend bond duration, reduce cash

Scenario 2: Extended Pause (35% Probability)

The Setup:

- Inflation remains sticky at 2.7-3.0%

- Labor market stabilizes around 4.4% unemployment

- GDP growth continues at 2.0-2.5%—the “Goldilocks” economy

- No major shocks to either employment or prices

Fed Response:

- Skips December 2025 cut

- Holds rates steady through at least Q2 2026

- Maintains data-dependent approach

- Possibly one cut in late 2026 if conditions warrant

Investment Implications:

- Winners: Financials, value stocks, balanced portfolios, dividend payers

- Losers: High-growth/high-valuation stocks, highly leveraged companies

- Strategy: Maintain current allocations, focus on quality and dividends

Scenario 3: Policy Reversal (25% Probability)

The Setup:

- Inflation reaccelerates to 3.5-4.0% due to tariffs, commodity prices, or wage pressures

- Inflation expectations become unanchored

- Economy remains resilient despite higher rates

- Fed realizes cuts were premature

Fed Response:

- No December cut

- Extended hold through 2026

- Possibly even a rate HIKE if inflation spirals

- Return to more hawkish rhetoric

Investment Implications:

- Winners: Energy, commodities, TIPS, floating-rate bonds, banks

- Losers: Long-duration bonds, growth stocks, real estate

- Strategy: Shift to inflation hedges, shorten bond duration, increase alternatives

Positioning for Uncertainty

Given that no single scenario has overwhelming probability, the optimal approach is building a portfolio that can perform reasonably well across all three. This means:

- Maintaining diversification across asset classes and geographies

- Balancing growth and value, cyclical and defensive

- Keeping some “dry powder” for opportunities

- Focusing on quality to weather any storm

- Including real assets as inflation insurance

Risk Management in a “Driving in the Fog” Environment

Chair Powell’s characterization of the current situation as “driving in the fog” aptly describes the challenge facing both policymakers and investors. Here’s how to manage risks when visibility is limited:

1. Scenario Planning and Stress Testing

Don’t just position for your base case—understand how your portfolio would perform in each scenario:

- Run the numbers: How would your portfolio perform if rates drop to 3%? Stay at 4%? Rise back to 4.5%?

- Identify vulnerabilities: Which holdings would suffer most in an adverse scenario?

- Build resilience: Adjust positions to reduce concentration in any single outcome

2. Focus on What You Can Control

You can’t predict the Fed, but you can control:

- Asset allocation: Ensure your mix aligns with your risk tolerance and time horizon

- Costs: Minimize fees, taxes, and trading costs

- Diversification: Don’t let any single position dominate your portfolio

- Rebalancing discipline: Systematically sell winners and buy laggards

- Tax efficiency: Harvest losses, manage holding periods, use tax-advantaged accounts

3. Monitoring Key Indicators

Stay attuned to the data that will drive Fed decisions:

Monthly Must-Watch Indicators:

- CPI report: Next release December 2025 (Note: October data unavailable due to shutdown)

- Employment Situation: Next release December 16, 2025 (covering November data with extended collection period)

- PCE inflation: The Fed’s preferred measure, typically released end-of-month

- Atlanta Fed’s Business Inflation Expectations: Forward-looking indicator of pricing pressures

- Consumer confidence: Leading indicator of spending and economic health

Fed Communication:

- FOMC statements and press conferences

- Regional Fed president speeches (especially the voters)

- Fed minutes (released 3 weeks after meetings)

- FOMC Summary of Economic Projections (quarterly)

4. Liquidity is King in Uncertain Times

Maintain adequate liquidity for three reasons:

- Opportunity: Volatility creates mispricing and buying opportunities

- Flexibility: Ability to adjust positions as clarity emerges

- Peace of mind: Knowing you won’t be forced to sell at inopportune times

Recommended liquidity levels:

- Conservative investors: 12-24 months of expenses in cash/short-term bonds

- Moderate investors: 6-12 months

- Aggressive investors: 3-6 months (but with access to credit lines if needed)

5. Avoid Timing Traps

The most costly mistakes in uncertain environments come from trying to perfectly time the market:

- Don’t wait for “the perfect entry”: Dollar-cost average into positions over time

- Don’t try to catch falling knives: Wait for signs of stabilization before buying beaten-down assets

- Don’t sell everything in fear: Maintaining some equity exposure is crucial for long-term returns

- Don’t chase performance: Last year’s winners often become next year’s laggards

6. The Role of Professional Advice

Complex environments like this highlight the value of professional guidance:

- Financial advisors: Help with asset allocation, rebalancing, and behavioral coaching

- Tax professionals: Navigate tax-loss harvesting and optimize tax efficiency

- Estate planners: Ensure your plan adapts to changing market conditions

The key is working with advisors who acknowledge uncertainty rather than claiming to have all the answers.

Conclusion: Embracing Uncertainty as Reality

The Federal Reserve’s path forward is genuinely uncertain—and that’s okay. The myth that Fed policy is predictable has always been just that: a myth. What’s unusual now is how openly the Fed is acknowledging this uncertainty, with Chair Powell explicitly stating that December’s decision is “far from a foregone conclusion.”

For investors, this environment demands a different mindset:

- Accept that multiple outcomes are possible and build portfolios that can handle them

- Focus on quality and fundamentals rather than trying to predict policy

- Maintain flexibility through adequate cash reserves and diversification

- Use volatility as opportunity rather than a reason to panic

- Stay disciplined in your investment process and avoid emotional decisions

The division within the FOMC reflects the complexity of the economic moment: inflation that’s too high for comfort but moderating, a labor market that’s softening but not collapsing, and incomplete data due to the government shutdown. There are no easy answers.

What we know for certain:

- The federal funds rate currently stands at 3.75-4.00%

- The December 9-10 FOMC meeting will be critical

- Inflation remains above the Fed’s 2% target

- The labor market is showing signs of stress

- Markets are pricing roughly 50/50 odds of a December cut

What we don’t know:

- Whether the Fed will cut, hold, or eventually even need to hike again

- How quickly inflation will return to target

- Whether the labor market weakness will accelerate or stabilize

- What economic data we’re missing due to the shutdown

In this environment, the best strategy is not trying to predict the unpredictable, but building a resilient portfolio that can adapt as more information becomes available. Focus on what you can control: diversification, quality, costs, taxes, and discipline.

The fog will eventually clear. Until then, proceed carefully but don’t stop moving forward.

📚 Related Articles on Sezarr Overseas

- Investment Strategies for 2026: Navigating Market Uncertainty

- Complete Bond Investing Guide: Maximizing Fixed Income Returns

- Protecting Your Portfolio from Inflation: Real Assets Strategy

- Dividend Investing in High-Rate Environments: Top Picks

Frequently Asked Questions

Will the Federal Reserve cut interest rates in December 2025?

As of mid-November 2025, the decision is genuinely uncertain. Market pricing via CME FedWatch shows approximately 50/50 odds of a cut. Fed Chair Jerome Powell stated that a December cut is “not a foregone conclusion—far from it.” The decision will depend on economic data released between now and the December 9-10 FOMC meeting, including the delayed November employment report scheduled for December 16. The Fed is deeply divided between hawks concerned about inflation (still at 3.0% headline CPI) and doves worried about labor market weakness (unemployment at 4.4% with rising long-term joblessness). The lack of October data due to the government shutdown further complicates the decision.

What is the current federal funds rate as of November 2025?

The current federal funds target range is 3.75-4.00%, set at the October 29, 2025 FOMC meeting. The Fed cut rates by 25 basis points at that meeting, marking the second consecutive quarter-point reduction (the first was in September 2025). This represents a total of 50 basis points in cuts from the previous range of 4.25-4.50%. The effective federal funds rate (the actual rate at which banks trade overnight) is approximately 3.88% as of November 18, 2025.

How should investors position their portfolios given Fed uncertainty?

The optimal strategy in this environment is building a balanced portfolio that can perform reasonably well across multiple scenarios. Consider a barbell approach: 40-50% in defensive assets (investment-grade bonds, dividend aristocrats, utilities), 30-40% in quality growth stocks and inflation hedges (real assets, TIPS, select technology), and 10-20% in cash for opportunistic deployment. Within fixed income, implement a bond ladder with maturities from 1-10 years to capture current yields while maintaining flexibility. Focus relentlessly on quality—companies with strong balance sheets, pricing power, and sustainable cash flow. Maintain international diversification (20-30% of equities) and include real assets as inflation insurance. Most importantly, avoid trying to perfectly time Fed decisions; instead, stay disciplined and rebalance systematically.

Why is long-term unemployment rising and should investors be concerned?

Long-term unemployment (those jobless for 27+ weeks) reached 25.7% of all unemployed workers in August 2025—the highest since the pandemic and a level that has historically coincided with or preceded recessions. This represents a rapid 4.2 percentage point increase in just 12 months, the fastest rise since COVID. Investors should be concerned because long-term unemployment is a leading indicator of deeper labor market weakness. Research shows only 11% of long-term unemployed workers find steady full-time employment within a year, and extended joblessness often leads to lasting career and earnings damage. This metric suggests the labor market is weaker than the headline 4.4% unemployment rate indicates, potentially warranting more Fed easing. However, it’s worth noting that structural factors like baby boomer retirements and reduced immigration also play a role in labor market dynamics.

What are money market funds yielding now and should I keep cash there?

Money market funds are currently yielding approximately 5.0-5.2%, making them attractive for short-term savings. Whether to keep significant cash there depends on your investment horizon and risk tolerance. The advantages: it’s one of the best risk-adjusted returns available currently, providing liquidity and capital preservation while earning meaningful income. The disadvantages: these yields will decline if the Fed continues cutting rates (potentially to 3-4% by late 2026 in an aggressive cutting scenario), and keeping too much cash means missing potential gains in stocks and bonds. A reasonable approach for most investors is maintaining 10-20% of your portfolio in money market funds or short-term bonds—enough for opportunities and peace of mind, but not so much that you miss long-term growth. If you’re retired or near retirement, you might go higher (15-25%). If you’re young and investing for decades, you might go lower (5-10%).

How does the government shutdown affect investment decisions?

The 44-day federal government shutdown that began in September 2025 has created a significant data gap that affects both Fed policymaking and investor decision-making. The Bureau of Labor Statistics was unable to collect or publish October employment data, and some economic indicators may never be released for that period. This “fog” means both the Fed and investors are operating with less complete information about the economy’s actual condition. For investors, this argues for: (1) Greater caution and diversification given increased uncertainty, (2) Maintaining higher cash reserves to capitalize on potential volatility, (3) Focusing more on company-specific fundamentals and earnings rather than macro data, and (4) Using alternative real-time indicators (credit card data, corporate earnings reports, regional Fed surveys) to supplement official statistics. The November employment report, scheduled for release December 16 with an extended collection period, will be critical for both the Fed’s December decision and market direction.

What sectors perform best when the Fed is cutting rates?

Historical performance during Fed cutting cycles shows significant variation depending on WHY the Fed is cutting. If cuts occur during economic expansion (a “soft landing”), growth-oriented sectors typically outperform: Technology, Consumer Discretionary, Financials (though banks face margin pressure), and Real Estate benefit from lower rates supporting valuations and reducing borrowing costs. However, if cuts are in response to a recession, defensive sectors perform better: Healthcare, Consumer Staples, and Utilities provide safety. In the current 2025 environment, with the Fed cutting preemptively to support a softening but not collapsing labor market, a balanced approach makes sense: favor quality growth stocks with strong cash flow in Technology, Healthcare, and Financial services, while maintaining defensive positions in Utilities and Consumer Staples. Within Financials, insurance companies often benefit from rate cuts more than banks. Real estate investment trusts (REITs) with inflation-protected leases and strong tenants also tend to perform well as rates decline.

⚠️ Important Disclaimer

This article is provided for general informational and educational purposes only and does not constitute financial, investment, tax, or legal advice. The analysis presented is based on publicly available information as of November 2025, including official Federal Reserve communications, Bureau of Labor Statistics data, and economic research from various sources. However, economic conditions and Federal Reserve policy can change rapidly.

Key Limitations and Considerations:

- Due to the federal government shutdown that began in September 2025, some October economic data is unavailable and may never be published. This creates uncertainty in the economic analysis.

- Federal Reserve policy decisions are inherently uncertain and can change based on new data. The probabilities and scenarios discussed are estimates based on current information.

- Past performance of investment strategies does not guarantee future results.

- Individual financial situations vary significantly. What works for one investor may not be appropriate for another.

- All investments carry risk, including the potential loss of principal.

Before making any investment decisions, you should:

- Consult with a qualified financial advisor who understands your complete financial picture

- Consider your risk tolerance, time horizon, and financial goals

- Conduct your own research and due diligence

- Understand the fees, risks, and tax implications of any investment

- Only invest money you can afford to lose

The author and Sezarr Overseas make no representations or warranties regarding the accuracy, completeness, or timeliness of the information provided. Any reliance you place on such information is strictly at your own risk. We shall not be liable for any losses or damages in connection with the use of this information.

Data Sources: Federal Reserve Board of Governors, Bureau of Labor Statistics, Bureau of Economic Analysis, CME Group FedWatch, Atlanta Federal Reserve, Federal Reserve Bank of Minneapolis, Bloomberg, CNBC, Reuters, Treasury Department. All statistics are from official sources and cited in context throughout the article.

Sources and References

This article incorporates verified information from the following authoritative sources:

- Federal Reserve Board of Governors – Official statements and press releases

- Federal Open Market Committee Minutes – October 2025

- CME Group FedWatch Tool – Market probabilities

- Bureau of Labor Statistics – Employment Situation Reports

- Federal Reserve Bank of Atlanta – Business Inflation Expectations, speeches

- Federal Reserve Bank of Minneapolis – Long-term unemployment research

- Federal Reserve Bank of Cleveland – Inflation nowcasting

- U.S. Treasury Department – Economic statements

- Bloomberg – Fed policy coverage

- CNBC – Fed minutes and market analysis

- Fortune – Fed division coverage

- CBS News – Interest rate decisions

- Al Jazeera – Economic analysis

- Charles Schwab – Investment research

- Visual Capitalist – Economic data visualization

- NPR – Labor market coverage

All statistics and quotes are sourced from official documents and reputable financial news organizations. Data is current as of November 20, 2025, with acknowledgment of data gaps due to the government shutdown.

Published by: Sezarr Overseas

Author: Sezarr Overseas Editorial Team

Publication Date: November 20, 2025

Last Updated: November 20, 2025

Word Count: 2,875 words

Reading Time: Approximately 14 minutes

© 2025 Sezarr Overseas. All rights reserved. This content may not be reproduced without permission.